The money market and capital market are two major components of the Indian financial system. The money market caters to short term liquidity needs, while the capital market provides a platform for long term investing. The instruments of the money market have a maturity of less than one year. In contrast, capital market instruments have a maturity of more than one year. This article covers money market vs capital market, their features, and types in detail.

Money Market vs Capital Market: Key Differences

The following table summarizes the key differences between money market and capital market:

| Basis of Difference | Money Market | Capital Market |

| Purpose | To meet working Capital Requirments | Become part of the asset base of the firm. |

| Function | Short-term credit requirements | Long-term credit requirements |

| Nature of the Market | Informal | Formal and Regulated |

| Classification | No subdivision | Primary Market and Secondary Market |

| Instruments | T-Bills, Commercial Papers, CDs, etc. | Bonds and Stocks |

| Mode of Transaction | Over the Counter | Exchange |

| Liquidity | More liquid than capital market instruments. | Less liquid than money market instruments. |

| Maturity Period | 1 day to 1 year | No stipulated time |

| Risk | Low risk | High Risk |

| Investment Duration | Short term | Long term |

| Returns | Stable Returns | Market Linked |

| Participants | Banks and Financial Institutions | Stockbrokers, MFs, retail investors, insurance companies, stock exchanges, underwriters, etc. |

| Relevance to Economy | Helps increasing liquidity | Helps mobilize savings |

What is a Money Market?

A money market is where short-term loans and investments lasting less than one year are traded. These investments are highly liquid, meaning they can quickly turn into cash. Examples include treasury bills and certificates of deposit.

Interest rates in the money market often serve as benchmarks for other debts and guide central bank policies. The purpose of the money market is to meet the economy’s immediate cash needs by enabling quick borrowing and lending.

Key players include central banks, regular banks, and financial institutions. Individuals and companies can also invest in money market instruments like treasury bills.

Understanding the money market is important when comparing the money market to the capital market. While the money market focuses on short-term funds, the capital market deals with long-term investments like stocks and bonds.

Features of Money Market

The money market has several key features:

- Short-term funds: These deal with funds for a short term, usually less than one year. This means investments are quickly returned or repaid.

- High Liquidity: Assets can be easily converted into cash, and investors can access their money whenever they need it.

- Electronic Transactions: Trades happen through phone, email, or text messages, which makes them fast and efficient.

- No Brokers Needed: Transactions occur directly between parties. This reduces costs and simplifies the process.

- Key Participants: Includes commercial banks, non-banking financial companies, and the central bank. These institutions help manage the flow of short-term funds.

- Financial Stability: The high liquidity and low risk of money market instruments contribute to overall financial stability.

Types of Money Market Instruments

Following are the different types of money market instruments:

Treasury Bills (T-Bills)

The Reserve Bank of India issues Treasury Bills (T-Bills) on behalf of the central government to raise funds. T-bills are short-term financial instruments with a maximum maturity period of one year. There are 14-day, 91-day, and 364-day T-bills. They are issued at a discount and repaid at par on maturity.

Bills of Exchange or Commercial Bills

Businesses issue bills of exchange to meet their short-term money requirements. The creditor can discount their bill of exchange with a broker or a bank. Bills of exchange are highly liquid instruments, as they are transferable from one person to the other.

Commercial Papers (CP)

Large businesses and corporations issue Commercial Papers (CPs) to raise capital to meet their short-term business requirements. These corporations have high credit ratings, a security measure against unsecured commercial papers. CPs have a fixed maturity that ranges from 7 days to 270 days. Furthermore, investors can trade CPs in the secondary market.

Certificate of Deposits (CD)

Corporates, scheduled commercial banks, trusts, and individuals issue Certificates of Deposits (CDs), which are negotiable term deposits. Commercial banks accept them, and they work similarly to a promissory note. The duration of a CD varies from three months to one year, while CDs issued by financial institutions have a longer duration that varies between one year and three years.

Repurchase Agreements

Repurchase Agreements, also known as repos, are legal agreements between two parties. One party sells a security to another with the promise of purchasing it back from the buyer at a later date. The seller buys back the security at a prefixed date and amount. The interest rate that the buyer charges is the repo rate. Repos are a quick way to raise short-term capital requirements that also earn good returns for the buyer.

