India is a vast and diverse country with many cities that offer different opportunities and challenges for real estate investors. While the metro or Tier 1 cities like Mumbai, Delhi, Bangalore, and Chennai have been the traditional hubs of real estate activity, they also face issues like overcrowding, pollution, traffic congestion, and high property prices. In contrast, many tier 2 cities in India are emerging as attractive destinations for real estate investment.

What are Tier 2 Cities?

Tier 2 cities are those that have a population of 50,000 to 100,000 and are well connected to rural, semi-urban, and major cities. These cities have a lower cost of living, upcoming infrastructure, higher growth potential, and improved quality of life. They are also developing industrial zones, business centres, residential and commercial spaces, education and healthcare facilities, and other amenities. While they may not be as globally renowned as Tier 1 cities, Tier 2 cities are gaining prominence for their rapid urbanisation and economic growth.

Advantages of Investing in Tier 2 City’s Real Estate

Tier 2 cities offer many advantages for real estate investors. Some of them are:

- Economic Growth: Tier 2 cities are witnessing robust economic growth, fueled by a shift towards decentralisation and government initiatives to promote regional development. These cities offer a conducive business environment, attract new industries, and provide ample employment opportunities.

- Infrastructure Development: Many Tier 2 cities are experiencing significant infrastructure development, including the expansion of transportation networks, the establishment of industrial parks, and the improvement of social amenities. This enhances connectivity and livability, making these cities attractive for real estate investments.

- Lower Costs: Compared to Tier 1 cities, Tier 2 cities offer lower land and property prices, making them more affordable for investors. This affordability, coupled with the potential for high returns, presents a lucrative opportunity for both residential and commercial real estate investments.

- Growing Middle-Class Population: Tier 2 cities are witnessing a rise in the middle-class population, leading to increased demand for housing, retail, and entertainment options. This growing consumer base provides a steady demand for real estate, making it a favourable investment proposition.

- Diversification: Investing in Tier 2 cities allows investors to diversify their real estate portfolios beyond the saturated Tier 1 markets. It provides an opportunity to capitalise on the untapped potential of emerging cities, which have the potential to grow and develop rapidly.

- Government Support: The government’s focus on urban development and smart city initiatives has directed attention towards Tier 2 cities. Investor-friendly policies, tax incentives, and regulatory reforms further encourage investment in these cities.

- High-Quality of Life: Tier 2 cities often offer a better quality of life with less congestion, a cleaner environment, and access to amenities. These factors attract individuals and businesses looking for a balance between urban comforts and a relaxed lifestyle.

Top Tier 2 Cities for Real Estate Investment in India

Many tier 2 cities in India are emerging as attractive destinations for real estate investment due to their lower cost of living, better infrastructure, higher growth potential, and improved quality of life.

Visakhapatnam

Visakhapatnam, also known as Vizag, is the largest city and financial capital of Andhra Pradesh. It is a strategically located port city connecting to Southeast Asia’s profitable markets. It is also a major industrial hub with sectors such as steel, petroleum, fertiliser, pharma and IT. Vizag is one of the smart cities under the Smart Cities Mission of the Government of India. It has also been ranked as the third cleanest city in India by Swachh Survekshan 2020.

Vizag offers investors a range of real estate options, from affordable apartments to luxury villas and plots. The city has witnessed a steady appreciation in property values over the years due to factors such as infrastructure development, employment generation, tourism potential and coastal location. Some of the popular areas for real estate investment in Vizag are Madhurawada, Gajuwaka, Rushikonda, Yendada and Bheemili.

The major infrastructure projects in Vizag include Bhogapuram Airport, the Redevelopment of Visakhapatnam Railway Station, Amazon Facilities, the Modernisation of Visakhapatnam Fishing Harbour, Six-lane Greenfield Raipur-Visakhapatnam Economic Corridor, South Coast Railway Zone Headquarters, and Singapore-style sea aquarium.

Nagpur

Nagpur is the third-largest city in Maharashtra. It is also known as the Orange City for its famous oranges. Nagpur is a prominent centre for trade and commerce in Central India, with IT, engineering, mining, textile and agro-based sectors. Nagpur is also an important educational hub with institutions such as IIM Nagpur, AIIMS Nagpur and VNIT Nagpur. It has been selected as one of the smart cities under the Smart Cities Mission of the Government of India. It has also been ranked as the second cleanest city in India by Swachh Survekshan 2020.

Nagpur offers a variety of real estate options for investors, from budget-friendly flats to premium bungalows and plots. The city has seen consistent growth in property values over the years due to factors such as infrastructure development, connectivity improvement, industrial expansion and educational excellence. Some of the popular areas for real estate investment in Nagpur are Wardha Road, Manish Nagar, Besa, Mihan and Jamtha.

The major infrastructure projects in Nagpur include Nagpur Metro, Samruddhi Mahamarg, Rail Projects, AIIMS Nagpur, and the National Institute of One Health, Nagpur.

