Should you invest in Bitcoin or control your urge? That’s a million dollar question today. Battle lines are drawn between Bitcoin fans and critics making this a tough one to conclude. In this short read, we look at Bitcoin movements, regulatory issues and investing principles to arrive at the answer.

Bitcoin’s Journey in 2017 and 2018

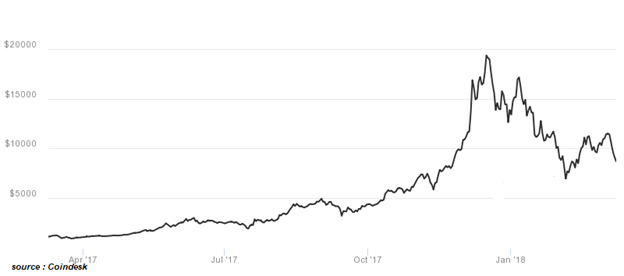

2017 was a spectacular year Bitcoin which where it skyrocketed 25 times from a value of $800 to nearly $20,000. This gigantic rise in Bitcoin prices generated widespread attention helping it become a household name. However after the one way journey to $20,000 till in December 2017, Bitcoin’s prices started to tumble. This downfall continued in 2018 has the prices have been shaky to say the least. Bitcoin prices fell 27% in January making it the highest fall in a month in absolute terms. Last read, Bitcoin was hovering at around $8,000 mark in mid March 2018. That is a 60% fall from the peak levels of December 2017!

What is behind the latest slump in Bitcoin prices?

A variety of factors seem to be causing the current crash in Bitcoin and other cryptocurrencies. The most obvious explanation is simply that Bitcoin is based on speculation—and all speculative bubbles burst. The moment may have come when a critical mass of Bitcoin investors sensed its value was on the downswing. This caused fear and a snowball effect of selloffs.

Here’s what financial gurus have to say on Bitcoin

Financial gurus like the economist Robert Shiller and Warren Buffett have warned about the dangers of Bitcoin and other cryptocurrencies. They believe that cryptocurrencies are fundamentally unsound investments. They’re subject to violent and rapid fluctuations in value and it is debatable if they genuinely have any value at all.

As Shiller told, Bitcoin “has no value at all unless there is some common consensus that it has value.” Shiller adds that “Bitcoin might totally collapse and be forgotten.”

Regulatory Crackdown on Bitcoin

The future of the cryptocurrency is in doubt because countries like China and South Korea have cracked down on cryptocurrency trading lately. This year in January, the Federal regulators in the U.S stopped a bank from raising $1 billion in an “initial coin offering” amid concerns of fraud. Japan, on the other hand, has enshrined bitcoin as legal tender in an apparent bid to become the new global center of FinTech. The Finance Ministry in India has also termed Bitcoin as illegal and ordered a crackdown on bitcoin exchanges running in India.

Marketing platforms also are not keen on promoting cryptocurrency. Facebook took the first step to ban all Bitcoin and cryptocurrency related ads on its network. Google, world’s largest digital marketing platform, followed suit and banned crypto ads in March 2018. Clearly, Google and Facebook want to prevent common people falling prey to crypto ads carrying the lure of high returns.

The Future of Bitcoin

It is highly improbable that Bitcoin will be allowed to replace or even coexist with central-bank issued currencies. While some governments may allow small transactions with virtual currencies, most others will remain averse to a monetary system which they cannot control. It does not help that cryptocurrencies offer a medium for criminals to launder money and use it for terror financing and other misdeeds. The utility or a currency which people cannot use to pay for items of daily use is questionable.

Bitcoin and other cryptocurrencies suffer from various challenges today. There have been increasing concerns over misuse of digital currencies by tax evaders and criminals. Central governments across the world are actively declaring Bitcoin as illegal for transactions. Extreme volatility in Bitcoin prices is unnerving investors forcing many to sell at a loss. To make things worse, there is no underlying asset behind Bitcoin which justifies its value on a fundamental basis.

Should you buy Bitcoin on the dips?

Buying on dips is a universal strategy used by investors and traders in stock markets. Using this strategy successfully requires an investor to time the market. Is buying on dips useful in Bitcoin? No; simply because stock markets are fundamentally expected to grow in the long run due to economic growth. The same cannot be said about Bitcoin since Bitcoin does not have any underlying asset and the prices are purely speculative.

Conclusion: Investors should stay away from Bitcoin

Fraught with the challenges described above and facing extreme price volatility, investing in Bitcoin is akin to gambling. If you have money to spare and like the thrills, you can invest a small percentage of your wealth in Bitcoin. For most people who do not have such fancies with their money, they are better off staying away from Bitcoin. They should rather stick to professionally managed financial instruments like mutual funds which have a proven history of generating high returns in the long term.

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Bitcoin’s Journey in 2017 and 2018

- What is behind the latest slump in Bitcoin prices?

- Here’s what financial gurus have to say on Bitcoin

- Regulatory Crackdown on Bitcoin

- The Future of Bitcoin

- Should you buy Bitcoin on the dips?

- Conclusion: Investors should stay away from Bitcoin

Show comments