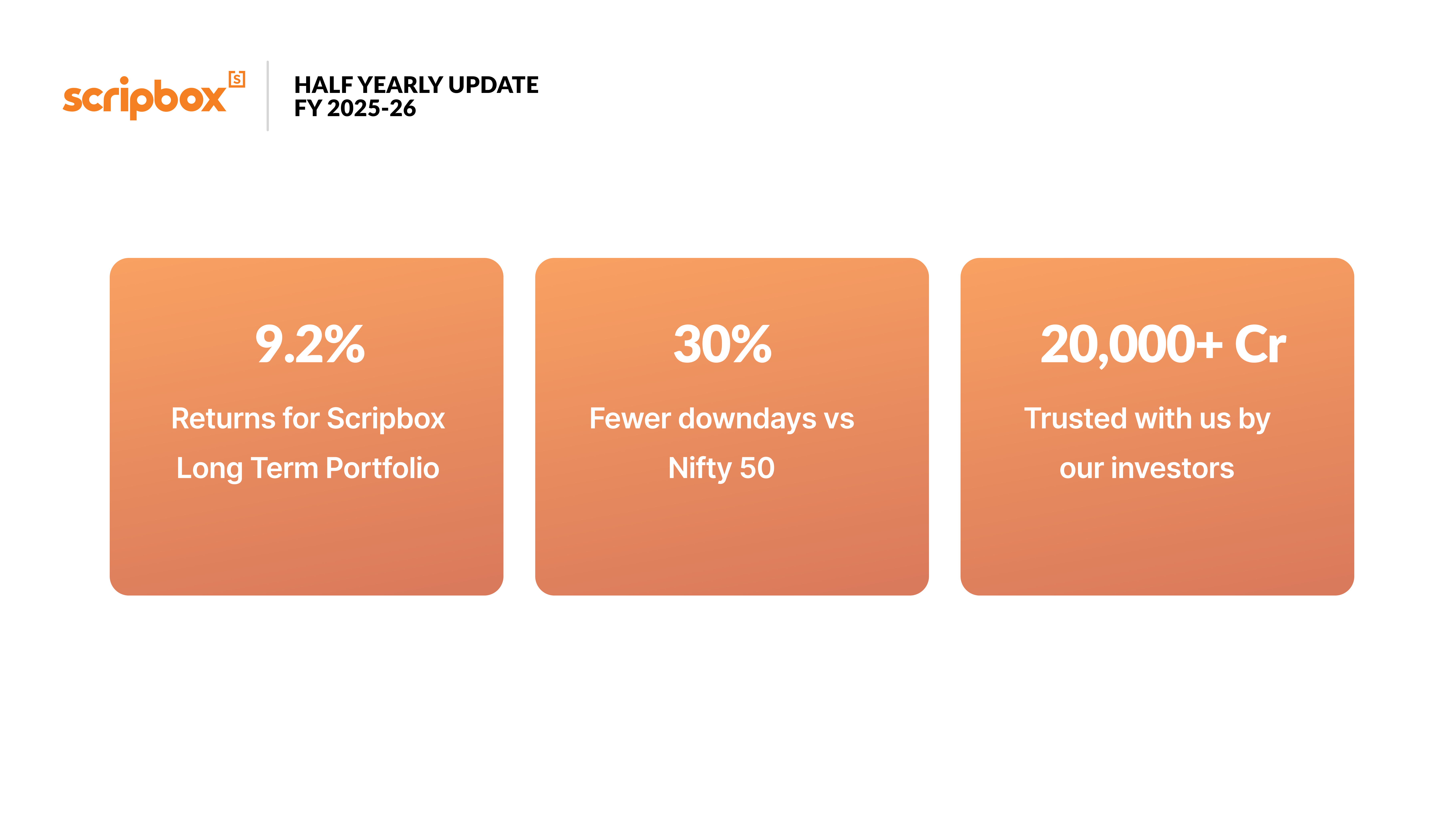

2025-26 Half Yearly Update: Performance of Scripbox Recommended Mutual Fund Portfolio

The first half of FY ’26 was all headlines—tariffs, border flashes, rate-cut surprises—yet through the chatter our Long Term Portfolio delivered 9.2% returns against Nifty’s 7.1%.

