The National Pension System is a government retirement scheme regulated by the Pension Fund Regulatory and Development Authority (PFRDA). All India citizens (residents and non-residents) within 18-65 years of age can invest in NPS. This article covers the NPS registration procedure, NPS login, and password reset procedure in detail.

NPS Registration Process

Individuals can register themselves for NPS either through online or offline mode.

Online NPS Registration

The NSDL website allows online registration of NPS. Following are the steps to register for online registrations of NPS:

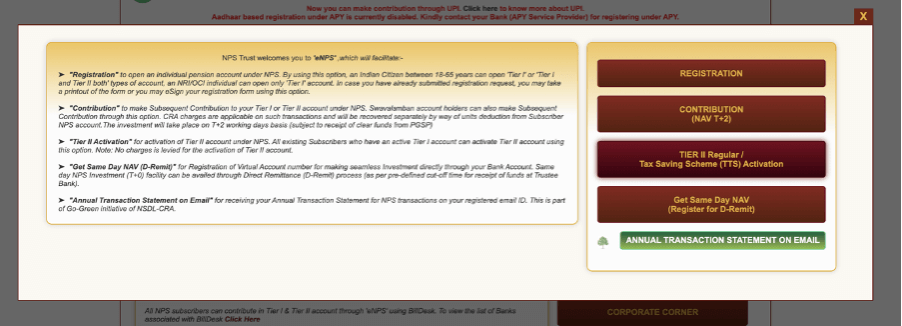

Visit the eNPS website, and select Nation Pension System.

In the pop-up, select the ‘Registration’ option to start the registration process.

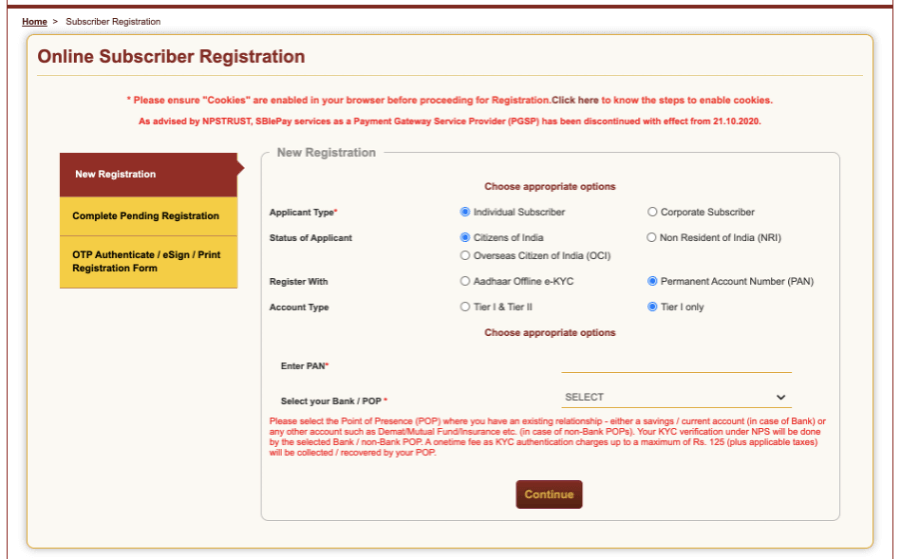

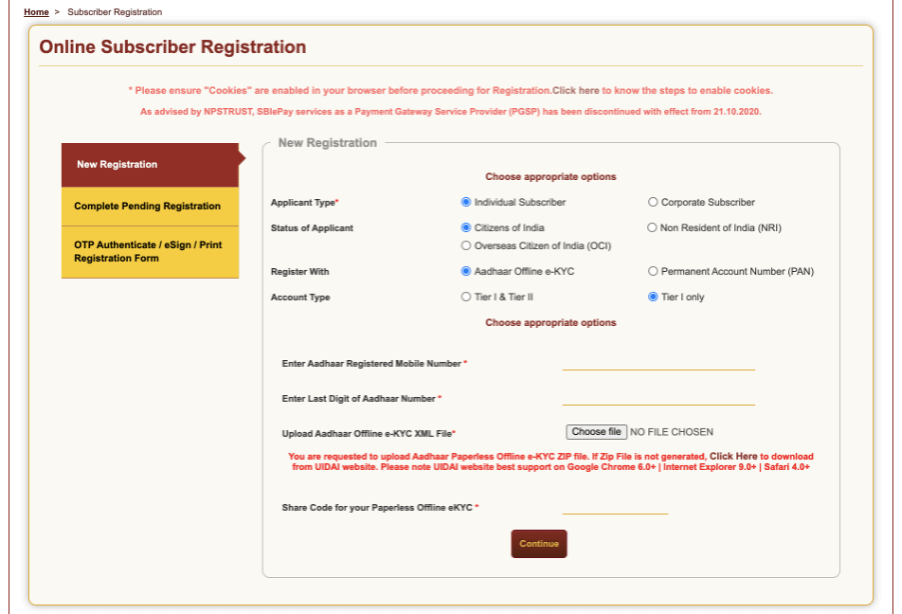

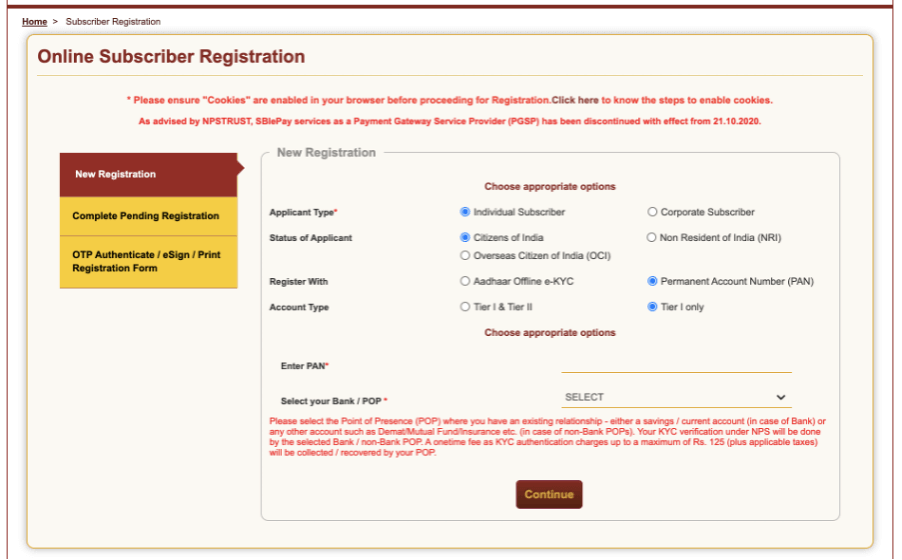

Choose the appropriate options from the following:

- Applicant Type: Individual subscriber or Corporate subscriber

- Status of Applicant: Citizen of India or Non-Resident of India (NRI) or Overseas Citizen of India (OCI)

- Register with: Aadhaar Offline e-KYC or Permanent Account Number (PAN)

- Account Type: Tier 1 and Tier 2 or Tier 1 only

If registering with Aadhaar Offline e-KYC, one has to enter the following details:

- Mobile number registered with Aadhaar

- Last digit of Aadhaar number

- Upload Aadhaar offline e-KYC XML File

- Share code for paperless offline eKYC

If registering with PAN, one has to enter the following details:

- PAN number

- Select your bank / POP

- Click on ‘Continue’ to proceed.

