What is a Dividend Policy?

A dividend policy is the company’s roadmap for deciding how and when to distribute its profits to shareholders. Drafted by the board of directors, this policy guides how often dividends are issued, how much will be paid out, and in what form cash, additional shares, or other assets. A company can satisfy shareholders by following a well-structured dividend policy while ensuring it retains enough funds to fuel future growth. Understanding the different types of dividend policy is crucial for addressing potential conflicts and strategic considerations.

This article examines dividend policy, its key elements, and the different types of dividend policies a company might adopt. It also explores how decisions on whether to pay an interim dividend or a final dividend depend on factors like profits, investment plans, and industry standards.

Understanding Dividends

Dividends are a crucial aspect of a company’s financial management, representing a distribution of a company’s earnings to its shareholders. Understanding dividends is essential for investors, as they provide a regular income stream and can significantly impact the value of their investments. Dividends can be paid in various forms, including cash, additional shares, or other assets. The decision to pay dividends depends on the company’s profitability, growth plans, and dividend policy.

When a company decides to distribute dividends, it signals financial health and stability, boosting investor confidence. The value of dividends lies not only in their immediate income but also in their potential to enhance the overall return on investment. For instance, regular dividend payments can make a stock more attractive, potentially increasing its market value. Additionally, dividends can serve as a cushion during market downturns, providing a steady income stream even when stock prices are volatile.

What Is a Dividend Policy and Why Does It Matter?

If you’re wondering, “What is a dividend policy?” or “What is a dividend policy?” both refer to the same concept. A dividend policy sets the ground rules for how a company decides on its dividend payouts. It’s a critical financial decision that affects how shareholders earn investment returns.

The company’s board of directors uses this policy to determine the dividend payout ratio (how much profit is shared as dividends), the frequency of dividend payments, and whether dividends will be paid. Essentially, it’s a guideline that ensures investors have a clear idea of when and how they’ll receive dividends.

Key Factors That Influence a Company’s Dividend Decision:

Several factors can shape a company’s dividend strategy:

- Profits: Dividends come from the company’s profits. Without profits, paying dividends isn’t usually possible.

- Investment opportunities: If the company spots a promising project that could lead to growth, it might hold back on paying dividends and instead use that money to fund expansion.

- Availability of funds: Sufficient retained earnings means the firm can comfortably pay dividends without sacrificing future projects.

- Industry trends in dividend payment: Companies often monitor their competitors’ dividend payouts. If everyone else is paying out steadily, following suit can help maintain investor confidence.

- Dividend payment history: A firm that has consistently paid dividends over the years aims to maintain steady payouts either keeping the amount fixed or ensuring a stable dividend payout ratio to meet shareholder expectations. The value of the dividend is often evaluated in relation to the company’s financial health and market conditions.

Objectives of Dividend Policy

The two main objectives of dividend policy are:

- Provide Income to Shareholders: Investors put their money into a company expecting returns. While capital gains are one form of return, dividends offer a more direct, regular income stream. When a company is profitable and doesn’t need all its earnings for growth, it distributes those extra funds as dividends, rewarding shareholders for their trust.

- Support Future Growth Without Excessive Debt: Instead of relying on loans or other costly forms of financing, companies can use retained earnings to fund new projects. This approach saves on interest costs and keeps the company more financially flexible. Once those growth needs are met, a company that has built up enough retained earnings can comfortably return some of its profits to shareholders through dividends, be it an interim dividend during the year or a final dividend at year-end.

