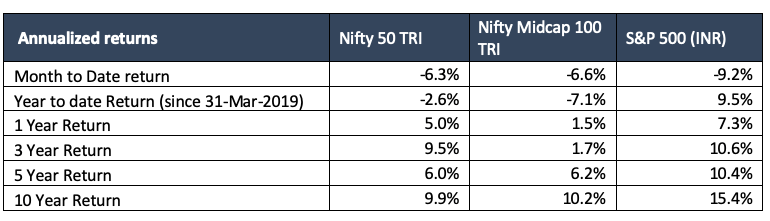

Equity markets in February 2020:

● The large-cap oriented Nifty was down by 6.3% for the month and the Nifty Midcap index was down by 6.6% for the month largely due to the Coronavirus impact globally.

● The S&P 500 (US Markets), in INR terms was down by 9.2% for the month, and up 9.5% for the year.

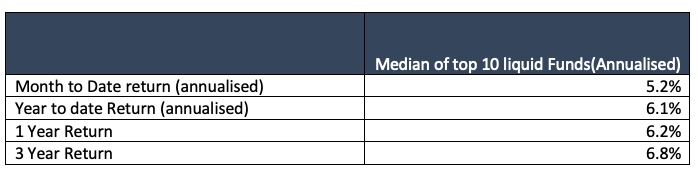

Debt markets in February 2020:

● Median returns of the Top 10 liquid funds averaged 5.2% annualised, down from the past year.

● The 10 year government bond yields are currently at 6.4%, down from 6.6% last month. This is despite the high fiscal deficit.

Factors affecting markets:

1. Equity markets traded on a negative note in February being particularly hit hard towards the end of the month, reflecting the seriousness of the potential impact the growing Coronavirus outbreak might have on the global economy. Corporate results have been weak as well, but growth rates of some of the larger companies have been better than overall economic growth. With the government coming up with various initiatives, economists expect an economic recovery in about 2 quarters.

2. Among the biggest challenges faced by the economy is continuing weakness in GDP growth coupled with a relatively high fiscal deficit. Some of the key initiatives like lower corporate tax rates are expected to kick start the investment cycle by the industry. Opening up the economy to foreign capital should help counter the impact of high fiscal deficit. For investors, the next 2-3 quarters is a critical period to watch.

3. With the Coronavirus outbreak, there are genuine fears about global economic growth. With the Indian economy already on a weak stretch, any impact onto the global economy can delay the prospects of the economic recovery. The impact on global supply chains is significant and it is hard to calculate the true extent of the disruption. Recovery from this crisis is unlikely to be quick as the world’s second-largest economy, China, is at the centre of this outbreak.

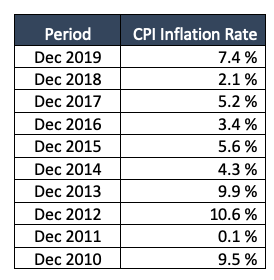

4. Over the past few years, inflation has been relatively muted in India and this is good for the economy, especially the poorer sections of the economy and the retirees. Over the past 2 months, we have seen inflation to be higher than the long term targets set by the regulator. If higher inflation persists, investors need to be aware of how it can impact their investment portfolios.

5. In time of higher inflation, interest rates tends to rise but we have also seen some of the larger companies operating in the economy get back their pricing power. Such companies tend to deliver inflation beating returns over time.

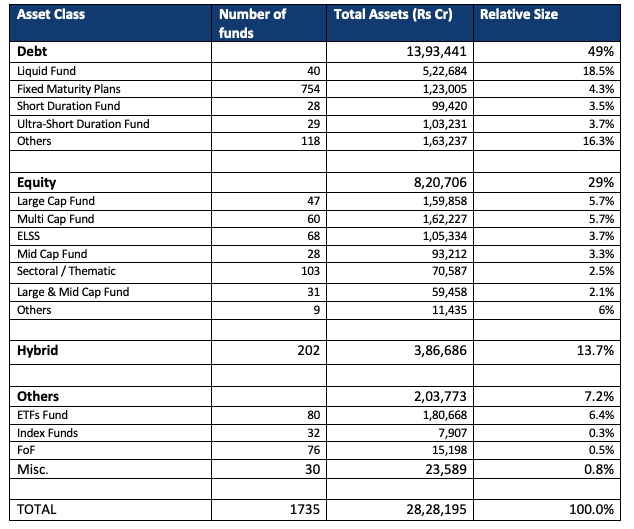

Indian Mutual Funds Industry :

With a total asset base of nearly Rs 28 lakh Cr ($ 405 billion), the Indian mutual fund industry has come a long way over the past 25 years, when the private sector was allowed to manage money on behalf of retail investors.

• 49% of assets are in debt funds, up from January, with liquid funds dominating the category. Liquid funds have provided fairly stable and reliable returns over time, with very little credit risk. Note that institutional investors, who mainly have current accounts, use liquid funds to get some better returns on the surplus cash.

• 29% of assets are in equities, up from January, which is predominantly dominated by individual investors. With Rs 8 lakh Cr invested in equities, the category is definitely catching up with retail investors as a long term inflation-beating asset class.

Summary:

The Coronavirus crisis is likely to impact equity-oriented funds, at least in the short term. However, the long term outlook is still positive. Despite the economic weakness, the large-cap oriented funds have been doing well and expected to deliver growth in long term equity markets returns. Investors with a long term view of markets have benefited from growth in NAVs in these funds.

Show comments