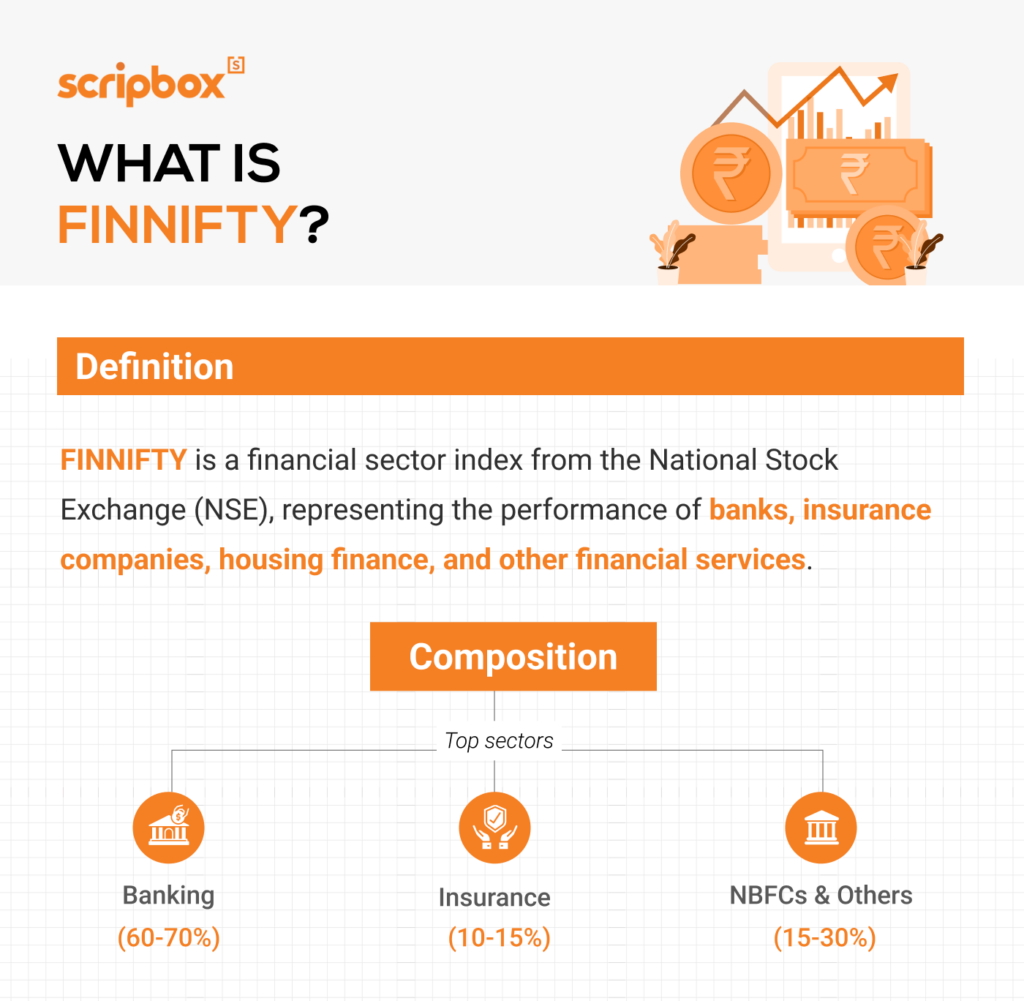

What is FINNIFTY?

The Nifty Financial Services Index, also known as FINNIFTY, was launched by the NSE on September 7, 2011. It comprises 20 stocks, including banks, financial institutions, housing finance companies, insurance companies, and other financial services companies, with their weight determined by free float market capitalisation. The FINNIFTY tracks the performance of these companies, and the weight of each stock depends on the market’s free float capitalization value.

Financial companies are essential for the success and survival of the economy, especially in countries like India, where the economy is continuously changing. Banks lend borrowers money from surplus savings. At the same time, NBFCs and Housing Finance Companies (HFCs) promote credit creation and overall economic growth.

Therefore, the behavior of this index depends on the performance of underlying economic sectors. In other words, FINNIFTY symbolizes Nifty Financial Services.

Note: Free float market capitalisation measures the total value of a company’s shares that are available for public trading, excluding shares held by insiders or controlling shareholders. This approach provides a more accurate representation of the stock’s liquidity in the market.

Introduction to FINNIFTY

FINNIFTY, also known as the Nifty Financial Services Index, is a benchmark index that tracks the performance of the financial services sector in India. It is a unique blend of two words – Financial and Nifty, signifying the intersection of financial expertise and the Nifty index. The FINNIFTY index is a vital tool for investors and analysts to gauge market trends and understand the intricate dynamics of the financial industry. By providing a comprehensive overview of the financial services sector, the Nifty Financial Services Index helps investors make informed decisions and strategize their investments effectively.

