Have you ever thought about saving Rs 1 crore for your future? In 2024, one crore rupees sounds like a lot of money. But will the value of 1 crore after 15 years still cover all your needs? In this blog, we’ll explore if Rs 1 crore will be enough for you after 15 years and how inflation affects your savings.

An inflation calculator can help you understand the future value of money by estimating how much your savings will be worth, considering the rate of inflation.

Understanding Inflation

Definition of inflation

Inflation is a sustained increase in the general price level of goods and services in an economy over a period of time. It is measured as an annual percentage increase in the Consumer Price Index (CPI), which represents a basket of goods and services commonly purchased by households. Inflation can be driven by various factors, including an increase in demand, a shortage of supply, or rising production costs. Understanding the basics of inflation is crucial for grasping how it impacts the value of money over time.

How inflation affects the economy

Inflation can have both positive and negative effects on the economy. On the positive side, a moderate level of inflation can stimulate economic growth by encouraging spending and investment. However, high inflation can erode the purchasing power of consumers, reducing the value of savings and creating uncertainty for businesses. This decrease in the value of money means that what you can buy with Rs 1 crore today will be significantly less in the future. Therefore, understanding the impact of inflation on the economy is essential for making informed financial decisions.

Importance of understanding inflation

Understanding inflation is crucial for individuals, businesses, and policymakers to make informed decisions about investments, pricing, and monetary policy. Inflation affects the value of money, the cost of living, and the overall economic well-being of a country. By understanding inflation, individuals can make informed decisions about their financial planning, investments, and spending habits. This knowledge helps in safeguarding the future value of money and ensuring long-term financial stability.

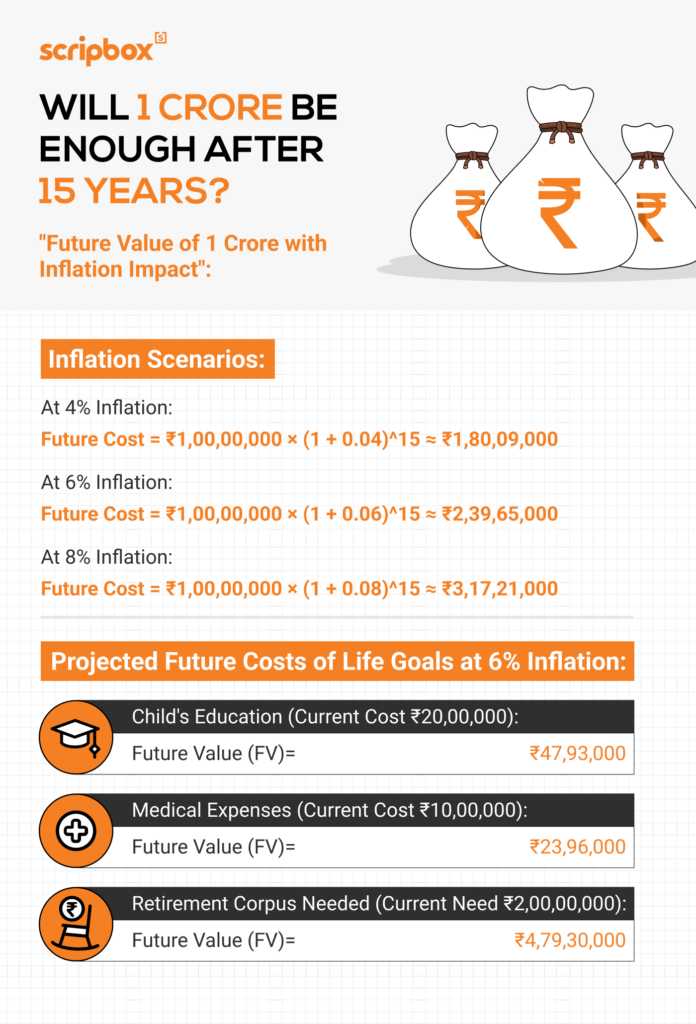

Is Rs 1 Crore Enough for the Future?

An amount like 1 crore rupees might seem huge today, but will the value of 1 crore after 15 years still meet all your needs? Money doesn’t hold the same value forever because of inflation. For example, a course fee of Rs 20 lakh today won’t stay the same after 15 years. Due to the average inflation rate in India, the cost could be much higher.

This is where financial planning and long term financial strategies become crucial. Think about how much your daughter’s education costs now. Then, figure out how much it might cost after 15 years. To see how inflation affects money, ask yourself, “How much did I spend 10 or 15 years ago?” You’ll notice that prices have increased, and money doesn’t buy as much as it used to. Inflation reduces the actual value of your money, so even a big amount like 1 crore may only cover some of your future needs.

