How does a Ponzi scheme make money?

A Ponzi scheme is an investment scam where the returns for earlier investors are paid from the money collected from later investors. The investors of such schemes are promised high returns with little to no risk.

The scheme promises to make money by investing it, but in reality, the same is not invested. Rather the money from new investors is used to pay off old investors. The schemes charge a fee for the service they offer. This is the main source of its revenue. The scheme collects money from one investor and pays another investor and the person running the scheme benefits from the fees they collect.

Ponzi schemes usually end when the flood of new investors are exhausted. This is when the schemes usually come to light.

Are Ponzi schemes illegal?

Ponzi schemes are considered fraudulent. They do not invest the money that is given to the portfolio manager. The investment management services that they promise to offer don’t take place. They collect money from new investors and pay the old investors the same. They transfer funds from one client to another and do not do any real investing. Moreover, they collect a small fee for the investment services they offer.

Why is a Ponzi scheme called a Ponzi scheme?

A Ponzi scheme is an illegal investment scheme that pays existing investors a portion of funds collected from new investors. The Ponzi scheme is named after Charles Ponzi, who committed one of the most famous frauds in New England back in 1920. He convinced investors to invest in a postage stamp and offered them an interest rate of 50% per quarter. During the same time, banks were paying an annual interest rate of 8%. Mr Ponzi used the funds from new investors to pay returns to existing investors.

The original scheme of Mr Ponzi was based on the legitimate arbitrage of international coupons (postage stamps). However, soon it began diverting money from new to make payments to old investors and himself.

The organizers of the Ponzi scheme often promise high returns with either little or no risk. These schemes use money from new investors to pay existing investors while keeping some of the money to themselves. Also, with no legitimate earnings, the basis of survival for Ponzi schemes is to maintain a constant flow of money.

Are banks a Ponzi scheme?

Banks are not Ponzi Schemes. Banks have real investments, projects and partnerships from which they generate revenue. From the revenue, a bank generates they pay their bank members.

Ponzi schemes promise high returns with either little or no risk. The scheme uses money from new investors to pay existing investors while keeping some of the money to themselves. Ponzi schemes will crash at any given moment when it becomes difficult to identify new investors. However, that is not the case with a bank.

Banks, on the other hand, are legal institutions that lend money to individuals. Banks offer lower interest rates to the depositors and invest the same money in high interest-paying investments. The profits made are given to the depositors. Furthermore, banks have their equity in addition to the debt they take from the depositors.

What is the new pyramid scheme?

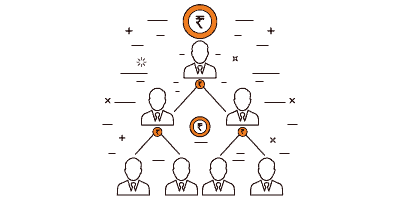

A pyramid scheme is a business model where the top-level members recruit a few members, and these members recruit more investors. When the new member is recruited, a certain up-front fee is collected. And as and when the fee is collected, a portion of it is given to the top-level members.

When the top-level member recruits a few members, they pay a fee. They are also required to hire more members and collect the fee from them. After collecting a fee from them, they will have to send a percentage of the fees to the first tire members. A pyramid scheme comes to an end when the pool of prospective new investors dries up. A pyramid scheme doesn’t sustain forever. As the lower levels of the pyramid shrink, the scheme comes to an end.

What companies are pyramid schemes?

A pyramid scheme is a structured scheme, where the initial schemer has to recruit other investors who shall continue to recruit others. Therefore, the chain continues. Sometimes, these schemes offer incentives like an investment opportunity where investors will get the right to sell a particular product. Each investor pays the person who recruits them for the chance to sell the item. Furthermore, the recipient shall share the proceeds with the ones at the higher levels of the pyramid structure. Many companies were proven to be using the Pyramid scheme. However, they eventually shut down. Some of the companies that were using the pyramid scheme are Burn Lounge, Inc., Fortune Hi-Tech Marketing, Nu Skin Enterprises, Herbalife and Amway.

What are some examples of pyramid schemes?

Pyramid schemes are usually either done in chit funds or for selling products. Amway, Sharadha Group Chit fund scam, Speak Asia, and City Limousines scam are a few examples of pyramid schemes. In all the cases, the money collected from new investors or distributors is used to pay off old investors. This led to scams of worth more than INR 3000 crore involving millions of people.

Frequently Asked Questions

A Ponzi scheme is an investment scam where the returns for earlier investors are paid from the money collected from later investors. The investors of such schemes are promised high returns with little to no risk.

Ponzi schemes are considered fraudulent. They do not invest the money that is given to the portfolio manager. The investment management services that they promise to offer don’t take place. They collect money from new investors and pay the old investors the same. They transfer funds from one client to another and do not do any real investing. Moreover, they collect a small fee for the investment services they offer.

A Ponzi scheme is an illegal investment scheme that pays existing investors a portion of funds collected from new investors. The Ponzi scheme is named after Charles Ponzi, who committed one of the most famous frauds in New England back in 1920. He convinced investors to invest in a postage stamp and offered them an interest rate of 50% per quarter. During the same time, banks were paying an annual interest rate of 8%. Mr Ponzi used the funds from new investors to pay returns to existing investors.

Banks are not Ponzi Schemes. Banks have real investments, projects and partnerships from which they generate revenue. From the revenue, a bank generates they pay their bank members.

The Ponzi scheme promises to make money by investing it, but in reality, the same is not invested. Rather the money from new investors is used to pay off old investors. The schemes charge a fee for the service they offer. This is the main source of its revenue. The scheme collects money from one investor and pays another investor and the person running the scheme benefits from the fees they collect.

Show comments