Face value is the original value of a share shown on the share certificate. In other words, it refers to the value listed on share certificates, digital records, and books. The face value is fixed when publicly listed companies issue stock through IPOs.

It doesn’t change with time unless there is a stock split. When a company announces a stock split, the value of each share reduces, and the number of shares increases.

Why is Face Value is Important to an Investor?

Face value is significant in the stock market. Therefore, if you want to invest in the market, you need to understand its relevance. Now, let’s see its importance.

- It aids in premium computation.

- It assists in assessing a stock’s current market value.

- It aids in determining the interest rate.

- It aids in the evaluation of profitability.

- Dividend: A dividend is always issued based on the face value of the share and not on the market price. Suppose ABC Ltd’s face value is Rs 10 and the market value is Rs 100, and if the company announces a Dividend Payout ratio of 50%, it means the dividend per share is Rs 10*50%= Rs 5.

- Stock split: A company can increase the number of outstanding shares by a stock split as well as lower the price per share without having any impact on the company’s overall market capitalisation. Therefore, a company goes for a stock split when the share price is relatively high, making it difficult for investors to afford them. When there is a stock split, companies issue additional shares to their existing shareholders.

Suppose the face value of XYZ Ltd is Rs. 5 and it decides to split the shares in a 1:5 ratio. Then the face value per share reduces to Rs 1.

| Particulars | Face value | Market value |

| Meaning | Original value as shown on the share certificate | Current price at which the share is traded |

| Decided by | Company | Demand and Supply, company’s future prospects. |

| Value | Low | High |

| Affected by market conditions | No | Yes |

| Constant or Inconstant | Constant, unless there is a stock split | Fluctuates throughout the trading period |

- Face value per share is equal to equity share capital divided by the number of outstanding shares.

- Market value per share is equal to the market value of the company divided by the number of outstanding shares.

How is Face Value Different from Book Value?

Let us understand the difference between the face value and book value of a share.

| Particulars | Face value | Book value |

| Value | Face value is the original value of a share as shown in the share certificate or books of the company. | Whereas book value is the value of a shareholder’s equity as per books of accounts. |

| Decided by | It is decided during the initial phases of the offering. | It is the residual value that remains if a company has to sell all assets or liquidate. |

| Constant or Inconstant | It does not fluctuate with time except when there is a stock split. | It changes as the reserves or profits of the company change. |

- Book value is equal to the difference between Tangible assets and Liabilities. It can also be calculated by adding Equity share capital and Reserves.

- Book value per share is equal to Book value divided by the number of outstanding shares.

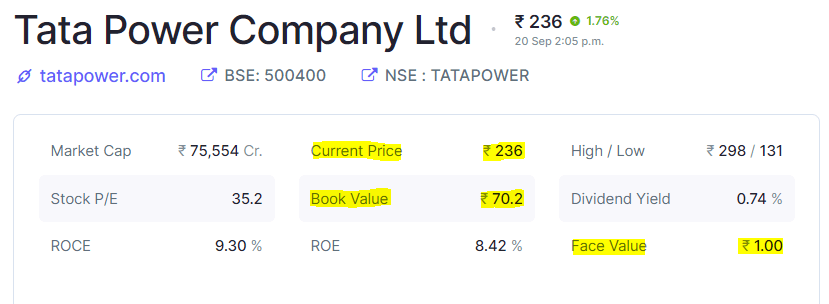

Source: Screener

In the above diagram, we can see face value, book value, and current price, which is nothing but the market value of a Tata Power share.

Frequently Asked Questions

Generally, it is constant. However, it changes when the company conducts a stock split, in which the face value of the share is reduced to half its original face value and the number of shares is doubled.

For example, if the FV of a share is Rs.10 and the company announces a stock split in the ratio of 1:1, then each share will be split into 2 and the FV of a share will be reduced to Rs.5.

What is the minimum face value of a share?

As per SEBI, INR 1 is the minimum face value requirement for any public limited company to get listed on the stock exchange.

Can the face value of a share be less than Re. 1?

As per SEBI, is INR 1. Therefore, it cannot be less than Rs. 1 because the minimum face value requirement for any public limited company to get listed on the stock exchange,

Can the share price fall below the face value?

Yes. It means that the shares are available at a discount. This happens when the company is not performing well or is bankrupt. Most of the stocks that are traded below their face value don’t remain listed for long.

Can companies issue shares at their face value?

Yes. Companies can issue shares at their face value. It is nothing but the issue of shares at par.

Show comments