Introduction to Index Funds

Index funds are a type of passively managed mutual fund that tracks and attempts to replicate the performance of a market index. They hold the shares comprising the chosen index in proportion to the replicated index.

Index funds are an example of passive investing, where the fund manager replicates the portfolio of the chosen index. This is in contrast to actively managed mutual funds, where the fund manager uses their expertise to build a portfolio of securities. Passive investing involves the fund manager building a portfolio of stocks and maintaining individual stock allocations in the same proportion as the replicated index.

Index funds that replicate specific indices like the Nifty 50, Nifty Midcap 150, etc., follow this strategy. They particularly appeal to those who prefer a passive investment strategy, as they aim to replicate the index returns rather than trying to outperform the market. However, this often leads to funds underperforming because of costs and transaction changes.

Understanding the Nifty 50 Index

The Nifty 50 Index is a well-diversified 50-stock index representing essential sectors of the economy.

The Nifty 50 Index represents about 54% of the free-float market capitalization of the stocks listed on the NSE as of September 30, 2024. The total traded value of Nifty 50 index constituents for the last six months ending September 2024 is approximately 27% of the traded value of all stocks on the NSE.

How Does a Nifty 50 Index Fund Work?

When you invest in a Nifty 50 Index Fund, the fund manager uses your money to invest in stocks in the same proportion as the Nifty 50 Index. The fund manager will build a portfolio where the weightage of stocks of each company will be the same as its proportion in the index. If a stock’s weightage has increased or decreased in the index, the fund manager of the Nifty 50 Index Fund will also replicate those changes in the fund.

Nifty 50 Index Funds don’t have a team to manage them, and they don’t buy and sell stocks actively, resulting in low-cost structures. They are the cheapest mutual funds you can invest in. By investing in a Nifty 50 Index Fund, you’re essentially betting on the continued growth and stability of the largest companies in the Indian market.

