The year ending March 2023 has been quite sluggish for equity investors. The year started off on a negative note, with the markets seeing a 10% correction in the first 100 days of the year. That correction was followed by a recovery that took the markets to a positive 10% territory by early December. Since December, the markets have been on a slow downward slope ending the year almost flat to mildly negative.

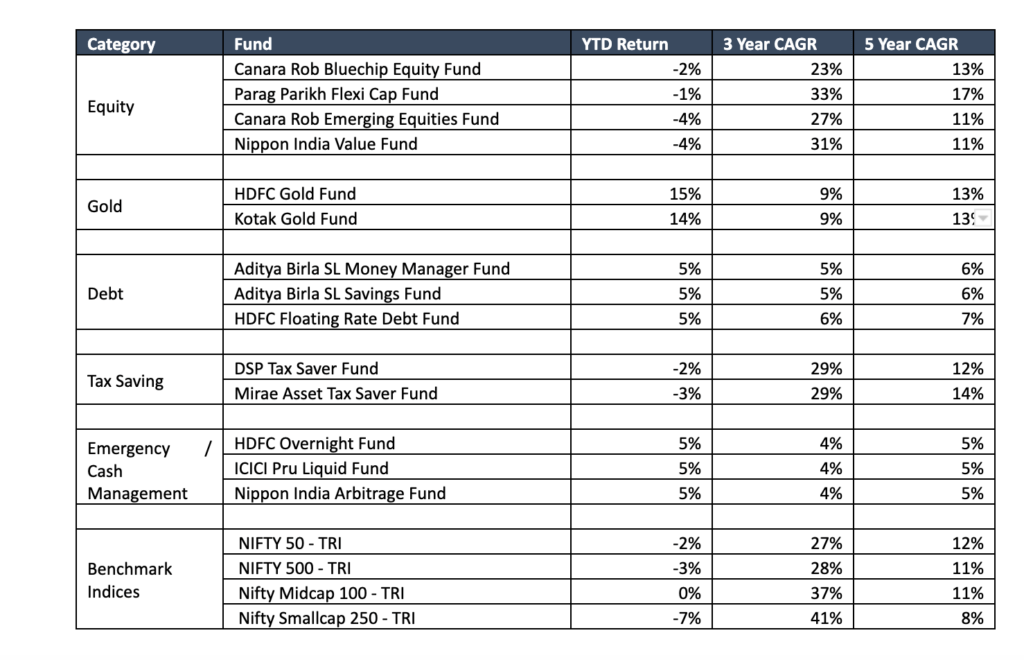

On the other hand, the investors in debt funds had some reason to cheer. After a prolonged period of low returns, FY23 was quite good for debt funds. Debt Funds saw returns ranging between 5.2% to 5.4% in the year.

Global Developments

On the global front, while Geo-Political tension continues unabated, commodity prices have also remained quite volatile. Crude Oil saw a decent correction from the high of $123 a barrel and ended the year at $70 a barrel. Developed countries continue to struggle with inflation, and central banks have aggressively hiked rates to control inflation.

The fragility of banking institutions has also come to the fore in the past 12 months. The government-orchestrated rescue of Silicon Valley Bank and Credit Suisse is well known. All these developments have led to a direct impact on safe-haven assets such as Gold which ends the year up 14% in INR terms.

Indian Economic Outlook

The Indian economic outlook continues to be quite positive, and the GDP is expected to grow slightly over 7% in the coming year. Inflation also remains at levels where the RBI need not be excessively concerned. Many macro indicators, such as GST Collections, EWay Bills, Purchasing Managers Index, etc, show a positive bias in the overall economy. Global institutions such as the IMF have opined that developing countries like China and India are expected to contribute to over 50% of the global growth for 2023.

We continue to believe that Indian Equities will deliver favourable outcomes over the long run. We believe that for investors with a long investing horizon, Indian Equities should continue to be the preferred asset class. The inclusion of uncorrelated asset classes into the portfolio will ensure that during periods of negative returns and high volatility, portfolios are insulated to some extent.

Indian Financial Markets Performance

The Indian Equity Market has seen a year that was quite range bound. The large-cap segment of the market, represented by the Nifty 50 TRI, closed the year -1.8%, while the Nifty 500 TRI, which represents the broad market, ended the year with a -3.1%. The Nifty Midcap 100 TRI ended the year at 0.4%, while the most pain was felt in the small-cap space, with the Nifty Small Cap 250 TRI ending the year with a -6.9%.

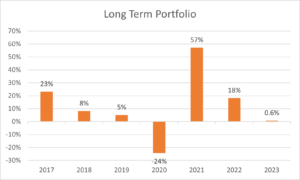

One needs to see this performance in the context of the past few years when the benchmark large-cap index saw phenomenal returns ending FY21 up 74% and FY22 up 18%.

Performance of the Scripbox Recommended Funds

The core idea of Scripbox

We have built a proprietary algorithm that leverages our deep domain expertise with our research process to curate investment portfolios for our customers. The reliance on a rule-based portfolio construction process ensures that there is no human bias that creeps into the selection of funds. It is our strong belief that investments should be evaluated and measured from a long-term perspective, and with regard to wealth creation, time is the most important factor at work.

All incremental investments will be in the latest set of funds, whereas some of the older investments will continue unless there are specific reasons to exit these funds.

At Scripbox, we continue to track and monitor each fund very closely, and we will reach out to our customers when we believe that an action is required from a portfolio change perspective.

Show comments