A systematic Investment Plan (SIP) is a mutual fund investment mode. One can choose either the lump sum investment route or the SIP route to invest in mutual funds. In SIP, investors can invest in mutual funds at regular intervals. SIP and long-term investing are the best combination for earning good returns.

Furthermore, SIPs also help in rupee cost averaging, as the investor invests across all the market cycles. There are many types of SIPs available in the market. Choosing the right SIP is the key to accumulating wealth. This article covers the 7 different kinds of SIPs and guides you in selecting the best SIP.

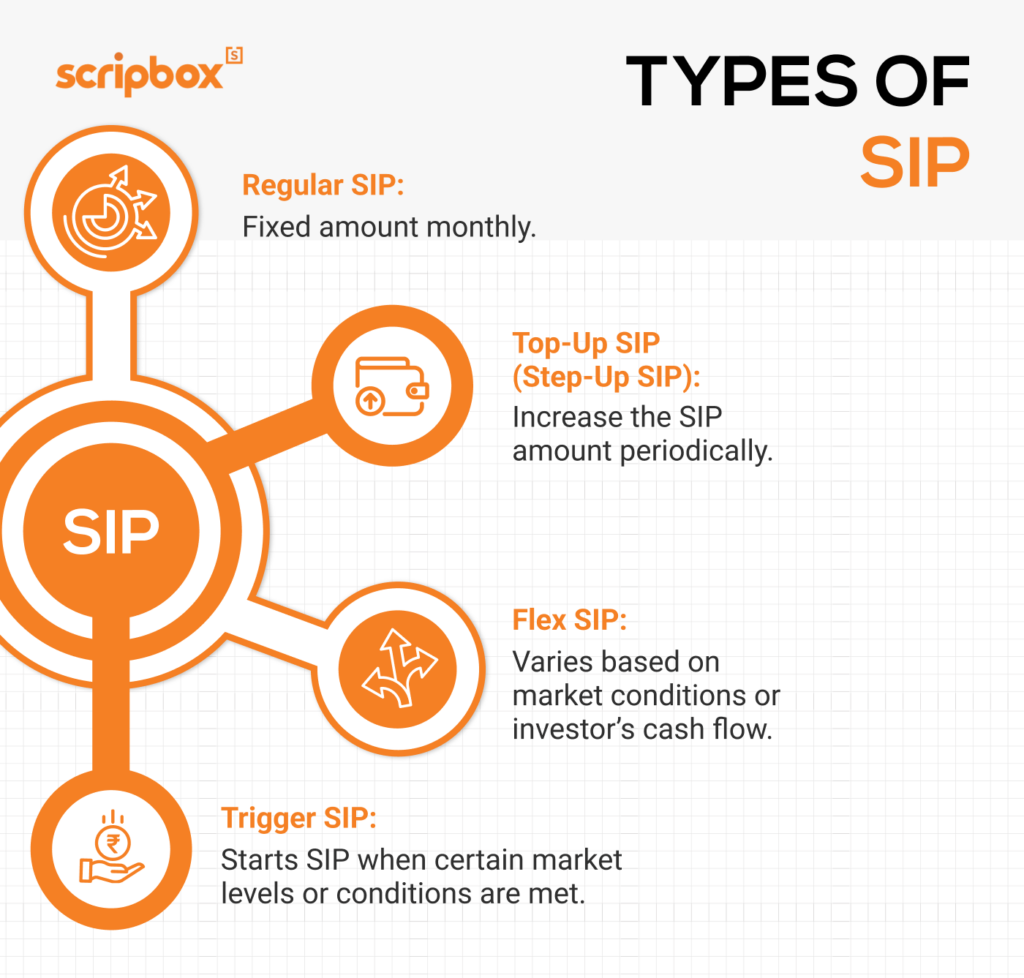

7 Different Types Of SIP

SIPs allow investors to adopt a disciplined way of investing with just a one-time mandate, and various types of systematic investment plans are available. Through SIP, one can make investments every month or quarter. Investing in SIP will help investors to generate significant returns in the long run. However, choosing the right kind of SIP is the key. Following are the 7 different types of SIP investments available in India:

- Regular SIP

- Top-up SIP

- Flexible SIP

- Perpetual SIP

- Trigger SIP

- SIP with Insurance

- Multi SIP

Estimate your mutual fund returns with SIP Calculator

What is a Systematic Investment Plan?

A Systematic Investment Plan (SIP) is a popular investment option that allows individuals to invest a fixed amount of money at regular intervals in a mutual fund scheme. It is a disciplined approach to investing in mutual funds that enables investors to build wealth over time.

Definition of SIP

A SIP is an investment plan that allows investors to invest a fixed amount of money at regular intervals, such as monthly, quarterly, or annually, in a mutual fund scheme. This systematic way of investing in mutual funds helps to reduce the impact of market volatility and timing risks, making it a preferred choice for many investors.

