What is a Mutual Fund?

Mutual fund is a financial instrument that pools money from different investors. The pooled money is then invested in securities like stocks of listed companies, government bonds, corporate bonds, and money market instruments.

As an investor, you don’t directly own the company’s stocks that mutual funds purchases. However, you share the profit or loss equally with the other investors of the pool. This is how the word “mutual” is associated with a mutual fund.

You get the advantage of the expertise of the fund manager and regulatory safety of the Securities Exchange and Board of India (SEBI). The professional fund manager ensures a maximum return to investors.

Definition and Overview

A mutual fund is a type of investment vehicle that pools money from many investors to invest in a diversified portfolio of stocks, bonds, and other securities. Mutual funds allow individuals to invest in a variety of assets with a single investment. They provide a way for individuals to access a wide range of investment opportunities that may not be available to them otherwise. Mutual funds are managed by professional investment managers who make investment decisions on behalf of the fund’s shareholders.

How do mutual funds work?

A mutual fund (MF) is when people pool their money to invest in a mix of assets. The MF full form stands for “mutual fund,” and its meaning is all about shared investing. Instead of putting all your money in one place, you spread it across many investments. This way, you don’t risk everything on a single stock or bond.

You don’t have to monitor the stock market yourself. Professional fund managers handle that for you. They research, pick the investments, and keep track of the market. This makes mutual funds popular with many types of investors. But what exactly are mutual funds? They are pooled investments managed by professionals, offering diversification and reducing risk.

An Asset Management Company (AMC) runs the mutual fund. They gather money from investors like you and invest it in different things, such as stocks, bonds, and other securities. This gives you diversification, spreading your money to lower risk.

With mutual funds, you can invest in assets like government bonds that might be hard to buy. Expert fund management can also help you earn more than a regular savings account or fixed deposit.

When you invest in a mutual fund, you get units that show your share of the fund. The value of your investment depends on the Net Asset Value (NAV), which changes with the market. If the NAV goes up, your investment grows. If it goes down, your investment loses value.

