Investing in mutual funds can be a smart way to grow your wealth, but the flexibility to manage your money is equally important. Mutual funds without a lock-in period allow you to sell your investments whenever needed, making them an ideal choice for short-term goals or those who value liquidity.

This blog’ll explore the best mutual funds without any lock-in period in 2024. Whether you’re looking for options with high returns, minimal restrictions, or the ability to exit quickly, this guide covers you. From understanding a lock-in period to uncovering the benefits of funds without one, we’ll help you make informed decisions to match your financial goals.

Let’s explore top-performing funds, key features, and why a no-lock-in period might be the right choice for your investment strategy.

Top Liquid Mutual Funds without Lock-in Period

| Name | 5 Yr Returns | Rating | Exp Ratio | Risk | Min Monthly SIP | Min Lumpsum | Category | Sub Category |

| HDFC Balanced Advantage Fund – Direct Plan – Growth | 21.96% | 5 ★ | 0.74% | Very High | ₹100 | ₹100 | Hybrid | Dynamic Asset Allocation Balanced Advantage |

| Parag Parikh Flexi Cap Fund – Direct Plan Growth | 26.81% | 5 ★ | 0.74% | Very High | ₹100 | ₹100 | Equity | Flexi Cap Fund |

| HDFC Mid-Cap Opportunities Fund Direct – Growth | 31.08% | 4 ★ | 0.74% | Very High | ₹100 | ₹100 | Equity | Mid Cap Fund |

| SBI Equity Hybrid Fund Direct – Growth | 15.51% | 3 ★ | 0.73% | Very High | ₹500 | ₹1000 | Hybrid | Aggressive Hybrid Fund |

| HDFC Flexi Cap Fund Direct – Growth | 24.98% | 4 ★ | 0.77% | Very High | ₹100 | ₹100 | Equity | Flexi Cap Fund |

| ICICI Prudential Bluechip Fund Direct – Growth | 20.78% | 5 ★ | 0.86% | Very High | ₹100 | ₹100 | Equity | Large Cap Fund |

| Nippon India Small Cap Fund Direct – Growth | 38.67% | 5 ★ | 0.68% | Very High | ₹100 | ₹5,000 | Equity | Small Cap Fund |

| ICICI Prudential Balanced Advantage Fund – Direct | 14.18% | 5 ★ | 0.87% | High | ₹100 | ₹500 | Hybrid | Dynamic Asset Allocation Balanced Advantage |

| Kotak Emerging Equity Fund Direct – Growth | 29.95% | 5 ★ | 0.38% | Very High | ₹100 | ₹100 | Equity | Mid Cap Fund |

What is Lock-in Period in Mutual Fund?

The Lock-in period is when you cannot sell or redeem your mutual fund units. However, once the lock-in period is completed, you can sell the mutual fund units whenever you wish. Mutual fund investments often have a lock-in period. A lock-in period applies to all closed-end mutual funds. Most open-ended mutual funds come without a lock-in period. However, except for one, Equity Linked Savings Scheme (ELSS) funds are open-ended equity schemes that have a three-year lock-in period.

In other words, investors will be unable to sell their shares during this time. Investors can opt to stay invested in the fund for as long as it survives or sell their mutual fund units after this term ends.

Though open-ended equity funds do not have any lock-in period, they have an exit load. Exit load is a fee that the fund house charges for exiting the fund within one year.

Having a lock-in period will affect the investment’s liquidity. In other words, the assets are illiquid for the lock-in tenure. You will not be able to exit the scheme prematurely. Thus, holding on to your investments is mandatory until the lock-in period is over.

