What Is a Mutual Fund?

A mutual fund pools money from multiple investors under the guidance of professional fund managers, who invest in a mix of assets such as stocks, bonds, or other securities according to the fund’s specific objectives. When you purchase shares in a mutual fund, you own a fractional stake in a diversified portfolio, reducing your overall risk exposure. By spreading investments across different holdings, mutual funds aim to balance potential returns with prudent risk management.

Mutual funds charge fees for managing your money. There are different kinds based on what they invest in and their goals. Understanding mutual funds and their investment strategy is important when comparing mutual funds to SIPs.

What Is SIP?

A Systematic Investment Plan, or SIP, is a way to invest money regularly in investments like mutual funds every month. This makes it easier to start investing, even if you don’t have a lot of money.SIPs help you build a habit of saving and investing, which is crucial for effective financial planning. They keep your money plans on track. When thinking about SIP vs mutual fund, remember that SIP is a method to invest in mutual funds, not a different investment. So, understanding SIP vs mutual funds helps you make good choices with your money.

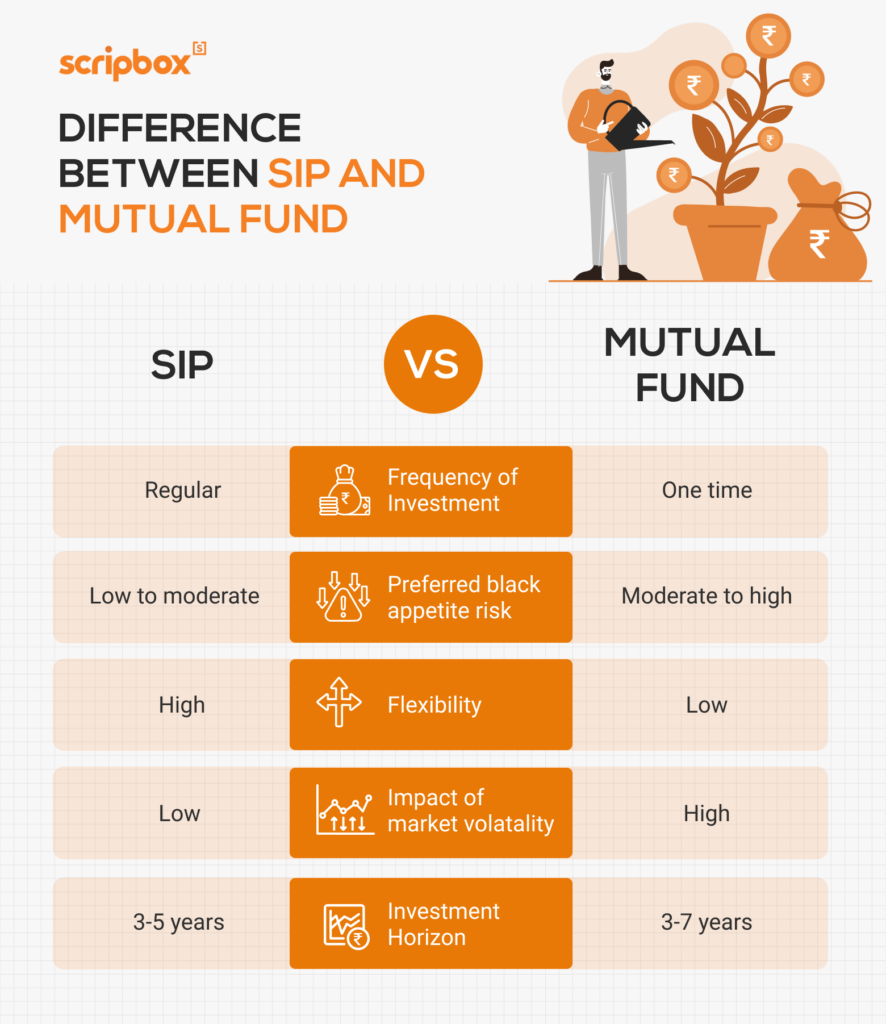

Key Difference between Mutual Fund and SIP

1. Investment Mode

While using SIP as a mode of investment, you make regular payments to purchase units of mutual funds, aligning with your investment goals and inculcating the habit of investing regularly.

