The Indian Equity Market will end FY20 in the red. The Large Cap Index (Nifty 50 TRI) was down by 33.7% and the broader market index Nifty Large Mid 250 TRI was down 34.4% as on 23rd March 20. The Corona Pandemic has led to a stock market rout across the globe and the Indian market has seen the effects of the same.

Over the long run, the case for Indian equities remains strong and equities as an asset class will continue to outperform fixed income.

With the current structure in the financial services sector, we believe that debt mutual funds continue to be the right investment vehicle for the short term needs of investors and they offer significant advantages to other fixed income investment options.

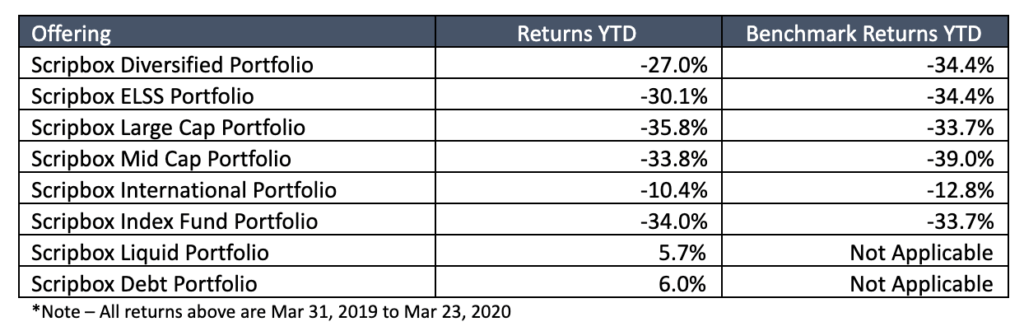

Report Card:

1. The core idea of Scripbox

Scripbox is designed to provide investors with a best in class investment platform that ensures that their savings are channelized into the right set of funds and thereby allow them to achieve their financial goals.

Our deep domain expertise combined with our research process has helped us build a proprietary algorithm that allows us to curate investment portfolios for our customers. Each portfolio will constitute a collection of mutual funds and we believe that these portfolios have a high probability to deliver returns that are superior to their benchmark indices.

All incremental investments will be in the latest set of funds, whereas some of the older investments will continue unless there are specific reasons to exit these funds.

At Scripbox we continue to track and monitor each fund very closely and we will reach out to our customers when we believe that an action is required from a portfolio change perspective.

2. Equity Market Performance

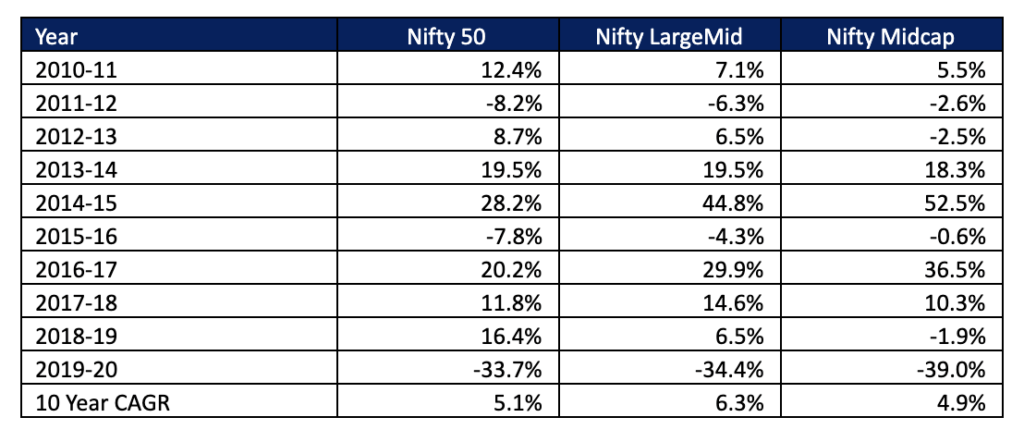

- In the financial year 2019-20 (till Mar 23, 2020), the Nifty 50 was down 33.7%, Nifty Large-Mid 250 was down 34.4% and Nifty Midcap 100 was down 39%.

