As the world battles the Coronavirus, the global economy has entered an uncertain phase. Markets showed that as they crashed in any country that has stock markets.

The 9th of March saw the BSE Sensex correct by almost 2000 points. And many times after. As of 31st March, it stood at 29,576 down from its peak of 41,000. The lowest it went to was 25,981 in the same month. The uncertainty of the economic impact of COVID-19 and, notably the crash in oil prices thanks to the price cuts by Saudi Arabia, is not only being witnessed by the Indian stock markets but globally as well.

The US stock markets saw falls of similar magnitudes reversing the long-term upwards trend that was dominating the headlines up until just a month ago.

The Indian markets have reversed much of the recent gains seen till February, rather quickly and you may have seen your gains made over the past years shrink in a matter of days. And that makes you wonder what will happen to your money?

So, what does the past tell us?

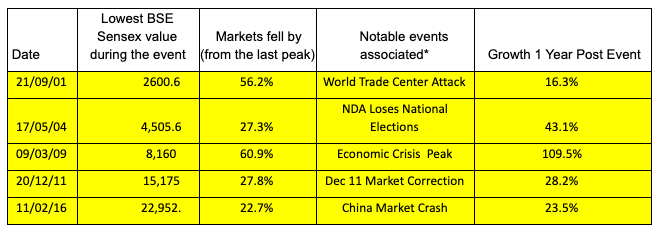

Let’s look at past events to see if there is something the long term investor can learn from. We analysed over three decades worth of market data to come to the conclusion that when markets have fallen from their peaks, the markets have nearly always given positive growth as early as one year after the fall.

The markets have almost always fallen dramatically in response to crises and calamities. However, those who stuck through the falls for at least 5-7 years, not only saw their wealth recover but grow dramatically thanks to their continued investing during the bad phase.

1. The most recent such crisis was the Global Financial Crisis of 2007-08. The Sensex was at 19,363 around the end of 2007. The lowest point saw the markets lose over half its value by March 2009 to close at 8,160. However, the Sensex within a year grew by 109%!

2. Similarly two decades back, during the dot com bust the markets went from 5000 to 2811 in a one year period. Over 43% of the market value was lost. But the Sensex was back at 5000 by November 2003.

* These are important events associated with the crashes but not the only reasons. Market crashes are complex and rarely can one event explain a market crash.

The markets have almost always fallen dramatically in response to crises and calamities. However, those who stuck through the falls for at least 5-7 years, not only saw their wealth recover but grow dramatically thanks to their continued investing during the bad phase.

Yes, long term investing requires conviction and faith but more so during times like these. If the past is any indicator, this too shall pass, at least for the long term investor who continues to invest.

Show comments