What are Tier 1 Cities in India?

India is one of the fastest-growing economies in the world, with a population of over 1.3 billion people and a rising urbanization rate. The demand for both residential and commercial properties is increasing in the country, especially in Tier 1 cities. Tier 1 cities are the hubs for economic activity, culture, education and innovation. These cities offer better infrastructure, connectivity, employment opportunities and quality of life than other cities in India.

Tier 1 cities are the most developed and urbanized cities in India. They have a large population, high per capita income, advanced infrastructure, and a strong presence in various sectors such as IT, finance, manufacturing, education, healthcare and entertainment.

Tier 1 cities also have a high demand for real estate from both end-users and investors. India’s top Tier 1 cities are Delhi, Mumbai, Kolkata, Chennai, Bengaluru, Hyderabad, Ahmedabad and Pune.

Advantages of Investing in Tier 1 City’s Real Estate?

Tier 1 cities offer many advantages for real estate investors. Some of them are:

- They have a stable and growing economy that attracts domestic and foreign investments.

- Their large and diverse consumer base drives the demand for housing and commercial spaces.

- Tier 1 cities have a well-developed transport network that connects them to other parts of the country and the world.

- They have a skilled and educated workforce that supports various industries and sectors.

- Their vibrant and dynamic culture offers a high quality of life and entertainment options.

Top Tier 1 Cities in India for Real Estate Investment

Based on various factors such as price trends, rental yields, supply-demand gap, infrastructure projects, policy initiatives and future prospects, the following are the top tier 1 cities for real estate investment in India:

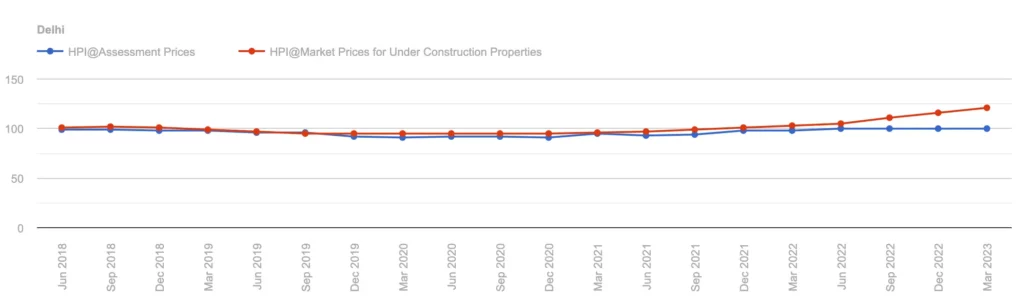

Delhi

Delhi is the political capital of India and one of the most populous cities in the world. It has a high demand for housing from various segments such as bureaucrats, politicians, diplomats, businessmen, professionals, students, and tourists.

Delhi, the political hub of India, combines rich history with modern infrastructure and a rapidly expanding economy. The city’s real estate market benefits from the presence of government institutions, diplomatic missions, and a large pool of multinational corporations.

Delhi also has a diverse and dynamic real estate market that offers a range of options from luxury to affordable.

Delhi residential properties cater to a diverse range of buyers, from affordable apartments to high-end villas. Some popular residential investment areas in Delhi are Dwarka, Vasant Kunj, Saket, Rohini, and Noida Extension. Commercial properties are in high demand, especially in areas like Connaught Place, Nehru Place, Saket District Centre, Netaji Subhash Place, and Aerocity, which house major corporate offices.

The major infrastructure projects in Delhi include NOIDA International Airport, Ashram Flyover Extension, Delhi-Mumbai Expressway, Delhi-Meerut RRTS, Dwarka Expressway and Aqua Blue Skywalk.