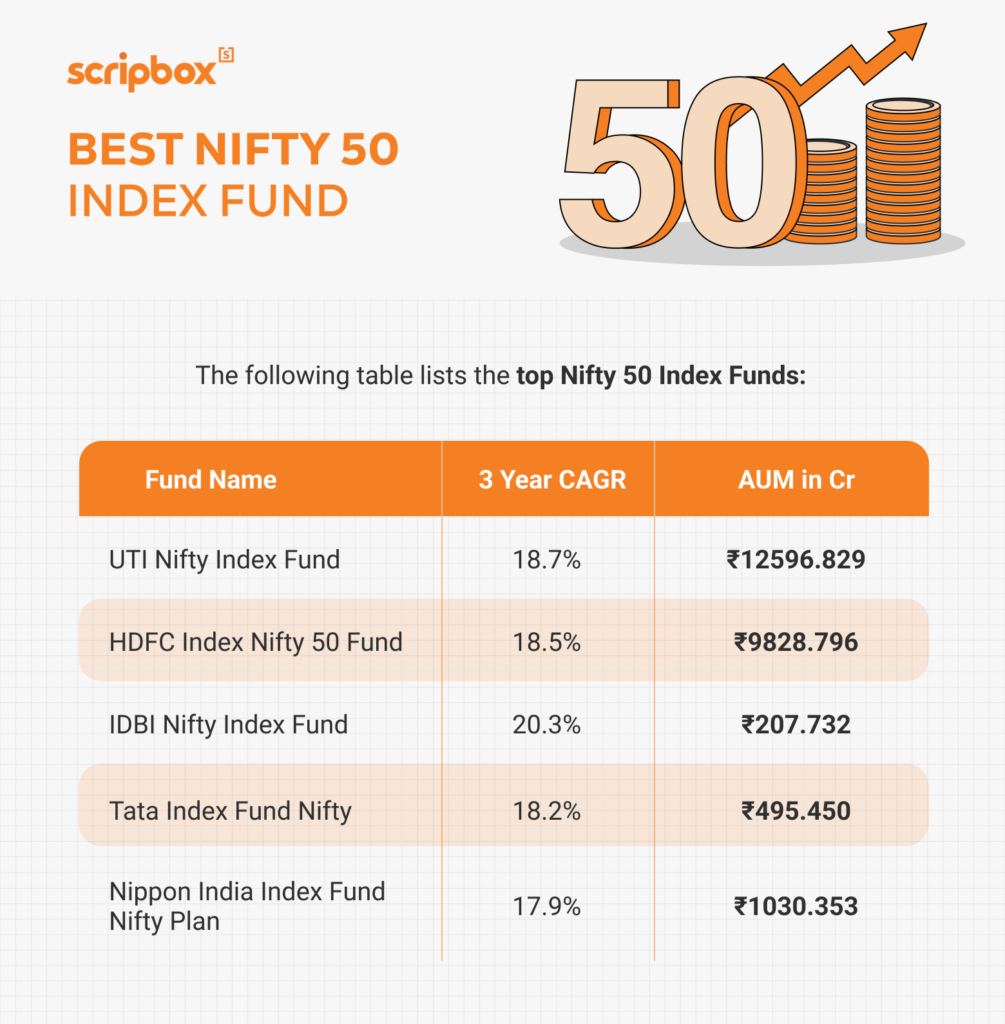

5 Best Nifty 50 Index Fund to Invest in 2025

Recommended Read: How to Invest in Nifty 50?

1. UTI Nifty Index Fund

UTI Nifty Index Fund is an open-ended mutual fund scheme. Therefore. this fund replicates and tracks the Nifty 50 Index in the same proportion as they exist in the Nifty 50 Index. Moreover, the composition of the index comprises the largest companies across different sectors.

Investment Objective: The fund’s investment objective is to invest in stocks of companies comprising the Nifty 50 Index and endeavor to achieve a return equivalent to the Nifty 50 Index through ‘passive’ investment. However, there can be no assurance or guarantee that the Scheme’s schedule’s investment objective will be achieved.

Fund details

- Expense Ratio: 0.41

- Launched: Mar 06, 2000

- ISIN: INF789F01JN2

- Benchmark: Nifty 50 TR INR

- SIP Minimum: Rs. 1000

- Lumpsum Min: Rs. 5000

- Risk: Very High Risk

Should You Invest in UTI Nifty Index Fund?

The UTI Nifty Index Fund is suitable for investors with a minimum investment horizon of 5 years. Hence, an investor who is looking for market exposure in the equity asset class at a relatively cheaper cost should consider investing in this Scheme. The fund aims to achieve its objective by adopting a passive investment strategy and investing in stocks of companies comprising the Nifty 50 Index. Furthermore, the fund provides capital appreciation and wealth creation over the long term.

2. HDFC Index Nifty 50 Fund

HDFC Index Nifty 50 Fund is an open-ended index mutual fund scheme. This index mutual fund scheme replicates the Nifty 50 Index. It replicates by investing in the stocks of companies in the same proportion that is listed under the Nifty 50 Index. Also, this fund is not biased towards any specific sector or industry different from the chosen Index. Furthermore, the Index comprises companies across various sectors, market capitalization, and growth potential, such as Reliance Industries, ICICI Bank, ITC Ltd, TCS Ltd, State Bank of India, and more.

Investment Objective

The scheme’s investment objective is to generate returns that are also in line with the performance of the NIFTY 50 Index, subject to tracking errors. However, there is no assurance that the scheme’s investment objective will be realized.

Fund details

- Expense Ratio: 0.4

- Launched: Jul 17, 2002

- ISIN: INF179K01KZ8

- Benchmark: Nifty 50 TR INR

- SIP Minimum: Rs. 1000

- Lumpsum Min: Rs. 5000

- Risk: Very High Risk

Should You Invest in HDFC Index Nifty 50 Fund?

