This month, as we reflect on the hard fought freedom earned by a previous generation, it feels right to consider the independence we seek for ourselves.

My sense is that what we seek today is a different kind of independence. The freedom to choose our work, to be the masters of our time, and to secure the future for our families, without depending on a monthly paycheque.

This definition isn’t about hanging up our boots. It’s about affording the freedom of choice.

While we are all desirous of getting to this state of Financial Freedom, and dare I may say – at the earliest possible, there are some influencing factors that have emerged in the recent years that should guide our planning for this goal. I would like to talk about these factors in this edition.

1. The challenge: Shortening and possibly changing careers

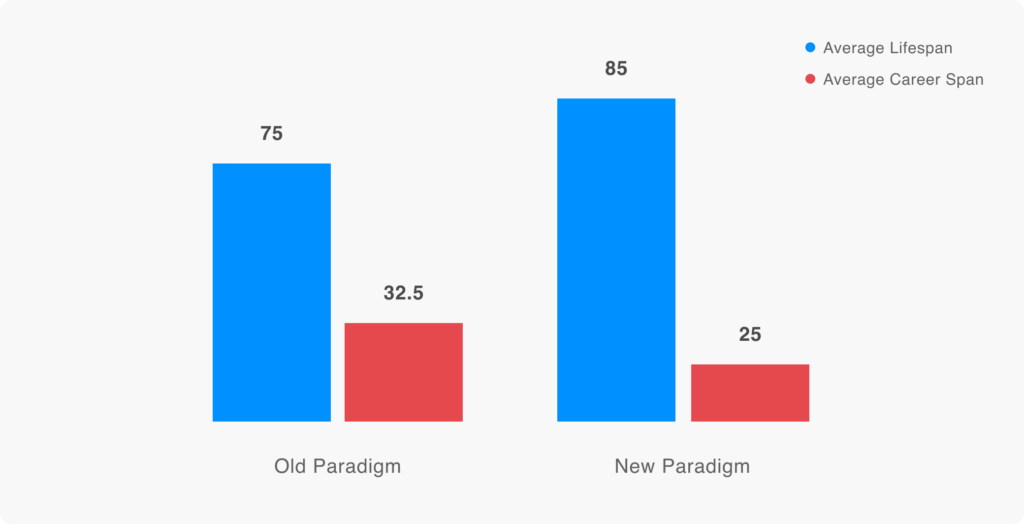

The landscape of work is changing at a breathtaking pace. Careers are compressing, with some reports suggesting that AI could displace a significant number of white-collar jobs by 2028.

The predictable, 35-year career arc is no longer a guarantee. This means we may have a shorter runway to accumulate the wealth needed for lifespans that are stretching well into our 90s and beyond. The quandary is unsettling: we are likely to have less time to save for a longer period of retirement.

The answer: A career buffer

The foundation for navigating this uncertainty is a robust defense. It starts with a career buffer, like having a confidence fund holding 12 months or even more of essential expenses.

It provides the breathing room to upskill, pivot, or weather a period of unemployment without derailing long-term goals.

Beyond this, it requires a conscious effort to ensure your entire portfolio is “freedom aligned.” The primary question to discuss with a trusted advisor should be how every rupee of your future savings can be fine-tuned to serve the goal of income independence first.

2. The challenge: Increasing lifespans

We all wish to live long and healthy lives and we do have a greater appreciation for this in our late 40s and 50s. Medical sciences and greater awareness of healthy living are bringing this dream closer to lived experience. Living well into one’s 90s is not an exception but pretty much an expectation today.

The implications are serious. Our corpus must account for the added decades of living expenses as well as medical expenses, while battling inflation.

The answer: A bigger corpus and alternative careers

The simplest answer seems to be to save more in line with what one might need for 40 years of retired life instead of the usual 25 years that most plans factor in. Of course, this is not as simple to execute, considering careers are shortening.

Apart from aligning more of our investments towards our freedom goal, we must also explore how we can turn our wealth of experience into alternative careers.

Whether through consulting or as domain experts, we must make ourselves ready for the roles that may come in the years ahead. Recently a 90 year old engineer “vibe coded” an app using AI. He had retired 3 decades ago and had no experience of writing code. Food for thought, perhaps?

3. The challenge: Competing responsibilities

Many of us are in the classic sandwich generation. Our responsibilities are to our parents as well as the next generation. A recent survey shows that 43% of High Net-worth Individuals save less than 20% of their post-tax income.

It’s not necessarily extravagance, but because they are prioritising a child’s dream of a ₹1-2 crore education abroad or providing for their parents’ healthcare. These are important aims, but they directly compete with the ₹5-10 crore independence goal, leaving it as a competing priority and probably a lower one.

The answer: A hierarchy of goals

This calls for a shift from a vague sense of duty to a structured plan. Have a candid family conversation to build a hierarchy of financial priorities. Your own financial independence must remain a priority. From there, you can cap other goals, such as education, at a sustainable portion of your net worth to avoid overstretching.

4. The challenge: A moving target

Your target number is not static; it’s a moving target. While headline inflation may dip, costs that are material , such as education and healthcare, consistently rise faster and are often dollar indexed. Healthcare costs as a percentage of expenses keep increasing with age for both you and your dependents.

The list of needs also grows as we and our families evolve. From timely home improvements to car upgrades to white goods replacements all add up in the long run and contribute to a moving target. A medical emergency that insurance can’t cover further strains your finances.

Furthermore, affluence encourages both bigger dreams and certain minimum expectations in terms of lifestyle. Whether we decide to pick up new hobbies such as golf or decide to rekindle our love for long distance biking expeditions, it all adds up.

To all this, add the potential cost of a “medical breakthrough” that costs a large amount. Would you not want to be in a position to afford this life enhancing moment for yourself and your loved ones?

Finally, consider that long term inflation means a lifestyle that costs ₹2 lakh per month today will require over ₹4-5 lakh per month in 20 years. The truth is that inflation’s silent erosion can turn “enough” into “not quite.”

The answer: A plan that is responsive rather than static

Life isn’t still so why should your financial plans be? Your financial plan cannot be a static document. It must be a living one. It is not just smart but necessary to update your goals, and if needed your investment approach, to address the changes in your life whether professional or personal.

A skilled advisor can stress-test your plan against spikes in inflation or unexpected costs, allowing you to adjust in time and ensure your freedom corpus outruns the shifting goalposts.

Ultimately, your financial independence is the most important project you will ever manage. Prioritising freedom isn’t selfish; it’s the foundation upon which all your other goals can rest securely.

The first step on this path is to ask yourself: Is my wealth truly aligned with my freedom?

P.S. The questions raised in this letter are often the starting point of the most important financial conversations a person can have. At Scripbox, we believe our first role is to listen, to understand your definition of freedom before everything else. Helping our clients chart that course from a successful career to a truly independent future is the reason we exist.

Show comments