Fixed Deposits or FDs are one of the most popular savings instruments in India. Investment in FD can be done for a few weeks to few years at a fixed interest rate. In this article, we will look at the two types of FDs, viz, interest payment and reinvestment. The article highlights the difference between these two and the calculation of interest with and without TDS for these two types of FD.

Interest Payout vs Reinvestment Option

Below is the table that points out the differences between the two options available under FDs.

| Point of Difference | Interest Payout Option | Reinvestment Option |

| Interest Payment | Interest is paid out every month or quarter | Interest is paid along with the principal at the time of maturity |

| Suitability | Suitable for investors who want regular income like retirees | Suitable for investors who are in no need of regular income |

| Reinvestment | Interest is not reinvested. It is paid out to the investor monthly or quarterly | Interest is reinvested into the FD along with the principal amount and paid only at maturity |

| Interest Calculation | Interest is calculated normally using the simple interest formula | Interest is calculated using compounded interest formula. Interest is compounded. |

| Tax | Interest earned quarterly or monthly will be taxable at the rate of 10%. However, the maturity amount is tax free. | Interest though earned at the time of maturity, will be taxed yearly at the rate of 10%. However, the maturity amount is tax free. |

Recommended Read: Tax on FD Interest

Calculation of Interest on FD

Interest rates of FDs are currently around 6-8%. Furthermore the longer the duration more will be the interest rate of an FD. If you are in no need of regular income, instead of opting for an interest payout, which pays you interest every month or quarter, you can choose a reinvestment scheme. You can reinvest the interest earned on an FD hence earning higher interest.

Example 1

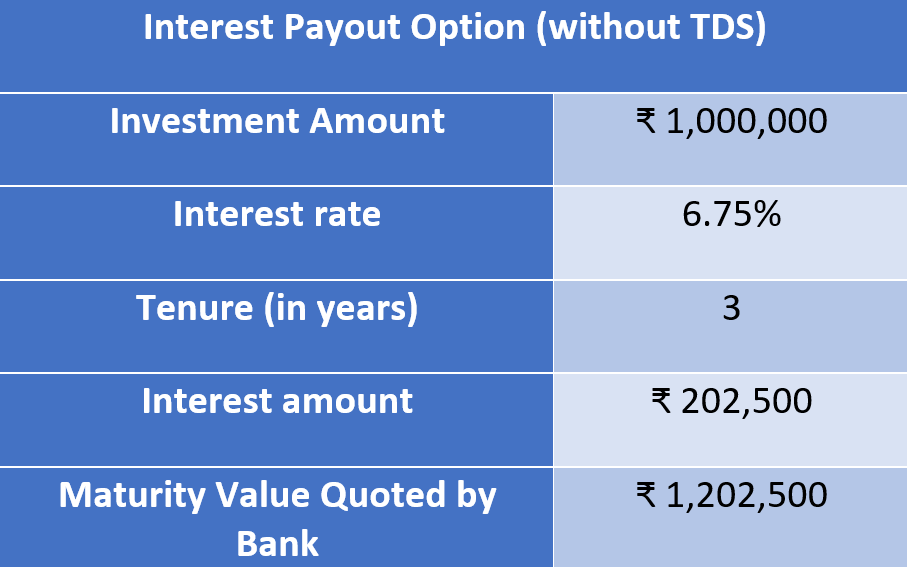

Interest Payment Option

Rs 10,00,000 FD invested for 3 years at the interest rate of 6.75% per annum. Simple interest is used to calculate the monthly interest payment. Below is the maturity value of the FD without TDS and income tax.

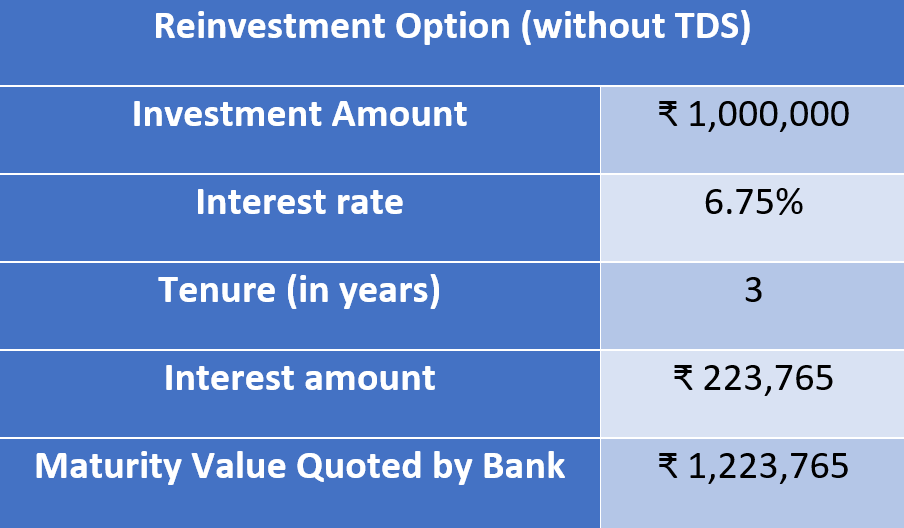

Reinvestment Option

Let’s say the Rs 10,00,000 FD is invested at 6.75% per annum under the reinvestment scheme. The monthly interest would’ve been reinvested in the FD at the same rate. The interest payment is calculated on a compounding basis. Below is the maturity value of the FD without TDS and income tax.