HDFC Index Nifty 50 Fund is suitable for a long-term investment of at least 5 years. Therefore, an investor looking for market exposure in the equity asset class at a relatively cheaper cost can consider investing in the Scheme. The fund aims to achieve its objective by adopting a passive investment strategy and investing in stocks of companies comprising the Nifty 50 Index. Furthermore, the fund provides inflation-beating growth over the long term.

3. IDBI Nifty Index Fund

IDBI Nifty Index Fund is an open-ended index mutual fund scheme that replicates the Nifty 50 Index by investing in the stocks of companies in a similar proportion to those listed under the Nifty 50 Index. This fund does not focus on any sector or industry other than the chosen Index. Furthermore, the Index comprises top companies across various industries and market capitalization.

Investment Objective

The scheme’s investment objective is to generate returns that are in line with the performance of the NIFTY 50 Index, subject to tracking errors. The Scheme may also invest in derivatives instruments such as Futures and Options linked to stocks comprising the Index or linked to the Nifty 50 Index. However, there is no assurance that the scheme’s investment objective will be realized.

Fund details

- Expense Ratio: 0.9

- Launched: Jun 25, 2010

- ISIN: INF397L01091

- Benchmark: Nifty 50 TR INR

- SIP Minimum: Rs. 1000

- Lumpsum Min: Rs. 5000

- Risk: Very High Risk

Should You Invest in IDBI Nifty Index Fund?

IDBI Nifty Index Fund is suitable for a long-term investment duration of at least 5 years. Therefore, any investor who is looking for market exposure in the equity asset class at a relatively cheaper cost can consider investing in the Scheme. The fund aims to achieve its objective by adopting a passive investment strategy and investing in stocks and derivatives of companies comprising the Nifty 50 Index. Furthermore, the fund aims to provide capital appreciation and wealth creation in the long term.

4. Tata Index Fund Nifty

Tata Index Fund Nifty is an open-ended mutual fund scheme reflecting the Nifty 50 Index. Therefore, this fund replicates and tracks the Nifty 50 Index in the same proportion as they exist in the Nifty 50 Index. Also, this fund does not opt for any other active sector or stock different from the chosen Index. Furthermore, the Index comprises the largest companies across various sectors, market capitalization, and growth potential.

Investment Objective

The investment objective of the Scheme is to reflect and also mirror the market returns with a minimum tracking error. However, this Scheme does not assure or guarantee any returns.

Fund details

- Expense Ratio: 0.52

- Launched: Feb 25, 2003

- ISIN: INF277K01741

- Benchmark: Nifty 50 TR INR

- SIP Minimum: Rs. 1000

- Lumpsum Min: Rs. 5000

- Risk: Very High Risk

Should You Invest in Tata Index Fund Nifty?

Tata Index Fund Nifty is suitable for a long-term investment duration of at least 5 years. Therefore, an investor who prefers to have market exposure in the equity asset class at a relatively cheaper cost can consider investing in the Scheme. The fund’s objective is to invest in stocks of companies comprising the Nifty 50 Index by adopting a passive investment strategy. Furthermore, the fund aims to deliver capital appreciation and wealth creation in the long term.

5. Nippon India Index Fund Nifty Plan

Nippon India Index Fund Nifty Plan is an open-ended index mutual fund scheme that mirrors the Nifty 50 Index. Thus, the fund’s objective is to replicate and track the Nifty 50 Index in the same proportion as it exists in the chosen Index. Also, this fund does not opt for any other active sector or stock that’s different from that particular Index. Furthermore, the Index comprises the largest companies across different sectors and market capitalization.

Investment Objective

The primary investment objective of the Scheme is to replicate the composition of the Nifty 50 and generate returns commensurate with its performance, subject to tracking errors. However, this Scheme does not assure or guarantee any returns.

