What are SIP Withdrawal Charges in Mutual Funds?

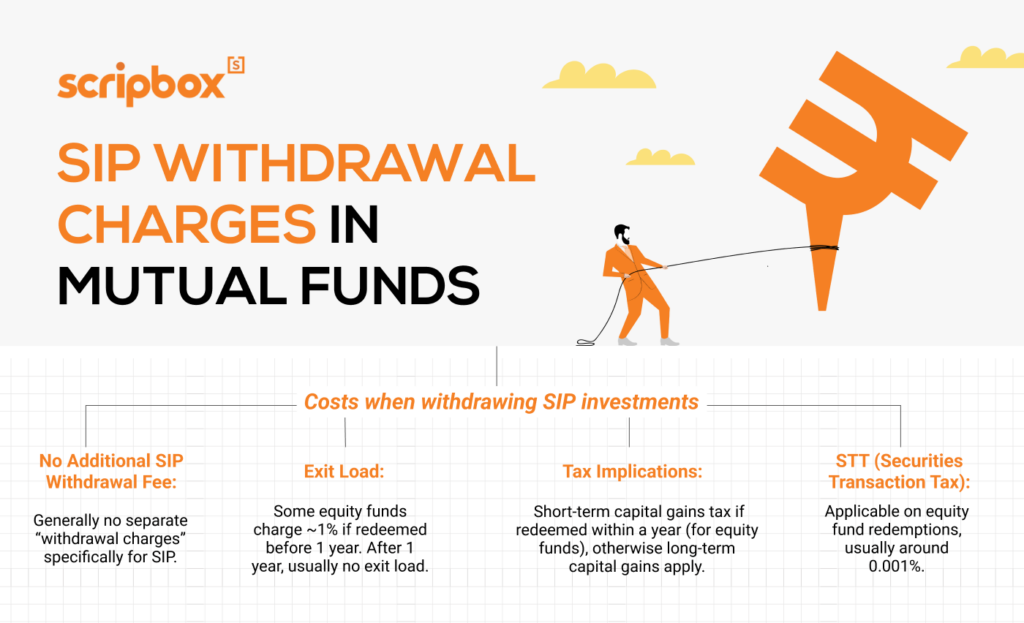

The fund house levies mutual fund withdrawal charges or exit loads to discourage investors from redeeming their investments too quickly. These charges are part of the broader category of mutual fund fees that investors should be aware of. Scripbox does not have any withdrawal charges. However, at the time of withdrawal, depending on whether your investments are classified as short-term or long-term, you may incur exit loads (to the mutual fund company) or capital gains taxes.

What is an Exit Load?

An exit load is a fee a mutual fund company charges when investors redeem or sell their units before a specified period. The primary purpose of an exit load is to discourage short-term trading and to compensate the fund for potential costs associated with the early redemption of units. In mutual funds, an exit load is calculated as a percentage of the value of the units being redeemed and is deducted from the redemption proceeds. If you decide to sell your mutual fund units before the stipulated time, the exit load will be subtracted from the amount you receive, reducing your overall returns. Understanding the exit load is crucial for investors to make informed decisions about mutual fund investments.

Exit Load Charges in Mutual Fund

| Type of Investment | Exit Load |

| Equity* | Exit load on equity mutual funds is 1% of the sale proceeds if sold within 1 year of purchase* |

| Debt | Exit load on debt mutual funds is usually none. |

| Tax Saving | Not applicable as the equity investments cannot be sold before the 3 year lock-in period, thereby exceeding 1 year. |

| US Equity | Exit load on US equity mutual funds is usually none. |

* Investment type: Equity

Fund Name: Parag Parikh Long Term Equity Fund (Growth)

Exit load: 2% on or before 365 days OR 1% after 365 days but on or before 730 days.

How to Calculate Exit Load in Mutual Funds

To calculate the exit load in mutual funds, you need to know the exit load percentage charged by the mutual fund scheme you are invested in. This information can be found in the mutual fund’s offer document or scheme information document (SID). The exit load is calculated as a percentage of the redemption amount at applicable NAVs. For example, if an exit load of 1% applies and an investor redeems Rs 10,000 worth of units, the fund will deduct Rs 100 as the exit load, and the investor will receive Rs 9,900 as the redemption proceeds. Understanding how to calculate the exit load helps investors anticipate the costs of redeeming their mutual fund units and plan their investments accordingly.

Which Mutual Funds Have Exit Loads?

Not all mutual funds charge exit loads; the specific exit load structure can vary from fund to fund. Generally, equity and hybrid funds tend to have higher exit loads than debt funds. Some mutual funds, such as index and exchange-traded funds (ETFs), do not charge exit loads. Reviewing the mutual fund’s offer document or scheme information document (SID) to understand the applicable exit load fees before investing in any mutual fund is essential. Awareness of the exit load structure helps investors choose the right mutual fund that aligns with their investment goals and time horizon.