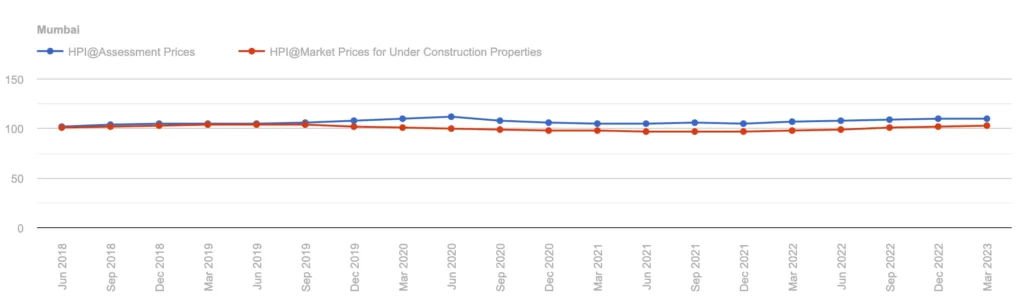

Mumbai

Mumbai, the financial capital of India, is a bustling metropolis that captivates investors with its extraordinary potential. It is one of the most expensive real estate markets in the world. It has a high demand for housing from various segments, such as professionals, businessmen, celebrities and NRIs. Mumbai also has a limited supply of land which pushes the prices up.

Mumbai is a commercial hub and is home to the country’s largest stock exchange, Bollywood, and numerous multinational corporations. The city’s real estate market thrives due to its vibrant economy, excellent connectivity, and high demand for housing and commercial spaces. Mumbai offers luxurious residential properties, high-rise apartments, and exclusive commercial spaces in prominent areas like Bandra, Worli, and Lower Parel.

The major infrastructure projects in Mumbai include Mumbai Metro, Mumbai-Ahmedabad Bullet Train Corridor, Navi Mumbai International Airport, Mumbai Coastal Road, Mumbai Trans Harbour Sea Link, and the Delhi-Mumbai Industrial Corridor.

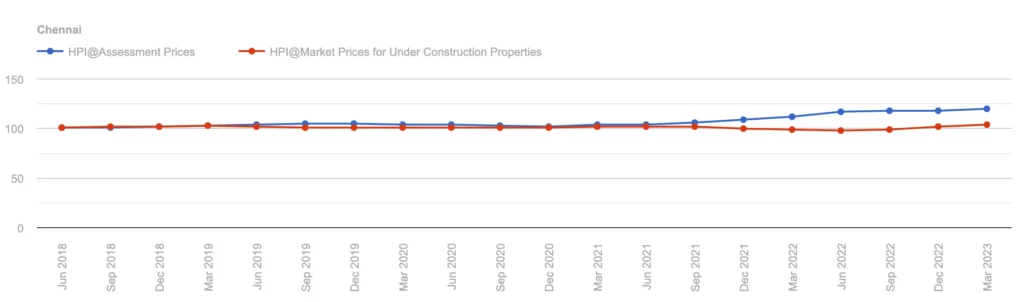

Chennai

Chennai is the automobile capital of India and one of the country’s major IT and industrial centres. The city’s real estate market is driven by its robust manufacturing sector, IT and ITES companies, and a large base of multinational corporations. It has a high demand for housing from professionals who work in various sectors such as IT, automobile, manufacturing and healthcare.

Chennai offers a wide range of residential properties, including apartments and independent houses, catering to diverse budgets. Some of the popular areas for residential investment in Chennai are OMR (Old Mahabalipuram Road), ECR, Velachery, Anna Nagar and Porur. Commercial spaces are highly sought-after in key areas such as T. Nagar, Guindy, T Nagar, Nungambakkam, Guindy, Perungudi and Sholinganallur.

The major infrastructure projects in Chennai include DLF Downtown (IT corridor), FinTech City, Market Of India, SPR City, Chennai Metro – Phase 2, Defence Corridor and Aerospace and Defence Park Sriperumbudur.

