Starting your investment journey with just ₹1000 per month can be a game-changer, primarily through a Systematic Investment Plan (SIP). Even with a small monthly amount, SIPs help you benefit from the power of compounding while building a habit of consistent saving and investing. They are easy to manage and work well for anyone—whether you’re just starting or already have experience in investing. In this blog, we’ll focus on the best SIP plans for ₹1000 per month in India, particularly those in the Flexi Cap category that have delivered impressive 5-year returns.

Where Can I Invest ₹1000?

Starting your investment journey with just ₹1000 per month can be a game-changer, primarily through a Systematic Investment Plan (SIP). Even with a small monthly amount, SIPs help you benefit from the power of compounding while building a habit of consistent saving and investing. They are easy to manage and work well for anyone—whether you’re just starting or already have experience in investing. In this blog, we’ll focus on how to choose the best SIP plans for ₹1000 per month in India, particularly those in the Flexi Cap category that have delivered impressive 5-year returns.

Understanding the Basics

To earn a consistent income through stock market strategies, it is essential to understand the fundamentals of investing.

Understanding the Basics

Investing in the stock market can seem daunting, but understanding the basics is crucial to making informed decisions. Before diving into investment options, it’s essential to grasp the fundamental concepts of the stock market. The stock market is a platform where shares of publicly traded companies are bought and sold. It operates on the principles of supply and demand, with prices fluctuating based on various factors such as company performance, economic indicators, and investor sentiment.

When you invest in the stock market, you are essentially buying a piece of a company, known as a share. The value of your investment can increase or decrease based on the company’s performance and market conditions. It’s important to understand terms like ‘bull market’ (when prices are rising) and ‘bear market’ (when prices are falling) and the concept of diversification, which involves spreading your investments across different assets to reduce risk.

By familiarizing yourself with these basics, you can make more informed decisions and feel more confident about investing in the stock market.

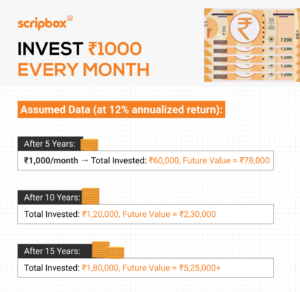

Why Start an SIP with ₹1000?

Investing ₹1000 per month in a SIP is an excellent way to grow your money steadily. Here’s why:

- Small Steps, Big Impact

Even small investments add up over time. With compounding, your contributions and the returns they generate grow together. Think of it like planting a seed that turns into a large tree over the years. - Disciplined Approach

SIPs ensure regular investment, helping you stay consistent regardless of market highs or lows. This disciplined strategy lowers risks over time and avoids the stress of market timing. - Hassle-Free Investing

SIPs are straightforward. You don’t need to track markets daily. The automated process makes investing simple, saving both time and effort.

Which SIP Plans to Invest for ₹1000 per Month

|

Mutual Fund Scheme Name |

AUM (Rs in Cr) |

5 Year Return |

|

Quant Flexi Cap Fund |

7912.16 |

128.33 |

|

JM Flexi Cap Fund |

4531.48 |

123.88 |

|

HDFC Flexi Cap Fund |

66225.06 |

108.49 |

|

Franklin India Flexi Cap Fund |

18251.58 |

94.12 |

|

Edelweiss Flexi Cap Fund |

2439.34 |

93.21 |

Check out our SIP Calculator. It is nothing short of magic!

Investment Options

Investing in the stock market offers various options, each with its unique characteristics and benefits. Two popular investment options are exchange-traded funds (ETFs) and Digital Gold.

Exchange Traded Funds (ETFs)

ETFs are a type of investment fund traded on a stock exchange, much like individual stocks. They offer diversification, flexibility, and transparency, making them an attractive option for investors. ETFs can be used to invest in various assets, such as stocks, bonds, and commodities. One of the key benefits of ETFs is that they allow you to invest in a broad range of assets without having to buy each one individually. This diversification can help reduce risk and improve the potential for returns.

Additionally, ETFs are known for their liquidity, meaning you can buy and sell them easily on the stock exchange. They also tend to have lower fees than mutual funds, making them a cost-effective option for investors. If you want to invest in a diversified portfolio with the flexibility to trade like a stock, ETFs might be the right choice.

Digital Gold

Digital Gold is a relatively new investment option that allows investors to buy, sell, and accumulate gold virtually. It offers a convenient way to invest in gold without the need to hold it physically. Digital Gold is a popular option for diversifying their portfolio and hedging against inflation. By investing in digital gold, you can benefit from its stability and long-term value without the hassle of storage and security concerns.