Benefits of SIP

SIPs offer several benefits to investors, including:

- Rupee Cost Averaging: SIPs help reduce the impact of market volatility by averaging the cost of investment over time.

- Disciplined Investing: SIPs encourage disciplined investing by regularly committing a fixed amount of money.

- Long-term Wealth Creation: SIPs help to create wealth over the long term by investing regularly in a mutual fund scheme.

- Flexibility: SIPs offer flexibility regarding investment amount, frequency, and tenure, allowing investors to tailor their investments to their financial goals.

How SIP works

SIPs work by investing a fixed amount of money at regular intervals in a mutual fund scheme. The investment amount is deducted from the investor’s bank account and invested in the chosen mutual fund scheme. Depending on their risk tolerance and investment goals, investors can choose to invest in various mutual fund schemes, including equity, debt, and hybrid schemes.

1. Regular SIP

A regular SIP is the simplest type of investment plan. Under this SIP, the investor invests a fixed amount at regular intervals. The SIP frequency can be monthly, bi-monthly, quarterly, or half-yearly. Furthermore, there are daily and weekly SIPs as well. However, these are not highly recommended ones. When choosing an SIP, investors can specify the SIP duration, installment amount, and frequency. In a regular SIP, you can mention the SIP duration, installment amount, and frequency, but you cannot change the investment amount during the tenure of the investment.

2. Top-up SIP

Top-up SIP or Step-up SIP allows investors to increase their SIP amount periodically. Many asset management companies have a provision to step up SIPs. Choosing a step-up SIP adds more flexibility to the recurring contributions and helps investors in parking bigger amounts. In other words, when an investor’s income increases, they can simultaneously increase their SIP contributions to save higher amounts. This will help them create their investment corpus faster because of the power of compounding. Therefore, it is advisable to choose SIP plans that offer this facility to top up the investments.

Furthermore, one can step up their SIP plans in multiples of INR 500. For example, if an investor is investing INR 10,000 in a mutual fund scheme and opts for a step-up every one year by INR 1,000. The SIP amount from the 13th month onwards will become INR 11,000. A regular top-up of the mutual fund investments will enable investors to generate their investment corpus sooner. Moreover, it also helps in reducing the effects of inflation on the maturity corpus.

3. Flexible SIP

As the name suggests, a flexible SIP allows investors to alter their investment amount. It is also known as Flexi SIP or Flex SIP. One can inform the fund house about changes in the SIP amount or contributions. However, the intimation has to be given at least a week before the deduction date of the SIP installment. Investors can adjust their SIP amount based on their financial or market conditions. There is a pre-decided formula for market conditions that allows investors to invest more when the markets are falling and reduce the SIP amount when the markets are high.

For example, if an investor faces a cash crunch, they can inform the fund house to halt their SIP payments until further notice. This allows investors to skip their SIP installments without defaulting. Similarly, an investor with surplus cash can increase their SIP amount for a particular duration. Therefore, per the investor’s instructions, the fund house can adjust the SIP amounts.

4. Perpetual SIP

While filling out the SIP application form, the investor has to select the tenure of the SIP. If no tenure is specified, then the SIP becomes a perpetual SIP. In other words, the SIP will continue until the investor instructs the fund house or the manager to stop the investments. Also, if an investor doesn’t wish to limit their contributions with a maturity tenure, they can voluntarily choose the perpetual SIP option in the application form. This allows the investor to stay invested for longer and observe the market. And, in the future, they can decide to redeem anytime.

5. Trigger SIP

Trigger SIP is suitable only for those investors who are well aware of the market dynamics and are sure of its movements. In this type of systematic investment plan, knowing when to take the buy and sell positions is very important. Under this type of SIP, investors can set their SIP start date or redeem or switch their SIP once the selected event occurs. The trigger can be set to any event. For example, a favorable market event, an index level or NAV of the fund, or capital appreciation or depreciation. Also, it is essential to note that the trigger SIP is recommended only for experienced investors as it incites speculations. Having sound knowledge and experience is essential to effectively setting appropriate triggers.

6. SIP with Insurance

A few asset management companies offer insurance cover if an investor opts for long-duration investments. The initial cover for the insurance is usually ten times the first SIP amount, and it gradually increases with time. Also, this feature is available only for equity mutual funds. It is important to note that term insurance is just an add-on feature and doesn’t impact the fund’s performance.

7. Multi SIP

A multi-SIP allows investors to start investing in multiple schemes of a fund house through a single instrument. This helps investors in diversifying their investment portfolio. Furthermore, it also reduces the amount of paperwork needed. Investors can give a single form and payment instructions to start their SIP plans.

Which Type of SIP is Best to Invest with Example?

