ELSS Investments Calculator

ELSS Calculator is a helpful tool that allows investors to understand the returns from a potential investment in an ELSS fund. The calculator determines the potential returns based on the investment type, i.e., SIP or Lumpsum investment.

What is an ELSS?

Equity Linked Savings Schemes (ELSS) are tax saving mutual funds. ELSS funds are open-ended equity funds with a lock-in of 3 years. They invest the majority of their assets in equity. These funds are the only mutual funds that qualify for INR 1.5 lakhs tax deduction annually under section 80C of the Income Tax Act. ELSS mutual funds give better returns than other tax saving options like PPF and FD. Among all other tax savings options, ELSS funds have the least lock-in period. One can start investing in ELSS funds with an amount as low as INR 500. They can either invest through the SIP route or invest a lump sum amount.

What is an ELSS calculator?

ELSS Calculator is a helpful tool that allows investors to understand the returns from a potential investment in an ELSS fund. The calculator determines the potential returns based on the investment type, i.e., SIP or Lumpsum investment. The ELSS calculator requires the following details to estimate the returns:

- Investment Type

- Investment Value

- Duration of Investment (>= 3 years)

- Rate of Return (p.a)

Upon inputting the required data, the calculator gives an estimate of the potential returns. Such estimation is good and helps in determining where or not to proceed with the investment. Hence, use the calculator to understand the returns from an ELSS investment. One can easily calculate SIP returns using this calculator as well.

How can an ELSS calculator help you?

ELSS investments are the best tax saving option available for investors who are willing to take some risk. Also, ELSS mutual funds have the lowest lock-in period amongst the other tax-saving schemes under Section 80 C. The ELSS calculator primarily helps investors determine the returns from an investment. Following are the advantages of Scripbox’s ELSS Calculator:

- An online and free calculator that helps in the easy computation of the Maturity Amount

- Investors can quickly generate the maturity value for multiple investment amounts, compare the returns, and finalize their investment value.

- The calculator provides fast and accurate results.

- Investors can compare the returns between SIP and lumpsum investments.

- The ELSS calculator is simple and doesn’t require any technical skills. By inputting the required data, the calculator does all the computation.

Therefore, using the calculator will help the investor in making an informed investment decision.

How does an ELSS Calculator work?

ELSS calculator works on a simple concept of the future value of an investment. The calculator, based on the inputs, calculates the future value of an investment. Calculating a future value of investment might not be a tedious task, but definitely, a time taking one. The calculator does the same work within seconds. Let’s take, for example, an investor, Ms. Anju, wants to invest in ELSS funds, a lump sum of INR 1.5 lakhs. She expects a 12% return from her investment and wants to hold her investment for seven years. The future value formula is,

FV = C(1+r)^t

Where FV is the future value,

C is the investment

r is the expected rate of return

t is the time horizon of the investment

Based on the above formula, the maturity value of Ms. Anju’s investment is INR 3,31,602.21.

For SIP investing, the future value concept holds good as well. However, since SIPs have multiple cash flows, the concept of annuity comes into the picture for simpler calculations.

Nevertheless, all these calculations can be done at the tip of your fingers if an ELSS calculator is used. Any SIP calculator can be used for calculating returns from these funds.

How to Use Scripbox’s ELSS Calculator?

Scripbox’s ELSS Calculator is a very intuitive tool that helps in determining the maturity value. The Scripbox’s ELSS Calculator can be used for SIP investments and lump sum investments. The input values to the calculator are:

Investment Type: Monthly or One-time investment

Investment Value: Amount that an investor wishes to invest in the ELSS mutual fund

Duration of Investment (>= 3 years): Tenure until which the investor would hold the investment in the fund

Rate of Return (p.a): Expected rate of return from the investment

Let’s understand how both the variations SIP ELSS Calculator and Lumpsum ELSS Calculator work.

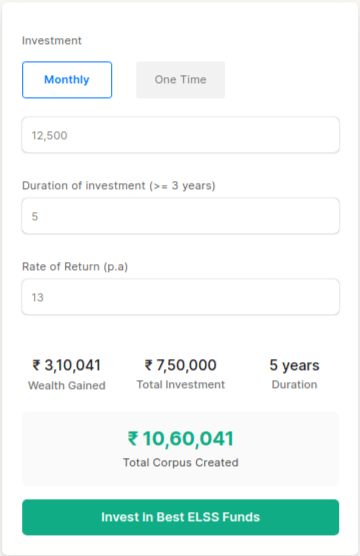

SIP ELSS Calculator:

For example, Ms. Veda wishes to invest in an ELSS mutual fund for tax saving purposes. She wishes to opt for a monthly installment option i.e., SIP, with INR 12,500 per month. Ms. Veda’s investment duration is five years and expects a return of 13% p.a. from it.