Fund details

- Expense Ratio: 0.59

- Launched: Sep 28, 2010

- ISIN: INF204K01IE3

- Benchmark: Nifty 50 TR INR

- SIP Minimum: Rs. 1000

- Lumpsum Min: Rs. 5000

- Risk: Very High Risk

Should You Invest in Nippon India Index Fund Nifty Plan?

Nippon India Index Fund Nifty Plan is suitable for a long-term investment duration of at least 5 years. Therefore, an investor who prefers to have market exposure in the equity asset class at a relatively cheaper cost can consider investing in the Scheme.

Advantages of the Nifty 50 Index Fund

Investing in the best Nifty 50 index fund offers several benefits that you should consider before starting your investment journey.

Low Cost

One of the primary benefits of Nifty 50 index funds is the low investment cost. Since these funds aim to replicate the performance of the Nifty 50 index, fund managers do not need to hire expensive analysts or researchers to select stocks. This absence of active management reduces operational costs, allowing the fund to charge some of the lowest fees among mutual funds. Lower expenses and expense ratios mean more money is invested, potentially leading to better returns.

Diversified Portfolio

Nifty 50 index funds invest in the top 50 companies in India across various sectors. This means your investment is spread out over multiple industries and businesses. Diversification helps reduce your portfolio’s overall risk because if one industry company underperforms, others may perform well enough to balance it. T

Easy to Invest

Investing in a Nifty 50 index fund is straightforward and convenient. You can purchase and sell these funds through various financial channels, including banks, brokerage firms, and online platforms. The simplicity of the investment process reduces the need for constant monitoring and management.

Unbiased Investment Approach

Nifty 50 index funds offer an unbiased investment strategy by eliminating the influence of individual fund managers’ decisions. The fund’s performance is directly linked to the Nifty 50 index, avoiding any personal biases or subjective judgments that might affect actively managed funds.

Lower Expense Ratios

Nifty 50 index funds usually have lower management fees than actively managed funds because they follow the Index without needing active stock selection. Lower expenses mean more investment returns stay with you, potentially boosting overall profits.

Who Should Consider Investing in Nifty 50 Index Funds?

Nifty 50 Index Funds offer diverse benefits and suit various investor profiles.

First-Time Investors

For beginners, these funds serve as a gateway to stock market investments by providing exposure to a varied portfolio of blue-chip companies.

Investors with Low-Risk Appetite

If you prefer lower risk, these funds invest in well-established companies across multiple sectors. This diversification reduces the risk associated with individual stocks, offering consistency and historically stable performance.

Long-Term Investors

People with horizons spanning five years or more can invest in them to achieve their financial goals, such as their children’s education, retirement, etc.

Investors Seeking Liquidity

These funds offer high liquidity since their assets are actively traded on the stock exchange. This makes it easy to buy or sell your investment anytime, providing flexibility when needed.

Cost-Conscious Investors

Due to passive management, Nifty 50 index funds generally have lower expense ratios. Lower fees mean more money stays invested, which results in positive potential returns over time.

How to Pick Funds with low tracking error

To pick the suitable Nifty 50 Index Fund, you must consider the following parameters:

- Expense Ratio: Lower expense ratios translate to higher returns for investors. Thus, it’s wise to pick funds with a lower expense ratio.

- Risk and Volatility: Since Nifty 50 index funds invest across 50 large-cap companies, they are still risky. Thus, ensure you are comfortable with the associated risks before investing.

- Exit Load: Before investment, check the fund’s exit load. Exit loads can affect returns if you redeem investment before the exit load tenure.

Returns on Nifty 50 Index Funds

Nifty 50 Index Funds have historically provided stable returns over the long term. The average 3-year return on Nifty 50 Index Funds is around 8.04%. However, it’s essential to note that past performance is not a guarantee of future returns.

Historical Performance

The UTI Nifty 50 Index Fund, one of the largest and longest-running Nifty 50 Index Funds, has a track record of over 22 years. It has a competitive expense ratio and a low tracking error, making it an attractive option for investors. As of October 31, 2024, the fund’s 3-year return is 12.10%, and its NAV is ₹170.2200.