Value of 1 Crore after 10, 15, 25, 50 years

Let us see how much 1 crore is worth in 10, 15, 25 and 30 years’ time.

| In 10 years | In 15 years | In 25 years | In 30 years | |

| Worth | 50 lakhs | 36 lakhs | 18 lakhs | 13 lakhs |

| Division Factor | 2 | 2.8 | 5.4 | 7.6 |

For example, to find how much is Rs. 1 crore in 15 years use the division factor of 2.8. That means, Rs 1 crore today will be worth (1 crore/2.8) approximately Rs. 36 lakhs after 15 years.

Assessing the Impact of Inflation

Let’s see how much you would need in 10, 15, 25, and 30 years’ time to have an equivalent wealth worth Rs 1 crore today.

| In 10 years | In 15 years | In 20 years | In 30 years | |

| Equivalent Corpus | 2 | 2.8 | 5.4 | 7.6 |

| Multiplication Factor | 2 | 2.8 | 5.4 | 7.6 |

For example, take your child’s higher education. Let us assume that it costs Rs 20 lakh today. Let’s assume again that he would go to college in 15 years. Now you need to determine how much this education (which costs Rs. 20 lakhs today) is going to cost after 15 years. Use the multiplication factor of 2.8 from the above table. That means, after 15 years you will need a corpus of (Rs. 20 lakhs * 2.8) = Rs. 56 lakhs to fund your child’s higher education.

For the mathematically inclined, we present the detailed calculation below:

Future Value (FV)= Present Value (PV) * (1+r) ^ n

where;

FV= Future value of your goal

PV= Present value or current cost of your goal

r= annual rate of inflation (in %)

n= time left to reach your goals (in years)

Using the values of the above example in a formula, assume education inflation is 7 percent. The same education course will cost Rs. 56 lakhs after 15 years.

Explore: Cost Inflation Index

Using an Inflation Calculator

How to use an inflation calculator

An inflation calculator is a valuable tool that helps individuals understand the impact of inflation on their money over time. To use an inflation calculator, you need to input the following information:

- The current value of money (e.g., ₹1 crore)

- The inflation rate (e.g., 5% per annum)

- The time period (e.g., 30 years)

The inflation calculator will then compute the future value of the money based on the inflation rate and time period. For instance, if you input ₹1 crore as the current value, 5% as the inflation rate, and 30 years as the time period, the inflation calculator will determine the future value of ₹1 crore in 30 years, accounting for the impact of inflation.

By using an inflation calculator, individuals can gain a better understanding of how inflation affects their money and make informed decisions about their financial planning, investments, and spending habits. This tool is essential for anyone looking to secure their financial future and maintain the purchasing power of their savings over the long term.

Strategies to Deal with Inflation

Inflation makes prices go up over time. This means the value of 1 crore after 15 years won’t be the same as it is today. To better plan for the future, consider using an inflation calculator. So, how can you protect your money?

- Invest in Growth Assets: Put your savings into things that can grow faster than inflation, like stocks or mutual funds. This can help increase the value of 1 crore after 20 years.

- Diversify Your Investments: Don’t rely on just one type of investment. Spread your money across different places to reduce risk.

- Keep an Eye on Inflation: The average inflation rate in India is around 6.2%. Make your plans accordingly.

- Save More Over Time: As you earn more, try to save more. This helps you keep up with rising costs.

- Use Inflation-Protected Options: Some investments, like inflation-indexed bonds, are designed to protect your money from inflation.

How to Build Wealth for Retirement

When you’re young, it’s the best time to focus on building wealth. This is when you have the most energy and can handle more risk. Investing in options like equity mutual funds is a flexible way to grow your money. These investments can help increase the value of 1 crore after 15 years, even considering India’s average inflation rate. Long term financial planning is crucial during this period to ensure a secure retirement.

As you approach retirement, it’s important to start protecting your wealth. This means shifting to safer investments that keep your money secure. Fixed-return Unit-Linked Insurance Plans (ULIPs) offer returns linked to the market but with more safety. They can help preserve the value of your savings over time. Finally, when you retire, you’ll begin to live off your savings. This is called the distribution phase. Planning for this stage ensures that your money lasts as long as needed. By understanding how inflation affects money, you can make smart choices to secure your financial future.

Conclusion

From the above discussion, we clearly understand that it is wise to add a realistic inflation figure to all your future financial requirements. If you are planning to create a sum for post-retirement life, you have to be more calculative and cautious. Apart for inflation, you must consider possibility of your outliving your expected age and change in interest rates post retirement.

Scripbox recommends you revisit and recalculate your goals. You have to work with real numbers as only being a crorepati will not help.

Find all this too much? Don’t worry. Scripbox’s goal-based investment methodology allows you to not only plan what your future requirements could be but also how much you need to invest today to achieve that. We take all the guesswork out of your planning to ensure that you are more likely to achieve your goal.

Explore our article on What is Cash Equity?

Show comments