That moment when your financial standing suggests success, yet you feel a certain restlessness.

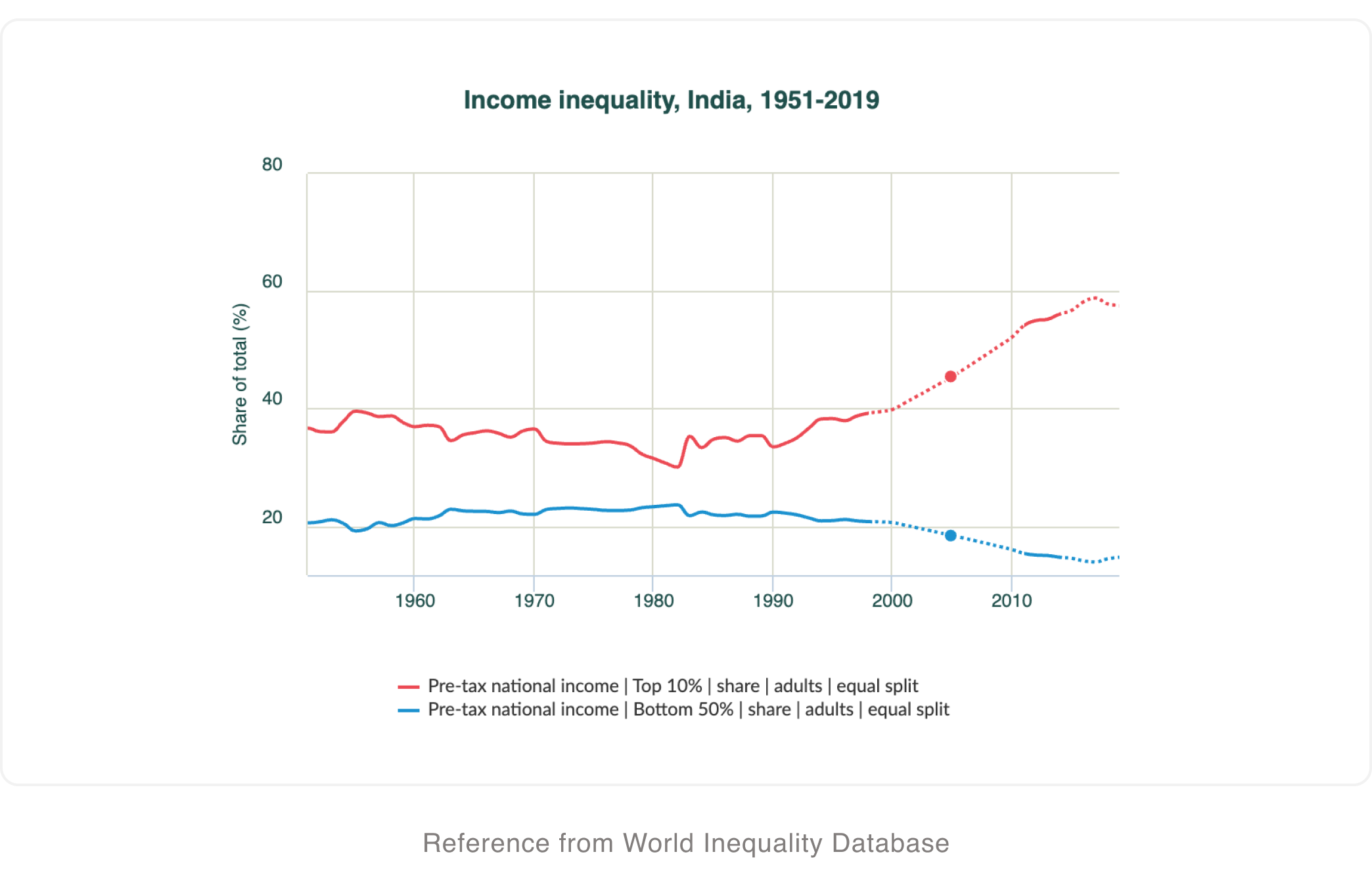

You’re quite likely among the top 1% in India – a milestone reached with a net worth over Rs 82 lakhs and an income exceeding Rs 20 lakhs, as recently highlighted by the Hindustan Times. The data are as of 2023.

Despite this seemingly significant wealth number, over 9 million individuals and households earn slightly above Rs 20 lakhs a year. However, the feeling of true financial peace can still seem elusive for many within this demographic.

Despite belonging to this affluent group, the lived experience for many urban professionals within it tells a different story. Talk to them, as I have, and the sentiment is often far from ‘amazing’.

The strange reality of the 1%

The reality for India’s “well-earning” often feels strangely at odds with expectation.

