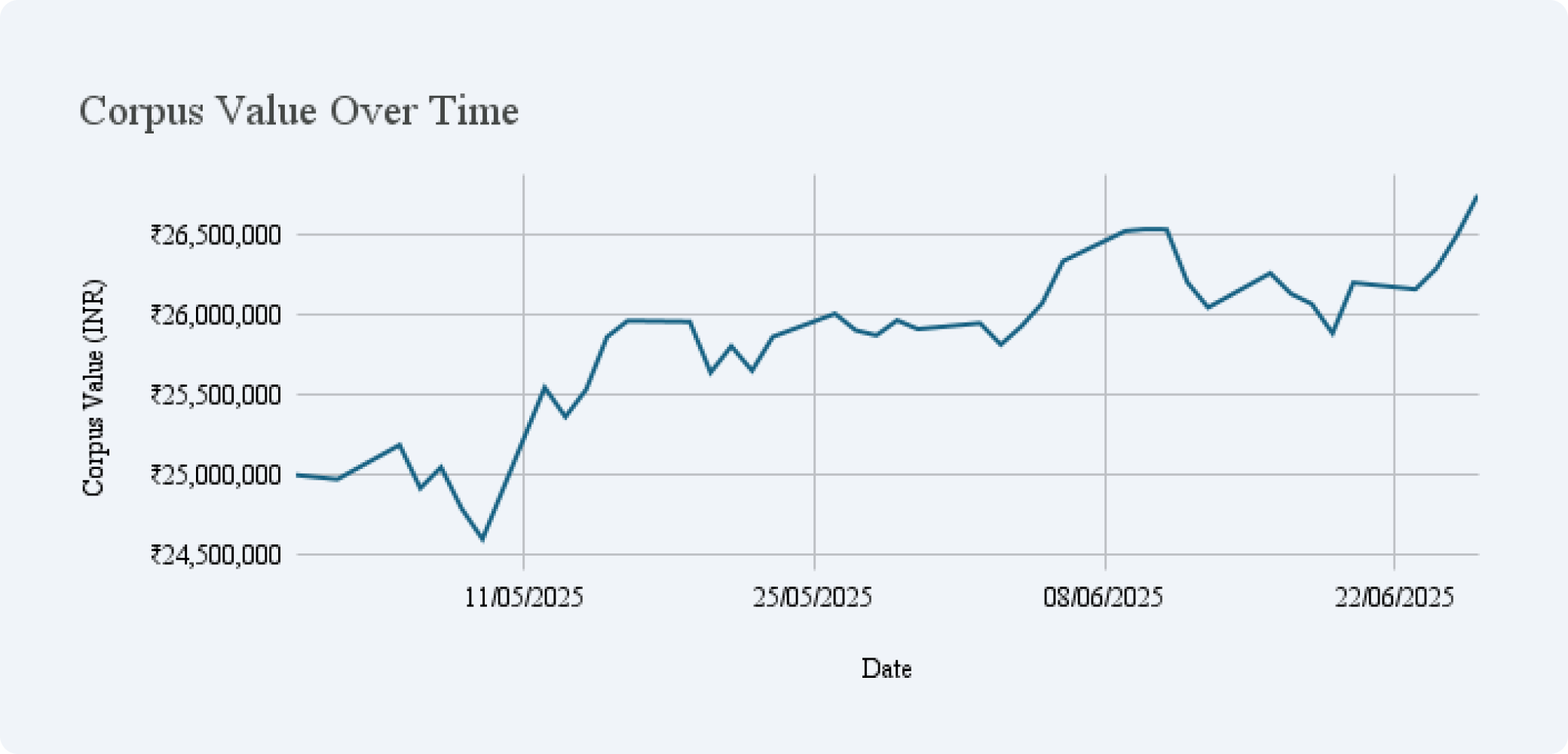

It is ironic, isn’t it? To see a 7 or 8-figure number on your portfolio statement, a symbol of success, and yet feel a fresh wave of unease. The last few months have likely made this paradox acute. A promising gain of ₹4 lakhs on Monday can evaporate by Thursday, erased by news of US tariffs or conflict in the Middle East.

The numbers are large, the swings are frequent, and the source is a flow of global events completely outside our control. This reality begs a more pressing question: How does one manage this uncertainty and not just in a portfolio, but within one’s own mind?

The real cost

To begin understanding how to build resilience, we must first be honest about where the vulnerabilities lie. Let’s consider a wealth structure that may feel familiar.