Which of the above seven types of SIP is the best? That depends on the investor’s goals, income, and knowledge. A regular SIP best suits all kinds of investors with a regular income source who prefer saving up for a secure future. A step-up SIP helps reach the financial goal faster and accumulates a higher corpus as the investment increases yearly. A perpetual SIP is a regular SIP that continues till eternity. It can be both a regular and a step-up SIP.

Flexible SIP is suitable for people with varying income levels, such as professionals and freelancers. Trigger SIP only suits investors who know market dynamics. SIP with insurance is a new type of plan, and investors have few options. Investors should opt only for this type of plan if the fund performance is good and the life cover provided by the fund house is free. Multi SIP only works when a fund house’s mutual funds are giving good returns in their category.

SIP is an investment plan that allows investors to invest regularly. Through SIP, one has to invest the same amount periodically or increase the amount of SIP due to market dynamics or having additional income at hand. Therefore, we will compare a regular SIP and step-up SIP and see which one gives better returns over a period of time.

Example

An investor wants to accumulate a corpus of INR 15 lakhs in 10 years. He can invest in a regular SIP and a top-up SIP. Let’s see the returns and SIP amount needed for a regular and step-up SIP. Let us assume he tops up his SIP by 10% each year.

Regular SIP

- Investment: INR 5,000 a month

- Tenure: 10 years or 120 months

- Total investment: INR 6,00,000

- Expected return: 12% per annum

- Expected maturity corpus: INR 11,61,695

- Return: INR 5,61,695

Step-up SIP

- Investment: INR 5,000 a month

- Tenure: 10 years or 120 months

- Total investment: INR 9,56,148

- Expected return: 12% per annum

- Expected maturity corpus: INR 16,87,163

- Return: INR 7,31,015

The returns from top-up SIP are higher than regular SIP for investing for the same tenure. If the investor wants to accumulate a corpus of 11.61 lakhs by doing a regular SIP, it would take ten years. However, in the case of a step-up SIP, the investor can reach the target of INR 11.61 lakhs in 8 years. Hence, a step-up SIP is the best as it allows investors to reach the target amount faster and combat the effects of inflation. As the purchasing power reduces with inflation, a higher maturity corpus will increase the investment’s actual return.

Check out our article on Best Date for SIP

Compare Regular SIP Vs Step Up SIP

| Particulars | Regular SIP | Step up SIP |

| Monthly SIP Amount | Rs. 10,000 | Rs. 10,000 |

| Duration | 5 Year | 5 Year |

| Annual Returns | 12% | 12% |

| Total Investment | Rs. 6,00,000 | Rs. 7,32,612 |

| Returns | Rs. 8,24,864 | Rs. 9,84,570 |

Which Type of SIP Should You Select and How?

Investors should select a SIP type that best suits their financial requirements, knowledge, and goals. A regular SIP allows investors to invest in an SIP regularly without a pause or top-up. A step-up SIP will increase the investment amount of SIP every year. Perpetual SIP is a SIP till eternity. Investors with regular income can invest in all these SIPs.

A Flex SIP best suits investors with irregular income. Freelancers, professionals, and people with no job security can consider investing in this SIP as they have the freedom to increase, decrease, pause, and restart the SIP as they wish.

A Trigger SIP best suits an investor who understands the market and its dynamics—an investor who doesn’t understand investing or how the market works shouldn’t pick a trigger SIP.

A multi-SIP allows investors to invest in different funds of a fund house. However, not all fund houses’ funds tend to perform well, so investors have to exercise caution while selecting this type of systematic investment plan.

Factors to Consider When Choosing SIP

When choosing a SIP, investors should consider the following factors:

- Investment Goals: Determine your investment goals, such as long-term wealth creation, retirement planning, or saving for a specific goal. Your goals will guide your choice of SIP.

- Risk Tolerance: Assess your risk tolerance and choose a SIP that aligns with your risk profile. Different mutual fund schemes have varying levels of risk.

- Investment Horizon: Consider your investment horizon and select a SIP that matches your time frame. Longer investment horizons can often tolerate more risk.

- Fees and Charges: Be aware of the fees and charges associated with the SIP, including management fees, entry loads, and exit loads. These can impact your overall returns.

Tips for Maximizing SIP Benefits

To maximize the benefits of SIP, investors should follow these tips:

- Start Early: Begin investing in a SIP as early as possible to take advantage of the power of compounding.

- Invest Regularly: Commit to investing regularly in a SIP to benefit from rupee cost averaging.

- Monitor and Adjust: Regularly monitor your SIP and adjust the investment amount, frequency, or tenure as needed to stay aligned with your financial goals.

- Diversify: Diversify your SIP portfolio by investing in a variety of mutual fund schemes to reduce risk and enhance potential returns.

By considering these factors and following these tips, investors can make the most of their systematic investment plans and work towards achieving their financial objectives.

Discover More

Show comments