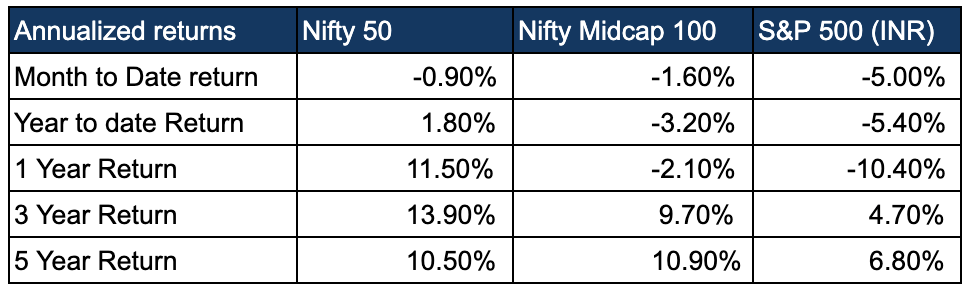

Equity markets in June 2019:

- Equity markets continued to trade on the negative side in June, partly adjusting for the strong performance over the prior few months. Post the elections, there is a sense of reality kicking into stock markets. With the NBFCs continuing to face liquidity issues, there are concerns over credit flow into the economy. Overall GDP growth has been affected over the last couple of quarters, which in turn affects growth rates of companies.

- Mid and small caps continued to trail the larger cap oriented Nifty in June-19. We have been seeing this trend over the past 18 months.

- The S&P 500 (US Markets), as measured in rupee terms was weak in June, partly driven by the strong Rupee.

On one side, some of these defaults are large and have a big impact on overall credit flows. On the positive side, promoters of such companies are acting quickly to sell off assets and repay the loans. This is important to note, as problems are part and parcel of any growing economy. It is the swift resolution of these problems which makes it a healthy economy.

Debt markets in June 2019:

- Median returns of the Top 10 liquid funds averaged 6.9 % pa, which is lower than the last 12 month average return of 7.5% pa. Interest rates have been coming down.

- Government bond yields have been coming off sharply, with the 10 year government bond yields trading close to 6.9%. This is good for the economy, as it reduces overall cost of borrowing for corporates and consumers. On the other hand, do expect overall debt market returns to come down in the coming months.

- Some large default by corporates like DHFL, Reliance ADAG group finance companies, IF&FS, Essel, etc continued to plague the bond market. Debt funds with large exposure to such companies have seen a fall in NAV values. On the other hand, the impact due to such bonds compared with the overall debt market continues to the relatively small.

Factor affecting markets:

- Defaults by large companies like DHFL, Reliance Capital group companies, etc continued to dominate headlines in June. On one side, some of these defaults are large and have a big impact on overall credit flows. On the positive side, promoters of such companies are acting quickly to sell off assets and repay the loans. This is important to note, as problems are part and parcel of any growing economy. It is the swift resolution of these problems which makes it a healthy economy.

- With the new government in place, with a strong mandate, one can expect some important reforms in the coming months. New budget to be presented on Jul 5th should set the tone for the coming years. We continue to expect a policy of pro-development on one side and better tax compliance on the other side.

- It is important to watch out for the current year monsoons, which has been weaker than normal so far. The economy is already fragile over the last couple of quarters and a good monsoon is important to support an economy turn around.

Summary:

All eyes on the new government policy, progress of the monsoon and the NBFC sector recovery, as all are necessary for the economic growth momentum to get back on track.

Show comments