The idea of a dividend represents a reward or additional money in popular perception and many investors opt for dividend options of mutual funds. Let’s look at how the dividend option works in a mutual fund and what other options are available for investors in a mutual fund.

Growth option vs Dividend Option in a Mutual Fund

In a growth option of the mutual fund, you allow the capital to grow. Thus you do not get periodic payouts from the mutual fund, unlike a dividend option.

In a dividend option of the mutual fund, the mutual fund pays you a dividend from the fund corpus.

A dividend is an optical illusion

Let’s say you’ve invested Rs 100 in a mutual fund. Over time the value of the mutual fund grows and your Rs 100 becomes Rs 110. At this time, the fund manager decides to distribute Rs 5 as a dividend. The dividend is paid by selling some of the underlying holdings in the mutual fund.

Thus the Rs 5 dividend is being paid from the return on the corpus made by you in the mutual fund. The mutual fund value drops to Rs 105 after the payment of Rs 5 as dividends to its investors.

Thus dividends should not be treated as extra money given by the mutual fund to its investors, since this is the money returned to you from the growth of the corpus.

Dividend in Equity funds vs Debt Funds

When investing in Equity funds, your main objective should be to grow your wealth over the long term. Receiving dividends is, therefore, pointless as it shifts money to cash instead of allowing it to grow.

In debt funds, investors are seeking a cash flow. Then how should the investor decide whether to invest in a dividend option or a growth option in a debt mutual fund?

To discuss this further, we need to understand how the growth option and dividend option is taxed in a mutual fund.

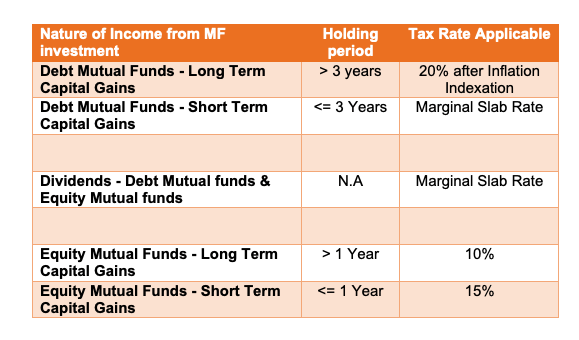

Taxation of Dividends vs Capital gains in a Mutual fund investment:

In a growth option of a mutual fund, all the returns on investment will be taxed as capital gains. In the case of the dividend option, returns made on the mutual fund investments will be taxed as dividends if a dividend is declared and the returns not declared as dividends will be taxed as capital gains.

The dividends are taxed when it is declared by the mutual fund which is at the discretion of the mutual fund manager. In the case of capital gains, the same is taxed where the action of sale of mutual fund investment is made, which is at the discretion of the investor.

Let see the tax rates for dividends and capital gains of a mutual fund.

The dividends are taxed at the marginal slab rate from FY 2020-21.

This means that different investors pay different amounts of tax for the same amount of dividend declared on their investment by the mutual fund as per their income tax slab.

The decision between a Growth option vs Dividend Option of a Debt mutual fund

We discussed earlier that investing in equity funds should be through the growth option to grow your investment for the long term. We will now discuss whether to choose the growth option or dividend option in the case of a debt mutual fund.

If you are an investor with less than Rs 10 Lakhs taxable income annually (including dividend receipts and assuming new tax regime), then you probably would be better off choosing the dividend option, since you pay negligible tax on the dividend income, as the income is taxed as per marginal slab rate.

If you are an investor with more than Rs 10 Lakhs of taxable income annually (including dividend receipts and assuming the new tax regime), then you should choose the growth option.

The returns made on the mutual fund will be taxed as capital gains and this will be taxed as per the information provided in the table above.

The tax on dividends is higher than the tax on capital gains from mutual funds once you cross the Rs 10 Lakh taxable income threshold.

If I choose the growth option in a debt mutual fund then how would I get monthly income from it?

In a dividend option of a debt mutual fund, once a dividend is declared, you will use the amount required by you upon its receipt, while the balance amount not used will have to be reinvested.

In a growth option of a debt mutual fund, no dividends are declared.

So how does an investor then make a withdrawal for his needs from the debt mutual fund investment? This is where the concept of the Systematic Withdrawal Plan (SWP) gets its importance.

In a Systematic Withdrawal Plan, you make monthly withdrawals of a specified amount for a specified period from your mutual fund investment.

The balance amount not withdrawn grows in the debt mutual fund. This is a tax-efficient manner since you defer tax from today’s date to a later date. But how does this work?

Let’s look at an example to see how this works

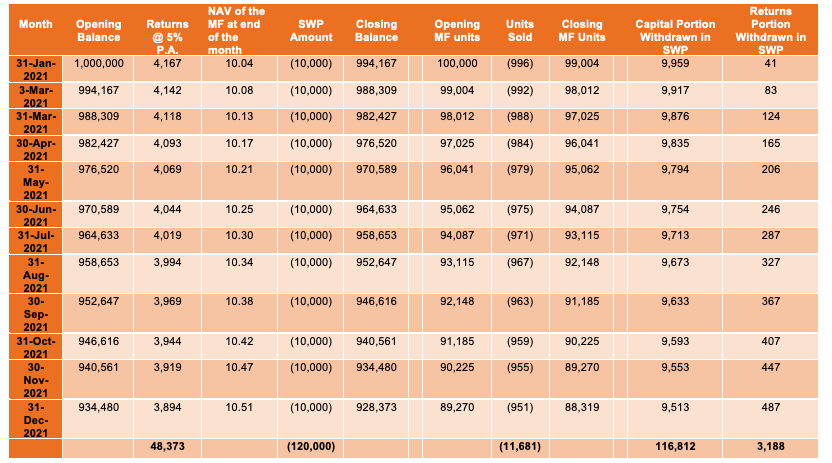

Let’s take an example below, where we invest Rs 10 Lakhs as a one-time investment at an initial NAV of Rs 10 per unit and you withdraw Rs 10,000 per month from the fund at the end of each month.

In the above illustration, you will be paying tax on capital gains of Rs 3,188 in the first year for a withdrawal of Rs 1.20 Lakhs from the debt mutual fund. The actual return earned, though, is Rs 48,373.

To reframe this, in the earlier months of withdrawal from a debt mutual fund, you will be withdrawing more from capital and less from returns made and in the later months more from returns earned and less from the capital invested.

Thus there is a deferral of tax payment on the returns earned today that will be paid in the future. The tax on such gains will be charged at the marginal slab rate if the investment has not completed a 3 year holding period.

If the debt mutual fund completes a 3 year holding period, then you will pay a negligible amount of tax on the returns made, since there is the benefit of inflation indexation adjustment on the capital gains made in a debt mutual fund.

In addition to the above benefit due to SWP, taking a growth option in a debt mutual fund also helps you in adjusting the losses that you may have realised from the sale of any other capital assets like equity or debt mutual fund or an equity share or a real estate property.

Show comments