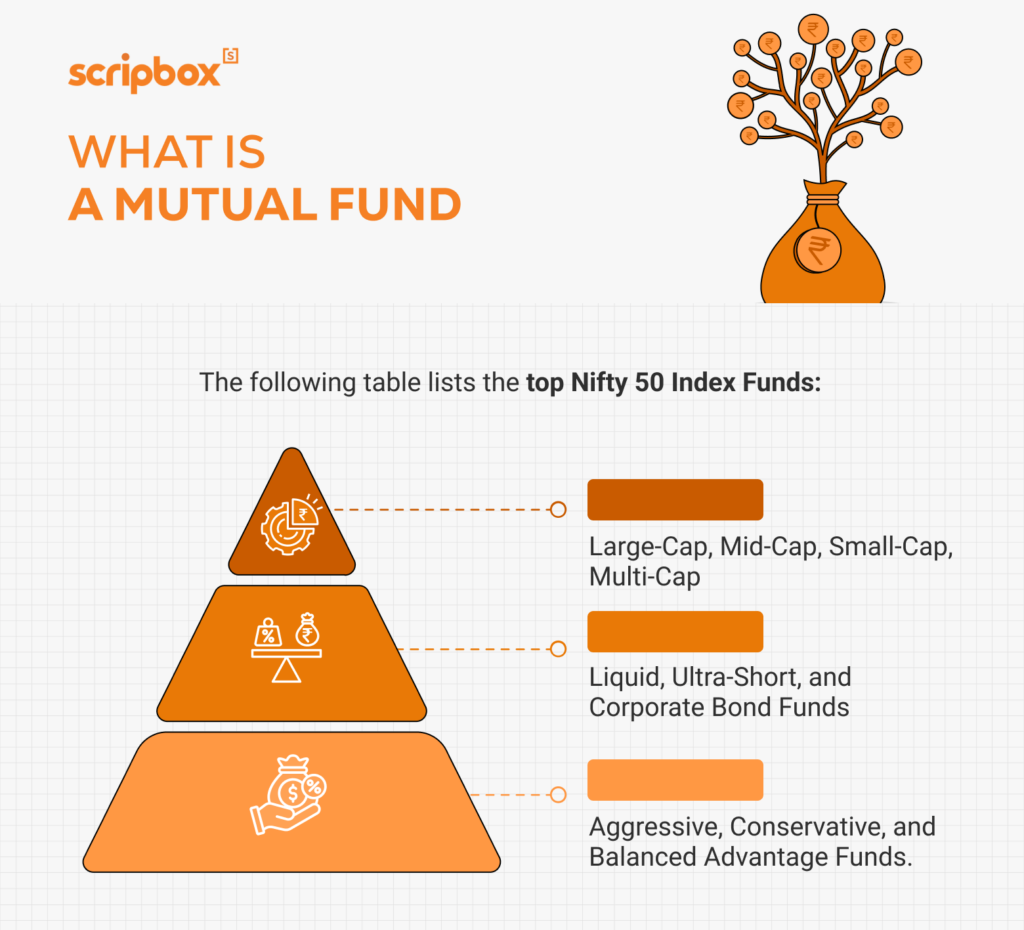

Types of Mutual Funds Based on Asset Class

Investors should select mutual funds based on their financial objectives and risk appetite. Proper mutual fund selection helps them meet their life goals within a defined time period by aligning with the fund’s investment objectives and strategies.

Mutual fund type depends on the defined objective and the underlying asset. Following are the categories of mutual funds:

- Equity Mutual Funds

Equity mutual funds invest pooled money mainly in stocks of different companies. Hence, they have an inherent higher market risk. Factors like earnings, revenue forecasts, management changes, and company and economic policy impact price movements and returns. Returns from equity funds fluctuate widely. Hence, you should invest if you understand the asset class risks associated with equity.

Types of Equity Funds

Equity funds can be further categorized depending on market capitalization and sectors.

- Based on Market capitalization, large-cap Equity Funds Invest in shares of well-established companies with a track record of performing consistently over a more extended period. These companies have sound fundamentals and are least affected by business cycles.

- Mid-cap Equity funds Invest in shares of mid-cap companies. Mid-sized companies have relatively lower performance stability but the potential to grow more than large-cap companies.

- Small-cap Funds—Invest in shares of small-cap companies. Small-cap companies have the highest potential to grow or fail. Thus, small-cap funds have a high-risk exposure but offer the opportunity to generate the highest returns.

- Multi-cap funds – Invest in a defined proportion across all market caps. Based on cues and trend analysis, the fund manager allocates aggressively to capitalize on the volatility.

- Sector-Based Equity Funds: Sector-based equity funds invest in stocks of a specific sector—for example, sectors like FMCG, technology, and pharma. Sector funds are prone to business cycle risk and sector getting out of focus.

2. Debt Mutual Funds

A debt mutual fund invests a significant portion of the pooled corpus in debt instruments like government securities, corporate bonds, debentures, and money-market instruments. Bond issuers “borrow” from investors by guaranteeing steady and regular interest income. Thus, debt funds are less risky than equity funds. The debt fund manager ensures that the fund invests in the highest-rated securities. The best credit rating signifies the issuer’s creditworthiness regarding regular interest payments and principal repayment.

Who Should Invest in Debt Funds?

Debt funds have less volatility and range-bound returns than equity funds. Thus, they are safer for conservative investors who are looking to grow wealth with minimal risk.

In fact, the interest income and maturity amount are known beforehand. Thus, debt funds are best for short-term (3 to 12 months) and medium-term (3 to 5 years) investment horizons.

Type of Debt Funds

Following are the debt funds available in India:

- Dynamic Bond Funds: The investment basket of a dynamic bond fund comprises both shorter and longer maturities. The debt fund manager aggressively tweaks the portfolio composition based on changing interest rate regimes, making the debt fund dynamic, hence the name.

- Liquid Funds: The short maturity of the underlying securities (not more than 91 days) makes the liquid funds almost risk-free. It is better than parking funds in savings bank accounts as it gives better returns with much-needed liquidity. You can redeem liquid funds almost instantly. If you are a short-term investor, debt funds like liquid funds could be better as you get 6.5 to 8% returns. Liquid funds are an effective tool to meet emergency fund needs.

- Income Funds: Fund managers invest heavily in securities with longer maturities to achieve greater stability and regular interest income flow. Most income funds have an average maturity of 5 to 6 years.

- Short-Term and Ultra Short-Term Debt Funds: There is another category in the maturity range of 1 to 3 years. The fund manager makes a call on the interest rate regime and invests in securities with maturity in that range. This is suitable for investors who are risk-averse and looking for interest rate movement safety.

- Gilt Funds: Gilt funds invest only in high-rated government securities. Since the government rarely defaults, they have zero risks. You can park your money in this instrument to have assured returns over a more extended maturity range.