Example 2

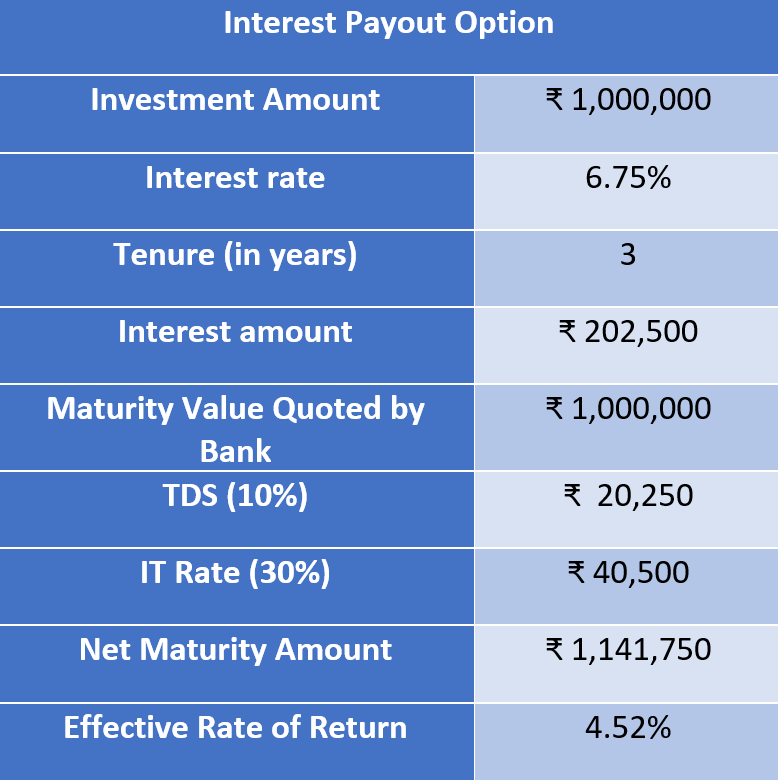

Interest Payment Option

Rs 10,00,000 FD invested for 3 years at the interest rate of 6.75% per annum. Simple interest is used to calculate the monthly interest payment. Below is the maturity value of the FD with 10% TDS and 30% income tax.

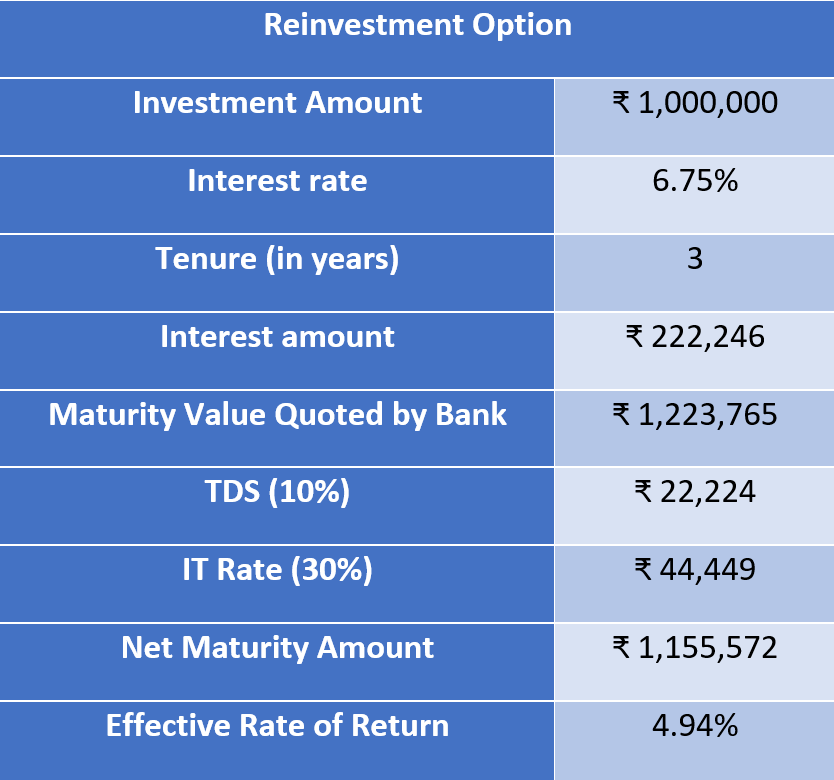

Reinvestment Option

Let’s say the Rs 10,00,000 FD is invested at 6.75% per annum under the reinvestment scheme. The monthly interest would’ve been reinvested in the FD at the same rate. The interest payment is calculated on a compounding basis. Below is the maturity value of the FD with 10% TDS and 30% income tax.

If you are looking for monthly income then interest payment option suits you better. Else, the reinvestment plan is the best choice because interest is compounded. The effective rate for interest in reinvestment options differs by 42 basis points in contrast to interest payment option. That is a difference of Rs 13,822. This might not seem a lot but as the tenure of the FD increases so will the gap between the maturity amounts of these two options will increase. What Einstein said is certainly noteworthy that compound interest is the eighth wonder of the world. It surely does wonders with the money invested.

Frequently Asked Questions

If the FD income exceeds INR 40,000 per annum in India, then the TDS rate applicable is 10%. Provided the investor submitted the PAN details to the bank. If not, then the TDS rate will be 20%. For senior citizens, the TDS threshold limit is INR 50,000.

Usually, in fixed deposits, there is no upper limit on the investment. However, tax-saving FDs have an upper limit of INR 1,50,000 per annum. For the rest of the FDs, the bank fixes the minimum and maximum investment amount.

Yes, one can get monthly interest on FDs. However, one has to choose for it while investing in FDs. Moreover, banks should offer a monthly payout for the investors to choose from. In India, most banks give investors a choice of interest payout frequency. The options available to investors are monthly, quarterly, half-yearly, annually, and at the time of maturity. Investors who want to receive monthly interest should opt for it at the time of investing in the FD.

Show comments