Dear Reader,

As we close the chapter on 2025, I want to begin with a simple note of gratitude. Your support through Scripbox’s milestones this year has been deeply humbling. As I often say, these achievements belong to you as much as they belong to us. Thank you for your trust.

Now, let us talk about the future.

By now, your inbox is probably overflowing with “Market Outlooks” and 2026 predictions. Pundits are busy charting the Sensex and anticipating the next geopolitical chess move.

I want to offer you a very different kind of prediction:

I have absolutely no idea what will happen in 2026.

And in my humble opinion, neither does anyone else.

As the physicist Niels Bohr famously said: “Prediction is very difficult, especially if it’s about the future.”

The fallacy of forecasts

If 2025 taught us anything, it is that the future is not a straight line drawn from the past. It is a series of surprises.

We crave certainty. It is human nature. We want the comfort of knowing where the path leads. But as John Kenneth Galbraith said, “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.”

Most of what we experienced this year were not true “Black Swans,” but Grey Swans, risks hiding in plain sight that still caught the world off guard.

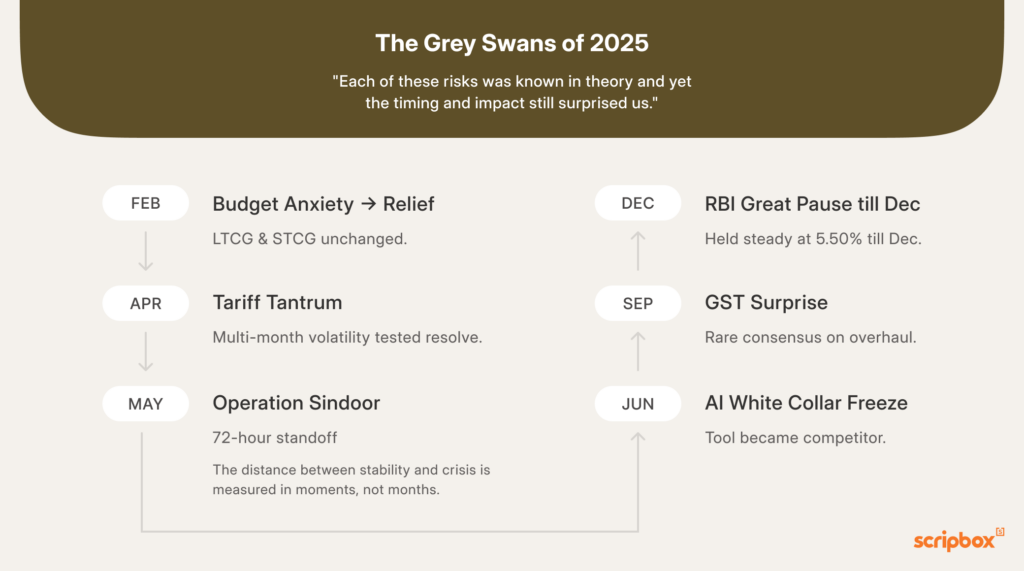

The Grey Swans of 2025

Here are a few that stand out:

- The Budget (February): Anxiety over capital gains tax gave way to relief when LTCG and STCG remained unchanged. Status quo rarely feels like good news, yet it was.

- The “Tariff Tantrum” (April): The risk of US tariffs was known, but the multi-month volatility still tested our patience and resolve.

- The AI “White Collar Freeze” (Mid-Year): We expected AI to be a tailwind. Instead, it became both a tool and a competitor. IT firms faced a difficult truth: how do you bill for hours an AI can do in seconds?

- The RBI’s “Great Pause”: Just as markets priced in rate cuts, the RBI held steady at 5.50%. The “higher for longer” stance pressured interest-sensitive sectors. IThe much awaited cut, to 5.25%, came only in December.

- The GST Surprise (September): A rare consensus to overhaul rates created an unexpected structural cushion for manufacturing.

Each of these risks was known in theory and yet the timing and impact still surprised us.

A sombre reality check

And then there was May.

While the Line of Control had been relatively quiet since 2019, silence is not the same as peace. Operation Sindoor shattered that illusion.

The escalation was rapid. The 72-hour standoff was, for many of us, the longest three days in recent memory.

For me, it wasn’t just another geopolitical event.

Coming from an Army family, I grew up with a deep awareness of how quickly “routine” can turn into “risk.” During those tense days, I found myself, like many of you, refreshing the news constantly, speaking to friends in service, and silently hoping that cooler heads would prevail.

It was a stark reminder that the distance between stability and crisis is measured in moments, not months.

And while markets barely moved, the lesson remained. We cannot control the geopolitical tides; we can only control the seaworthiness of our own vessel.

Respond, don’t react

So, if we cannot predict the future, what can we do?

We can prepare.

The antidote to uncertainty isn’t a better forecast, it is better behaviour.

- Reacting is emotional: selling after a headline, chasing a trend because “everyone else is.”

- Responding is strategic: building a portfolio that is meant to survive tariffs, pauses, cycles, and surprises without constant tinkering.

This philosophy guides every decision we make for your wealth.

The only prediction that matters

I cannot tell you what the markets will do in 2026.

But I can predict one thing with 100% certainty: There will be noise.

There will be new crises, new breakthroughs, new reasons to worry and new reasons to hope. What I can promise is this: we will not try to outguess the market. We will outlast it.

We will stay focused on your goals, your time horizon, and your financial peace of mind.

The most successful investors in 2026 won’t be the ones with the sharpest crystal ball, rather they will be the ones with the steadiest hand.

Here’s to a 2026 full of surprises, and the wisdom to navigate them.

Wishing you and your family a very happy 2026,

Atul Shinghal

CEO and Founder, Scripbox

P.S. If you’re wondering how resilient your portfolio is to the unknown, let’s have a conversation. We are always here.

Show comments