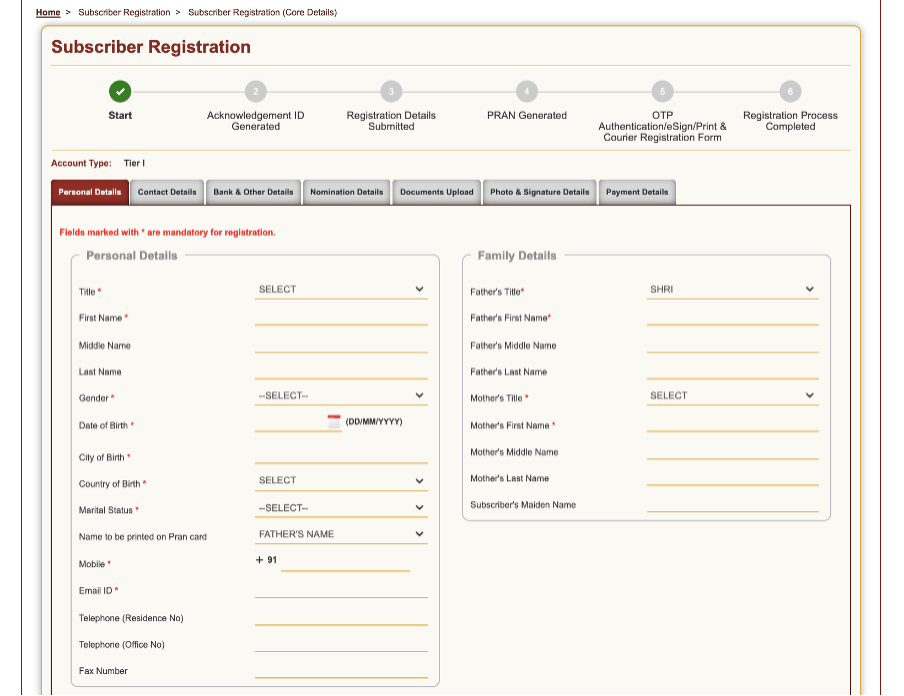

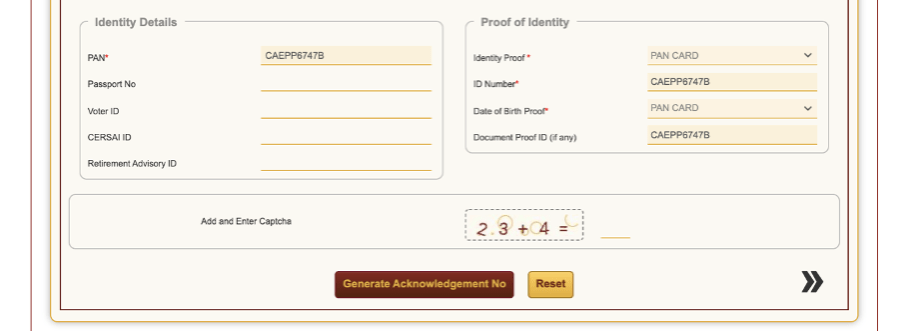

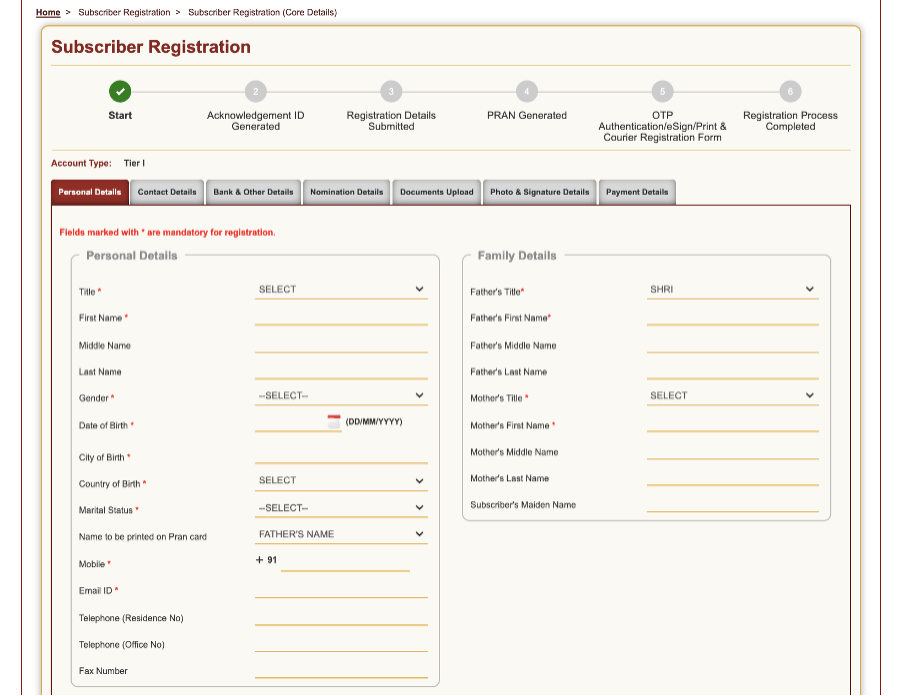

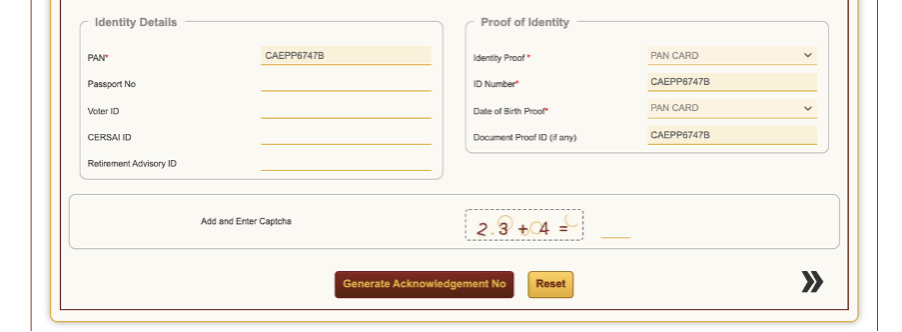

- Next, on the ‘Subscriber Registration’ page, provide all the necessary details to generate ‘Acknowledgement Number’ and proceed.

- Upon providing all the details, making the payment and generating the PRAN, one can complete the registration process by providing OTP authentication or e-sign it or print and courier the registration form.

Offline NPS Registration

To register for the National Pension Scheme offline, one has to visit the nearest Point of Presence – Service Providers (POOP-SP) and collect the NPS registration form. They can also download the NPS registration form online by clicking here.

Once the NPS registration form is filled with all necessary details, one can submit it to the POP-SP along with all the required documents. One can find the nearest POP-SP location by clicking on the links below.

How to fill the NPS Registration Form?

One can fill the NPS registration form either online or print the form, fill it and courier it.