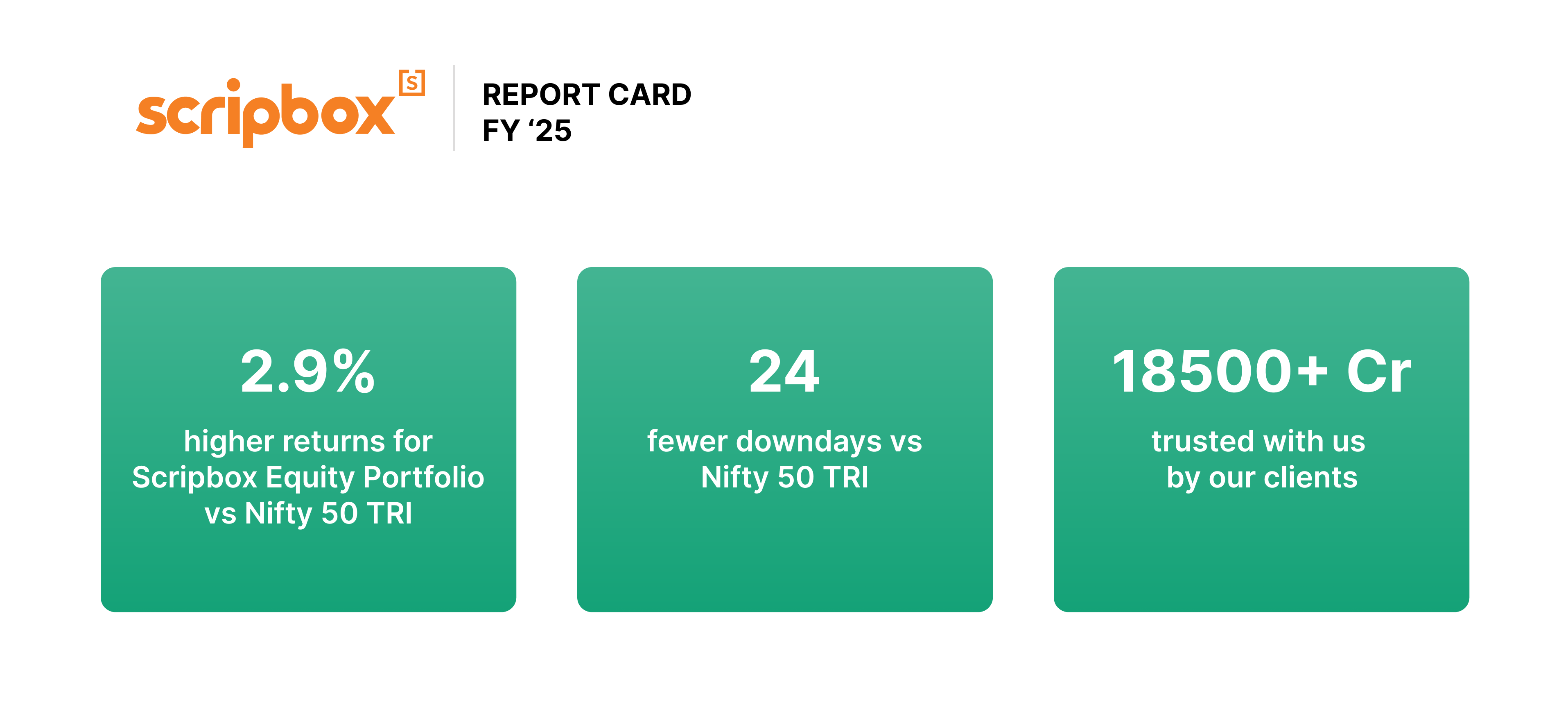

2024-25 Report Card: Performance of Scripbox Recommended Mutual Fund Portfolio

In a year that tested investors’ resilience and long-term commitment, the Scripbox Equity Portfolio not only weathered the storm but thrived by outperforming the benchmark Nifty-50 index.

