NPS Login: Registration, and Password Reset Procedure

The National Pension System is a government retirement scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). All India citizens (residents and non-residents) within 18-65 years of age can invest in NPS. This article covers the NPS registration...

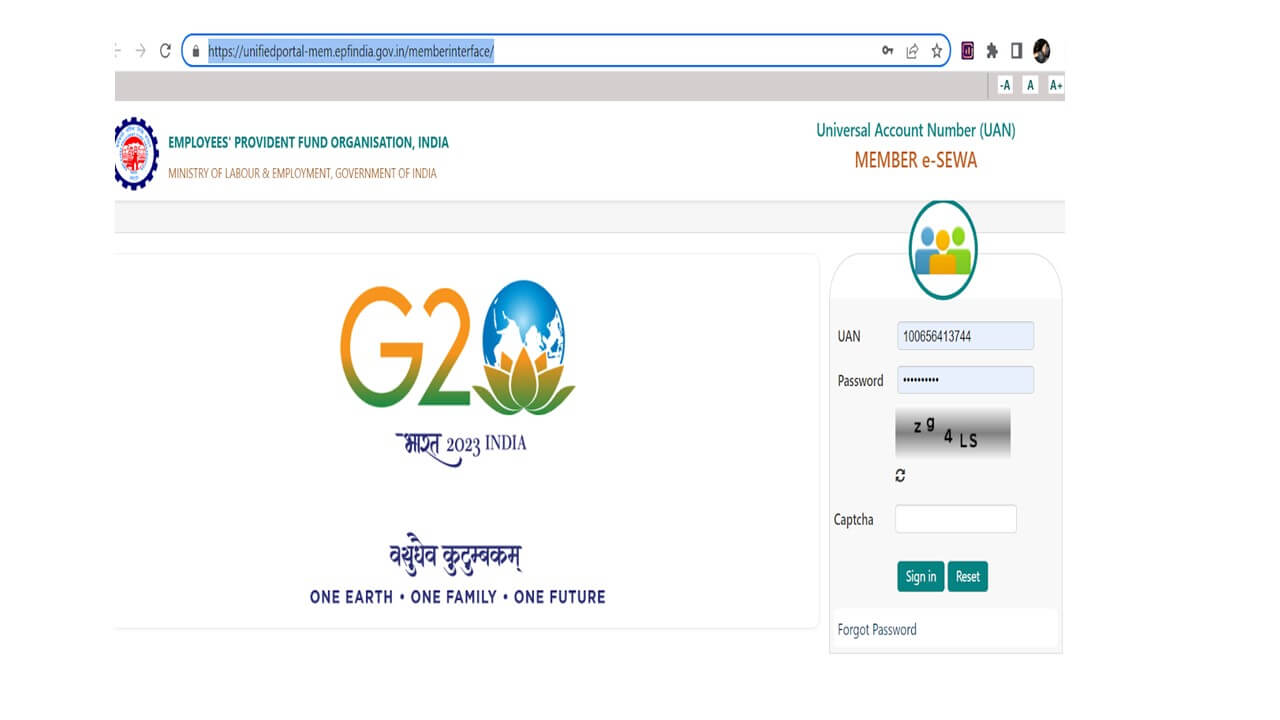

EPFO KYC Update Online – How to Update KYC in EPFO

Universal Account Number or UAN is a unique number allotted by the EPFO to all employees at the time of their first job. The UAN remains the same during the employment tenure despite a change in the employees' job. Through...

Employee Pension Scheme (EPS Pension): Eligibility, Formula, Types

Employee Pension Scheme (EPS) is a social security scheme from the Employees’ Provident Fund Organisation (EPFO). The main purpose of the scheme is to make provisions for employees in the organised sector for pension. However, for a person to be...

Pradhan Mantri Awaas Yojana Gramin: Meaning, Beneficiary List, Registration

What is PMAYG? The development of rural India is equally important for the progress of the nation. Unavailability of resources and poverty has in fact forced people in these areas to live in unhygienic conditions. Enhancing the quality of life...

SBI Senior Citizen Scheme – SCSS Interest Rate & Benefits

Financial security is a concern for the old and aging. Generally, they lock away funds in FDs or some other safer forms of investment. Though these schemes are safe, they do not generate a lot of return. The Senior Citizen...

Practical Insights For Wealth Creation

Our weekly finance newsletter with insights you can use

Your privacy is important to us

How to Update EPF Nominee Online

EPF Nominee Every salaried employee in India has an account with Employee Provident Fund Organisation (EPFO). Also, every EPF account holder must have a nominee for their EPF account. This will enable the nominee to withdraw from their EPF account...

Best Bank Account to Open in India 2026

It is essential to have a bank account to manage all financial transactions digitally in today's generation. Also, all government subsidies are routed through bank accounts only. Furthermore, the government has taken initiatives to ensure that all the citizens in...

How to Merge Two UAN Numbers Online?

Universal Account Number (UAN) is the unique number allotted to EPFO members. Multiple EPF accounts are linked to a single UAN. However, there can be instances where an individual has two active UAN numbers. Having two active UANs is against...