Online filling of NPS Registration Form

The following steps will help an individual to complete the NPS registration form online:

- Fill in all the mandatory details under the Personal Details section to generate an ‘Acknowledgement Number.’

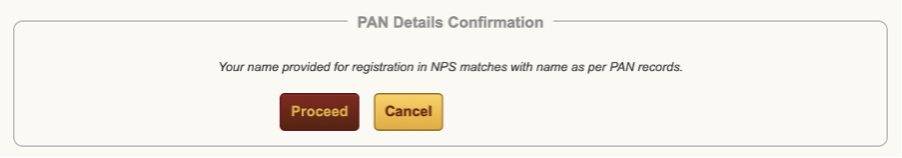

- Once you click on the ‘Generate Acknowledgement Number’ button, click on proceed in the ‘PAN details confirmation’ pop-up.

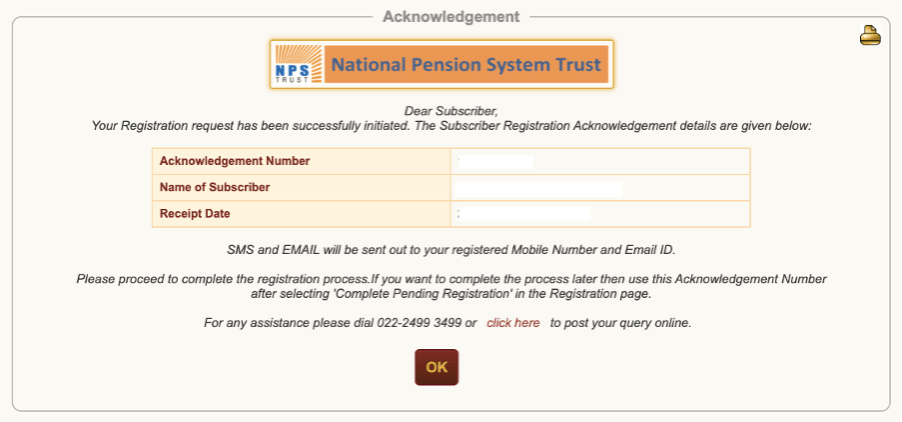

- Next, you will get the Acknowledgement Number, click on ‘OK’ to proceed.