2. Power of Compounding in SIP Investments

In an SIP, an investor invests with financial discipline and regularly accumulates wealth over a period of time. SIP can be a better route to achieving a financial plan and investment goals.

Mutual funds provide an investor with an option either to reinvest the earnings or returns. If an investor reinvests in the same plan instead of withdrawing, he can enjoy the benefits of the power of compounding.

The 8-4-3 Rule of Compounding

The 8-4-3 rule demonstrates the acceleration of wealth creation through SIP investments:

- First 8 years: Money grows steadily with consistent returns

- Next 4 years: Growth accelerates as returns compound

- Final 3 years: Exponential growth occurs due to the snowball effect

Mathematical Impact

For example, a monthly SIP of ₹21,250 invested at 12% annual returns for 15 years can grow to ₹1 crore through the power of compounding.

This demonstrates how small, regular investments can create substantial wealth over time when combined with the power of compounding

3. Flexibility

Through SIP investments, you have greater flexibility. You can invest small amounts regularly, weekly, fortnightly, or monthly at your convenience. Hence, SIP is best for salaried people or persons with regular cash flows.

SIPs offer a range of investment options and allow you to invest in mutual funds without disturbing your present lifestyle and expenditure pattern. You can also invest a lump sum in a mutual fund scheme anytime you have surplus money.

4. Cost Averaging

If you invest in SIP, you can benefit from cost averaging, which helps you lower the overall purchase cost by buying more units when the market conditions are down and fewer units when the market conditions are up.

This helps you reduce your average purchase cost.

On the other hand, in a lump sum mode of investment, sometimes you end up purchasing all the units at a price that can be higher as you do not get the benefit of averaging.

5. Volatility

Investors, especially new ones, are often confused about the best time to enter the market. If you invest in a lump sum, there is always the question of timing the purchase, which can lead to exposure to high volatility periods.

With an SIP, the purchase is spread over time, and only some parts of your entire investment will face higher-than-usual market fluctuations.

Explore: Best Date for SIP in Mutual Funds

Benefits of SIP and Mutual Funds

Investing in SIP and mutual funds offers numerous benefits to investors. Some of the key advantages include:

- Disciplined Investing: SIP helps investors develop a disciplined approach to investing, which is essential for long-term wealth creation. By committing to regular investments, you build a habit that can lead to significant financial growth over time.

- Rupee Cost Averaging: One of the standout benefits of SIP is rupee cost averaging. This strategy reduces the impact of market volatility on your investments by spreading out your purchases over time. When the market is down, you buy more units; when it’s up, you buy fewer. This helps in lowering the average cost of your investments.

- Flexibility: Mutual funds offer a high degree of flexibility. You can choose from a wide range of schemes that cater to different risk appetites and investment goals. Whether you prefer equity, debt, or hybrid funds, there’s something for everyone.

- Diversification: Mutual funds provide diversification, which helps to spread risk across various asset classes. By investing in a mutual fund, you own a small part of many different investments, reducing the overall risk of your portfolio.

- Professional Management: Mutual funds are managed by experienced professionals who have the expertise to make informed investment decisions. This professional management can be particularly beneficial for those who may not have the time or knowledge to manage their investments actively.

- Liquidity: One of the attractive features of mutual funds is liquidity. You can redeem your investments anytime, making it a convenient option for those who may need easy access to their money.

Factors to Consider When Choosing Between SIP and Mutual Funds

When deciding between a Systematic Investment Plan (SIP) and investing directly in mutual funds, there are important things to think about. Understanding the difference between SIP and mutual fund options can help you make the best choice for your money.

Investment Horizon

Your investment horizon is how long you plan to keep your money invested. If you want to invest over a long time, a SIP vs mutual fund approach might suit you. SIPs let you invest amounts regularly, like every month. This makes it easier to start investing, even if you don’t have much money right now. Some mutual funds may need more money upfront, which might not be affordable for everyone.