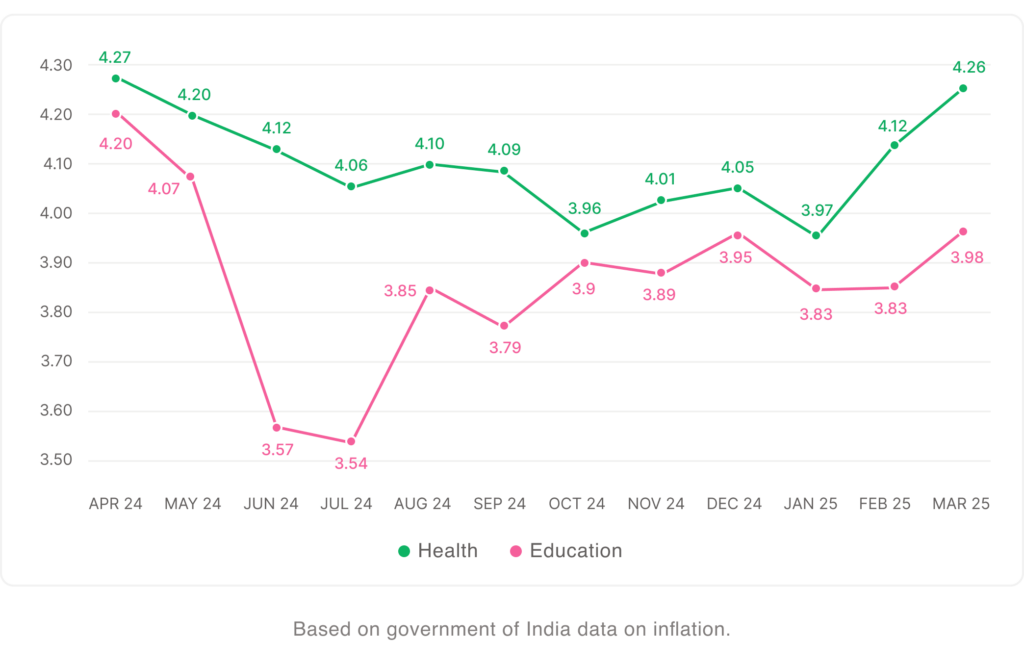

While relatives in smaller towns might see a picture of enviable success, you grapple with the relentless climb of living costs – school fees up 4.7% monthly (March 2025), and EMIs that can devour at least 30% of urban incomes (Perfios-PWC, 2025). And then there are the broader anxieties of a job market increasingly shaped by AI and unpredictable economic shifts.

From tech managers to startup marketers and senior surgeons, the pressure is a shared reality for India’s new 1%.

This level of financial success alone isn’t automatically translating into the peace of mind they might have envisioned

Many within this income bracket express that ₹20L incomes are “barely enough” for families with big goals—₹1 Cr for education, ₹10 Cr for retirement. These aren’t just first-world challenges; in India, we straddle plenty and scarcity.

Most of you own homes but juggle hefty loans. You’re successful but worry about AI or market dips. You’re educated but stressed about your kids’ schools. Retirement? It’s often what’s left after necessities.

So, where might one find a path to that elusive peace?

It’s likely that for many of you within this 1%, a familiarity with investing has been a significant part of your journey. That, coupled with your professional skills and dedication, has undoubtedly helped your income growth.

But for many of you, the demands of your careers may have resulted in your portfolios becoming a collection of disparate pieces – mutual funds, stocks, FDs, and property, often representing a significant portion, perhaps 50% to 70%, of your overall net worth.

This landscape can feel disconnected from the specific milestones you truly wish to achieve. Perhaps, this leaves you feeling well-off but not really free.

And perhaps this feeling of being well-off but not truly free is made worse by India’s relatively low engagement with financial advisors, despite the increasing adoption of market-oriented investments since 2015.

I see the result in portfolios that aren’t really cohesive. And while the challenge of finding an advisor one can trust implicitly is undeniable, it seems clear that for many in this position, professional guidance is essential.

What you truly need is a partner who can help you build a comprehensive plan, one that looks beyond mere wealth accumulation. Someone who can guide you not just towards greater affluence, but towards a place where you feel genuine ease and security.

This partner can help you define your personal “peace number” – that financial threshold aligned with your life goals and values, rather than just your wealth number. Recognizing that this “peace number” is unique to each individual underscores the necessity of a customized approach.

It might be time to consider finding such a partner. It could be a wealth manager or an RIA (Registered Investment Advisor) – as long as they work for your best interests and your cherished dreams.

Our Approach

This very reality – the juggling of success with underlying anxieties, the pursuit of wealth without guaranteed peace – shapes our thinking at Scripbox.

Ultimately, it’s not about the fleeting satisfaction of buying the next dream car, but about securing the right education for your child and ensuring the well-deserved rest in retirement after years of dedication.

At Scripbox, we are building for these families.

P.S. If you want to find out where do you stand with respect to your earnings and wealth, check this: https://wid.world/income-comparator/IN/

Thanks for reading,

Atul Shinghal

CEO and Founder

Scripbox

Show comments