This article was first published in Moneycontrol.

How frequently do you ponder about leaving your Nine-to-five routine and enjoying things that you have always wanted to do? It may be a three-month vacation, signing up for a course, pursuing a business intrigue, going on a sabbatical, baby sitting during your kids’ initial years or taking care of your ageing parents. It could also be a lay off at work, which you haven’t considered at all, or unexpected emergencies and unforeseen circumstances.

A career break is usually three months to three years long. To plan for it, you need to assess the duration of the break, potential expenses, source of funds and adequate insurance covers (medical and life) for you and your family. Planning will help you to feel more comfortable about taking the final call. It will enable you to take the break without financially draining you and without having to compromise on your plan.

The first step towards creating your financial plan for the break is to estimate your expenses. This would be rather easy if you are taking the break for higher education; your tuition fee and living expenses are almost fixed. However, if you take a long vacation, your expenses will vary based on your choice of destination, travel, accommodation and food. Needless to say, if you are travelling as a backpacker, staying at hostels or BnBs and cooking your own meals, your break would cost you much less than the one with hotel stays and dining out. Also, it is a good idea to clear any short-duration debt before going on a break.

Factoring expenses

When you are calculating the expenses, make sure you consider the following:- Will your family be dependent on you for finances?

– Do you incur fixed expenses such as rent or EMI?

– Do you have medical/health insurance? If it is company provided, will it still cover you during your sabbatical?

– To minimize expenses, do you have to undergo any lifestyle changes like moving in with parents, selling your vehicle and cutting spends on shopping and leisure?

– Will you be working as a freelancer or doing a part-time job during your break?

Let’s say you are going on a two-month vacation to Europe. It would cost you Rs 25-30 lakh across the following major expense categories:- Airfare

– Intercity Travel Cost – Trains, Bus, Car Rentals, etc.

– Accommodation Cost – Hotels, Airbnb, Hostels, etc.

– Food and Beverages

– Activity Costs

– Visa

– Pre-trip Expenses

– Emergency Expenses

Making the right investments

If you are planning to take the break within three years, it is recommended that you start a monthly SIP in low-duration debt funds without any lock-in period or exit loads. Compared to holding the money in savings account or in FD/RDs, you could get higher return from these low-risk mutual funds with high liquidity. Starting a SIP helps you save money systematically every month. If your break is 5 or more years away, you could opt for a SIP in Hybrid (Balanced) mutual funds instead of debt schemes.

Lump-sum investments such as referral or performance bonus, returns from past investments and quarterly incentives could come in handy while planning for your break. When your break is around the corner, spend these amounts wisely. You may use this bonus money to repay any short-term debts and invest the remaining in low-duration mutual funds.

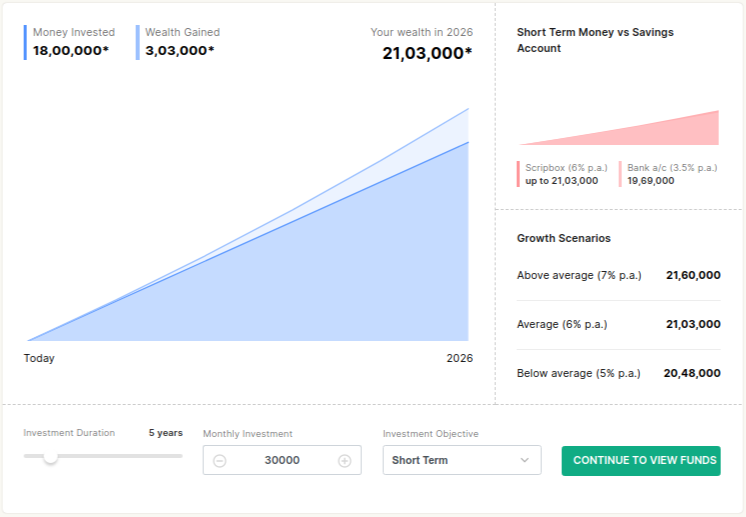

Here is an illustration to show you the returns from a Rs 30,000 p.m. five-year SIP in a popular hybrid fund. As you can see, with a Rs 30,000 monthly investment, you are able to plan for your break in a five-year window.

Source: Scripbox SIP Calculator

Note: Estimation is based on historical return of the funds and done to facilitate informed decision making for investors. Actual results may vary.

If you are going on a long break (say one or more years), you can draw a monthly income from your mutual fund corpus. During your break, you may pause your long-term SIPs and start drawing a monthly income through a Systematic Withdrawal Plan (SWP) from your investment corpus to support your monthly expenses during the break.

It’s always good to be prepared for the worst. Buying term and health policies is highly recommended before taking a break from your job. Having an emergency fund is another aspect. An emergency Fund is a saviour during emergencies that you haven’t planned for and cannot be covered by either your insurance or your investment for the break. If you don’t have this already, start investing for it along with your investment for the break.

Taking a break from your regular life is important. While a lot of us want it, few end up taking it. If you are serious about taking one in future, planning your finances and investing for the break becomes a necessity. When you do not work, your investment will work for you!

Check Out SIP Calculator

Show comments