Risk Tolerance

How much risk you can handle is key when choosing between SIP and mutual funds. If you’re okay with ups and downs in the market, you might choose equity mutual funds. If you prefer less risk, debt or hybrid mutual funds might be better. Consider how comfortable you are with market changes and pick matching investments.

Financial Goals and Preferences

Deciding between a mutual fund and a SIP depends on your goal. Think about your financial goals and how steady your income is. Sometimes, using SIPs and mutual funds can give you the benefits of regular investing and taking advantage of market opportunities.

Maximizing Returns with SIP and Mutual Funds

To maximize returns with SIP and mutual funds, consider the following strategies:

- Long-term Investing: Investing for the long term helps you ride out market fluctuations and benefit from the power of compounding. The longer you stay invested, the more your money can grow.

- Regular Investing: Regular investing through SIP helps reduce the impact of market volatility and allows you to benefit from rupee cost averaging. By investing a fixed amount regularly, you can smooth out the market’s highs and lows.

- Diversification: Diversifying your investments across various asset classes and schemes helps to reduce risk and increase potential returns. A well-diversified portfolio can protect you from the poor performance of a single investment.

- Monitoring and Rebalancing: Regularly monitoring and rebalancing your investment portfolio ensures it remains aligned with your risk appetite and investment goals. Rebalancing involves adjusting your portfolio to maintain your desired asset allocation.

- Tax Efficiency: Considering the tax implications of your investments and choosing tax-efficient options can help maximize returns. For instance, investing in Equity-Linked Savings Schemes (ELSS) can provide tax benefits under Section 80C of the Income Tax Act.

Recommended to Use Scripbox’s: SIP Calculator

Top Performing Mutual Funds for SIP in India on Basis of Best Returns

Taking into account the data from the past 5 years, our experts have curated a list of top performing mutual funds that you can invest in through SIP

| Fund Name | Category |

| Canara Rob Bluechip Equity Fund-Reg(G) | Large Cap Fund |

| IIFL Focused Equity Fund-Reg(G) | Focused Fund |

| Parag Parikh Flexi Cap Fund-Reg(G) | Flexi Cap Fund |

| Canara Rob Emerg Equities Fund-Reg(G) | Large & Mid Cap |

| Nippon India Value Fund(G) | Value Fund |

| DSP Tax Saver Fund-Reg(G) | Tax Saving |

| Mirae Asset Tax Saver Fund | Tax Saving |

Conclusion

We hope this has helped you to understand the differences between SIP and mutual fund investment. And now you will be able to evaluate when it comes to SIP vs mutual funds.

SIPs offer flexibility, lower cost due to averaging, and offer an effective way to manage volatility. It’s simply a smarter way to invest.

While debating on SIP vs mutual funds, an investor must consider his/ her convenience of investing based on income and earnings. You can use Scripbox’s lumpsum calculator to get an estimate of wealth gained and maturity value.

Frequently Asked Questions

The choice between SIP and mutual fund lumpsum investing largely depends on the availability of funds. SIP helps you invest small amounts regularly. This inculcates the habit of investing among individuals. On the other hand, with lumpsum investments, you need to be proactive and invest. Since SIP investments are automated, you need not worry about when to invest and how much to invest.

SIP and mutual fund lumpsum investments invest in the same mutual fund and have the same portfolio exposure. Thus, both are subject to the same risks and volatility. However, when investing for the long term, the SIP mode of investing will help you average out the market volatility.

For lower regular income, SIP may come across as the most feasible mode of investment. You can invest a small amount regularly and gradually increase your contributions.

For the long term, SIPs will help you average out the market volatility and benefit from the power of compounding.

Related Pages

- What Is a Mutual Fund?

- What Is SIP?

- Key Difference between Mutual Fund and SIP

- Benefits of SIP and Mutual Funds

- Factors to Consider When Choosing Between SIP and Mutual Funds

- Maximizing Returns with SIP and Mutual Funds

- Top Performing Mutual Funds for SIP in India on Basis of Best Returns

- Conclusion

- Frequently Asked Questions

Show comments