- Over the last decade, the Nifty 50 has returned a CAGR of 5.1% whereas Nifty Large-Mid returned a CAGR of 6.3%

- Given where the markets are currently, we believe that there is a negative bias in the performance numbers since the returns reflect a point in time picture

- We continue to believe that the case of Indian equities remains strong and equities as an asset class will continue to outperform fixed income over the long run.

As history has shown us over and over again, when the market swings with extreme force, the downside is also quite stretched.

3. Mutual Fund Industry

The top 25 funds by assets delivered a Median return of -34.2% in the current year indicating a marginal outperformance over the Nifty 50 TRI and a marginal underperformance over the Nifty LargeMid 250 TRI. The MidCap focussed indices lagged their large cap peers by a reasonable margin.

As markets evolve, active funds tend to find it difficult to beat the benchmark returns. The ability to generate returns in excess of the benchmark is also known as the ability to generate Alpha.

We believe that while the Indian market is developing quite fast, we strongly believe that the opportunities to generate Alpha are still available and there are fund managers who are capable of doing so.

4. Funds recommended by Scripbox – by Category

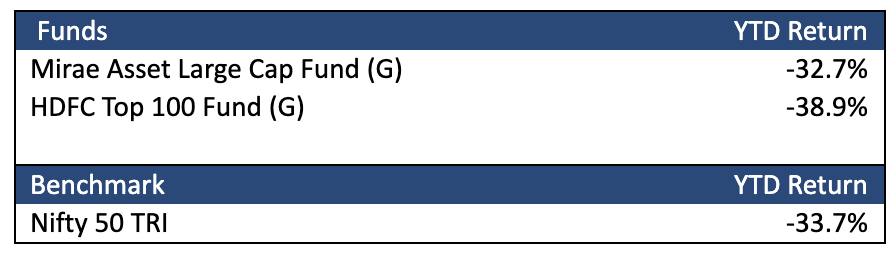

A. Large Cap Funds:

Mirae Asset Large Cap Fund outperformed the benchmark while HDFC Top 100 Fund underperformed the benchmark

