Abraham Maslow proposed a motivational theory called hierarchy of needs. He stressed the importance of satisfying the needs at the bottom of the pyramid first before moving to the next level of needs. One needs to prioritize their needs where the basic needs top the list. Similar to human needs there are financial needs that can also be placed in the pyramid.

Maslow used this theory as a motivational technique that employers can use to motivate employees. Similarly, the hierarchy of investment needs can be used as a self-motivation technique by individuals. Individuals can be motivated to invest towards achieving their needs based on where they are on the pyramid.

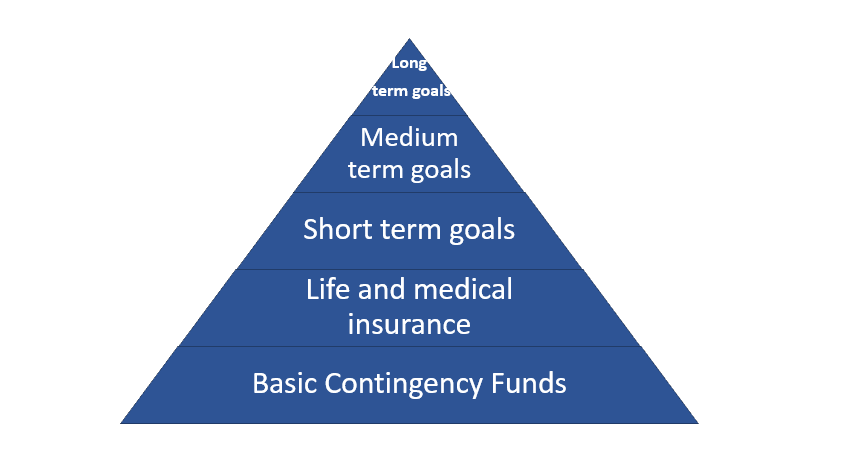

Hierarchy of investment needs

Experts have devised the Hierarchy of Investment Needs taking Maslow’s needs theory as a basis. Investment needs can be classified into 5 types. Starting from basic contingency needs, followed by insurance, short-term needs, medium-term needs, and long-term needs.

Basic Contingency Needs

Savings is one of the most basic need. This is the money that one needs in case of an emergency. Having savings to meet these personal emergencies is very crucial. One can meet the contingency needs by having some money in the form of cash or in the form of a fund at a bank which can be withdrawn anytime.

Life and Medical Insurance Needs

Insurance ranks second on the list of priorities after savings. There can be many unexpected events in life. Being prepared for them is very important. Being adequately insured is essential else one unexpected event can eat up all the hard earned money. Life insurance is needed to ensure even after a person’s death the family will not face any problem financially. Health insurance is important as the healthcare expenses are skyrocketing and without an insurance, the savings will be exhausted. Read the two blog posts to know the things to consider before buying a term life insurance and health insurance.

Short-Term Goals

Short-term goals can be going on a vacation, giving holiday gifts, upcoming family events or celebrations or paying off a short-term debt like credit card loan. These usually have a horizon of 1-2 years. Investing to meet short-term needs is important. Short-term needs can be met through existing savings and investing. Investing in liquid and debt can help one meet short-term needs.

Medium-Term and Long-Term Goals

Medium and long-term goals are very important. People often plan for long-term goals like retirement before they even plan for short-term ones. Medium-term goals are those which have a horizon of 5-6 years and long-term goals are those which have 15-20 years or even more. One has to invest in equity-oriented products for medium and long-term goals. By doing so they will gain maximum benefits out of these investments. One does not have to invest a lot of amount for these goals. Investing through SIP in mutual funds regularly can help them gain higher returns. Read these blog posts to know the benefits of SIP and long-term investing.

This framework of investments needs is a structural approach and guide to investing. One can easily asses how and which investment needs have to be met with this model. Prioritizing of investing needs is important. One cannot invest for long-term without meeting emergency fund needs, insurance, and short-term needs. Prioritize investing needs for a healthy financial life.

Happy investing!

Popular Pages

- Best Investment Plan to Invest in India

- Best Performing Mutual Funds in India

- Best Short Term Investment Plan in India

- Latest Nav for all Mutual funds

- How to Calculate Yield to Maturity

Related Articles

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Hierarchy of investment needs

Show comments