Investing in a Nifty 50 Index Fund can be a good option for those looking for a low-maintenance investment that still offers the potential for growth. They provide a straightforward way to gain exposure to a broad market segment through a single investment, making them an excellent component of a diversified investment portfolio.

Taxation of Nifty 50 Index Funds

The taxation of capital gains in Nifty 50 Index Funds is similar to that of equity mutual funds. Capital gains are categorized as short-term capital gains (STCG) and long-term capital gains (LTCG).

Gains from Nifty 50 Index Funds with a holding period of less than one year are treated as STCG, which is taxable at 20%.

On the other hand, holdings for more than a year attract LTCG tax. LTCG above INR 1,25,000 is taxable at 12.5%.

Understanding Tracking Error in Nifty 50 Index Funds

Tracking error is crucial for evaluating how closely a Nifty 50 index fund mirrors its benchmark index. Among large-cap index funds tracking the Nifty 50, some funds have demonstrated remarkably low tracking errors, with Navi Nifty 50 Index Fund leading at 0.01%

. Key Factors Affecting Tracking Error The tracking error in Nifty 50 index funds typically occurs due to three main factors:

- Fund expenses and management fees that erode returns

- Cash holdings maintained for redemptions

- Timing differences in rebalancing when index constituents change

Current Performance Recent data shows that large-cap index funds generally maintain lower tracking errors than mid-cap and small-cap funds.

This superior tracking efficiency occurs because Nifty 50 stocks are highly liquid and frequently traded, making it easier for fund managers to replicate the index accurately. Impact on Investors A lower tracking error indicates better index replication and typically translates to more predictable returns. For instance, if the Nifty 50 gains 4% in a month and the index fund gains 3.5%, the tracking error would be 0.5%

This small difference can significantly impact long-term returns, making it essential for investors to choose funds with consistently low tracking errors. For investors seeking to invest in Nifty 50 index funds, it’s crucial to examine the tracking error and its stability over time, as a consistently low tracking error indicates better fund management and cost efficiency.

Evaluating the Nifty 50 Index Fund

To pick the right Nifty 50 Index Fund, you must consider the following parameters:

- Asset Under Management (AUM): Funds with extremely large AUM can face liquidity issues. Thus, too big or too small funds in terms of AUM must be avoided.

- Expense Ratio: Lower expense ratios translate to higher returns for investors. Thus, it’s wise to pick funds with a lower expense ratio.

- Risk and Volatility: Since Nifty 50 index funds invest across 50 large-cap companies, they are still risky. Thus, ensure you are comfortable with the associated risks before investing.

- Exit Load: Before investment, check the fund’s exit load. Exit loads can affect returns if you redeem investment before the exit load tenure.

Taxation of Nifty 50 Index Funds

Capital gains taxation of Nifty 50 Index Funds is similar to equity mutual funds. Capital gains are categorized as short-term capital gains (STCG) and long-term capital gains (LTCG).

For a holding period, of less than one year, gains from Nifty 50 Index Funds are treated as STCG. STCG is taxable at 15%.

On the other hand, if the holding period is over a year attract LTCG tax. LTCG above INR 1,25,000 are taxable at 12.5%.

Discover More

- Introduction to Index Funds

- Understanding the Nifty 50 Index

- How Does a Nifty 50 Index Fund Work?

- 5 Best Nifty 50 Index Fund to Invest in 2025

- 2. HDFC Index Nifty 50 Fund

- Advantages of the Nifty 50 Index Fund

- Who Should Consider Investing in Nifty 50 Index Funds?

- How to Pick Funds with low tracking error

- Returns on Nifty 50 Index Funds

- Taxation of Nifty 50 Index Funds

- Understanding Tracking Error in Nifty 50 Index Funds

- Evaluating the Nifty 50 Index Fund

- Taxation of Nifty 50 Index Funds

Show comments