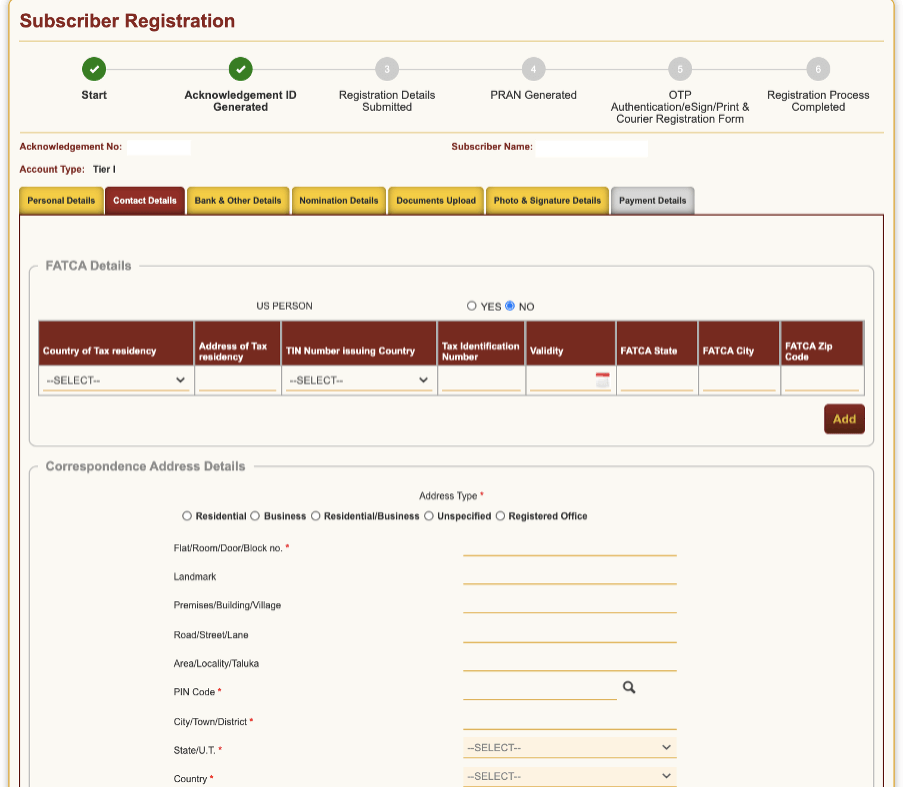

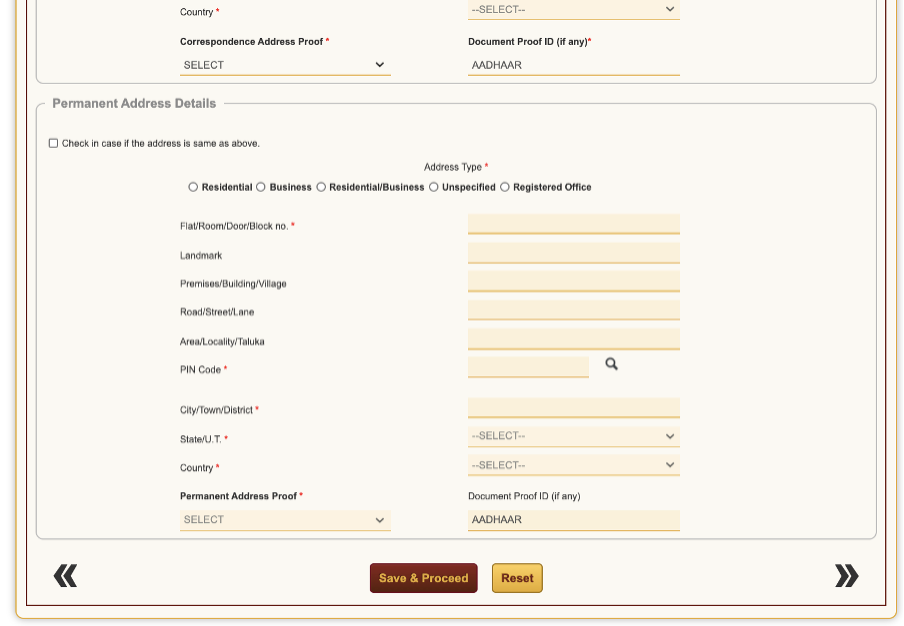

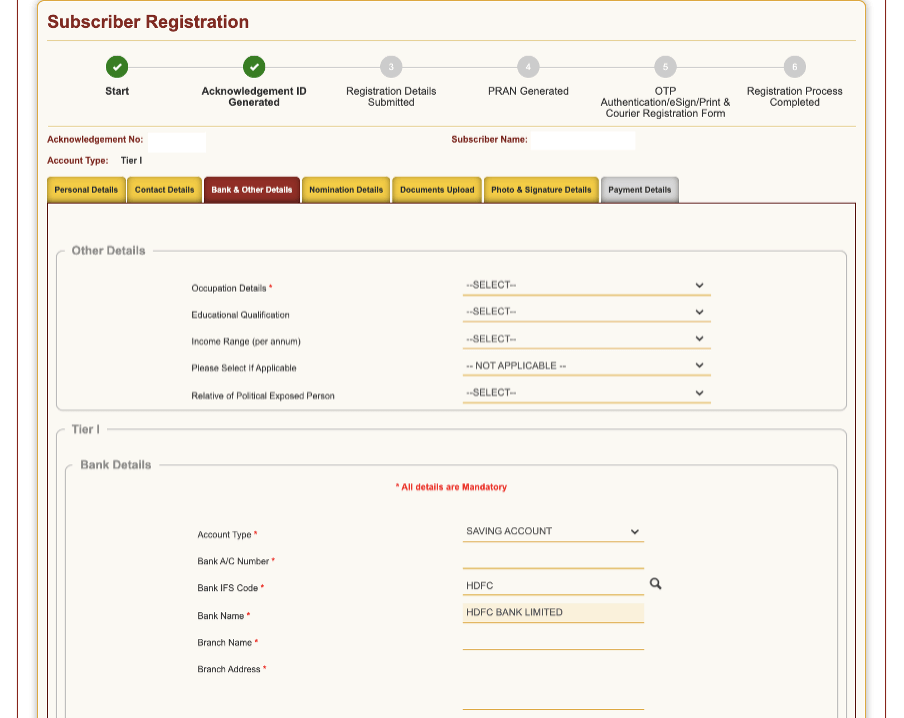

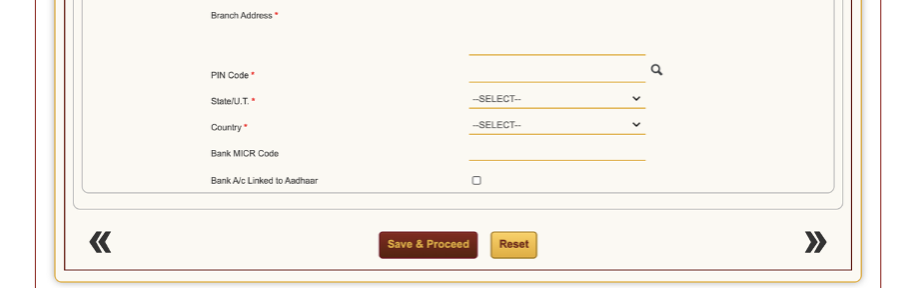

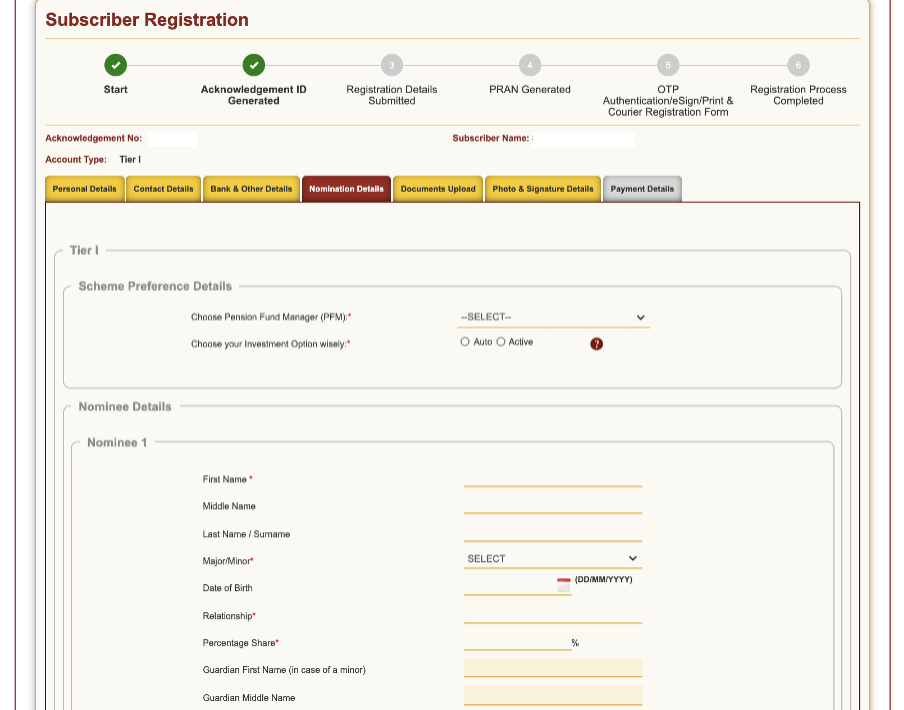

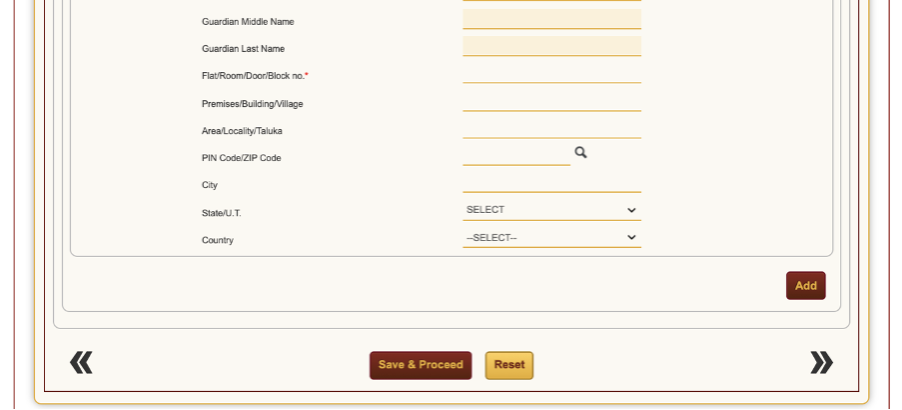

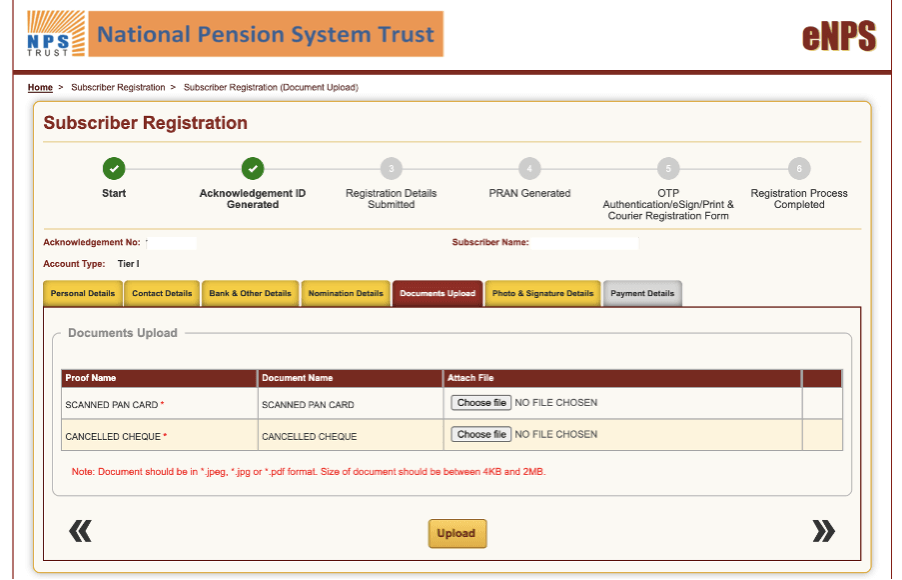

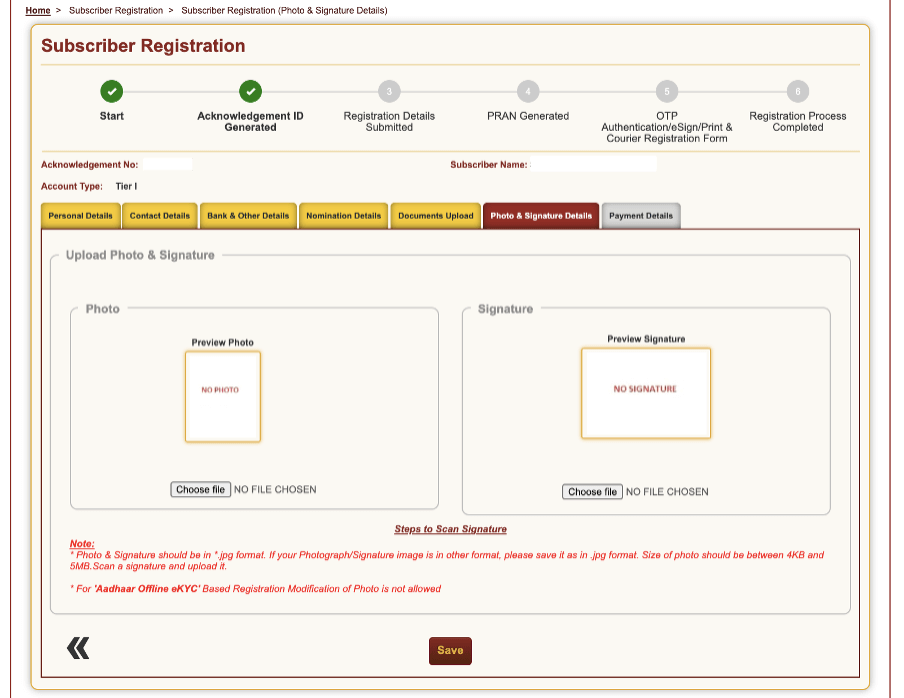

- Now enter all the remaining mandatory details under the Contact details, Bank and other details, Nomination Details, Documents Upload, and Photo and signature details tabs to proceed to the payments tab. After providing all the necessary information in each tab, click on the ‘Save and Proceed’ button to move to the next section.

Following are the screenshots of each tab:

Contact Details Tab:

Bank and Other Details Tab:

Nomination Details Tab:

Documents Upload Tab:

Photo and Signature Details Tab:

- Next, click on ‘Save’ after uploading the photo and signature to proceed to payment details.

- Select the Pension fund manager from the option given and click on the ratio you want to invest in various investments and securities.

- Upon successful submission of the registration details, PRAN is generated.

- Next, you have to authenticate the registration with an OTP or e-sign or print and courier the registration form to complete the registration process.

Form CSRF: NPS Subscriber Registration Form

The Consumer Subscriber Registration Form (CSRF) is the NPS registration form. Filling the form is the primary step for registering for the NPS scheme. The form has to be filled in block letters and with a black ink pen. One can fill the form by providing the following details:

Photograph

On the top left corner of the form, you have to paste a passport size photograph.

Selection of category

Please select the category applicable to you. For example, you can choose either the central government, state government, or corporate sector, etc.

Personal details section

In this section, you have to fill in your name, maiden name, mother’s name, father’s name, date of birth, city and country of birth. You also have to fill in details such as marital status, spouse name and gender.

Proof of Identity

In this section, you have to fill in the identification number of any of the identity documents. The accepted proof of identity is Voter ID, Passport, Driving License, NREGA Job Card and others.

Proof of Address

In this section, you have to tick any accepted address proofs for correspondence address and permanent address.

Correspondence and Permanent Address

In this section, you have to fill in the complete address.

Contact details

This section includes your details like phone number and Email ID.

Other details

In this section, you have to fill in their occupation details, income range, educational qualifications, and political exposure.

Subscriber’s bank details

In this section, you have to give the bank account details from which you want to make NPS contributions. The details include bank account number, bank name, branch address, branch name, IFSC code, and MICR code.

Subscriber’s nominee details

This section includes details of the nominee. A nominee will get the investment proceeds in case of the subscriber’s unfortunate demise. The nominee’s name and relationship with the subscriber have to be filled.