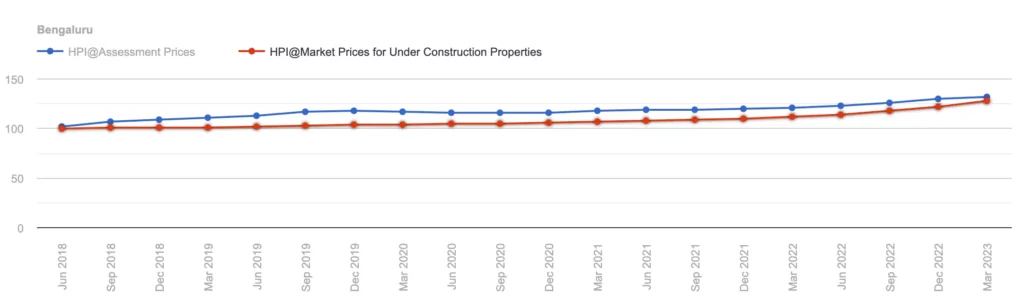

Bengaluru

Bengaluru, known as the Silicon Valley of India, has emerged as a leading global technology hub. The city’s thriving IT sector, world-class educational institutions, and pleasant climate make it a sought-after destination for real estate investments. It has a high demand for housing from young professionals, entrepreneurs and ex-pats who work in various IT companies and startups.

Bengaluru is also the startup capital of India and hosts many innovative companies in sectors such as e-commerce, biotechnology, education and healthcare.

Bengaluru offers affordable and luxury residential options, co-working spaces, and commercial properties in tech parks like Electronic City, Whitefield, and Manyata Tech Park. Some of the popular areas for residential investment in Bengaluru are Whitefield, Sarjapur Road, Electronic City, HSR Layout and Hebbal.

The major infrastructure projects in Bengaluru include Second Longest Highway In India (Surat–Chennai Expressway), Chennai Bengaluru Industrial Corridor (CBIC), Bengaluru-Vijayawada Expressway, Bengaluru Suburban Railway Project, Bengaluru Peripheral Ring Road Project, Nandi Hills Ropeway Project, Upper Bhadra Irrigation Project.

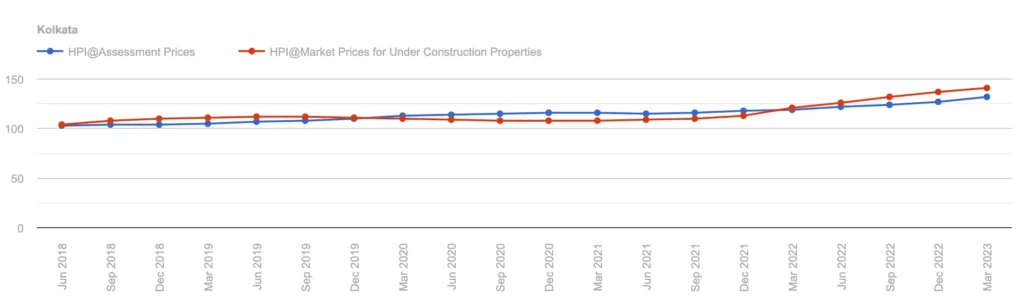

Kolkata

Kolkata is the intellectual capital of India and one of the oldest cities in the country. It has a high demand for housing from various segments such as academics, artists, writers, businessmen, professionals, and NRIs. The city has a mature and stable real estate market that offers reasonable prices and moderate growth.

The city has consistently shown a stable and upward trajectory in terms of real estate growth. With continuous improvements in infrastructure, Kolkata has emerged as a favored choice for numerous burgeoning start-ups and prominent IT companies. The real estate sector in Kolkata has experienced significant prosperity, particularly due to the developers’ delivery of a multitude of premium projects at affordable prices.

Kolkata is also India’s city of arts, culture and cuisine. It boasts a rich heritage and is a significant commercial and financial centre in Eastern India. The city’s real estate market benefits from its diverse industries, including jute, textiles, and information technology. Kolkata offers affordable residential properties with spacious apartments and colonial-era houses. Some of the popular areas for residential investment in Kolkata are Alipore, Ballygunge, Salt Lake City, New Town Rajarhat, and Howrah. Commercial properties are concentrated in areas like Park Street, Salt Lake City, and Rajarhat, which house corporate offices and shopping complexes.

