What is the Folio Number in Mutual Funds?

When you invest in a mutual fund scheme, the asset management company (AMC) generates a unique folio number linked to your Permanent Account Number (PAN). This number is also referred to as a Folio Number. A PAN number is a mandatory requirement for mutual fund investments and is a crucial part of the KYC (Know Your Customer) information.

This number is used to track the investor’s investments and transactions and ensure accurate record-keeping. Checking mutual fund transactions and status using folio numbers has become more accessible through various applications, and it is crucial for effective investment management.

What is a Folio Number?

A folio number is a unique identification number assigned to an investor by a mutual fund Asset Management Company (AMC). Think of it as a bank account number for your mutual fund investments. This number is crucial for tracking all your investments and transactions within a particular AMC. Whether you are investing in equity, debt, or liquid funds, the folio number helps keep everything organized. It can be numeric or alphanumeric and is essential for investing through the AMC route. Multiple folios can be consolidated into a single folio number for easier record-keeping.

Importance of Folio Number in Mutual Fund Investment

The folio number plays a pivotal role in mutual fund investments. It is a central reference point for tracking all your investments and transactions. This unique identifier helps determine the fees applicable to you and the specific funds you are entitled to. When investing through the AMC route, the folio number is indispensable. Additionally, if you have multiple folios, they can be consolidated into one, simplifying your record-keeping and making it easier to manage your investments. Essentially, the folio number is your key to a streamlined and efficient mutual fund investment experience.

Characteristics of a Folio Number

A folio number is a unique identifier assigned to each investor in a mutual fund. Every investor needs a distinct folio number for each AMC they invest in. This number provides an approximate representation of the total number of unique investors in mutual funds. Over time, an investor might end up with multiple folios within the same AMC. However, these can be consolidated into a single folio number for better record-keeping. This unique identifier ensures that all your investments are tracked accurately, making managing your mutual fund portfolio easier.

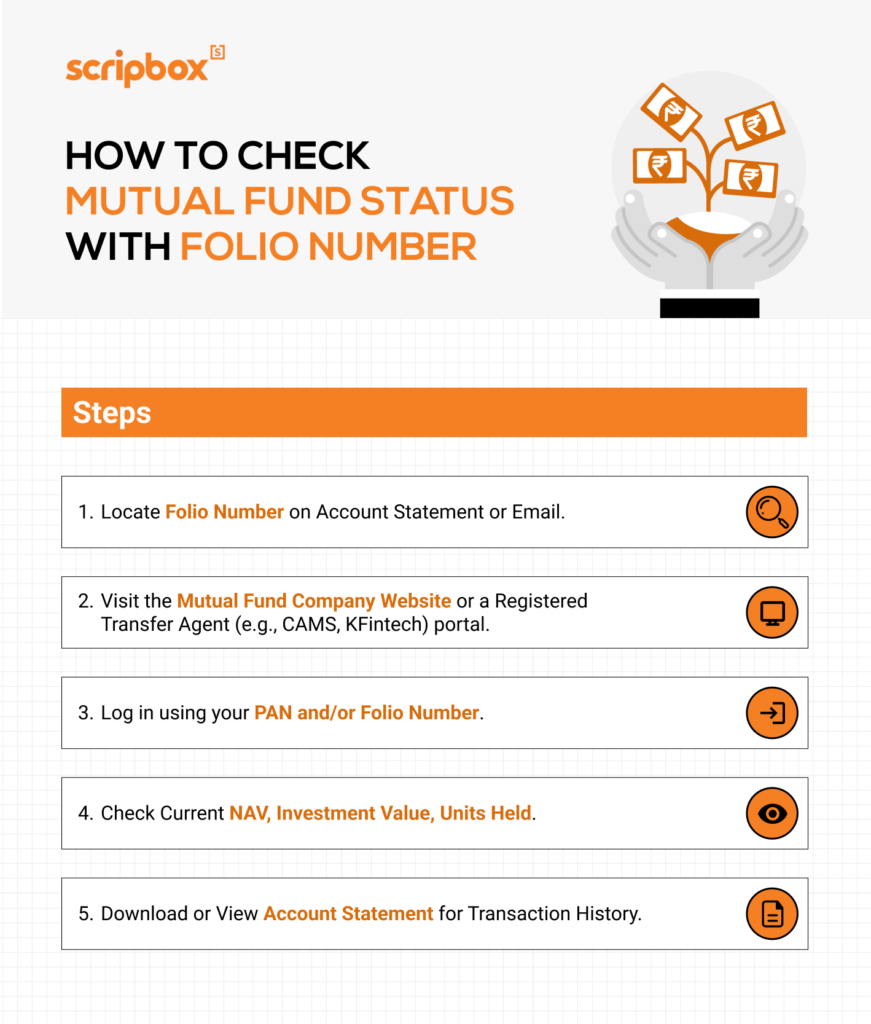

5 Ways to Check Mutual Fund Status with Folio Number

1. Check Fund Status Through Online Mode:

These days, individuals mostly prefer investing online. Some websites, like Karvy, CAMS, etc., allow you to check your fund status through a folio number. You only have to register on these websites with your mobile number and PAN card.

2. Check Fund Status Through AMC Customer Care

You can call the customer care of the respective asset management company to find out your mutual fund status. You must provide details like your PAN card and folio number to the service provider. Once verified, the service provider will provide details of the funds under your PAN. You must contact the respective fund house if the investment is in different AMCs.

3. Check Fund Status from Fund’s Website:

Every fund house has its dedicated website as it allows different fund investment options. Also, you can check the mutual fund status by logging in. However, you must first register with a PAN card, mobile number, email ID, and folio number.