NPS Option Details

In this section, you choose to open a Tier II account and get the PRAN printed in Hindi.

Pension fund selection and investment option

In this section, you can choose the pension fund manager from the available list of fund managers. However, you can choose only one fund manager. You also have to fill the investment option. There are two investment options available. They are the auto choice and active choice. In case you pick the active choice, you have to fill in the percentages for the asset mix. However, there is a maximum limit in each of the asset classes. On the other hand, if you pick the auto mode, you have to select the maximum cap on equity investments.

Declaration of FATCA

In this section, you have to declare whether they are a person from the USA or no. Additionally, you have to also give residence status and Tax Identification Number in each country. Here, you also have to sign along with the date, place and name.

Declaration by the subscriber

In this section, you have to declare that you understood the NPS scheme and all the details provided by them are correct. Also, have to sign at the end of the section along with the place and date.

Declaration by employer

This section applies only to government subscribers. Here details of date of joining, employee code, employee group, and date of retirement has to be filled. Also details like office and ministry they are working and DDO registration number, basic pay and pay scale have to be filled. The employer has to sign at the end of this section.

Declaration by corporate

This section applies to corporate subscribers only. Here one has to fill details of employee code, joining, date of retirement, CBO No., and Corporate Regd. Number (CHO No.). The employer has to sign at the end of this section.

Declaration by aggregator

This section applies only to NPS-Lite subscribers. This section has to be filled and signed by the aggregator.

POP-SP Section

This section has to be filled by POP-SP. It includes POP-SP registration number, receipt number, and other details. The authorized signatory has to sign it along with a seal.

CRA – Facilitation Centre

This section has to be filled by the CRA or Central Recordkeeping Agency.

Acknowledgement

This section will be filled by the POP-SP and given to you. You have to keep this acknowledgement safe as proof.

Documents required for form CSRF

You can submit the following documents:

- Identity proof: Voter ID, Passport, PAN Card, Driving License, NREGA Job Card.

- Proof of address: Passport, Ration card, Aadhar Card, gas bill, water bill, electricity bill, and Driving license,. However, if you are submitting utility bills, they shouldn’t be older than two months.

- Cancelled cheque

Annexure-1

Annexure 1 to CSRF form is the Tier II account application. A subscriber already having a Tier I account can open a Tier II account. This is a voluntary investment account. Hence it is not a mandatory account. You have to fill the form with the following details:

PAN Card number

Bank account details

In this section, you have to give the bank account details from which you want to make NPS contributions. The details include bank name, bank account number, branch address, IFSC code, branch name, and MICR code.