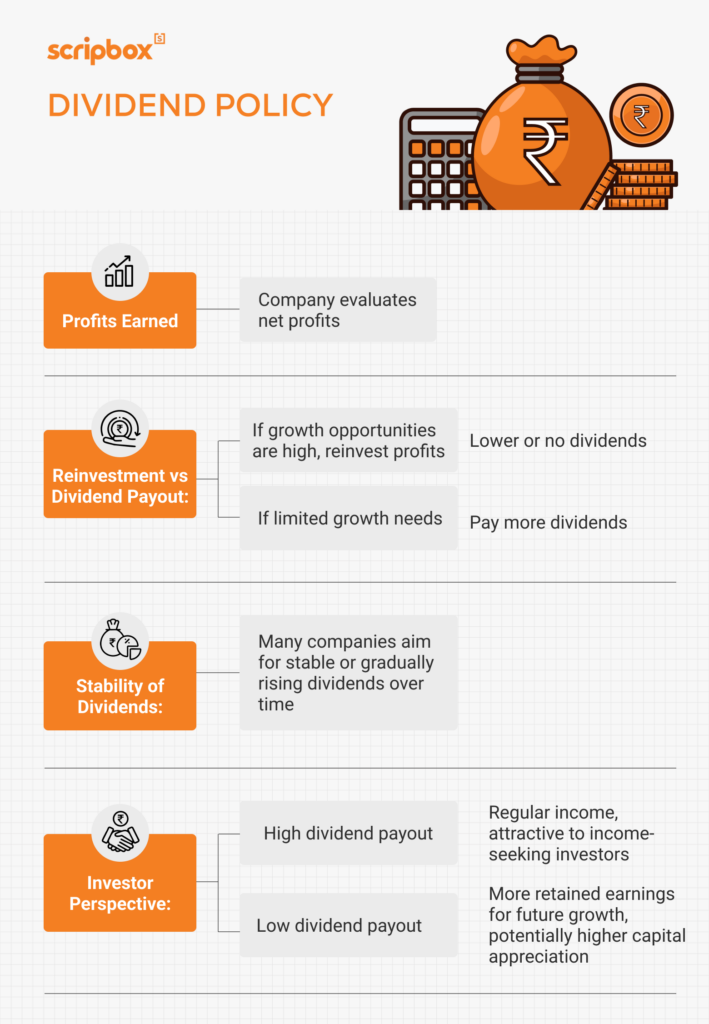

How Does Dividend Policy Work?

When a company makes a profit, it has to take a decision to either retain the profits or share them with the shareholders. A company decides dividends based on multiple factors. However, the payment of dividends can happen in terms of cash, stock, property or scrip. Following are the different types of dividends:

- Cash Dividend: Cash dividends are the most common and popular form of dividend payouts. The company issues a dividend to all shareholders. The cash dividend amount is deposited into the shareholder’s bank account according to their shareholding.

- Stock Dividend: Through stock dividend payouts, a company issues additional shares to its common shareholders without any consideration. When a company issues less than 25% of the previously issued shares, the dividend is a stock dividend. On the other hand, it is a stock split when the company issues more than 25% of the last issue.

- Property Dividend: A company sometimes issues an on-monetary dividend to its shareholders. The company records the property dividend against the asset’s current market price, which can be either higher or lower than the book value. Therefore, the company records the transaction as either a profit or a loss.

- Scrip Dividend: In a scenario where the company does not have enough dividends, it may issue a promissory note. This note indicates that the company will pay dividends at a later date. Essentially, this creates a payable note for the company.

What are the Types of Dividend Policies?

Companies can choose from several approaches when deciding how to share their profits. These choices directly impact how and when dividends are paid out to shareholders. Generally, there are four common types of dividend policies:

Stable Dividend Policy

Under a stable dividend policy, the company sets a fixed dividend amount that it aims to pay out regularly. Even when profits dip, the company tries to maintain this steady payout. While this approach reassures investors looking for consistent income, it also puts pressure on the company to meet these payments, even in lean times.

Regular Dividend Policy

In a regular dividend policy, the company sets a percentage of its profits to be distributed as dividends. If profits increase, dividends rise accordingly; if profits fall, dividends naturally decrease. Many experts consider this policy a fair way to balance investor expectations and company profitability. It can help maintain goodwill with investors since the dividend amount adjusts in line with actual performance.

Irregular Dividend Policy

With an irregular dividend policy, there’s no set schedule or amount. The board of directors decides if and when to pay dividends based on the company’s priorities. For example, if the firm wants to invest heavily in a new project, it might hold back on issuing a dividend even if it had paid one in previous quarters. While this policy offers flexibility for the company’s growth plans, it can leave investors uncertain about their expected income.

No Dividend Policy

In a no-dividend policy, the company reinvests all profits into the business rather than distributing them to shareholders. This approach is common among growth-oriented firms that prefer to funnel resources into new projects and expansions. However, investors who rely on dividends for steady income may find this approach less appealing.

Factors Affecting Dividend Policy

Several key factors influence how a company decides on the best dividend policy, including:

- Profitability: The company must have sufficient profits to pay dividends. The more profitable the firm, the greater its ability to distribute returns to shareholders.