Surat

Surat is the economic capital of Gujarat. Known as the “Diamond City of India,” it is a global centre for the diamond and textile industries. Surat’s strong economic base, excellent connectivity, and proactive government policies have fueled the growth of the real estate sector. The city offers a vast range of investment opportunities in residential, commercial, and industrial segments. Surat has been selected as one of the smart cities under the Smart Cities Mission of the Government of India.

Some of the popular areas for real estate investment in Surat are Vesu, Adajan, Pal, Dumas and Althan.

The major infrastructure projects in Surat include Surat smart city project, Railway station redevelopment, the Surat metro project, High-speed rail, and Tapi riverfront development.

Coimbatore

Coimbatore is the industrial capital of Tamil Nadu. It is also known as the Manchester of South India for its extensive textile industry. Coimbatore is a major industrial hub with sectors such as engineering, automobile, aerospace, IT and healthcare. Coimbatore is also a well-established education hub with institutions such as IIM Coimbatore, PSG College of Technology and Coimbatore Institute of Technology. Coimbatore has been selected as one of the smart cities under the Smart Cities Mission of the Government of India.

Some of the popular areas for real estate investment in Coimbatore are Saravanampatti, R S Puram, Peelamedu, Kovaipudur and Avinashi Road.

The major infrastructure projects in Coimbatore broadly include energy conservation, water restoration and conservation, water supply, solid waste management, model roads, and smart surveillance.

Chandigarh

Chandigarh is the joint capital of Punjab and Haryana and a union territory of India. It is also known as the City Beautiful for its planned architecture and greenery. Chandigarh is a prominent centre for administration, education, tourism and IT. Chandigarh has been selected as one of the smart cities under the Smart Cities Mission of the Government of India. Chandigarh’s organized layout, strong infrastructure, and burgeoning IT and services sector make it an attractive destination for real estate investments. The city offers a mix of residential, commercial, and retail opportunities. Some of the popular areas for real estate investment in Chandigarh are Zirakpur, Mohali, Panchkula, Mullanpur and Kharar.

The major infrastructure projects in Chandigarh broadly include portable water and waste-water management, public health and solid waste management, mobility and social development, and energy reforms.

Jaipur

Jaipur, the capital city of Rajasthan, is known for its rich history, cultural heritage, and tourism. It is also known as the Pink City for its distinctive pink-colored buildings. Jaipur is a major tourist destination with attractions such as Hawa Mahal, Amber Fort and Jantar Mantar. Over the years, it has emerged as a major trade, commerce, and manufacturing centre. Jaipur’s strategic location, well-connected transportation network, and robust infrastructure have positioned it as a favourable real estate market.

The city offers numerous residential and commercial project opportunities, including IT parks and SEZs. Jaipur has been selected as one of the smart cities under the Smart Cities Mission of the Government of India. Some of the popular areas for real estate investment in Jaipur are Jagatpura, Ajmer Road, Vaishali Nagar, Tonk Road and Mansarovar.

The major infrastructure projects in Jaipur include Jaipur Smart City Limited (JSCL), multi-level parking, Chaugan Stadium, and the Rajasthan School of Arts.

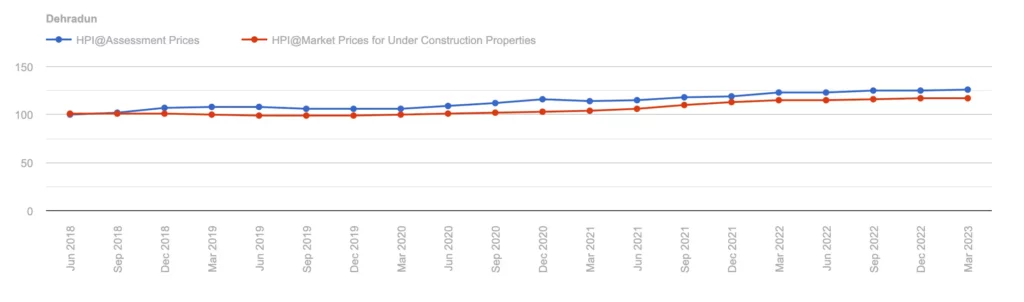

Dehradun

Dehradun is the largest city and capital of Uttarakhand. It is also known as the Doon Valley for its scenic location between the Himalayas and the Shivaliks. Dehradun is a popular hill station and a gateway to other tourist destinations such as Mussoorie, Rishikesh and Haridwar. Dehradun is also an important centre for education, research, defence and IT. Dehradun has been selected as one of the smart cities under the Smart Cities Mission of the Government of India.

The city is witnessing rapid urbanization, fueled by its proximity to Delhi-NCR and improved infrastructure. Dehradun’s pleasant climate, serene surroundings, and growing demand for residential properties make it an attractive investment option. The city also offers potential commercial developments, including hospitality and education. Some of the popular areas for real estate investment in Dehradun are Sahastradhara Road, Rajpur Road, GMS Road and Mussorie.

