Have you ever received a stock tip SMS or WhatsApp message? Most likely it’s a manipulator trying to loot you. These messages typically carry a fantasy about a hidden opportunity in a stock that it is going to move up drastically.

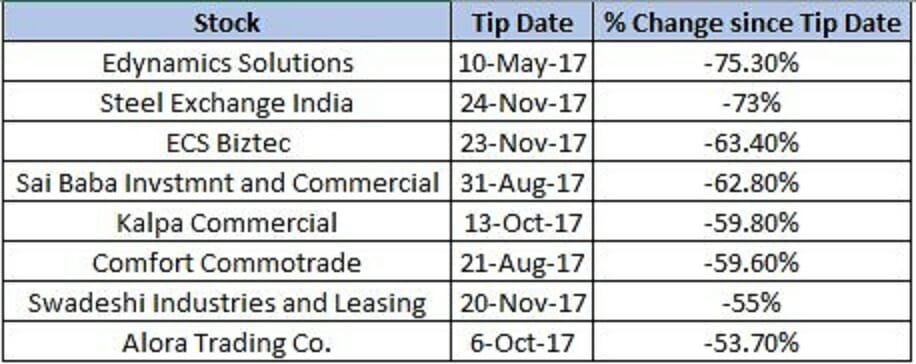

Recommendations by tipsters have fallen badly

The above table shows the stocks that have fallen by more than 50% since their tip date. There are more in the list. These SMS stocks have declined at a time when the overall markets have been doing exceedingly well. Even after the post-Budget correction, the Nifty and Sensex are trading 10-12% above their June-July 2017 levels.

Modus operandi of tipsters

The tips come from cartels of brokers and operators involved in stock price manipulation and generally target small investors. They first pump up the stock price of dud stocks and then lure gullible investors to buy them at high prices. The operator cartel gets hold of contact details of clients from stock brokers and trading portals and carpet bomb them with tips on SMS and social media. These investors are goaded into buying the stocks the cartel wants to offload. They are fooled into thinking that they are buying hidden gems at rock bottom prices. Experts say that investors who are serious about making money from stocks should ignore SMS tips. It is better to invest in a blue-chip stock even if the price is high than buy low-priced junk.

Check the Red Flags

To be fair, it is difficult for newbie investors to separate the chaff from the grain when it comes to stock recommendations. Though, there are few red flags that you check before making an investment.

- The SMS tipsters mask their identities or use parody accounts to send the tips. It is common for tipsters to use the name of well-known equity research firm or brokerage house to gain your trust.

- The stock tip is about a small company with a very low market cap.

- The stock is cheaply priced, typically less that Rs. 100.

- The company may also join in with positive announcements of large orders, new products, etc.

- Look for recent news on merger or takeovers, big orders or significant policy changes from the company.

Invest right for high returns

If you want to earn high returns by taking high risk, Mutual funds is the right way to go. Upwardly’s advisory team has curated two portfolios just for this reason.

This portfolio consists of four funds with the best track record and future potential. It has delivered an annual return of 17.9% over the past 10 years. A monthly SIP of Rs. 5000 in this portfolio started 5 years ago is worth Rs. 4.63 lakhs today.

This portfolio consists of 3 funds that have historically given high returns with high volatility. These funds invest in smaller size firms which have the potential to grow at a much faster pace. It has delivered an annual return of 20.3% over the past 10 years. A monthly SIP of Rs. 5000 in this portfolio started 5 years ago is worth Rs. 4.93 lakhs today.

Explore What is Annual Return?

Conclusion

So, the next time you receive an SMS tip on a dubious stock from a top brokerage house, take the recommendation with a pinch of salt. Instead of betting on obscure tips, you can invest in Mutual Funds which are professionally managed by fund managers, whose every day job is to track the markets and manage investments. All mutual funds are governed by SEBI and are highly secure and transparent. In short, mutual funds today, provide the right ground for investing with the least effort, and with the potential for maximum returns.

Start your investments in the best mutual funds at Scripbox

- Confused if your portfolio is performing right enough to meet your goals?

- How long have you been investing in mutual funds?

- What is your current portfolio size?

- What is your approximate annual household income?

- Your profile does not qualify for a call with a Financial Expert.

- Recommendations by tipsters have fallen badly

- Modus operandi of tipsters

- Check the Red Flags

- Invest right for high returns

- Conclusion

Show comments