Micro Systematic Investment Plan (SIP) is an investment option introduced by mutual fund companies to attract more investors. The concept of Micro SIP allows individuals to invest in mutual funds in smaller amounts at regular intervals.

What is Micro SIP in Mutual Funds?

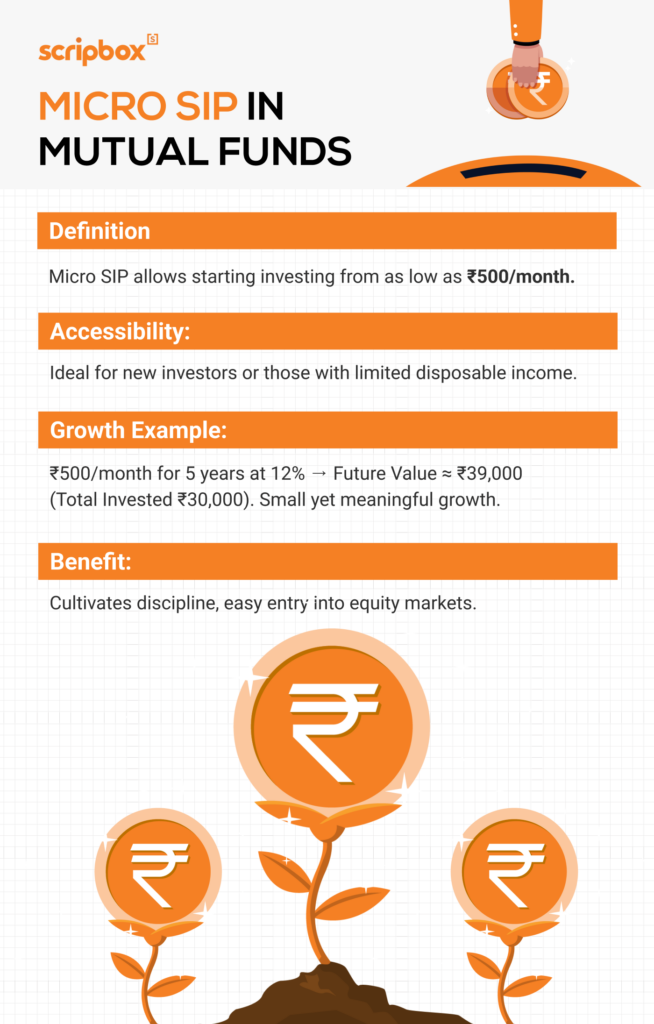

Micro SIP is a variant of the traditional SIP. It allows investors to invest smaller amounts at regular intervals, sometimes as low as Rs. 100. Micro SIP aims to help small investors who may not have large sums of money to invest in mutual funds to start investing with smaller amounts.

Micro SIPs can benefit low-income individuals, students receiving pocket money, and even children. Investors must know specific conditions, such as documentation requirements and investment limits for micro SIPs. By saving just Rs 100 to Rs 500 each month, anyone can accumulate substantial money without straining their finances. Thus, micro SIPs are a practical investment option for many individuals.

Understanding Micro SIP

Micro SIP is a type of Systematic Investment Plan (SIP) that allows individuals to invest small amounts of money at regular intervals in a mutual fund scheme. It is designed to make investing in mutual funds more accessible and affordable for small investors. With Micro SIP, investors can start investing with as little as Rs. 100 per month, making it an ideal option for those who want to invest small amounts regularly.

Micro SIPs are a variant of the traditional SIP, which requires a higher minimum investment amount. Micro SIPs are designed to help small investors who may not have large sums of money to invest in mutual funds. By investing small amounts regularly, investors can accumulate substantial money over time without straining their finances.

Mutual Funds with Minimum Sip Amount Rs. 500

| Fund Name | 5 Year Returns | AUM |

| Quant Tax Saver Plan | 25.6% | Rs. 4924 Cr |

| Canara Robeco Equity Taxsaver fund | 17.2% | Rs. 6137 Cr |

| Mirae Asset Tax Saver Fund | 17.1% | Rs. 17985 Cr |

| Bank of India Tax Advantage Fund | 20.40% | Rs. 888 Cr |

| Union Tax saver ELSS Fund | 17.2% | Rs. 708 Cr |

SEBI Regulations for Investing in Micro SIP

The Securities and Exchange Board of India (SEBI) regulates the mutual fund industry in India. According to SEBI, mutual funds can offer Micro SIPs with a minimum investment of Rs. 100 and a maximum investment amount of Rs. 50,000. The investment frequency can be monthly, quarterly, or half-yearly. The investment amount and frequency can be changed or stopped at any time by the investor.

Features of Micro SIP in Mutual Funds

The following are the key features of Micro SIP in Mutual Funds:

- Low Investment Amount: Micro SIPs allow investors to start investing with a small amount, as low as Rs. 100. This feature is useful for small investors who may not have a large sum of money to invest.