The major infrastructure projects in Dehradun include the Delhi-Dehradun Economic Corridor, the Haridwar Ring Road Project, the Dehradun-Paonta Sahib (Himachal Pradesh) road project, the Himalayan Culture Center at Dehradun and State of the Art Perfumery and Aroma Laboratory (Centre for Aromatic Plants) in Dehradun.

Indore

Indore is the commercial capital of Madhya Pradesh. It is also known as the Mini Mumbai for its resemblance to India’s financial hub. Indore is known for its thriving manufacturing, trading, and service sectors. Indore’s strategic location, well-planned infrastructure, and investor-friendly policies have contributed to its real estate market boom. The city provides ample opportunities for residential and commercial investments, including developing IT and SEZ zones.

The city has seen a consistent growth in property values over the years, due to factors such as infrastructure development, connectivity improvement, industrial expansion and educational excellence. Some of the popular areas for real estate investment in Indore are Super Corridor, Nipania, Vijay Nagar, AB Road and Bypass Road.

The major infrastructure projects in Indore broadly include heritage conservation projects, underground cabling systems, building schools under smart city mission, and riverfront projects – building of bridges.

Mysuru

Mysuru, also known as Mysore, is a historical city in Karnataka renowned for its cultural heritage and educational institutions. It is also known as the City of Palaces for its magnificent royal heritage. The city has witnessed steady growth in the IT and manufacturing sectors, attracting investors and professionals. Mysore is under the Jawaharlal Nehru National Urban Renewal Mission [JNNRUM].

Mysuru’s well-preserved heritage, excellent connectivity, and growing demand for residential properties make it an emerging real estate market. The city also offers scope for commercial and hospitality projects. Some of the popular areas for real estate investment in Mysuru are Hunsur Road, Bogadi Road, Yadavagiri and Vijayanagar.

The major infrastructure projects in Mysuru include road infrastructure development, beautification of Circles, underground drainages, storm water drains, multi-level parking lots, and footpath development.

Lucknow

Lucknow is known as the City of Nawabs for its rich history and culture. Lucknow is a major centre for administration, education, tourism and IT. Lucknow is also a culinary and artistic hub with specialities such as Awadhi cuisine, chikankari embroidery and Lucknowi music. Lucknow has been selected as one of the smart cities under the Smart Cities Mission of the Government of India.

Lucknow’s strategic location, improved connectivity, and government initiatives like the Lucknow Metro project have boosted its real estate market. The city provides opportunities for residential, commercial, and retail projects, catering to the growing needs of its expanding population. Some of the popular areas for real estate investment in Lucknow are Gomti Nagar, Shaheed Path, Sushant Golf City, Faizabad Road and Kanpur Road.

The major infrastructure projects in Lucknow include IT City, a world-class stadium, J P International Centre, Gomti Riverfront Development Project, Lucknow-Kanpur industrial corridor and the expressway.

Tier 2 Cities: Future Prospects in India

The future prospects of Tier 2 cities in India remain promising. As the focus shifts beyond metropolitan areas, these cities are expected to witness sustained economic growth, infrastructure development, and increased demand for real estate. Factors such as government initiatives like “Smart City” projects, improving connectivity, favorable investment policies, and the decentralization of industries contribute to their growth potential. Additionally, the availability of affordable land, lower competition, and relatively lower property prices compared to Tier 1 cities make them attractive to investors.

Risks and Challenges of Investing in Tier 2 Cities

While Tier 2 cities offer numerous opportunities, certain risks and challenges are associated with real estate investments in these areas. Some of the key factors include:

- Market Volatility: Tier 2 cities may experience higher market volatility compared to established Tier 1 cities due to emerging market dynamics and a relatively limited investor base.

- Infrastructure Development: Although infrastructure is improving, some Tier 2 cities may still require significant investment in areas such as transportation, utilities, and social infrastructure. Delays or inadequate infrastructure development could impact the growth potential of real estate investments.

- Regulatory Environment: Regulatory frameworks in Tier 2 cities may not be as mature as in Tier 1 cities, leading to uncertainties in land acquisition, permits, and approvals. Investors need to be aware of the local legal and regulatory landscape.

- Economic Stability: While Tier 2 cities are growing, their economies may be more susceptible to fluctuations and external factors compared to Tier 1 cities. Investors should carefully evaluate these cities’ economic stability and diversification before making investment decisions.

- Market Awareness: Tier 2 cities may have limited market data and research available, making it crucial for investors to conduct comprehensive due diligence and understand the local market dynamics, demand-supply trends, and growth potential.

Conclusion

The top Tier 2 cities in India have favourable economic growth, infrastructure development, and high quality of life, making them attractive for residential and commercial investments. They offer a combination of affordability, quality, growth and potential that is hard to find in tier 1 cities. However, you must carefully assess the risks and challenges associated with investing in Tier 2 cities and conduct thorough research before making investment decisions. You need to do your due diligence and research before investing in these cities, taking into account the location, demand, supply, price, returns, risks and future prospects of the property.

Show comments