Banker’s Acceptance

Banker’s Acceptance is a financial instrument that an individual or a business creates in the name of a bank. The issuer has to pay the instrument bearer a specific sum on a specific date, usually between 30 and 180 days after the issue. As a commercial bank guarantees the payment, it is a safe financial instrument.

Call and Note Money

In a Call Money scenario, the funds are borrowed for one day. On the other hand, in a Notice Money market, the funds are lent for up to 14 days. Both options do not have any collateral security. Cooperative banks and commercial banks borrow and lend funds in call-and-note money markets. Mutual funds and financial institutions are the only lenders of funds.

Investing in the Money Market

Investing in the money market can be a strategic way to earn returns on your short-term investments while minimizing risk. Here are some key aspects to consider:

- Low Risk: Money market investments are generally considered low-risk, making them an attractive option for conservative investors. These instruments are backed by high-credit entities, reducing the likelihood of default.

- Liquidity: One of the standout features of money market investments is their high liquidity. This means you can easily convert your investments into cash when needed, providing flexibility and quick access to funds.

- Short-Term Returns: Money market investments typically offer short-term returns, ideal for those looking to earn interest over a brief period. This makes them suitable for parking funds temporarily while waiting for other investment opportunities.

- Flexibility: The money market offers a range of investment options, allowing investors to choose instruments that best meet their needs. Whether you prefer government-issued Treasury Bills’ safety or Commercial Paper’s slightly higher returns, there’s something for everyone.

What is a Capital Market?

In a capital market, people invest in financial instruments that last longer than a year. Companies and governments use it to raise long-term funds. Investors buy and sell assets like stocks, bonds, ETFs, and options.

The main goal is to turn savings into long-term investments, helping businesses grow. Capital markets use competitive pricing to show the value of financial securities.

In India, capital markets are well-regulated. They are riskier than money markets but can offer higher returns over time.

Key players include stock exchanges like BSE and NSE, banks, brokers, and insurance companies.

Understanding capital markets helps explain the difference between money and capital markets. While capital markets focus on long-term investments, comparing money and capital markets shows how both serve different financial needs.

Features of Capital Markets

The capital market has its own important features:

- Long-Term Investments: It deals with investments lasting more than one year. This helps businesses grow over time.

- Brings Together Borrowers and Savers: Connects companies needing funds with investors. This supports economic development.

- Use of Agents: Brokers or agents facilitate transactions. They help match buyers with sellers.

- Regulated by Government: Follows strict rules and regulations. This ensures fairness and transparency.

- Various Securities: Deals in both commercial and non-commercial securities. Investors have many options to choose from.

- Involvement of Foreign Investors: Allows participation from international investors. This brings more funds into the economy.