- Credit Opportunities Funds: Credit Opportunity Funds are a relatively riskier instrument that focuses more on higher returns by holding low-rated bonds or taking a call on credit risks. The fund manager of credit opportunity funds relies more on interest rate volatility to earn higher returns.

- Fixed Maturity Plans: These closed-ended debt funds invest in fixed-income securities like government bonds and corporate bonds. You invest only during the initial offer period, and your money remains locked in for a fixed tenure, which could be months or years.

Types of Mutual Funds Based on Investment Objectives

Here’s a detailed look at the various mutual fund types:

1.Growth-Oriented Funds

Objective: To achieve wealth creation over the medium to long term through capital appreciation.

Investment Strategy: Allocate over 65% of the assets to equities or equity-related instruments.

Suitable For: Investors seeking higher returns and willing to accept higher levels of risk over a longer investment horizon. These funds are ideal for those looking to understand a mutual fund that can offer substantial growth.

2. Income-Oriented Funds

Objective: To provide regular income through interest or dividend payments.

Investment Strategy: These funds are mainly invested in fixed-income securities such as government bonds, corporate bonds, debentures, and money market instruments. They focus on assets that offer steady and predictable returns.

Suitable For: Investors looking for lower risk and regular income, such as retirees or individuals needing periodic cash flow. While these funds offer stability, they have limited potential for significant wealth creation over the defined period.

3. Balanced Funds (Hybrid Funds)

Objective: To achieve a balance between growth and income with lower risk.

Investment Strategy: Allocate 60% of the assets across equities and debt instruments.

Suitable For: Balanced funds are a good option for those exploring investing with a moderate risk profile.

4. Liquid Funds (Money Market Funds)

Objective: To ensure liquidity, capital protection, and reasonable income in the short term.

Investment Strategy: Investments are made in short-term, high-quality debt instruments like government securities, treasury bills, certificates of deposit, commercial paper, and inter-bank call money. The typical maturity period is up to 91 days.Suitable For: These funds are ideal for those seeking minimal risk and high liquidity.

Advantages of Investing in Mutual Funds

Investing in mutual funds (MF) offers several benefits to help you achieve your financial goals. Whether you’re looking for growth, income, or safety, there’s a mutual fund type that suits your needs. Here’s why mutual funds are a wise investment choice:

- Expert Money Management

Your money is managed by professional fund managers with expertise in the financial markets. They research and select the best stocks, bonds, and other securities to include in the fund. This means you don’t have to worry about how to invest in mutual funds effectively—they do it for you. Mutual fund share pricing and redemptions occur only at the end of each trading day, providing a structured timing for transactions.

2. Low Cost

Mutual funds are cost-effective investments. The expenses are shared among all investors, and regulations cap the expense ratio at 2.5%. This low cost gives you more value for your money compared to investing on your own.

3. Systematic Investment Plan (SIP) Option

With a SIP, you can start investing with as little as Rs. 500. You can set up weekly, monthly, or quarterly automatic investments. Using a SIP mutual fund calculator can help you plan your contributions and estimate potential returns.

4. Flexibility to Switch Funds

If a mutual fund isn’t performing as expected, some schemes let you move your investment to another fund. However, always review any charges or conditions tied to the switch to avoid unexpected costs.

5. Diversification

Mutual funds reduce risk by distributing your investment across a mix of assets. By doing this, you can minimize the risk in case of any loss.

6. Ease of Investment and Redemption

Managing mutual funds is straightforward. You can buy, sell, or redeem units based on the current Net Asset Value (NAV). Upon redemption, the funds are typically credited to your bank account within a few business days.

7. Tax Advantages

Funds like Equity Linked Savings Schemes (ELSS) provide tax-saving benefits. Under Section 80C of the Income Tax Act, you can claim deductions of up to ₹1.5 lakh annually, combining tax savings with potential long-term wealth generation.

Lock-in Period Advantages – Some mutual funds have a lock-in period, especially close-ended schemes. You may benefit from long-term capital gains tax rates, which are usually lower.

Mutual Fund Fees

Mutual fund fees are charges deducted from the fund’s assets to cover the costs of managing the fund. These fees can include management fees, administrative costs, and marketing expenses. The fees are typically expressed as a percentage of the fund’s average net assets and are deducted from the fund’s returns.

Operating Expense Ratio (OER)

The Operating Expense Ratio (OER) measures the fund’s operating expenses as a percentage of its average net assets. The OER includes management fees, administrative costs, and marketing expenses. A lower OER can help increase investors’ returns.

Load

A load is a one-time commission charged by some fund companies when an investor buys or sells shares of a mutual fund. Depending on the fund, the load can range from 1% to 5.75% or more. The load can impact the net return of the investment.