Using Scripbox’s ELSS calculator, Ms. Veda can expect to earn INR 10,60,041 from her investment after five years. Any SIP calculator can help in calculating the same for Ms. Veda.

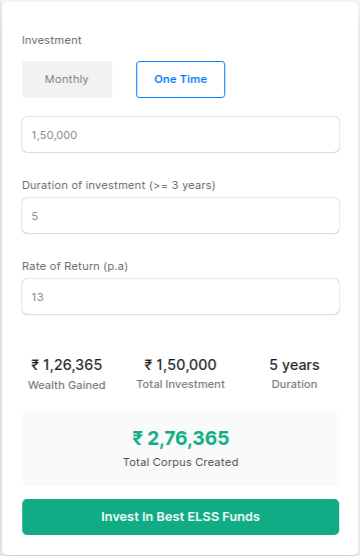

Lumpsum ELSS Calculator:

Assuming the same example, Ms. Veda would like to invest in an ELSS mutual fund. She makes a one-time investment of INR 1,50,000 for a period of 5 years. The expected return is 13% p.a.

Ms. Veda’s lumpsum investment would earn INR 2,76,365 at the end of 5 years.

Therefore, with the help of the ELSS calculator, an investor can compare the returns from SIP and lumpsum investments. The calculator will also help in deciding the type of investment. ELSS funds are like any other equity mutual funds. These funds are subject to market risks. Hence it is advised to invest in an ELSS mutual fund for the long term and through SIP. It would help in overcoming the short term market fluctuations and averaging out risks.

Best ELSS Mutual Funds in India

The top ELSS funds to invest in India are Mirae Asset Tax Saver Fund (G) and Motilal Oswal Long Term Equity Fund (G).

| Recommended Mutual Funds |

| Mirae Asset Tax Saver Fund |

| Motilal Oswal Long Term Equity Fund |

Mirae Asset Tax Saver Fund

Mirae Asset Tax Saver Fund aims at wealth creation for the investor. The fund invests across market capitalization, theme, and investment styles. It has a diversified portfolio of strong companies at a reasonable price. The fund follows a bottom-up approach strategy and invests in growth-oriented companies available at reasonable prices.

Expense ratio: The fund charges 1.79% of the asset under management

Asset Under Management: INR 3,184cr

The minimum SIP amount is INR. 500

Minimum Lump sum amount is INR 500

Motilal Oswal Long Term Equity Fund

Motilal Oswal Long Term Equity Fund invests aims at capital appreciation through a diversified portfolio. The fund invests in equity and debt across sectors and capitalization levels. They follow a bottom-up strategy of investing. They pick only those businesses that they understand, have favorable long term economies, a margin of safety, and trustworthy management.

Expense ratio: The fund charges 2.11% of the asset under management

Asset Under Management: INR 1,411cr

The minimum SIP amount is INR. 500

Minimum Lump sum amount is INR 500

Frequently Asked Questions

Investing in ELSS funds comes with a dual benefit of capital appreciation and tax saving up to INR 1.5 lakhs under section 80C of the Income Tax Act.

ELSS funds are for those investors looking to save tax while investing in equities and gaining exposure in it. These funds are also for those investors who are looking for diversified options in mutual funds. ELSS is not an option for investors looking for fixed returns like other tax saving options. Since ELSS invests in equity, the returns from it are market-linked and hence fluctuate.

ELSS funds have a lock-in period of 3 years. The investment made in these cannot be redeemed for three years. Once the three years period has passed, the investors can withdraw the investment whenever they want. Or, they can also choose to continue their investment in the fund.

Investment in ELSS funds is eligible for tax exemption up to INR 1.5 lakhs under section 80C of the Income Tax Act. Since ELSS funds are open-ended equity funds, they are treated similarly to equity funds for tax purposes. Since ELSS have a three-year lock-in period, there is no question of short term capital gains. However, they are subject to long term capital gains tax of 10% of the gains are beyond INR 1 lakh.

One can invest in ELSS funds through SIP and lump sum route. However, the SIP route is a better way to invest in ELSS funds as they are equity-based funds. Investing in ELSS funds through SIP can have multiple benefits. It inculcates discipline in investors by investing regularly. It helps in planning ahead of the taxes, which is usually pushed to the end. Finally, it helps in averaging the investment cost as the investment is done throughout various market cycles. One can invest in ELSS funds online from the fund houses website or any platform like Scripbox. Offline investing is also an option by visiting the nearest branch of the fund house.

SIP is a route of investing in mutual funds, and ELSS is a type of mutual fund. One can invest in ELSS funds through SIP or lumpsum route. If one is confused between picking ELSS funds vs. other equity mutual funds for investing, then the purpose of investing should be questioned. If the purpose is tax saving, then ELSS is the right choice. But tax saving is not the primary reason for investing, but saving up for the long term or any goal, one should choose other equity mutual funds available in the market.