The Nifty Financial Services Index (FINNIFTY) was introduced to provide a focused benchmark that captures the performance of India’s diversified financial services sector more effectively. Prior to its launch, existing indices bundled financial stocks with broader market segments, making it difficult for investors and market participants to gauge pure financial services performance or manage risk exposure specific to this crucial sector. By isolating the financial services domain, FINNIFTY meets the need for a specialized index that better reflects the growth, risk profile, and opportunities within banks, NBFCs, insurance, and other financial segments, enabling more precise portfolio construction and risk management strategies.

The FINNIFTY Index

The FINNIFTY index is a free-float market capitalization-weighted index that comprises up to 20 top financial services companies listed on the National Stock Exchange (NSE). The index is calculated using the free-float market capitalization method, which takes into account the market value of the companies’ outstanding shares. The weightage of each company in the index is dynamic and can shift with market fluctuations and periodic reviews. This methodology ensures that the index accurately reflects the market conditions and the relative importance of each constituent company, making it a reliable indicator of the financial services sector’s performance.

Methodology

The FINNIFTY index is constructed based on the free float market capitalization methodology. Nifty 50 also follows the same methodology. Also, the weightage rebalancing happens every six months – on January 31 and July 31.

The base date for FINNIFTY is January 1, 2004, and the base value for the index is 1000. Moreover, companies must be part of the Nifty 500 to be eligible for FINNIFTY.

No single stock will have a weightage of more than 33% because the weightage of each stock is on the basis of free-float market capitalization. Also, the weightage of the top three stocks cumulatively should not be over 62% when the rebalancing occurs.

What are the Sectors Involved in FINNIFTY?

The following are sectors and their weightage involved in FINNIFTY.

| Sector | Weightage |

| Banks | 63.1% |

| Housing Finance Firms | 18.5% |

| NBFCs | 8.1% |

| Insurance Firms | 8% |

| Other Financial Services | 1.3% |

| Financial Instituions | 1.1% |

| Total Financial Service Exposure | 100% |

Uses of the Nifty Financial Services Index

The following are the major uses of the Nifty Financial Index (FINNIFTY) –

- Benchmark: FINNIFTY serves as a specialized yardstick for tracking the performance of India’s financial sector, allowing investors to measure returns against a more relevant benchmark than broader indices like the Nifty 50 or BSE Sensex. For instance, a portfolio manager running a bank and financial services fund can assess whether their selections outperform FINNIFTY over a set period, ensuring an apples-to-apples comparison within the same sector.

- Hedging Against Individual Stocks: Professional investors often replicate FINNIFTY’s composition by purchasing constituent stocks in proportion to their index weights (which decline as you move down the list). For example, if the largest stock makes up 15% of the index, an investor might mirror that exact weighting in their portfolio. Conversely, someone holding a large position in a single financial services stock can hedge sector risk by shorting FINNIFTY futures or using FINNIFTY options, thus offsetting potential losses from sector-wide volatility.

- Mutual Funds: Investors can prefer to put their money in mutual funds that track these stocks in the index. Some mutual fund schemes comprising FINNIFTY stocks are Invesco India Financial Services Fund, ABSL Banking and Financial Services Fund, and Sundaram Financial Services and Opportunities Fund. Therefore, investors who avoid investing directly can invest via mutual funds.

- Futures & Options: Investors can also choose stocks from the FINNIFTY index and trade in futures and options for such stocks. The fee and the expiry date will be mentioned in the derivative contract. However, it can be a risky alternative for investors who are not experienced, as they can quickly lose money.

Benefits of Investing in FINNIFTY

Investing in FINNIFTY, or the Nifty Financial Services Index, offers a range of advantages for investors looking to tap into the financial sector:

- Diversification: By investing in FINNIFTY, you spread your portfolio across top financial services companies, reducing the risk of relying on just one or two stocks.

- Sector Exposure: FINNIFTY gives direct access to the financial sector’s growth potential, including banks, NBFCs, and insurance companies.

- Trading Flexibility: FINNIFTY offers futures and options and supports multiple trading strategies, making it a great choice for active traders.

- Liquidity: FINNIFTY derivatives are highly liquid, ensuring quick and seamless trading opportunities.

- Hedging Opportunities: FINNIFTY can be used to hedge risks associated with fluctuations in the financial sector, offering protection during market volatility.