- Flexibility: Investors can change the investment amount and frequency at any time, depending on their financial situation.

- Diversification: Investors can choose to invest in multiple mutual fund schemes, which helps to diversify their portfolio.

- Compounding: Regularly investing in Micro SIPs can help investors take advantage of compounding, which helps them build a larger corpus over time.

Advantages of Micro SIP in Mutual Funds

The following are the advantages of Micro SIP in Mutual Funds:

- Low Cost: Micro SIPs have a lower investment amount, which means that investors can start investing with a smaller amount. This feature benefits small investors who may not have much money to invest.

- Disciplined Investing: Micro SIPs encourage disciplined investing, as investors must invest regularly. This feature helps investors to avoid the temptation of timing the market.

- Diversification: Micro SIPs allow investors to invest in multiple mutual fund schemes, which helps to diversify their portfolios. This feature helps to reduce the risk of investing in a single scheme.

- Long-term Investment: Micro SIPs are suitable for long-term investment goals like retirement planning or purchasing a house. Regularly investing over a long period helps build a larger corpus.

How to Invest in Micro SIP

Investing in Micro SIP is a straightforward process. Here are the steps to follow:

- Choose a mutual fund scheme that offers Micro SIP.

- Check the minimum investment amount and frequency of the Micro SIP.

- Fill out the application form and provide the required documents, such as a photo identification document and address proof.

- Set up a systematic investment plan with the mutual fund company.

- Invest the minimum amount regularly, either monthly, quarterly, or half-yearly.

Investors can also invest in Micro SIP through online platforms like the mutual fund company’s website or mobile app. This makes it easy to invest and manage investments from anywhere, at any time.

Choosing the Right Mutual Fund Scheme

When choosing a mutual fund scheme for Micro SIP, investors should consider several factors, such as:

- Investment objective: What is the investor’s investment objective? Is it to generate income, capital appreciation, or a combination?

- Risk tolerance: What is the investor’s risk tolerance? Are they willing to take on high-risk investments or prefer low-risk investments?

- Investment horizon: What is the investor’s investment horizon? Are they investing in the short term or long term?

- Fund performance: How has the mutual fund scheme performed in the past? Has it consistently delivered returns?

- Fees and charges: What are the costs associated with the mutual fund scheme? Are they reasonable?

Investors can choose a mutual fund scheme that aligns with their investment objectives and risk tolerance by considering these factors. Diversifying investments by investing in multiple schemes to reduce risk is also important.

Things You Should Know Before Investing in a Micro SIP

The following are the things you should know before investing in a Micro SIP:

- Risk: Like all investments, mutual fund investments carry risk. Investors should understand the risks of mutual fund investments before investing in a Micro SIP.

- Returns: Mutual fund investments do not guarantee returns. The returns are dependent on the performance of the underlying securities.

- Fund Selection: Investors should carefully select a mutual fund scheme based on their investment goals, risk profile, and investment horizon.

- Charges: Mutual funds charge fees and expenses, such as management fees and expense ratios. Investors should understand the charges associated with the mutual fund scheme before investing.

- Taxation: Mutual fund investments are subject to taxation. Investors should understand the tax implications before investing in a Micro SIP. Capital Gains from mutual funds are taxable in the investor’s hands. For equity mutual funds, capital gains from investments held for less than one year attract a short-term capital gains tax of 15%. On the other hand, for investments held for more than one year, long-term capital gains of more than INR 1,00,000 are taxed at 10%.

Frequently Asked Questions

The minimum investment amount for a Micro SIP is INR 100.

Mutual funds can offer Micro SIPs with a maximum investment amount of INR 50,000, as per the regulations set by the Securities and Exchange Board of India (SEBI).

No. A Pan card isn’t mandatory in micro SIP if the maximum investment amount is INR 50,000 or lesser in a financial year.

KYC is not mandatory for Micro SIP. However, the investor must produce a self-attested copy of their photo identification document and address proof.

Individuals, minors, NRIs (excluding PIOs), and sole proprietorships are eligible to open Micro SIPs. However, institutional investors such as HUFs are not eligible to invest through Micro SIPs.

Yes, investors can change the investment amount and frequency in a Micro SIP at any time.

No, there is no lock-in period for Micro SIP investments. Investors can redeem their investments at any time.

Yes, investors can choose to invest in multiple mutual fund schemes through a Micro SIP. Diversifying the portfolio is a recommended investment strategy to reduce the risk of investing in a single scheme.

- What is Micro SIP in Mutual Funds?

- Understanding Micro SIP

- Mutual Funds with Minimum Sip Amount Rs. 500

- SEBI Regulations for Investing in Micro SIP

- Features of Micro SIP in Mutual Funds

- Advantages of Micro SIP in Mutual Funds

- How to Invest in Micro SIP

- Choosing the Right Mutual Fund Scheme

- Things You Should Know Before Investing in a Micro SIP

- Frequently Asked Questions

Show comments