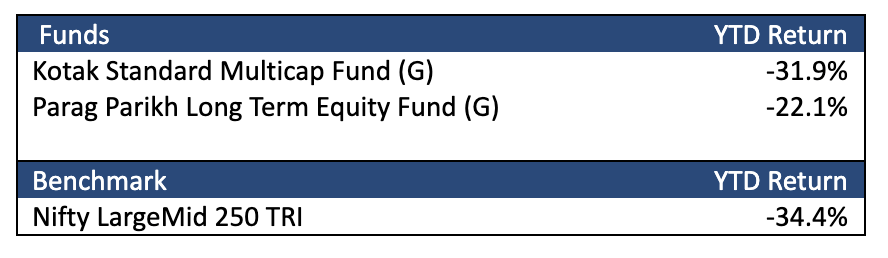

B. Diversified Funds:

Both Funds recommended in the category have outperformed the benchmark Index

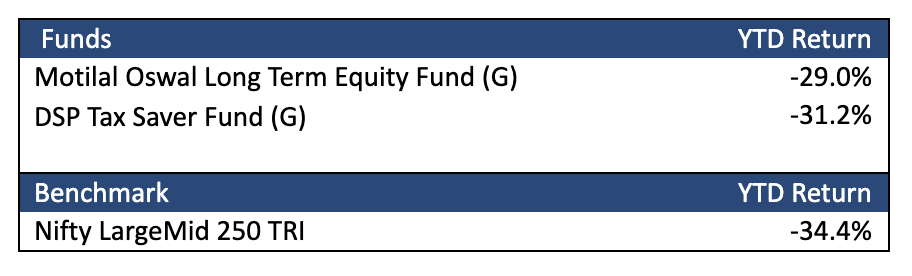

C. ELSS Funds:

Both the funds recommended in the category have outperformed the benchmark index

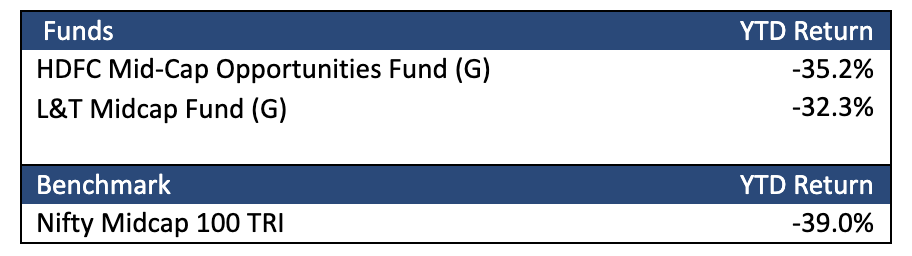

D. Midcap Funds:

Both the funds recommended in the category have outperformed the benchmark index

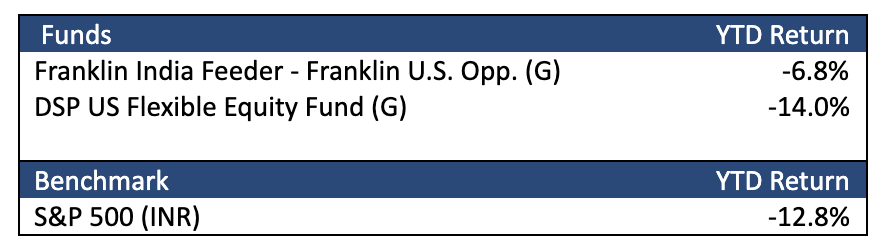

E. International funds:

Given the exposures that these funds provide (US Equity); investors should expect the performance of these funds to be divergent from the Indian Market. These funds can be used to provide an uncorrelated return to the overall portfolio and thereby reduce risk.

Of the two funds recommended in this category, one fund outperformed and another underperformed the benchmark Index in INR terms.

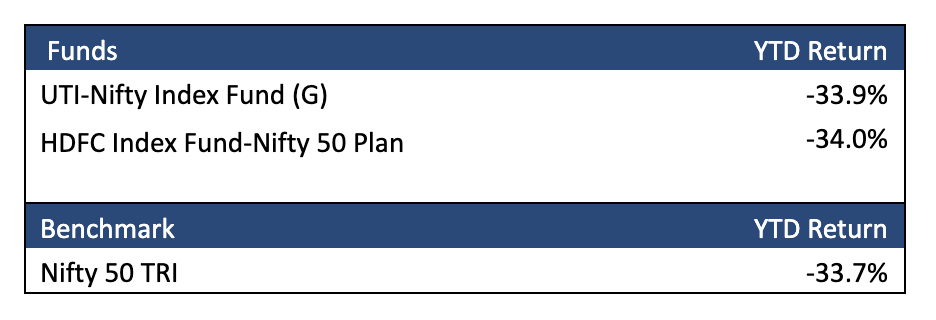

F. Index Funds:

Both the funds recommended in this category performed in line with the benchmark Index. Investors should not expect a result that is very divergent from the benchmark that these funds track.

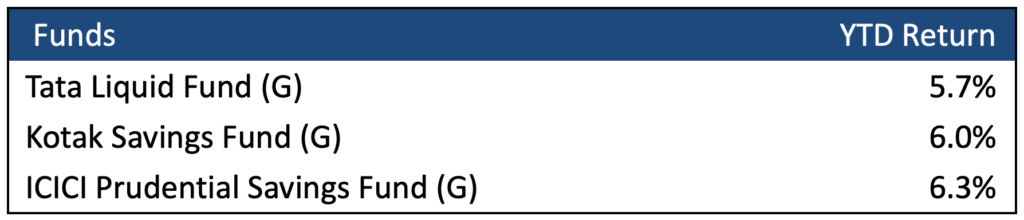

G. Liquid Funds:

We recommend that our customers hold their emergency reserves in a portfolio of Liquid Funds. These funds tend to offer the best levels of capital protection.

H. Debt Funds:

We recommend that our customers hold their fixed income investments in a portfolio of debt funds. We recommend that these funds be spread across the three categories Liquid, Ultra-Short and Low Duration. These funds tend to offer high levels of capital protection and are expected to beat FD Returns

Note : All the benchmarks returns are based on Total Returns Index

You can read last year’s report card here.

Show comments