- Cost-Efficiency: Instead of buying multiple individual stocks, investing in FINNIFTY provides lower-cost exposure to a basket of financial companies.

- Benchmarking: FINNIFTY is a key benchmark for evaluating performance in the financial services sector, aiding in better asset allocation.

Risks of Investing in FINNIFTY

While FINNIFTY provides a targeted view of India’s financial services landscape, investors should be aware of the following risks, especially how they might manifest during economic downturns or periods of market stress. Below are potential challenges and suggested strategies for mitigation:

- Concentration Risk

- Challenge: The index comprises a relatively small set of large financial companies, meaning the performance of a few key players can disproportionately influence the index. During economic downturns or industry-specific crises, underperformance by these major constituents can rapidly drag down the entire index.

- Mitigation: To manage this risk, investors may balance their FINNIFTY exposure with broader market indices or diversify into other sectors. Additionally, employing hedging tools—such as options or futures on the index—can help offset unexpected losses.

- Limited Small-Cap Exposure

- Challenge: FINNIFTY primarily focuses on large-cap financial institutions, which can exclude smaller, potentially faster-growing companies. This limited scope might reduce the potential for high-growth returns often found in emerging firms.

- Mitigation: To capture higher-growth opportunities, some investors choose to complement their FINNIFTY holdings with mid-cap or small-cap funds, either within the financial sector or across broader market segments.

- Sector-Specific Volatility

- Challenge: Being concentrated in financial services, FINNIFTY is particularly vulnerable to shifts in interest rates, regulatory policies, and broader economic conditions. During periods of stress, banks and financial institutions can face higher default rates, liquidity pressures, or government intervention, all of which can exacerbate volatility.

- Mitigation: Investors can navigate sector-specific risks by maintaining a diversified portfolio spanning multiple industries, closely monitoring regulatory announcements, and using financial derivatives or other hedging mechanisms to manage exposure. Regularly reviewing macroeconomic indicators—such as GDP growth, inflation, and monetary policy changes—can also help adjust positions proactively.

Selection Criteria for Investing in FINNIFTY

- Sector Eligibility: Only companies from the finance sector are eligible for inclusion in FINNIFTY. This ensures that the index accurately reflects the performance of the financial industry.

- Weighting: The weight of each sub-sector within the index is determined by its median free-float market capitalisation, which considers only shares available for trading, excluding promoter holdings. This approach ensures that the index’s composition reflects the relative importance of each sub-sector and allows for dynamic adjustments based on market fluctuations.

- Company Selection: Twenty companies are selected from each subsector, ensuring a balanced representation. Due to their higher liquidity, priority is given to companies listed on the NSE’s futures and options segment.

- Inclusion Criteria: To ensure the index’s quality and stability, companies must meet certain criteria, such as having a minimum average free-float market capitalization and not exceeding specific weighting limits.

Factors Affecting the FINNIFTY Index

The FINNIFTY index is influenced by a variety of factors, including economic indicators, monetary policy decisions, and interest rates. Economic indicators such as GDP growth, inflation rates, and employment levels can significantly impact the performance of the financial services sector, which in turn affects the FINNIFTY index. Additionally, monetary policy decisions by the central bank, such as changes in interest rates, can influence the profitability of financial institutions, thereby affecting the index. Understanding these factors is crucial for investors as they navigate the complexities of the financial market and make informed investment decisions.

How to Invest in the FINNIFTY Index?

Before investing in FINNIFTY, it’s essential to match your choice of financial instrument—whether Exchange-Traded Funds (ETFs), mutual funds, or derivatives—to your specific risk tolerance, time horizon, and overall investment strategy.

Begin by assessing your comfort with market fluctuations and how often you wish to trade. For instance, if you favor frequent, flexible trades with lower transaction costs, an ETF tracking the FINNIFTY might be ideal.

Those seeking professional fund management and automatic rebalancing could opt for a FINNIFTY-focused mutual fund. In contrast, experienced traders looking to hedge existing positions or capitalize on short-term price movements might explore derivatives like futures and options on FINNIFTY.

Next, evaluate each product’s cost structure, liquidity, and minimum investment requirements. ETFs typically carry lower expense ratios and offer intraday liquidity, allowing quick entry and exit, whereas mutual funds often have higher fees but provide systematic investment plan (SIP) options for gradual deployment of capital.

Derivatives require a thorough understanding of margin requirements and implied leverage, making them better suited for seasoned investors comfortable with managing higher risk. Ultimately, a step-by-step approach—starting with clarifying your goals, selecting the right vehicle, and continuously reviewing performance—can help ensure that your FINNIFTY investment aligns with both your objectives and market conditions.