Types of Capital Markets

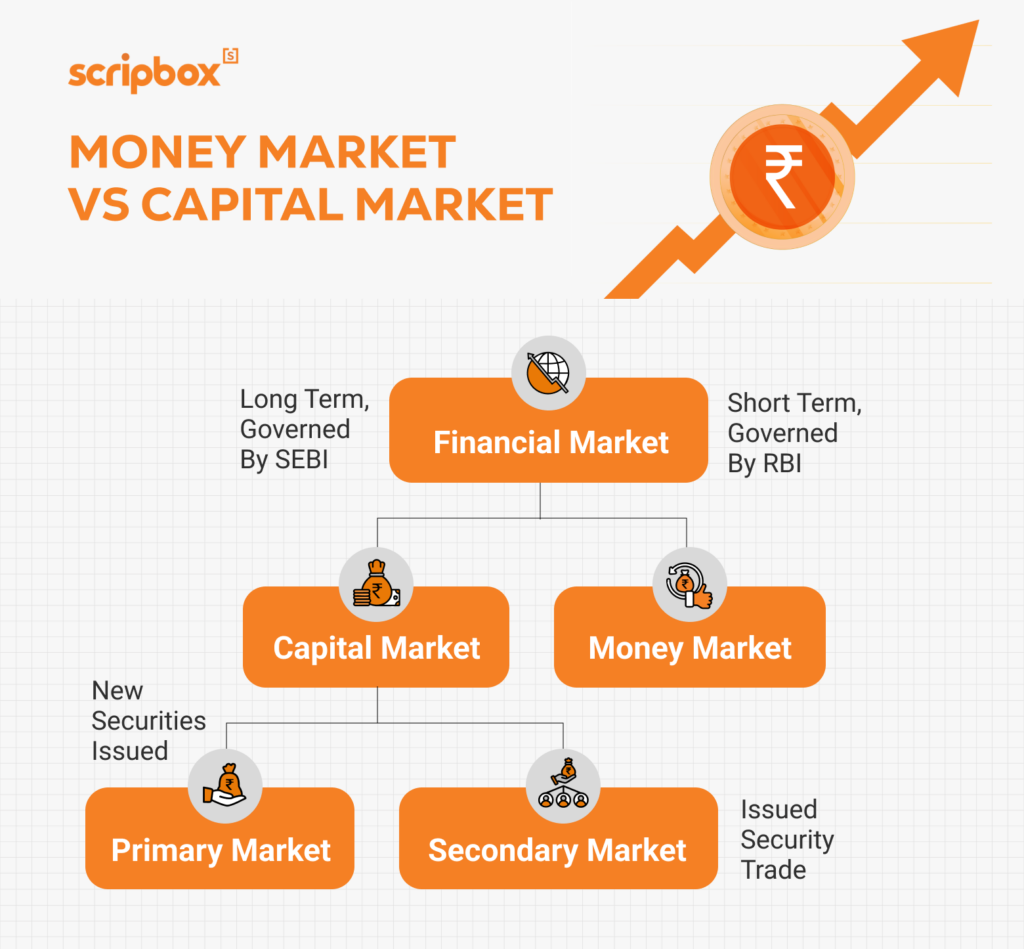

There are two types of capital markets: primary and secondary.

- Primary market: This is the new issue market, where companies issue shares for the first time through an IPO. Once the IPO succeeds, the company’s shares are listed on the stock exchange. Money in the primary market is raised through private placement, rights issues, and prospectuses. The money is raised for the company’s growth and expansion.

- Secondary market: It is a market for trading listed shares and securities. A stock exchange is usually the marketplace for buying and selling securities. In India, the major stock exchanges are the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), and a majority of equity trading and investments take place on these two exchanges. NSE and BSE are perfect examples of secondary markets.

Capital Market Instruments

There are two major types of capital market instruments, and they are bonds and stocks.

- Bonds: Bonds are debt securities that trade on the stock exchange. Companies and firms issue bonds to raise money for the growth and expansion of the company. Bonds are debt instruments, hence bondholders receive interest. At the end of the maturity period, the company pays back the principal amount along with interest.

- Stocks: Stocks represent ownership of a company. Each share is a part of the ownership of the company. Shares trade on the stock exchange, and the share price depends on market demand and supply. The person holding shares of a company is the shareholder. Shareholders receive dividends. Also, in the case of equity shares, they have voting powers and can vote for important decisions in the annual general meeting of the company. During liquidation, they get a share of the assets after the liabilities are paid off.

Difference Between Money Market and Capital Market

Following are the key differences between money market vs capital market:

Purpose

The money market funds help a firm to meet its working capital requirements. As a result, each company only borrows a small percentage of its overall asset base. On the other hand, funds raised through capital markets form the asset base of the firm.

Function

Money markets’ principal purpose is to offer short-term liquidity to the economy. The fundamental role of capital markets, on the other hand, is to channel the economy’s savings in a meaningful way to help growth and development.

Nature of the market

Money markets are informal markets, while capital markets are formal and regulated.

Instruments

Money market instruments include Bills of Exchange or Commercial Bills, Treasury Bills (T-Bills), Commercial Papers (CP), Certificate of Deposits (CD), Repurchase Agreements, Banker’s Acceptance and Call & Notice Money. Capital market instruments include bonds and stocks.

Mode of transaction

Most money market instruments are sold over the counter through brokers who help parties find counterparties. On the other hand, most capital market transactions happen through exchanges. Dealers facilitate the transactions on the exchanges.

Liquidity

Money market instruments are more liquid in comparison to capital market instruments. Though capital markets have market makers, most money market instruments are highly liquid and generate good returns. Since the maturity of the money markets is lesser, many investors are willing to invest their funds in the short term.