* Investment type: Equity

Fund Name: Parag Parikh Long Term Equity Fund (Growth)

Exit load: The fund imposes an exit load if the units are redeemed on or before 365 days at 2%, or 1% if redeemed after 365 days but on or before 730 days.

| Investor exit upon subscription | Exit loads as a % of redemption proceeds |

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 | 0.0050% |

| Day 6 | 0.0045% |

| Day 7 | 0.0000% |

(This is applicable for all investments made in liquid funds post October 19, 2019)

SIP Withdrawal Charges with Example

Some mutual funds may impose an exit load for SIP withdrawals if the investment is redeemed before a specified period. For instance, if you withdraw your SIP investment within a year from the investment date, the mutual fund may charge an exit load ranging from 0.5% to 2% of the redemption amount.

In the case of investment through SIP, every installment is treated as a fresh purchase. For example, you are investing an amount of INR 1,000 through monthly SIP in a fund that charges an exit load of 1% for a holding period of less than 1 year. If you withdraw the investment towards the end of 2 years, then investments made in the first 12 months will not attract an exit load. Investments made after 12 months will attract the 1% exit load.

| Month | Investment Amount | Exit Load as on April 2023 |

| Jan-21 | ₹1,000 | No Exit Load |

| Feb-21 | ₹1,000 | No Exit Load |

| Mar-21 | ₹1,000 | No Exit Load |

| Apr-21 | ₹1,000 | No Exit Load |

| May-21 | ₹1,000 | No Exit Load |

| Jun-21 | ₹1,000 | No Exit Load |

| Jul-21 | ₹1,000 | No Exit Load |

| Aug-21 | ₹1,000 | No Exit Load |

| Sep-21 | ₹1,000 | No Exit Load |

| Oct-21 | ₹1,000 | No Exit Load |

| Nov-21 | ₹1,000 | No Exit Load |

| Dec-21 | ₹1,000 | No Exit Load |

| Jan-22 | ₹1,000 | No Exit Load |

| Feb-22 | ₹1,000 | No Exit Load |

| Mar-22 | ₹1,000 | No Exit Load |

| Apr-22 | ₹1,000 | 1% |

| May-22 | ₹1,000 | 1% |

| Jun-22 | ₹1,000 | 1% |

| Jul-22 | ₹1,000 | 1% |

| Aug-22 | ₹1,000 | 1% |

| Sep-22 | ₹1,000 | 1% |

| Oct-22 | ₹1,000 | 1% |

| Nov-22 | ₹1,000 | 1% |

| Dec-22 | ₹1,000 | 1% |

| Jan-23 | ₹1,000 | 1% |

| Feb-23 | ₹1,000 | 1% |

| Mar-23 | ₹1,000 | 1% |

| Apr-23 | ₹1,000 | 1% |

It is Recommended to Use Scripbox’s SIP Calculator to find returns

Capital Gain Taxes

| Type of Investment | Holding Period to beclassified “Long Term” | Tax on Long-TermCapital Gains | Tax on Short-TermCapital Gains |

| Equity | 1 year from purchase | 10% capital gains tax on gains over Rs.1 Lakh | 15% flat tax on the gain amount after exit load deduction + cess |

| Debt | 3 years from purchase | 20% tax after “indexation”: a process by which you can adjust your purchase cost upwards based on inflation | Tax based on your income tax bracket (10% or 20% or 30% + cess) |

| Tax Saving | 3 year lock-in for these equity funds to be eligible for section 80C income tax deduction | 10% capital gains tax on gains over Rs.1 Lakh | Not applicable as these investments cannot be sold before the 3 year lock-in period |

| US equity | 3 years from purchase | 20% tax after “indexation”: a process by which you can adjust your purchase cost upwards based on inflation | Tax based on your income tax bracket (10% or 20% or 30% + cess) |

Frequently Asked Question

Systematic Investment Plan (SIP) withdrawal charges in mutual funds refer to any fees or costs associated with redeeming or withdrawing your investment from the mutual fund through the SIP. It’s important to note that SIP withdrawal charges are not common in all mutual funds and may vary depending on the AMC and the specific fund you have invested in, such as tax saver or elss etc. The charges, if applicable, are typically disclosed in the fund’s offer document or Key Information Memorandum (KIM).

Some mutual funds impose an exit load on investors who redeem their units within a specified period after the purchase. The exit load is usually expressed as a percentage of the redemption amount or NAV. For example, if the exit load is 1% and you redeem Rs. 1,000 worth of units, you may incur a charge of Rs. 10. Read more about mutual fund exit load.

Tax saver and ELSS mutual funds have a minimum SIP tenure or lock-in period during which investors are not allowed to withdraw their investments without incurring charges. This lock-in period could vary from a few months to a few years, depending on the fund’s policies.

Show comments