- Dividend Payment History: A consistent track record of paying dividends helps build investor confidence. Investors who value regular income often prefer companies with a strong dividend history.

- Availability of Fund and Growth: When a company needs capital to fund growth opportunities, such as launching new products or entering new markets, it may retain earnings rather than pay out a dividend. Conversely, if the company’s growth needs are met, it can comfortably share a portion of its profits with investors.

- Industry Dividend Trends: Companies often consider what their peers are doing. If competitors offer regular dividends, following suit might help attract and retain shareholders. On the other hand, if the industry norm is to reinvest profits, a no-dividend policy might make more sense.

Ultimately, the chosen dividend policy whether it involves a stable payout, a flexible approach like an interim or final dividend, or no dividend at all should align with the company’s long-term financial strategy and meet the expectations of its investor base.

What is the Difference Between a Cash Dividend and a Stock Dividend?

Dividend-paying companies often pay shareholders cash as a percentage of the share price. A cash dividend is a regular cash payment by a company to its shareholders. The money that the company issues as a dividend is often a percentage of free cash that it doesn’t use for any investment.

On the other hand, stock dividends are in the form of more company shares. For example, when a company announces a 10% stock dividend, an investor with 100 shares is eligible to receive 10 shares as a stock dividend, which means the investor will now have 110 shares.

Cash dividends are taxable. At the same time, stock dividends are subject to tax only when the investor chooses to sell the extra stocks for cash.

What is an Interim Dividend?

An interim dividend is a dividend payment to the shareholders during a fiscal year. In other words, it is the payment of dividends before the annual audit of financial statements. An interim dividend is paid out in smaller amounts than the annual dividend and in monthly or quarterly intervals (paid more than once). Furthermore, the company uses retained earnings to pay such dividends. Retained earnings are the earnings from previous fiscal years that the company retains back in the company. These do not include the current year’s profits.

The board of directors of a company declares, votes, and approves the disbursement of the interim dividend. However, the shareholders have the right to overturn the decision and refuse the interim dividend payments.Often, companies declare interim dividends along with the release of quarterly or semi-annual results. Interim dividends are frequently paid to a company’s equity shareholders, and their rate is lower than the final dividend payout. Alternatively, some companies issue stock dividends instead of cash dividends.

What is a Final Dividend?

A final dividend is a payment issued by a company’s board of directors after it has released its annual financial results. Typically announced at the Annual General Meeting (AGM), this final payout often comes after any interim dividends issued throughout the year and is generally higher than those earlier payments.

The final dividend amount depends on the company’s full-year profits and established dividend policy. Unlike stock dividends, final dividends are usually paid in cash. The board proposes the final dividend through an Ordinary Resolution at the AGM, which must gain approval from at least 51% of the shareholders to pass.

It’s important not to confuse a final dividend with a “last dividend.” A “last dividend” refers to a payout made when a company is winding up (liquidating). This liquidation dividend is the surplus left over after selling off assets and settling all liabilities, making it separate from the regular final dividend.

What is the Difference Between the Interim Dividend and Final Dividend?

There are several key distinctions between interim and final dividends:

- Timing:

- Interim Dividend: Paid during the financial year, often mid-year, before the AGM and the release of full financial statements.

- Final Dividend: Paid after the company has published its annual financial results and held its AGM.

- Who Declares Them:

- Interim Dividend: Declared by the board of directors.

- Final Dividend: Declared by shareholders at the AGM based on the board’s recommendation.

- Source of Funds:

- Interim Dividend: Paid out from retained earnings.

- Final Dividend: Paid from the company’s current-year profits.

- Coverage Period:

- Interim Dividend: Covers part of the financial year, often the first six months.

- Final Dividend: Reflects the full financial year’s performance.

- Company Rules and Rights:

- Interim Dividend: The board can declare it only if the company’s Articles of Association allow it.

- Final Dividend: Considered a right of shareholders and does not typically require special provisions.

- Obligation and Revocation:

- Interim Dividend: Even if declared, the company can still withdraw it before payment if needed. No debt obligation arises.

- Final Dividend: Once declared, it cannot be revoked, creating a debt obligation for the company to pay the specified amount to shareholders.

What is the Benefit of Dividend Stocks?

A dividend policy offers several benefits to both the company and its shareholders. Some of the key benefits include:

- Providing a Stable Source of Income for Shareholders: A well-defined dividend policy ensures that shareholders receive a consistent and predictable income, which can appeal to income-focused investors.