Digital Gold can be purchased in small amounts, making it accessible even with a limited budget. It also provides the flexibility to buy and sell anytime, giving you control over your investment. Digital Gold is worth considering if you want to invest in a safe-haven asset that can protect your wealth against economic uncertainties.

Alternative Investment Avenues

In addition to traditional investment options, alternative avenues can provide attractive returns. One such option is the Public Provident Fund (PPF).

Public Provident Fund (PPF)

The Public Provident Fund (PPF) is a government-backed savings scheme that offers a higher rate of return than most debt instruments. It is a popular option for those looking to save for their retirement or other long-term goals. PPF offers tax-free returns and is eligible for tax exemption under Section 80C of the IT Act, making it an attractive option for individuals seeking a safe and tax-efficient investment.

PPF has a lock-in period of 15 years, which encourages long-term savings. The interest rate on PPF is determined by the government and is usually higher than that of fixed deposits. Additionally, the returns from PPF are compounded annually, which can significantly boost your savings over time. If you are looking for a secure investment with tax benefits and a decent rate of return, the Public Provident Fund is an excellent choice.

By understanding the stock market basics and exploring various investment options, you can make informed decisions to achieve your financial goals. Whether you’re looking to invest Rs 1,000 or more, numerous options are available to suit your needs.

Five big takeaways

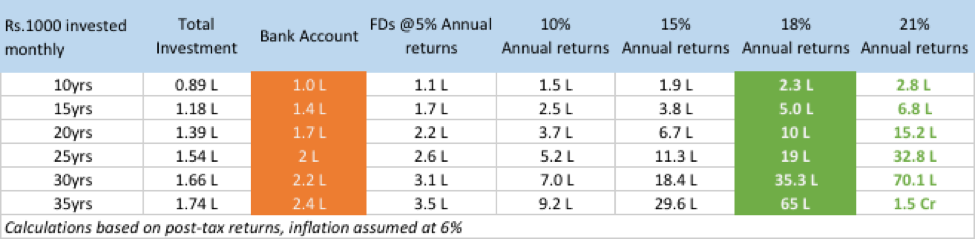

1. To get anything above Fixed Deposits, you need to take some amount of risk. The higher the risk, the higher the return. The choice is yours. We think, not taking any risk is the biggest risk you’re taking.

2. Every time you spend the next 1000 rupees; think about what you’re missing out. Ten yrs later, you could take a vacation off to Europe! One pizza, one vacation off the list! One more pizza, there goes your 18th birthday gift for your future kid.

3.Where you invest matters the most. The same amount sitting idle in your bank, will not even get you a pizza! See Table B which has the inflation adjusted numbers.

4. If you wait long enough for compounding to do its magic on your Rs.1000 investments, at retirement you’d have a cool 1.4 Cr on your investment of 3.6L. That’s worth Rs 35.3L in today’s terms (accounting for inflation)

5. Break your goals into multiple 1000 rupee goals. Surprise gift for your wife on your 10yr anniversary or that Rolex you’ve been only ogling at in those glossy magazines? Use this rule of thumb. For every 1000 you could get something that’s worth Rs 5L today, 15yrs later or worth Rs 10L today, 20yrs later.

5 Bonus: Every 3% extra in returns, doubles your wealth! See the 30yr results for 15%, 18% and 21%. So the next time you see an opportunity that yields 3% less, you know what to do.

Where to invest?

To most Indians, a recurring deposit (a monthly form of FD) at a scheduled bank is the standard route. While this may seem reasonable, the earning potential is limited for two reasons. First, the average interest paid is 7%, falling drastically as the banks overflow with cash thanks to demonetization. Second, you pay taxes of up to 30% (depending on your tax slab) on your earnings.

Choosing the right investment options can help you maximize your returns and minimize risks.

Investment advisor to help you make the most on your 1000 rupee investment

While the above calculations are built on MS Excel, achieving those requires a complete understanding of various investment options, risks, market conditions, macroeconomic factors, and timing.

At Scripbox, we do all of that, and the size of your pocket doesn’t matter. It works for all amounts of investment.

It just takes 5 minutes to set up your investment account. Are those numbers achievable?

Harley’s price estimation is based on the annual price hike for automobiles from 2011 to 2015 (3.8%) and does not account for currency fluctuations.

- All returns are indicative of past performance. Actual performance can vary.*

Check Out Best Investment Options 2021

Show comments