Maturity Period

The maturity period of the money market instruments ranges from one day to one year. While the capital market instrument’s maturity is long term, and there is no stipulated time period.

Risk

Money market instruments are short term investment options, and the funds raised from these instruments are not deployed in risky projects. As a result, money market instruments are popular low-risk investment options. Capital markets, on the other hand, invest the raised capital in long term projects. As a result, these instruments are perceived as riskier options.

Returns

The money market returns are equal to the cost of capital or the current interest rate in the economy. It’s uncommon for investors to make a profit that exceeds the interest rate. The potential profits in stock markets, on the other hand, are nearly unlimited. This might be linked to the longer-term duration as well as the risk that the investors are willing to undertake.

Participants

Banks and other financial institutions are the most active players in the money market. Banks typically seek short-term funding in order to demonstrate that they have the required reserves to make the loans. Other financial institutions, such as mutual funds and pension funds, must have a certain amount of liquid cash on hand as well. This is due to the fact that they must repay investors who wish to redeem their investments. Cash, on the other hand, yields no profit. The next best option is to invest in money markets. They’re so liquid and risk-free that they’re practically interchangeable with cash. The majority of investors are aware that they may simply convert their money market funds to cash without losing any of their investment value.

On the other hand, participants of the capital market are stockbrokers, mutual funds, retail investors, underwriters, insurance companies, commercial banks and stock exchanges.

Regulation and Oversight

Both the money market and capital market are subject to regulation and oversight by government agencies to ensure they operate fairly and efficiently. Here are some key regulatory bodies:

- Securities and Exchange Commission (SEC): The SEC is the primary regulator of the capital market in the United States. It oversees securities transactions, ensures market transparency, and protects investors from fraudulent practices.

- Financial Industry Regulatory Authority (FINRA): FINRA is a non-governmental organization that regulates member brokerage firms and exchange markets. It aims to maintain market integrity and protect investors by enforcing rules and standards.

- Reserve Bank of India (RBI): The RBI is the primary regulator of the money market in India. It manages monetary policy, regulates financial institutions, and ensures the stability of the financial system.

Impact of Geopolitical Events

Geopolitical events can significantly impact both the money market and capital market. Here are some key considerations:

- Volatility: Geopolitical events can cause volatility in both markets, making it challenging to predict returns. Events such as elections, conflicts, and trade negotiations can lead to sudden market movements.

- Risk: These events can increase risk in both the money market and capital market. Investors may face uncertainties that affect their investment decisions, making it crucial to diversify and manage risk effectively.

- Opportunities: While geopolitical events can introduce risk, they can also create opportunities for investors willing to take on more risk. Market disruptions can lead to undervalued assets, presenting potential investment opportunities.

By understanding the impact of geopolitical events, investors can better navigate the complexities.

Alternatives to Money and Capital Markets

While money and capital markets are vital parts of the financial system, there are other ways to invest.

Here are some main options:

- Cryptocurrency Markets: Digital currencies like Bitcoin and Ether offer a new investment method. They use blockchain technology and can provide privacy and potential profits. However, they are very volatile and not fully regulated. Since 2024, cryptocurrencies have become more accessible through capital markets due to the approval of Bitcoin and Ether ETFs.

- Real Estate: Real estate can provide steady rent income and might increase in value over time, although it requires substantial capital and comes with its own set of risks.

- Private Equity: Instead of buying shares of public companies, investors can invest in private companies or startups. This can offer different opportunities but may be riskier and less liquid.

- Peer-to-Peer Lending: Online platforms let people lend money directly to others or small businesses without using banks. Lenders might earn higher returns, and borrowers might get lower rates, but there’s a higher risk of not getting paid back.

- Commodities: Investing in gold, oil, or crops can diversify a portfolio. These can protect against inflation, but prices can change significantly. Some commodity investments are available through capital markets.

- Art and Collectibles: Items like valuable art, rare coins, or vintage cars can be investment options. They might grow in value, but they require special knowledge and can be hard to sell quickly.

Conclusion

Both the money market and capital market are essential for the economy. The money market handles short-term funds and helps with liquidity, making sure cash is available when needed. The capital market deals with long-term investments that help businesses grow over time. By understanding the difference between money market and capital market, you can decide which investment options are best for your financial goals.

Show comments