The Indian Equity Market ended the year on a high note. While the starting point was depressed – owing to the impact of the pandemic, the Large Cap Index (Nifty 50 TRI) was up by 74% for the year and has recorded a 15% CAGR over the past 3 years. While there is concern about a second wave, India is quite well positioned to tide over such an occurrence given our experience and the vaccination drive in place.

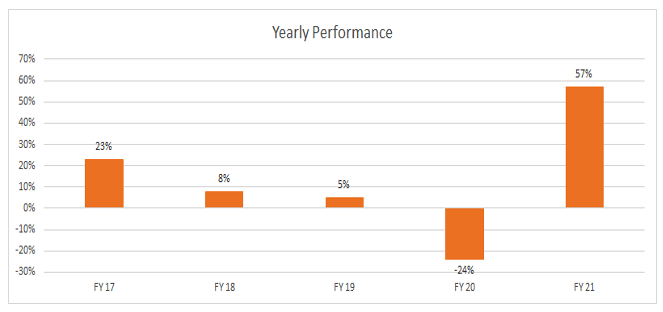

The performance of Scripbox long term wealth over the past few years is as below

1. Equity Market Performance

- In the financial year 2020-2021 (till Mar 25, 2021), the Nifty 50 was up 68%, Nifty Large-Mid 250 was up 80% and Nifty Midcap 100 was up 96%. The corresponding 3 year compounded return for the indices stood were Nifty 50 at 13.7%, Nifty Large-Mid 250 at 11.7% and Nifty Midcap 100 at 7.8%.

- The high performance of the previous year can be attributed largely to where the equity market ended last year and the sharp rebound that was witnessed in the economy coming out from the lockdown period.

- Over the last decade, the Nifty 50 has returned a CAGR of 11.2% whereas Nifty Large-Mid returned a CAGR of 13.5% and Nifty Midcap 12.9% – which means that over a timeframe of 5.3 to 6.5 years, investors in these benchmarks have doubled investor money.

- We continue to believe that the case of Indian equities remains strong and equities as an asset class will continue to outperform fixed income over the long run also.

- There have been years when there has been significant volatility but real value has been created over the long term. Markets reward the patient.

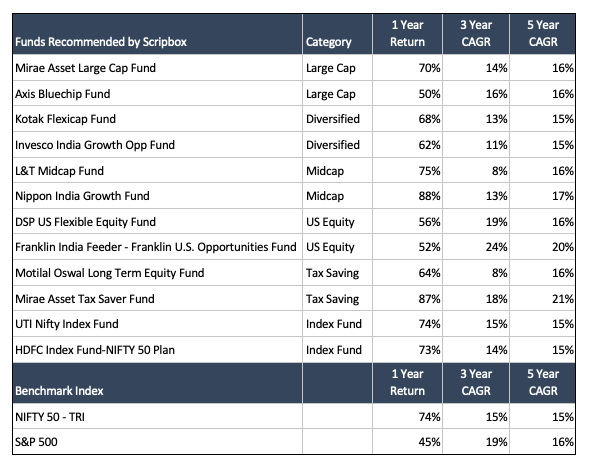

2. Equity Funds recommended by Scripbox

Among the funds recommended by Scripbox, few have underperformed the benchmark on a 1-year return basis and a few have out-performed. However, we believe that equities should be considered as long term investments and measured over the corresponding investing horizon.

When the objective is growth an investor should opt for equities.

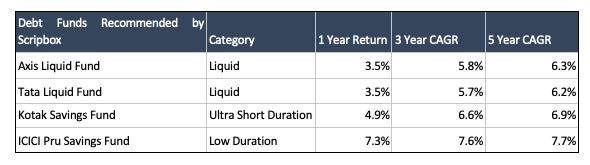

3. Debt Funds Recommended by Scripbox

When it comes to debt investments, we are of the view that this asset class is meant for capital protection and investors should not reach for yield.

We recommend that our customers hold their emergency reserves in a portfolio of Liquid Funds. These funds tend to offer the best levels of capital protection. For objectives that have short term horizons, we recommend a blended approach with allocation to 3 categories.

The last year has been an environment of low-interest rates, especially on the shorter duration funds. However, we continue to believe that when it comes to debt investing (especially for emergency funds) the safety of capital takes higher precedence over returns.

4. The core idea of Scripbox

We have built a proprietary algorithm that leverages our deep domain expertise with our research process to curate investment portfolios for our customers. The reliance on a rule-based portfolio construction process ensures that there is no human bias that creeps into the selection of funds. It is our strong belief that investments should be evaluated and measured from a long term perspective and with regard to wealth creation, time is the most important factor at work.

All incremental investments will be in the latest set of funds, whereas some of the older investments will continue unless there are specific reasons to exit these funds.

At Scripbox we continue to track and monitor each fund very closely and we will reach out to our customers when we believe that an action is required from a portfolio change perspective.

Note : All the benchmarks returns are based on the Total Returns Index

You can read last year’s report card here

Show comments