1. Announcement by Mirae Mutual Fund:

As per a recent notification by the fund house, the following changes are being implemented from May 1, 2019.

- Mirae Asset India Equity Fund will be renamed Mirae Asset Large Cap Fund.

- The fund was earlier categorised as a ‘Multi-cap fund’, which meant that it could invest across large, mid and small caps. With this change, it will be categorised as a ‘Large Cap fund’. This means, it will predominantly invest in large cap stocks only.

2. About the fund:

- The fund has been in existence since April 2008. Currently it has a total Assets Under Management of nearly Rs 10,500 cr.

- Though it is a multi-cap fund, more than 85% of the assets are invested in large companies. As per SEBI classification, a “Multi-cap” fund should invest more than 65% of its assets in equities, whereas a “Large-cap”, should invest more than 80% of its assets in large cap stocks.

- It is important to note that the fund’s current portfolio composition is closer to it being a “large-cap” oriented fund rather than a “multi-cap” fund.

- Therefore this change by the fund house reflects the fund’s current composition. Based on how it is managed, we don’t see any material impact for investors from the perspective of the investor objectives.

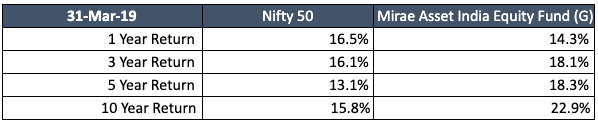

3. Performance:

- Mirae Asset India Equity Fund is currently a component in Scripbox selection of funds and it has performed well over both the medium and longer term.

- Existing holder of the fund will continue to hold the fund in the portfolio.

- For new investors and incremental investments, based on their overall asset allocation and portfolio composition, we will evaluate the fund against its peers in ‘Large-cap’ and decide on the allocation.

Note : All annualised returns.

Show comments