Subscriber’s nomination details

Details of the nominee(s) come under this section. In case of the subscriber’s unfortunate demise, a nominee will get the investment proceeds. The nominee’s name and relationship with the subscriber are to be filled.

Subscriber’s scheme preference

If you want the same fund manager as a Tier I account, then you can simply tick on the box available. In case you want a new fund manager, you will have to fill in all the details. Here, you can choose the pension fund manager from the available list of fund managers. However, you can choose only one fund manager. You also have to fill the investment option. There are two investment options available. They are the active choice and auto choice. In case you pick the active choice, you have to fill in the percentages for the asset mix. However, there is a cap on each asset class. On the other hand, if you pick the auto mode, you have to select the maximum cap on equity investments.

Declaration by the subscriber

In this section, you must declare that you understood the NPS scheme. All the details provided by them are correct. And, sign at the end of the section along with place and date.

To be filled by POP-SP/POP/Nodal Office

POP-SP has to fill this section with the name, place, date, registration number, and signature with seal.

Annexure-II

Annexure-II is the additional request details form. Here you can give the father’s name and mother’s name in full if the same hasn’t been covered on page 1 of the CSRF application form. This form is also useful when you want to get the PRAN Card printed in Hindi. The form requires basic details like the subscriber’s full name and the father’s or mother’s name in Hindi and the subscriber’s sign.

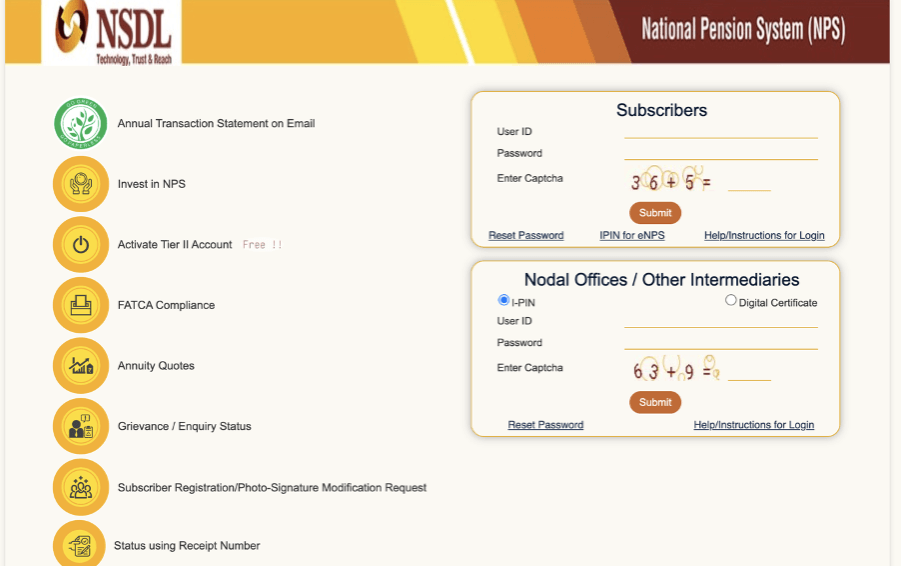

NPS Login Through NSDL NPS Portal

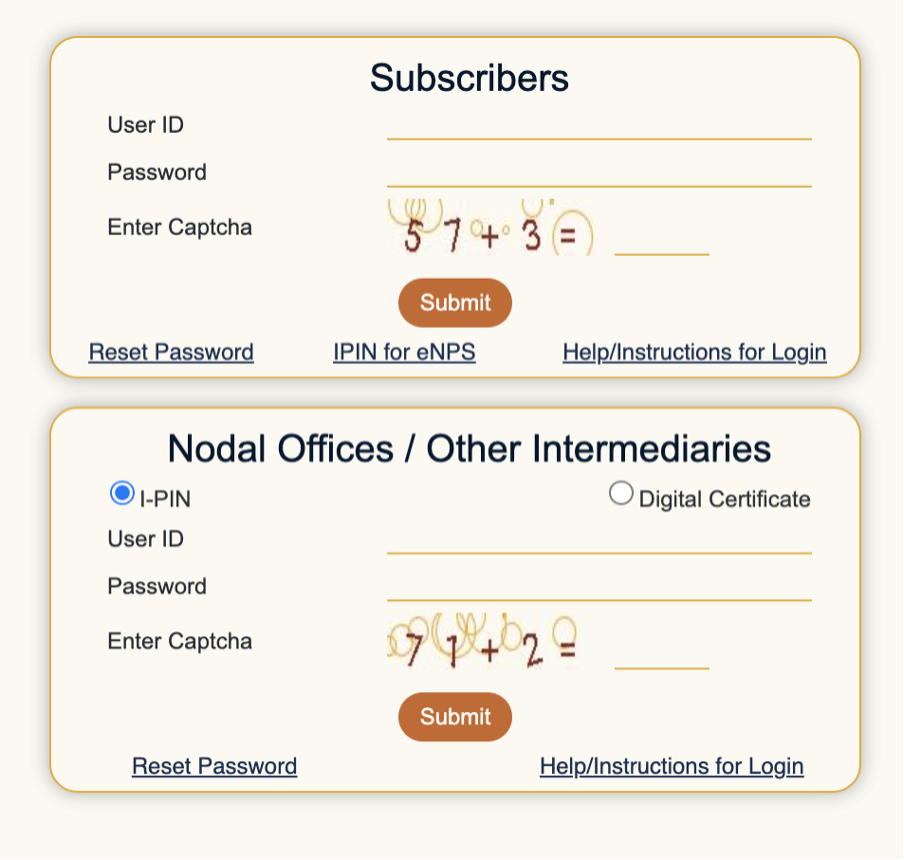

To login to your NPS account through the NSDL portal, one has to follow the steps below.

- Firstly, visit the official NSDL website.

- Under the login tab, click on ‘Subscriber’s NPS Regular’. You will be redirected to the login page.

- Then, enter the user ID, password and captcha and click on submit to login to your NPS account.

