What’s the news?

Currencies swing wildly across the global market.

What does that mean?

The sharp fluctuations of some of the world’s major currencies are adding to the uncertainty in the global economic outlook. The US dollar index continues to scale new heights. This, in turn, translates into weak performance for other currencies such as the British Pound, Japanese Yen, and the Indian Rupee, which have fallen to record lows against the dollar.

The era of cheap liquidity, which lasted during the time of covid, has well and truly come to an end.

The Central Banks across advanced and emerging countries are tightening their monetary policy to tame the rising inflation risk. Last week, the US Federal Reserve hiked the policy interest rates by 75 bps (1 bps is 1/100th of a percentage), and the Fed Chair has signalled more rate hikes in the coming months.

The series of interest rate hikes by 300 basis points by the US Federal reserve since March 17, 2022, is one of the major reasons for the dollar strengthening. When the interest rate increases in the US, there is a rise in the risk premium for investable assets across the globe. The risk premium is the return in excess of what a risk-free investment (such as US treasury bonds) yields that an investment instrument must generate if it is to be considered for investing.

Rising rates in the US reduce the attractiveness of holding risk assets, and therefore it leads to the investors pulling funds away from local markets. Emerging market outflows in the form of dollars strengthen the US dollar further and weaken other countries currencies.

Besides, when there is global uncertainty, then the US dollar has always been seen as a safe haven for investors. The Russian invasion of Ukraine, Economic-political problems of Europe, and The Chinese zero covid policy have led to a rise in global uncertainties, and that has increased the demand for the Dollar as a safe haven.

The Indian Rupee has plunged to an all-time low of 81.67 against the US dollar.

The falling rupee may adversely impact central government finances. This can come through a higher subsidy bill on fuel and fertilizers, a higher import bill on other items, gold and, thus increasing the trade deficit along with importing inflation.

The RBI has been continuously intervening in forex markets to protect against any sharp depreciation in the rupee. RBI has tried to defend the weakening Rupee via Dollar sales which have depleted its forex reserves to $545 billion from the peak of $642 billion a year ago.

The widening current account deficit means that the Rupee will remain under pressure, and this would imply that RBI will have to sell more Dollars to defend the Rupee further.

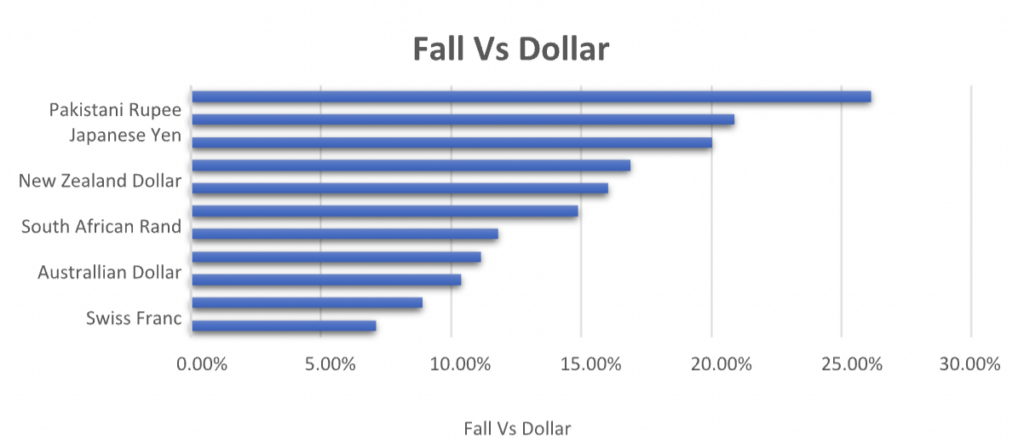

The Indian rupee is not the only currency that depreciated against the dollar in 2022. Many other currencies are depreciating against the dollar and by much more than the rupee. However, Rupee also strengthened against G10 currencies like the euro, yen, and pound sterling.

The chart below shows the fall of each currency against the dollar in 2022.

How does that impact your wealth?

In the near term, foreign investors are likely to pull out money from India due to the rate hikes by the Federal Reserve and the simultaneous strengthening of the US Dollar.

In the short run, the Rupee may go down further as the RBI may not be able to match the quantum of rate hikes by the US Fed.

However, the recent traction in exports will find further momentum once the US Dollar starts to reverse the rise. This reversal will start to happen once the US inflation is bought under control and global uncertainties go down.

Schemes and themes like The Product Linked Incentive (PLI), Atmanirbhar Bharat, Make in India, China plus one strategy will lead to rising exports over time and reduce the dependency on current imports.

The Equity market will be volatile in the near term, and it will reflect in the performance of your mutual fund investments.

On a longer-term basis, India remains one of the attractive investment options with strong fundamentals, and therefore the short-term market fluctuations may be used for accumulating more funds and stock units if you have the available reserves. Check your asset allocation first if you intend to walk down this path.

Show comments