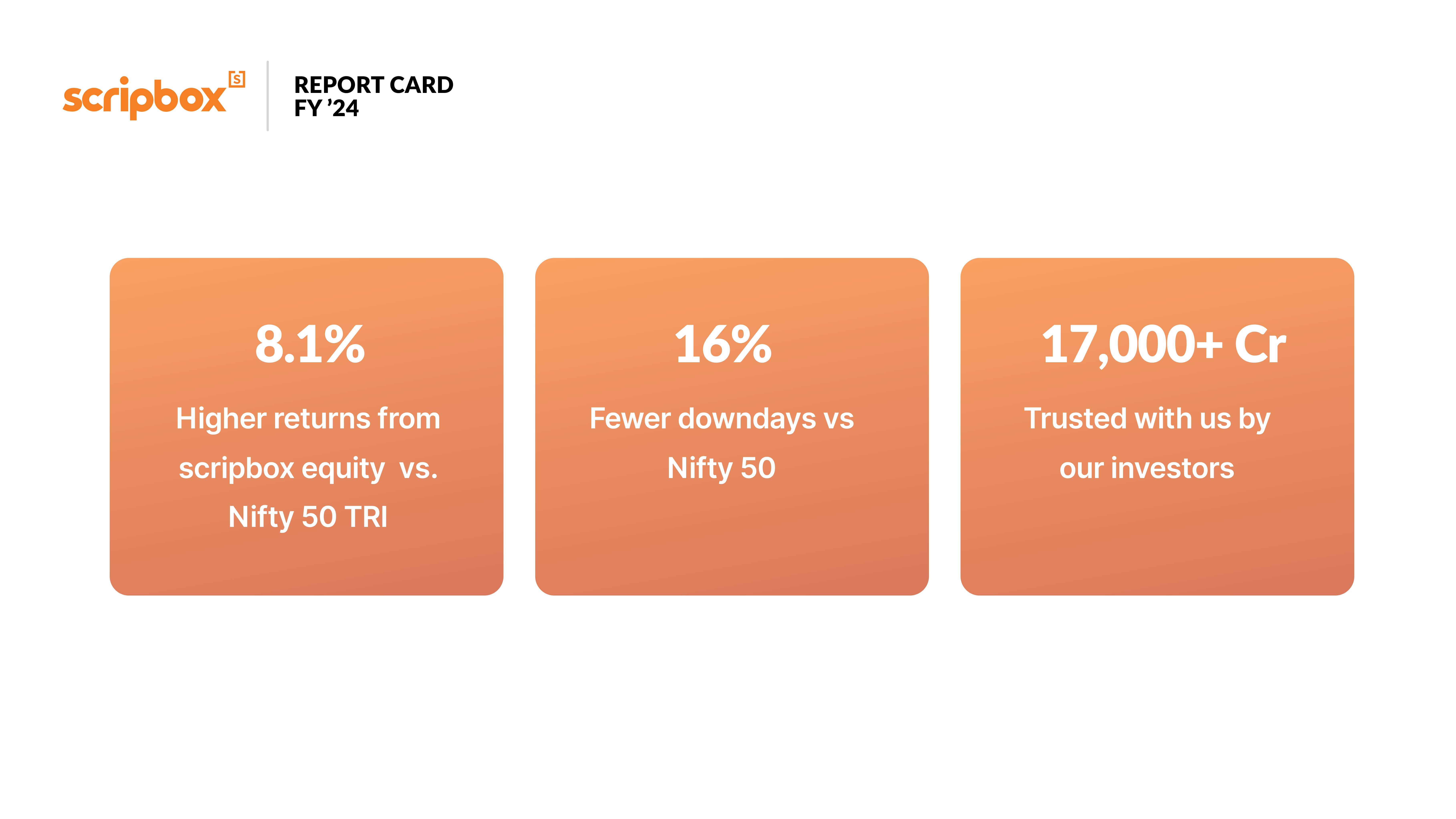

2023-24 Report Card: Performance of Scripbox Recommended Mutual Fund Portfolio

In FY ’24, when equity markets thrived, Scripbox’s carefully selected equity funds outperformed Nifty 50 TRI.

2022-23 Report Card: Performance of Scripbox Recommended Mutual Fund Portfolio

Here’s how the Scripbox recommended set of funds performed last year.

2021-22 Report Card: Performance of Scripbox Recommended Mutual Fund Portfolio

Here’s how the Scripbox recommended set of funds performed last year.

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

2020-21 Report Card: Performance of Scripbox Recommended Mutual Fund Portfolio

Here’s how the Scripbox recommended set of funds performed last year.

2019-20 Report Card: Performance of Scripbox Recommended Mutual Fund Portfolio

How you measure your rate of return can make a significant difference in terms of how you assess an investment.

2019 Report Card: Performance of Scripbox Recommended Short Term Money (Debt Mutual Funds) Portfolio

Scripbox debt index has returned 8.43% in the past year (Aug 18 – Jul 19) while the Fixed deposit rate for the said period has been around 6.25%. There was an outperformance of the Scripbox funds to the tune of...