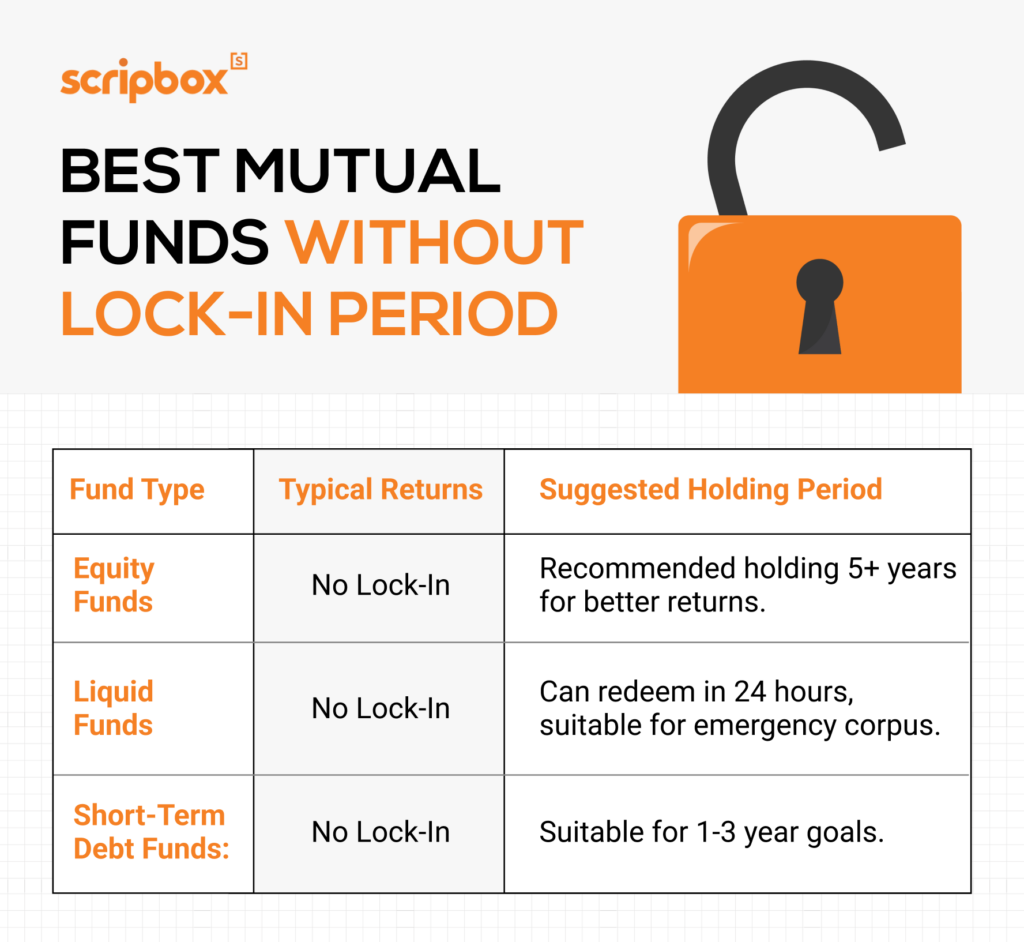

Which Funds have no Lock-in Period

Open-ended debt, hybrid, and equity mutual funds usually don’t have a lock-in period, except for ELSS funds under the equity category. This means you can sell your investments anytime. There are no restrictions on when to sell or how long to hold these funds. You can exit when you’ve made good returns if the fund is not performing well, or if the fund no longer fits your financial goals.

In contrast, closed-ended funds like fixed maturity plans and Equity Linked Savings Schemes (ELSS) have a lock-in period. You can’t sell or redeem your fund units during this time, even if the fund is underperforming or your goals change.

Lock-in periods can benefit investors by encouraging them to stay invested for the long term, which can lead to better returns. Many new investors react to small market changes, which can hurt their overall gains. A lock-in period helps them stay committed to the investment, allowing it to grow over time.

Lock-in periods also help maintain the fund’s stability. If too many people sell at once, it could create liquidity problems for the fund. By restricting redemptions during the lock-in period, the fund’s assets remain steady, which ultimately benefits all investors.

Benefits of No Lock-In Period in Mutual Funds

- Easy Liquidity: Investors can sell their funds anytime they want, which lets them gain quick access to funds for emergencies or other financial needs without delays.

- Flexibility in Investment Strategy: The holding period is not restricted, so you can easily switch between funds to maximize your investments.

- Ideal for Short-Term Goals: No lock-in period makes these funds perfect for short-term financial goals like vacations, home improvements, or building an emergency fund.

- No Early Exit Penalties: Unlike investments with fixed lock-in periods, you won’t face hefty exit charges for withdrawing your money early.

Conclusion

While investing in a mutual fund, you should identify funds that perfectly align with your investment needs. For example, if you wish to save for your retirement 25 years from now, you can invest most of your funds in equity schemes. Even under the equity category, you can allocate assets across large-cap, mid-cap, value funds, etc. Since the investment tenure is long-term, you can take a comfortable amount of risk with your funds. Also, as equity schemes tend to generate a higher return in the long term, equity investments will help you develop a significant corpus for your goal.

Furthermore, the lock-in period can be the least of your concerns when your investment tenure is long since you are certain to stay invested for a long time. Therefore, it is essential to give more weight to other qualitative and quantitative factors when selecting a mutual fund.Next, if your goal is tax saving, ELSS mutual funds are your best bet to generate significant returns. Also, these schemes have the lowest lock-in period compared to other tax saving schemes under Section 80C of the Income Tax Act, 1961. ELSS funds have a three-year lock-in period, and investments up to INR 1,50,000 per annum qualify for tax deduction under Section 80C of the Income Tax Act, 1961.

Thus, whether or not a fund has a lock-in period will depend solely on your investment purpose, goal, and tenure.

Discover Best Funds

Show comments