The Indian Equity market was a mixed bag in financial year 2018-19 with the key indices providing mixed returns. Though the Nifty was up 16.4% for the year, the Nifty Midcap 100 was down 1.9% and the Nifty Small Cap 250 was down 12.4% for the year. This shows a wide divergence of performance between the Large, Mid and Small cap Indices in this year.

The year also witnessed some key changes in fund management, triggered by regulation. This has had an implication on the Scripbox portfolio construction and fund selection algorithms. The following section covers the key triggers and the resulting implication on the Scripbox algorithm.

A. Long Term Capital Gains

In the 2018 central government budget, a 10% Long Term Capital Gains (LTCG) tax was imposed on equity stocks and equity mutual funds, with grandfathering benefits. There is a minimum threshold of Rs 1 lakh, post which the LTCG applies. This has an impact on the rebalancing of funds in the portfolio, which we used to have till last year. With LTCG, there is an added cost element, in the form of taxes, for the investor.

Impact on Scripbox algorithm

- We have removed the rebalancing trigger.

- Funds that are no longer recommended will continue to remain in the portfolio. Scripbox will monitor these funds on an ongoing basis. Exits will be recommended when we find significant adverse conditions.

- We have also optimised the withdrawal algorithm (in the event an investor wants to redeem a part of his portfolio) to ensure tax efficient redemptions.

B. Standardised Fund Categories

SEBI issued a regulation on how Asset Management Companies need to categorise each fund and prescribed the mandate of the funds within that category . For example, a large cap oriented equity fund can invest predominantly in large caps only and a Mid cap oriented fund can invest predominantly in mid caps only.

As a result, the fund manager’s flexibility to invest across the spectrum of companies is limited, but it is also easier to predict the core constituents of the funds. This is a good development reflecting the maturing of our markets.

C. Given these changes, and the Mid-Year changes made to the portfolio components, we will also shift the periodic review for all funds to an April-March cycle.

Report Card:

1. The core idea of Scripbox

The objective of the Scripbox portfolio of equity funds is to select a portfolio of 4 Equity funds, with a mix of large and mid-cap companies, that have a consistent track record of performing better than the overall equity market and therefore expected to do better than the benchmark indices over time. All incremental investments will be in the latest set of funds, whereas some of the older investments will continue unless there are specific reasons to exit these funds.