4. Contact Your Broker to Check Status:

Many people invest in mutual funds through a broker/distributor, where they have all the details about the client’s investments. The broker can track the mutual fund status through your folio number. You can directly contact your broker to learn about the status of your mutual funds.

5. Check Through Consolidated Account Statement:

The two depositories in India, NSDL and CDSL, collect and analyze individuals’ investments. Suppose you own a Demat account and invest in mutual funds through it. In that case, the depository sends monthly consolidated account statements via email containing all the details of investments in stocks and mutual funds. This helps you track your mutual fund status.

You can use the above methods to track your mutual fund status through folio numbers. The folio number remains the same if you purchase multiple schemes from a fund house. Sometimes, the fund house creates different folio numbers under one PAN card. If you forget your folio number, you can always contact the AMC to send your mutual fund statement, which contains the folio number. Moreover, the folio number is linked to the PAN card, so worrying is unnecessary.

Where Can I Find My Folio Number for a Particular AMC?

If you’re investing in a mutual fund from an Asset Management Company (AMC) like HDFC Mutual Fund or ICICI Prudential Mutual Fund, locating your folio number is relatively straightforward. Every investor is assigned a unique folio number by the AMC, which is tied to their PAN. Here’s how it works:

- Unique Folio for Each AMC:

- If you are invested in multiple AMCs, you will have a separate folio number for each one. For instance, if you invest in 7 different AMCs, you’ll have seven folio numbers.

- This folio number can be used for all your investments under that specific AMC, whether in equity, debt, or liquid funds.

- Handling Multiple Folios in the Same AMC:

- Over time, you may create multiple folios within the same AMC. Don’t worry—AMCs allow you to consolidate these folios into one for better record-keeping. Simply write to the AMC requesting to merge the folios, and they’ll handle it for you.

- Folio Number as a Reference Point:

- Your folio number is a central reference for all your investments with that AMC. It helps the AMC check and track the units you hold under that number.

- You can also use your folio number to quickly get a complete list of your investments with that AMC, saving time and effort.

- Importance of a Unique Folio:

- A unique folio number eliminates the need to redo the KYC process every time you transact with the same AMC. It’s a simple and effective way to streamline your mutual fund investments.

Advantages of Having a Folio Number:

A folio number is like your unique ID for mutual fund investments, and it comes with several benefits that make your investing journey easier and more efficient:

- Easy Tracking: With a folio number, you can monitor all your investments under the same fund house without juggling multiple account details. This simplifies monitoring across various schemes you might have invested in.

- Hassle-Free KYC: Once your folio is linked to your PAN, you don’t need to repeatedly go through the Know Your Customer (KYC) process for new investments with the same fund house. It’s a one-and-done process, saving time and effort.

- Simplified Transactions: Buying, selling, or switching between funds becomes much easier when all your investments are tied to a single folio number.

- Saves Time and Energy: Instead of managing multiple account numbers and details, a folio number centralizes everything, making your life simpler.

- Flexibility: You can have multiple folio numbers with the same fund house if you prefer to segregate investments for better organization—for example, one for long-term goals and another for short-term needs.

- Seamless Growth: As the mutual fund industry expands, the number of folios reflects investor confidence fueled by digital accessibility and regulatory reforms. It shows how more people recognize mutual funds as an intelligent way to diversify, grow wealth, and participate in the economy.

- Professional Management: Through your folio, you get access to professional fund managers who handle your investments, helping you achieve better returns without navigating the market yourself.

- Customizable Numbers: Folio numbers are often a mix of letters and numbers, tailored to ensure unique identification, making every investor’s journey secure and personalized.

Who Decides and Allocates the Folio Number?

The folio number is a unique number generated and allocated by the Asset Management Company when you invest in a mutual fund. The folio number is linked to your Permanent Account Number (PAN). Think of it like a bank account number for mutual funds. The fund company uses this number to keep track of your holdings. It’s like a unique code that links all your investment details together for a fund.

How do you find the Folio Number for Mutual Funds?

To find the folio number for your mutual funds, you can follow these steps:

- Check your Consolidated Account Statement (CAS): Your AMC provides this statement, which usually mentions the folio number in the top corner.

- Review your Mutual Fund Account Statement. Whether you transact through SIPs or lump sum investments, the folio number is typically mentioned on the statement.

- Contact the AMC: To get your folio number, call the AMC’s toll-free number, send them an email, or visit their office.

- Visit the AMC’s Website or Mobile App: Sign in to your account and find the folio number in the portfolio section.

- Consult Your Broker or Financial Advisor: They can help you find the folio number and provide you with the necessary information.

By following these steps, you can easily find your folio number and use it to check your mutual fund status, track your investments, and make informed decisions about your mutual fund portfolio.

Frequently Asked Questions

Yes, a folio number is a mandatory requirement for investing in mutual funds, as it is used to track the investor’s investments and transactions.

Yes, an investor can have multiple folio numbers with different mutual funds or AMCs.

No, a folio number is a unique identification number that cannot be changed. However, an investor can merge multiple folio numbers into one by submitting a request to the AMC.

Yes, a folio number is necessary for the redemption of mutual fund units as it helps to identify the investor’s holdings.

Yes, a folio number can be used for tax purposes as it helps to track the investor’s investments and transactions for tax reporting purposes.

Folio numbers are for mutual funds. Thus, you cannot use folio number to check shares.

Recommended Read: Capital Gain Statement

- What is the Folio Number in Mutual Funds?

- What is a Folio Number?

- Importance of Folio Number in Mutual Fund Investment

- 5 Ways to Check Mutual Fund Status with Folio Number

- Where Can I Find My Folio Number for a Particular AMC?

- Advantages of Having a Folio Number:

- Who Decides and Allocates the Folio Number?

- How do you find the Folio Number for Mutual Funds?

- Frequently Asked Questions

Show comments