The major infrastructure projects in Kolkata include Kolkata Siliguri Expressway, Kolkata Trolley Buses, Kolkata Airport Expansion, Kolkata Metro Expansion, World Trade Center Kolkata, and Silicon Valley Hub Kolkata.

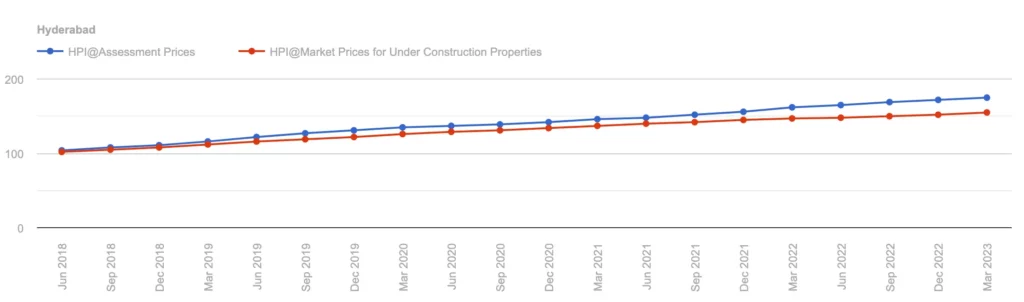

Hyderabad

Hyderabad, the city of pearls, is the pharmaceutical capital of India and one of the country’s emerging IT and business hubs. The presence of several multinational corporations, IT parks, and a robust infrastructure make it a prime destination for real estate investments.

Hyderabad offers a range of residential properties, including gated communities and luxury apartments. Hyderabad also has a relatively low cost of living and real estate compared to other tier 1 cities. Some popular residential investment areas in Hyderabad are Gachibowli, HITEC City, Kondapur, Nallagandla and Kukatpally. Commercial properties are in high demand, particularly in areas like HITEC City, Gachibowli, and Madhapur, which host numerous tech companies. Hyderabad also has a growing retail sector that offers a variety of shopping and dining options. Some of the popular areas in Hyderabad are Banjara Hills, Jubilee Hills, Madhapur, Begumpet and Secunderabad.

The major infrastructure projects in Hyderabad include Vijayawada Nagpur Expressway, Nagpur Hyderabad Bengaluru Expressway, Hyderabad Mumbai Bullet Train, Hyderabad Pharma City, Hyderabad Regional Ring Road, Hyderabad Indore Expressway.

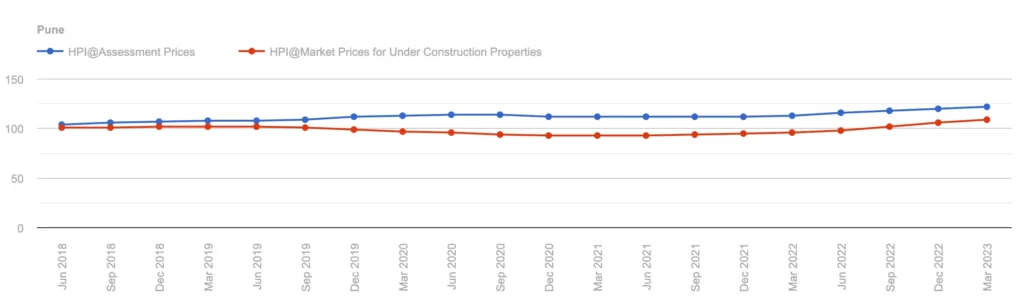

Pune

Pune is the educational capital of India and one of the country’s leading IT and manufacturing hubs. It has a high demand for housing from students, professionals and industrialists who work in various sectors such as IT, engineering, automobile and education. Pune also has a moderate cost of living and real estate compared to other tier 1 cities. Some of the popular areas for residential investment in Pune are Hinjewadi, Kharadi, Wagholi, Baner and Wakad.

Pune has a high demand for office spaces from IT, engineering, automobile and education sectors. It also has a vibrant retail sector offering various shopping and entertainment options. Some of the popular areas for commercial investment in Pune are Magarpatta City, Viman Nagar, Aundh, Kalyani Nagar and Koregaon Park.