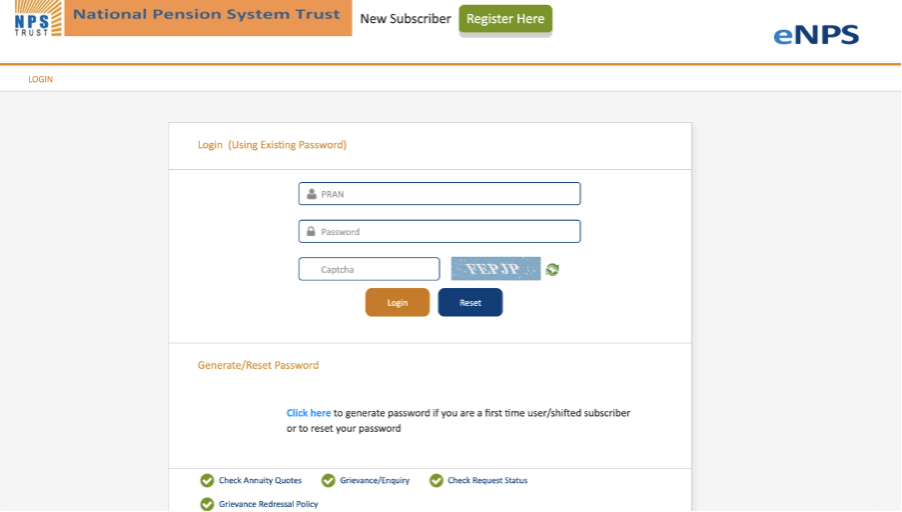

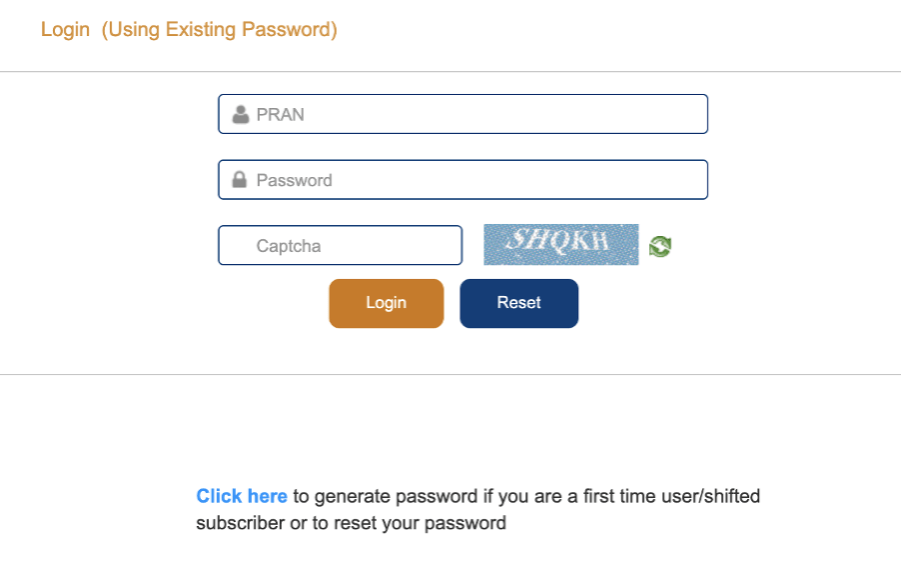

NPS Login Through Karvy NPS Portal

In addition to logging in to the NPS account through NSDL, one can also login to NPS through Karvy NPS Portal. Following are the steps to log in to NPS through Karvy’s online portal:

- Visit the Karvy NPS Portal and click on ‘Login’.

- Enter PRAN, Password and Captcha to login.

- If you are an existing NPS user, you will be redirected directly to your account.

- However, new users will be directed to the following page.

- Here you will have to provide PRAN, Date of Birth and captcha to generate an OTP. You will receive the OTP on your registered mobile number. You can set a new password after confirming the ‘generate new NPS account password’ request using the OTP.

- Also, if you are logging into your Karvy NPS Account for the first time, you will have to set a new password.

NPS Login Through Net banking

Most of the banks have a facility to login to E-NPS. To log in to your NPS account using net banking, follow the steps below.

- Firstly, log in to your internet banking.

- Under the ‘Services’ tab, search for NPS and click on it.

- Then, check your account details and to make sure it is your NPS account.

- You will be able to make contributions and check the balance of NPS through internet banking.

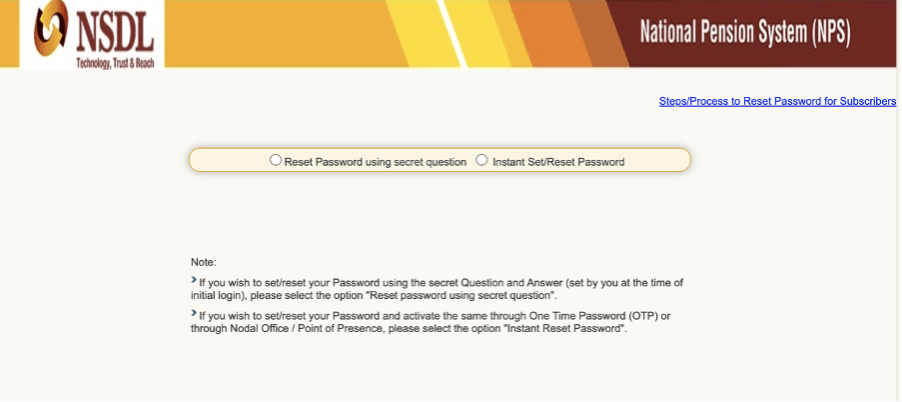

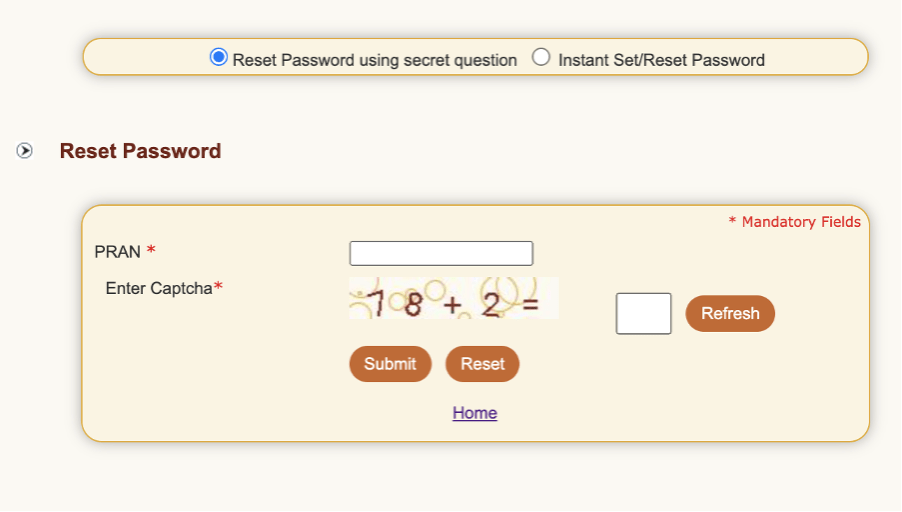

How to reset the password on NSDL NPS Portal?

In case the NPS subscriber has forgotten their NPS login password, they can reset the same by following the below steps:

- Visit the NSDL website.

- Under the ‘Subscribers’ login section, click on ‘Reset Password’.

- You have to choose between the ‘Reset Password using the secret question’ option or the ‘Instant Set/ Reset Password’ option to reset your password.

- Under the reset password using the secret question option, you have to provide the PRAN number and enter the captcha to proceed.