Evaluating Mutual Funds

Evaluating mutual funds involves researching and comparing different funds to determine the best fit for an investor’s goals and risk tolerance. This can include looking at the fund’s investment objectives, fees, and performance history.

Watch Out for “Diworsification”

“Diworsification” is an investment term for when too much complexity can lead to worse results. Many mutual fund investors tend to overcomplicate matters by acquiring too many funds that are too similar. As a result, they lose the benefits of diversification. To maximize returns, it’s essential to keep a balanced portfolio and avoid over-diversification.

How to Invest in Mutual Funds?

Investing in mutual funds (MF) effectively grows your wealth through professional management and diversification. Understanding the MF complete form and MF meaning is essential before you begin. Here are some professional and informative methods on how to invest in mutual funds:

- Direct Investment with Fund Houses

You can invest directly by visiting the branch office of the mutual fund company, also known as the Asset Management Company (AMC). You can fill out the form, provide the KYC documents, and submit a cheque or demand draft for your investment amount. Alternatively, download the form from the AMC’s website, fill it out carefully, and submit it in person or by mail.

2. Online Mutual Fund Investment Platforms

Online platforms have made investing in mutual funds convenient and accessible. With a mobile phone and an internet connection, you can choose from various mutual funds based on your financial goals, risk appetite, and investment horizon. These platforms often provide tools like a SIP mutual fund calculator to help you plan your investments through Systematic Investment Plans (SIPs). SIPs allow you to invest a fixed amount regularly, starting from as low as Rs. 500.

You’ll need your PAN card details, identity proof, and an active bank account to link with your investment account. Select the mutual fund scheme, verify your KYC, and pay online.

3. Using a Demat Account

If you have a Demat account for trading stocks, you can also use it to invest in mutual funds.

Log in to your Demat account, navigate to the mutual funds section, and select the schemes you wish to invest in. Complete the transaction by transferring the investment amount online. Investing through a Demat account centralizes your holdings, making tracking and managing your investment portfolio easier.

4. Through Registrars like Karvy and CAMS

Registrars and Transfer Agents (RTAs) such as Karvy and CAMS facilitate online and offline mutual fund investments. For online investments, go to the RTA’s website, sign up for an account, and enter your folio number if you already have investments. Then, choose the mutual fund schemes you want and complete the payment process.

For offline investments, visit the nearest RTA office, fill out the application form, and submit it along with a canceled cheque and your KYC documents.

RTAs work with many mutual fund companies, making it easier for you to invest in different types of funds through a single platform.

5. Through Mutual Fund Agents or Distributors

Mutual fund agents or distributors can provide personalized assistance in choosing and investing in mutual funds. Ensure the agent is registered with the Association of Mutual Funds in India (AMFI) and verify their credentials before proceeding.

Taxation on Mutual Funds

When you sell your mutual fund units, you realize capital gains are subject to taxation based on how long you’ve held the units. According to the Finance Ministry’s changes in the Union Budget of 2024, the tax rates are now as follows:

Equity Funds

- Short-Term Capital Gains (STCG): Taxed at 20% if units are sold within one year.

- Long-Term Capital Gains (LTCG): If units are held for more than one year, gains exceeding Rs. 1.25 lakh are taxed at 12.5%.

Debt Funds

- Short-Term Capital Gains (STCG): Taxed according to the investor’s income tax slab if units are sold within three years.

- Long-Term Capital Gains (LTCG): Taxed 12.5% without indexation benefits if units are held for over three years.

Is Mutual Fund Tax-Free?

Mutual funds are not entirely tax-free. Depending on factors such as the type of fund, holding period, and gains, investors may be subject to taxes like capital gains tax on their mutual fund investments.

What Are the Tax Implications of Investing in Mutual Funds?

The tax implications of mutual funds depend on the type of fund and the holding period:

- For Equity Funds:

- STCG Tax: 20% if units are sold within one year.

- LTCG Tax: 12.5% on gains exceeding Rs. 1.25 lakh if units are held for more than one year.

- For Debt Funds:

- STCG Tax: As per the investor’s income tax slab if units are sold within three years.

- LTCG Tax: 12.5% without indexation on gains if units are held for over three years.

How to Invest in Mutual Funds Through Scripbox

Mutual fund investment through Scripbox is a quick, paperless and hassle-free experience. Following are the steps to invest;

Step 1 – Visit Scripbox and Get Started

Click “Let’s Get Started” on the Scripbox home page. The page will scroll down to show you different objectives.