The major infrastructure projects in Pune include Pune Smart City Mission, Pune Ring Road Project, Pune Metro Rail Project, and Pune Airport Expansion Project.

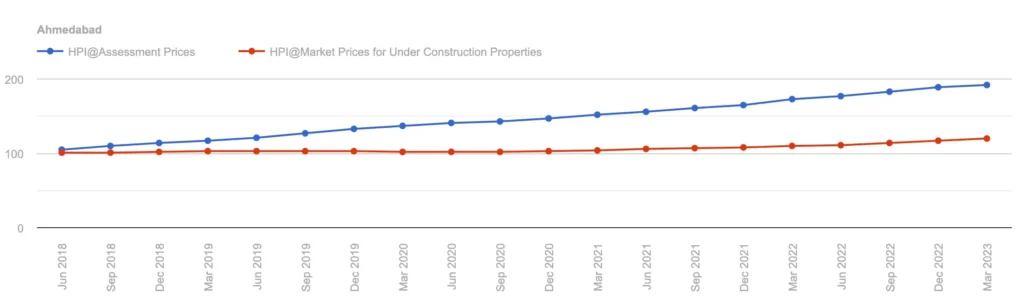

Ahmedabad

Ahmedabad is the largest city and former capital of Gujarat. It is also one of India’s most industrialized and prosperous cities, with sectors such as textiles, chemicals, pharmaceuticals, engineering and IT. It also hosts several educational institutions, research centres and cultural events.

Ahmedabad has a lot of potential for real estate investment, especially in areas such as SG Highway, Bopal, Gota and Chandkheda. These areas offer affordable housing options with good connectivity and infrastructure.

Ahmedabad Mumbai Bullet Train, Tharad – Ahmedabad Expressway, Delhi Ahmedabad High-Speed Rail Corridor, Sardar Vallabhbhai Patel Sports Enclave, and Ahmedabad Metro Phase 2.

Real Estate Risks and Challenges of Investing in Tier 1 Cities in India

Investing in real estate in India’s top cities comes with various risks and challenges. Here are some of the key ones to consider:

- Regulatory and policy factors: The Indian real estate sector is subject to extensive regulations, and changes in government policies can significantly impact the market. For instance, the introduction of the Real Estate (Regulation and Development) Act (RERA) in 2016 aimed to enhance transparency and accountability but led to delays and increased costs for developers.

- Economic conditions: The real estate market in India closely correlates with the economy’s overall health. During economic downturns, the demand for real estate tends to decrease, resulting in lower prices and difficulties in finding buyers or tenants.

- Financing limitations: Buyers, particularly those seeking high-end properties, may encounter limited financing options. Additionally, high borrowing costs can make it challenging for buyers to afford a property.

- Escalating property prices: The Indian real estate market faces a significant challenge in the form of soaring property prices, especially in major cities like Mumbai and Delhi. These high prices make it difficult for the average middle-class population to afford properties in these locations.

- Unfinished projects: Buyers often face concerns regarding unfinished projects and delays in completion. Regulatory obstacles, funding issues, and legal disputes can cause project delays, negatively impacting buyers’ interests.

- Lack of transparency: Transparency is a persistent issue in the Indian real estate market. Buyers often struggle to make informed decisions due to inflated property prices and subpar construction quality. This lack of transparency can make investing in real estate a more complex endeavour.

Conclusion

India’s top Tier 1 cities offer unparalleled real estate opportunities, attracting domestic and international investors. Tier 1 cities showcase remarkable economic growth, excellent connectivity, and diverse industries, making them ideal residential and commercial property investment destinations. However, it is important to consider the challenges and risks associated with it. Unfinished projects, inflated property prices, financing limitations, and construction quality are some of the challenges associated with real estate investing. Furthermore, you should also consider factors such as location, budget, preference and purpose before purchasing. Real estate investing is a risky and complex process that requires careful research and analysis.

Show comments