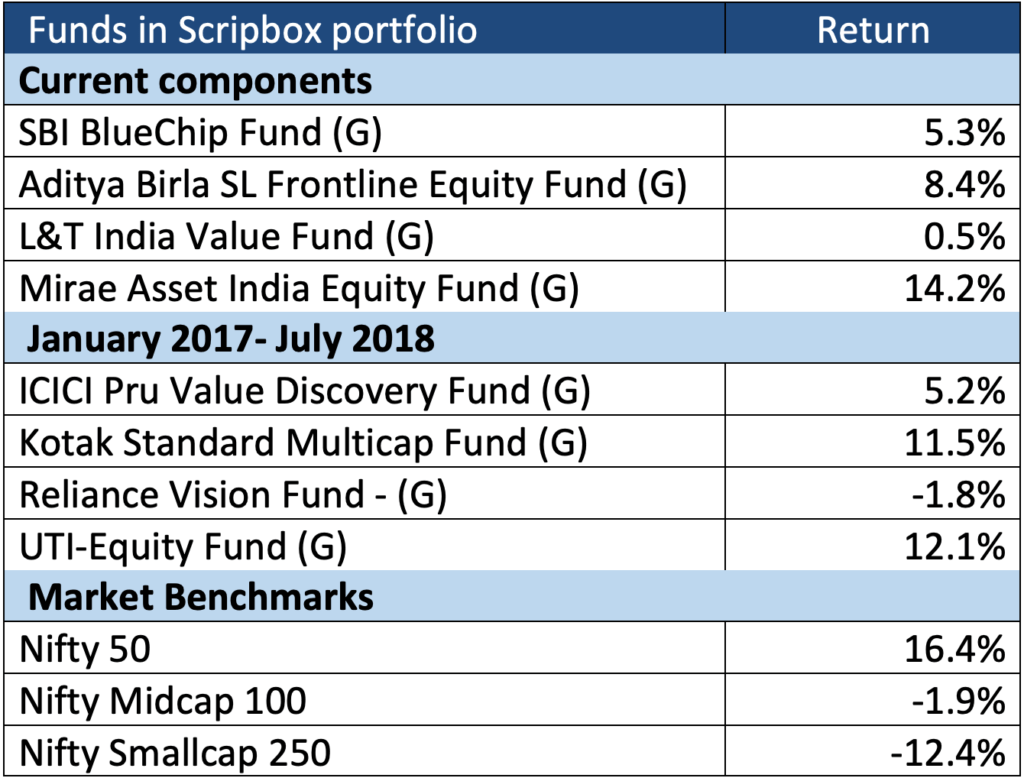

We have the following 4 equity funds in our 2018-19 portfolio of equity funds. The older components are also listed, as these funds are still in the portfolios of our investors. This report card is based on the performance of these funds from April 1, 2018 till March 31, 2019.

Large Cap Equity

- SBI Blue Chip Fund (G)

- Aditya Birla Sunlife Frontline Equity Fund (G)

Diversified Equity

- Mirae Asset India Equity Fund (G)

- L&T India Value Fund (G)

Mutual fund holdings prior to the last funds review

- Nippon India Low Duration Fund (G)

- ICICI Pru Value Discovery Fund (G)

- Kotak Standard Multicap Fund (G)

- UTI Equity Fund (G)

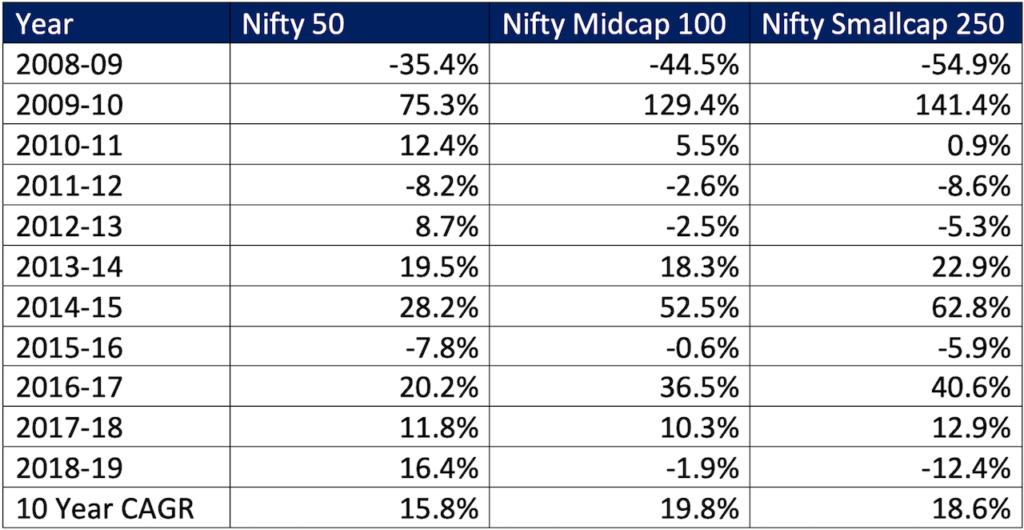

2. Benchmark Performance

- In Financial year 2018-19, the Nifty 50 returned 16.4% (till 31, March 2019), Nifty Midcap 100 was down 1.9% and the Nifty Smallcap 250 was down 12.4%

- Over the last decade, the Nifty 50 has returned a CAGR of 15.8%

- We continue to believe that the case of Indian equities remains strong and equities as an asset class will continue to outperform fixed income over the long run.

Note: Financial year 2018-19 is till March 31,2019.

3. Scripbox Portfolio of Equity Funds

Most funds had to change their investment objective and rebalance their portfolios in the middle of the year to align to standardised categories. This means that our practice of benchmarking performance against the Nifty 50, is no longer relevant.

All four funds in the current Scripbox portfolio underperformed the Nifty 50 index but performed better than the Nifty Midcap 100.

4. Scripbox Portfolio compared to other funds

The top 25 funds by assets delivered a Median return of 6.5% (as on March 31, 2019) in the current year indicating the top funds did worse than the Nifty 50 but better than the Nifty Mid-cap 100.

Note : All the benchmarks returns are based on Total Returns Index

You would also like to read best performing mutual funds in India

You may also like to check out the best large cap mutual funds in india

Show comments