Mutual fund schemes fulfill most of the financial objectives. You can pick the objective that aligns with your financial needs.

For example, we have taken “Start a SIP” to invest in the best equity and debt mutual funds.

Step 2 – Create a Plan

You will be prompted to create a plan to invest in mutual funds here.

Provide the investment amount and number of years needed to create a plan. The hypothetical example shows a SIP of Rs. 8000 and 10 years as the stay-invested period.

Click on “Create a plan” to proceed.

Step 3 – Choose Between “Long Term Wealth” and “Short Term Money”

Scripbox gives you two options to build wealth. You have the option to pick one of them.

Long-Term Wealth: The plan invests in risky equity for aggressive investors.

Short-Term Money: The plan invests in safe debt & money market instruments and is for risk-averse investors.

The example selected is the “Long Term Wealth” option, where you will get plan details indicating the best mutual funds and the expected returns.

Click on “Continue” to proceed with fund investment.

Step 4 – Account Creation and Login

You can invest through Scripbox by creating an account. You will need an email ID and password.

You can also create the account using your Facebook or Google account.

Step 5 – Plan Confirmation

When you log in, you will see the plan below.

Click on “See Recommended Funds” to proceed with mutual fund investment. Next, you will see the list of the algorithmically selected best mutual funds and investment amounts.

You can either accept the selection or change the funds and amount. To do so, click “I Want to change funds/amount.”

Click the tab “Next” to proceed with payment.

Step 6 – Bank Details and Money Transfer

You need to provide the Bank account and PAN details necessary for investment. The account will be used for investment and the mutual fund houses will credit the redemption amount directly into your specified bank account.

Explore our article on factors affecting the mutual funds performance

Frequently Asked Questions

A mutual fund is a financial instrument that pools money from different investors. The pooled money is then invested in securities like stocks of listed companies, government bonds, corporate bonds, and money market instruments. The expert and professional fund management help investors outperform the returns of traditional investment vehicles like bank savings accounts and fixed deposits.

Mutual funds are definitely a very good investment option for investors who are looking for a diversified investment. Investors who do not have the time and expertise to shortlist, invest and track their investments can consider investing in funds. Mutual funds are managed by professional experts who dedicate their time to build a portfolio of different asset classes. Moreover, one can start their investment through small amounts. Also, they can regularly invest through SIPs and develop disciplined investment habits. Mutual funds do not have any lock-in period, and hence the redemption process is hassle-free.

Furthermore, mutual funds offer a variety of schemes that suit a diverse range of investors. In other words, investors who seek to get equity exposure can invest in equity funds. While investors who like to limit their equity exposure can either invest in debt funds or hybrid funds.

Therefore, mutual funds are for everyone who wishes to start their investment journey with the help of professional fund managers. They are also suitable for investors who lack time to manage their investments. Moreover, the returns from funds in the long term have been promising for its investors.

Mutual fund investments are subject to market risks. In other words, mutual fund investments are market-linked and hence are subject to market volatility. Therefore, no mutual fund is 100% safe. However, mutual funds are regulated by the Securities Exchange and Board of India (SEBI), and default risk is nil. Mutual funds have varying levels of volatility. In other words, equity funds majorly invest in equities and are highly volatile to the changing market dynamics. On the other hand, debt mutual funds invest across different debt instruments issued by the government and corporates and hence are comparatively less volatile than equity mutual funds.

Unlike bank deposits or government bonds, mutual funds do not guarantee returns. Moreover, in the long term, mutual funds have the capacity to earn high returns in comparison to traditional investment options. Therefore, investors who understand the markets and have the capacity to undertake some volatility can invest in mutual funds.

The Securities Exchange and Board of India (SEBI) is the regulatory body for mutual funds. SEBI strives to protect investor interests. The Association of Mutual Funds in India (AMFI) is association of all the Asset Management Companies of SEBI-registered mutual funds in India. It also ensures best business practices and code of conduct and represents SEBI, RBI, and the Government of India on all matters concerning the mutual fund industry.

Relevant Pages

- What is a Mutual Fund?

- How do mutual funds work?

- Types of Mutual Funds Based on Asset Class

- Types of Mutual Funds Based on Investment Objectives

- Advantages of Investing in Mutual Funds

- Mutual Fund Fees

- Evaluating Mutual Funds

- How to Invest in Mutual Funds?

- How to Invest in Mutual Funds Through Scripbox

- Frequently Asked Questions

- Relevant Pages

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

Show comments