This market index cannot be purchased directly, like company shares. However, there are multiple ways through which one can invest in the index as follows –

FINNIFTY Vs Bank NIFTY: Key Differences

The following are the differences between FINNIFTY Vs Bank NIFTY.

| Parameters | FINNIFTY | Bank Nifty |

| Sector Composition | Includes banks, NBFCs, HFCs, and insurance, offering broader financial exposure. | Focuses solely on banking, intensifying interest-rate and credit-related risks. |

| No. of stocks | Comprises of 20 companies, reducing single-segment volatility. | Features 12 banking stocks, leading to sharper market movements. |

| Performance History | Typically remains more stable in downturns due to diversified coverage. | Often sees pronounced fluctuations, outperforming in economic booms but underperforming in busts. |

| Volatility | Experiences generally lower volatility given its wider financial mix. | Exhibits higher volatility, driven by rapid shifts in interest rates and credit conditions |

| Correlation with Nifty 50 index | Shows about 94% correlation with a Beta of 1.2, reflecting slightly broader sector influence. | Correlates around 98% with Nifty 50, amplifying both gains and losses in line with the broader market. |

| Market Impact | Has lower trading volumes but offers a more comprehensive snapshot of the financial sector. | Highly liquid and significantly shapes market sentiment due to its concentrated focus on leading banks. |

Financial Services Sector

- 5 out of 20 stocks of the FINNIFTY index are constituents of Bank Nifty and account for 63.89% weightage in the FINNIFTY index and 87.48% weightage in Bank Nifty.

- The financial sector is the largest listed company, accounting for 33.5% of the Nifty 500 index.

- The financial industry accounts for 35% of the foreign portfolio investments (FPIs) assets under management (AUM).

- As per recent reports, 48% of FPI’s net inflows are invested in the financial services sectors.

- In the last few years, there have been big IPOs in the financial services sector, and a few big companies are still in the process of getting listed.

- Most Asset Management Companies (AMCs) have schemes related to the financial services sector.

- Therefore, the Nifty Financial Services Sector is a complete package of the Indian Financial sector, including banks and other financial companies.

Mutual Fund Schemes Investing in Banking and Financial Sector

- HDFC Banking & Financial Services Fund

- Tata Banking & Financial Services Fund

- SBI Banking & Financial Services fund

- Aditya Birla Sun Life Banking & Financial Services fund

- Baroda BNP Paribas Banking and Financial Services Fund

Frequently Asked Questions

The FINNIFTY derivatives are settled in cash, and the expiry is the last Thursday of the month of expiry for the monthly contract. For weekly contracts, the day of expiry is Thursday.

The National Stock Exchange (NSE) provides options and futures in seven weekly and three monthly serial contracts. Also, NSE is offering weekly futures for stock derivatives for the first time.

The significant advantage of investing in FINNIFTY is it helps to reduce the non-systematic risk involved in investment. The non-systematic risk refers to declining revenues, strikes, rise in financing cost, narrowing profit margins, drop in sales, natural disasters, etc. Besides this, unsystematic risks refer to business risks and financial risks. By investing in different companies, investors can diversify their risk. Therefore, FINNIFTY comprises of top leading companies in the financial industry to help to diversify the unsystematic risks and also gives a chance to invest in top financial companies with maximum market capitalization.

It invests in 20 stocks, and Some of the top stocks that FINNIFTY invests in are HDFC Bank, HDFC Housing Finance, ICICI Bank, Kotak Bank, Axis Bank, Bajaj Finance, SBI, Bajaj Finserv, HDFC Insurance, Shriram Transport Finance and many more.

The major difference between FINNIFTY and Nifty 50 is the number of stocks in the index. Also, ten FINNIFTY companies are a part of the NIFTY 50 list which accounts for less than 40% of weightage in NIFTY 50. Also, the volatility is higher in the FINNIFTY index due to exposure limited only to the financial sector, whereas NIFTY 50 is a broad market-based index. Lastly, the risk-to-reward ratio for FINNIFTY is 0.64 and for NIFTY 50 is 0.61.

- What is FINNIFTY?

- What are the Sectors Involved in FINNIFTY?

- Uses of the Nifty Financial Services Index

- Benefits of Investing in FINNIFTY

- Risks of Investing in FINNIFTY

- Selection Criteria for Investing in FINNIFTY

- Factors Affecting the FINNIFTY Index

- How to Invest in the FINNIFTY Index?

- FINNIFTY Vs Bank NIFTY: Key Differences

- Financial Services Sector

- Frequently Asked Questions

Show comments