Gold ETF vs Gold Sovereign Bond

Gold is the most coveted and desired asset for Indians. The yellow metal is not just used as an asset for consumption in the form of jewellery but also for investment purposes. Investing in gold helps in diversifying an investment...

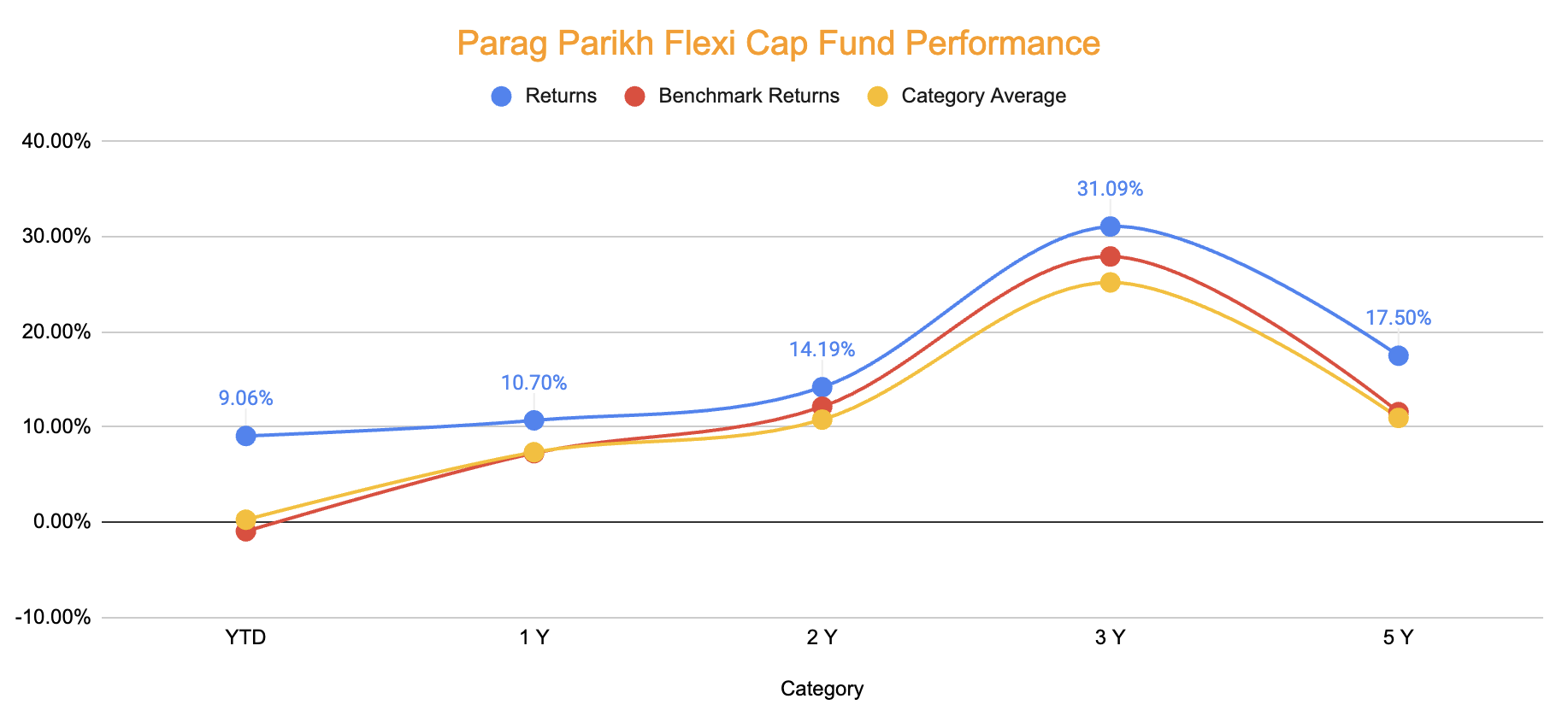

Parag Parikh Flexi Cap Fund Portfolio & Performance Review

Parag Parikh Flexi Cap Fund is among the popular and well-managed funds in the flexi cap category. The fund has a unique investment strategy that combines value investing and international diversification. The fund has delivered a return of 18.02% over...

Smart Beta Funds

Exchange-traded funds (ETFs) are pooled marketable securities that function very similarly to mutual funds. Unlike mutual funds, you can buy and sell exchange-traded funds (ETFs) on the stock exchange, similar to conventional stocks. A smart beta ETF expands on a...

Growth vs Dividend Reinvestment

Fund houses offer multiple options for investing in mutual funds based on investor’s needs. Investors who prefer getting regular income have the dividend option. While investors who want to stay invested for long horizons have the growth and dividend reinvestment...

Difference Between Bonds and Bond Funds

Bond and bond funds are debt schemes. Bonds are debt instruments that earn fixed income, i.e., generate stable returns for the investors. The investor buys bonds from the bond issuer for a predetermined duration. The bond issuer promises to pay...

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

Balanced Fund

What is Balanced Fund? Balanced funds or Balanced Hybrid Funds are a type of hybrid fund. They are open-ended balanced schemes investing in both equity and debt instruments. As per SEBI regulations, these funds have to invest 40%-60% of assets...

What are Target Maturity Funds – Advantages & Disadvantages

What are Target Maturity Funds? Target Maturity Funds (TMF) are index-tracking debt funds that invest in bonds. Target maturity funds assist investors in navigating the risks associated with debt funds. These funds align their portfolios with the fund's maturity date....

Dividend Payout Ratio

A company’s dividend payout policy is the decision about the distribution of the company’s profits to its shareholders. A dividend payout policy of a firm is a financial decision that involves decisions on dividend payout ratio, and the frequency of...