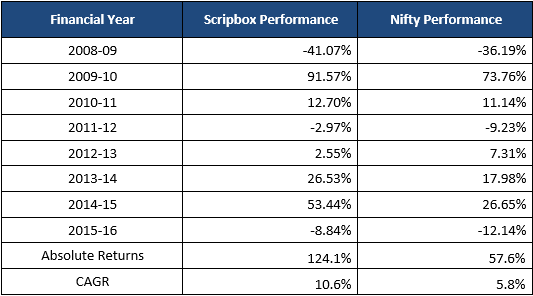

After a strong 2014-15, the Indian Equity Market was in a phase of consolidation. The Nifty was down 12.14% on a Year to Date Basis in the financial year 2015-16. In comparison, the Scripbox ELSS portfolio was down by 8.84% resulting in an out performance of 3.3% over the benchmark index. This out-performance is in line with the historical average out the performance of the Scripbox portfolio over the Nifty.

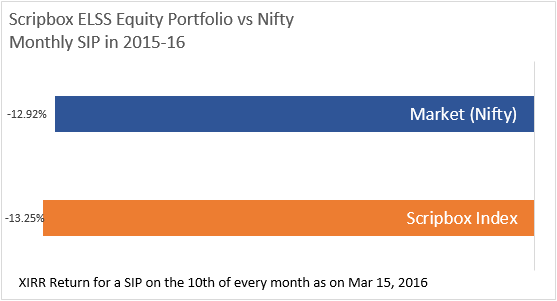

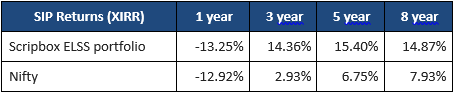

For our regular SIP investors, a monthly SIP in Scripbox recommended portfolio would have returned -13.25% this year against -12.92% for a SIP in the Nifty.

Overall, we believe that the equities continue to be the best option among investable assets and we are quite confident entering FY2016-17.

1. The core idea of Scripbox:

The objective of the Scripbox portfolio of ELSS equity funds is to select a portfolio of 2 tax saving equity funds that have a consistent track record of performing better than the Nifty and therefore expected to do better than the Nifty.

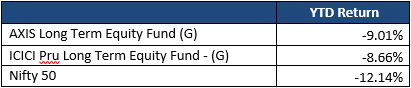

We had the following 2 tax saving funds in the financial year 2015-16 portfolio of tax saving funds. This Report card is based on the performance of these funds from April 1, 2015, till Mar 15, 2016.

- AXIS Long Term Equity Fund (G)

- ICICI Pru Long Term Equity Fund – (G)

The analysis of the absolute performance of the Scripbox ELSS equity portfolio is a combination of the performance of the Nifty, and the performance of the portfolio relative to the Nifty.

2. Nifty Performance :

- In 2015-16, the Nifty was down 12.14% (till 15, Mar 2016)

- Over a decade, the Nifty has returned a CAGR of 10.5%.

- We continue to believe that the case of Indian equities remains strong and equities as an asset class will continue to outperform fixed income over the long run.

These are returns based on a one-time investment, for returns for a SIP investor, kindly refer section 6 below.

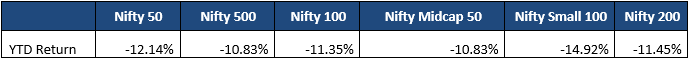

3. Nifty Relative to Other Benchmarks

In financial year 2015-16, all benchmarks including the mid cap and small cap indices were in the negative, there was some relative outperformance of the mid and small caps over the benchmark large cap index.

4. Scripbox Portfolio of ELSS Equity Funds

Both funds in the Scripbox portfolio outperformed the benchmark index. Performance of both the funds were fairly satisfactory and ahead of the Nifty.

5. Scripbox Portfolio compared to other funds:

The top 10 funds by assets delivered an average return of -10.29% in the current financial year and the Scripbox portfolio performed in line at -8.84%, compared with -12.14% in Nifty. On the whole, we are satisfied with the fund selection.

6. Returns for SIP investors

Assuming a SIP on the 10th of each month, the XIRR returns for a SIP investor was -13.25% in the Scripbox portfolio of tax saving funds, compared with -12.92% in the Nifty.

SIP returns in the Scripbox ELSS portfolio have been better than the Nifty over all holding periods except in the last financial year.

Show comments