- Maintaining Investor Confidence: Regular dividend payments can help maintain and even boost investor confidence in the company, as they reflect the company’s ongoing profitability and commitment to sharing profits with its shareholders.

- Retaining Earnings for Future Growth: By balancing dividend payouts with retained earnings, a company can fund future growth and development without relying excessively on external financing.

- Enhancing Transparency and Credibility: A clear dividend policy enhances transparency, as it provides investors with a clear understanding of how and when they can expect to receive dividends. This transparency can improve the company’s credibility and attractiveness to potential investors.

- Influencing Cost of Capital and Shareholder Value: A consistent dividend policy can positively influence the company’s cost of capital by attracting a stable investor base. Additionally, it can enhance shareholder value by providing regular returns and potentially increasing the stock’s market value.

A well-defined dividend policy can also help to attract and retain investors, as it provides a clear understanding of the company’s approach to profit distribution.

Implementing a Dividend Policy

Implementing a dividend policy requires careful consideration of several factors, including the company’s profitability, cash flow, debt levels, and growth stage. The company’s board of directors is responsible for setting the dividend policy, often approved in board meetings. The policy should be regularly reviewed and updated to align with the company’s financial goals and shareholder expectations.

When implementing a dividend policy, companies should consider the following:

- Type of Dividend Policy to Adopt: Companies can adopt various dividend policies, such as stable, regular, or irregular. The choice depends on the company’s financial stability and long-term goals.

- Frequency of Dividend Payments: It is crucial to decide how often dividends will be paid—whether quarterly, semi-annually, or annually. The frequency should align with the company’s cash flow and profitability.

- Amount of Dividend to be Paid: The dividend amount should be carefully calculated to balance rewarding shareholders and retaining enough earnings for future growth.

- Method of Dividend Payment: Companies must decide whether to pay dividends in cash, stock, or other assets. Each method has different implications for the company’s financial health and shareholder satisfaction.

- Impact on Financial Performance and Shareholder Value: The chosen dividend policy should support the company’s overall financial strategy and enhance shareholder value. Considering how the policy will affect the company’s financial performance, investor relations, and market perception is essential.

By carefully considering these factors, a company can implement a dividend policy that supports its financial goals while meeting shareholder expectations.

What is the Benefit of Dividend Stocks?

- Dividend-paying stocks are profitable to shareholders in two ways. They offer capital gains through capital appreciation and additional income through dividends. They also provide consistent income through dividends. Dividend-paying companies are usually cash-rich and strong, with good long-term performance prospects. Additionally, dividend-paying stocks are less vulnerable to volatility.

- Twofold benefits: Dividend-paying stocks offer twofold benefits to shareholders. First, they benefit from capital appreciation. Second, they provide additional income to their shareholders. This enhances their investment portfolio, as the dividend reinvestment plan can generate more returns.

- Consistent income to shareholders: Dividend-paying stocks provide consistent income to their shareholders, helping them with additional income

- Low volatility: Dividend-paying stocks usually belong to sectors whose performance don’t wholly depend on economic cycles. Hence, these stocks are less vulnerable to market volatility.

More Reads below:

- Reduce Investment Risk

- Are Large Cap Funds high Risk?

- Should You Choose Best Fund?

- Exit Insurance

- Risk Profile Before Investing

- Financial Planning for Maternity Leave

- 7 Enemies to your Financial Success

- Union Budget 2020

- Difference between Equity and Preference Shares

- How to Invest in your 20’s?

- ELSS Tax Benefits

- Avoid Investing in Penny Stocks

- Current Price

- What is a Dividend Policy?

- Understanding Dividends

- What Is a Dividend Policy and Why Does It Matter?

- Key Factors That Influence a Company’s Dividend Decision:

- Objectives of Dividend Policy

- How Does Dividend Policy Work?

- What are the Types of Dividend Policies?

- Factors Affecting Dividend Policy

- What is the Difference Between a Cash Dividend and a Stock Dividend?

- What is an Interim Dividend?

- What is a Final Dividend?

- What is the Difference Between the Interim Dividend and Final Dividend?

- What is the Benefit of Dividend Stocks?

- Implementing a Dividend Policy

- What is the Benefit of Dividend Stocks?

Show comments