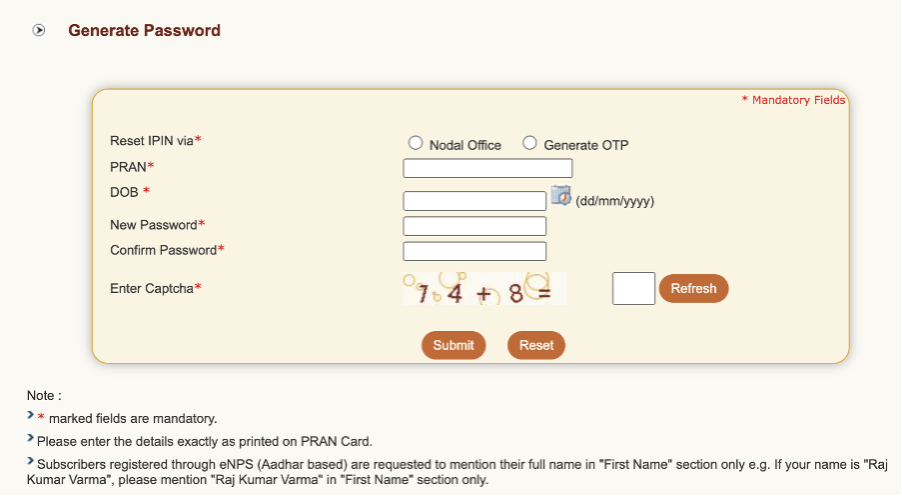

Under the Instant Set/ Reset Password, you will have to provide the following:

- Reset IPIN via: Nodal Office or Generate OTP

- PRAN

- Date of Birth (DOB)

- New Password

- Confirm Password

- Captcha

Upon providing the above details, click on submit to proceed and reset the NPS login password.

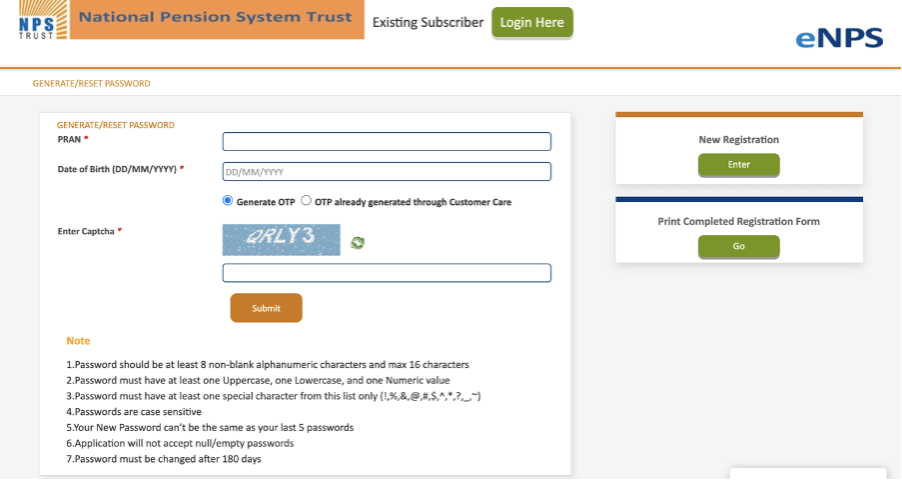

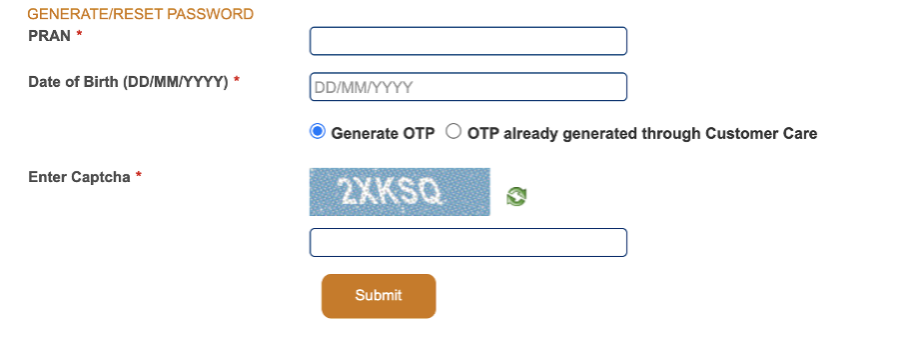

How to reset the password on Karvy NPS Portal?

To reset the NPS account password on Karvy NPS Portal, follow the steps below:

- Firstly, visit the Karvy NPS Portal website.

- Click on Log in, and you will be redirected to the login page.

- Then, click on ‘Generate or Reset Password’.

- Here, you will have to enter your PRAN, date of birth and generate OTP. Once you enter OTP, you will be able to set a new password for your NPS account.

NPS Helpline

For assistance or queries regarding the NSDL NPS account or Karvy NPS account, one can call on the following NPS Helpline Numbers and contact numbers:

| Office Location/Type | NPS Helpline Numbers |

| Mumbai (Head office) | Telephone – (022)2499-3499Fax – (022) 2499-4974 / (022) 2495-2594 |

| NPS Grievance Redressal Officer (Level 1) | (022) 2499-3499 |

| NPS Chief Grievance Redressal Officer (Level 2) | (022) 2495-2594 |

| NPS Exit Grievance Escalation (Level 1) | (022) 2499-4274 |

| NPS Exit Grievance Escalation (Level 2) | (022) 2499-4974 |

| Kolkata (NPS Branch Office) | Telephone – (033) 2290-1396 / (033) 2281-4461Fax – (033) 2289-1945 |

| Chennai (NPS Branch Office) | Telephone –( 044)2814-3917/( 044)2814-3918Fax – (044) 2814-4593 |

| New Delhi (NPS Branch Office) | Telephone-(011) 23705418 / (011) 2335 3817Fax- (011) 2335 3756 |

| Ahmedabad (NPS Branch Office) | Telephone – (079)2646-1376Fax – (079) 2646 1375 |

How to download the NPS App?

To download the NPS by NSDL e-Gov app, one has to visit the play store or App Store on your android or apple mobile. Then, search for the NPS app and download it.

Once the app is downloaded, enter the PRAN, and the PIN received in the PRAN welcome kit to access your NPS account through the app.

Once logged in to the app, one can check your balance in the Tier I and Tier II account. One can also check their profile, including Email and mobile number. Moreover, the app also accepts requests for statements of transactions and contributions. The statements will be sent to the registered email ID. Also, one can request to withdraw from the Tier II account using the app.

What are NPS Online Services?

The following services can be availed online for NPS:

- Change of personal details (address, mobile number, email address)

- Generate or reset IPIN

- Change scheme preferences

- View account statement online

- ePRAN card view and reprint

- Aadhaar seeding

- Change account details

- Furthermore, through the NPS app, one can avail of the following services:

- Submit your Contribution Online for Tier I & Tier II

- Request/View Transaction Statement to your email ID

- Change Scheme Preferences

- Change address using Aadhaar

- Aadhaar Seeding

- View your account details

- View current holding

- Change your password/ Secret Question.

- Generate your password using secret question/OTP

- View last five contributions

- Initiate withdrawal from Tier II

- Change your contact details (Telephone /Mobile number/email ID)

- Get notifications related to NPS.

- One can easily download the NPS app from either the Google play store or the Apple app store.

Discover More

Related Articles

- NPS Registration Process

- How to fill the NPS Registration Form?

- NPS Login Through NSDL NPS Portal

- NPS Login Through Karvy NPS Portal

- NPS Login Through Net banking

- How to reset the password on NSDL NPS Portal?

- How to reset the password on Karvy NPS Portal?

- NPS Helpline

- How to download the NPS App?

- What are NPS Online Services?

Show comments