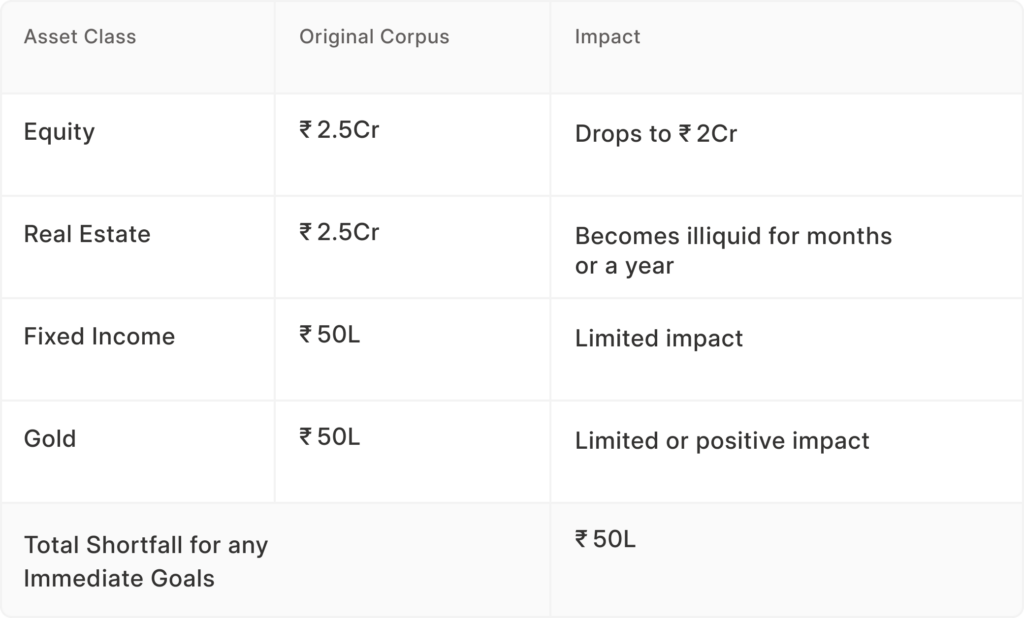

The family home, often a source of immense pride, might represent the largest portion, perhaps 50-60% of total wealth. Below that, equities and mutual funds could make up another 25-30%, with fixed deposits and bonds providing a 10-15% cushion. The remainder frequently sits in gold or other traditional assets.

When global uncertainty strikes, each of these pillars is tested differently. A market correction of 15-20% creates a temporary,but jarring, drop in the equity portion. The real estate can become utterly illiquid precisely when cash is needed.

But the true impact extends far beyond the numbers on a statement. A 20% correction on a ₹2.5 crore portfolio doesn’t just mean being down ₹50 lakhs on paper. It means a daughter’s US MBA fund is suddenly short.

It means that the early retirement target quietly shifts from age 55 to 60. This is the real, human cost of uncertainty.

The financial costs we’ve just outlined are tangible. But there is also the hidden psychological toll. It’s an uncomfortable truth that the mental burden of volatility seems to increase with wealth.

A ₹5 lakh drop on a portfolio of ₹25 lakhs feels significant, undoubtedly. A ₹50 lakh drop on ₹2.5 crores doesn’t just feel ten times worse; it can feel overwhelming.

This experience can trigger what I’ve come to think of as the “Affluent Anxiety Cycle.” It often begins with our own human wiring for loss aversion. All of us are built to feel the pain of a loss far more intensely than the pleasure of a gain. When those losses are measured in tens of lakhs, that ancient survival instinct can become crushing.

Should I book profits? Should I buy this dip? What if this is the bottom… or what if the fall has just begun? The questions multiply, each one heavier than the last. It’s easy to be left wondering if one is the only person feeling so untethered.

If any of this sounds familiar, please know you are not alone. Recent Grant Thornton research revealed that even among high earners, only 11% feel confident their investments will meet their expectations.

And this is what makes this uncertainty unique: the sheer weight of responsibility. It is the knowledge that your family depends on this financial stability; that school fees and healthcare are not discretionary. It is the sense of stewarding wealth not just for today, but for the next generation.

Building a fortress for your peace of mind

The encouraging news is that while we cannot control the world, we can control how we prepare for it. We can build a fortress for one’s peace of mind, using strategies that go beyond the obvious.

This means shifting from rigid asset allocation to more responsive strategies prepared for different global scenarios, be it inflation, conflicts, or sudden shocks. It means ensuring wealth is not trapped in illiquid assets during a crisis, by keeping 12-18 months of essential expenses accessible.

Most importantly, it means recognising that the most valuable advisor is one who not only manages money, but who also listens to our fears and acts as a steadying hand in turbulent times.

This resilience has an emotional component. It involves creating pre-commitment rules for how to act during a crisis, before the crisis hits. It can mean creating a family financial constitution, bringing a spouse and even older children into the discussion so that everyone understands the long-term plan when the seas get rough.

Your true peace number

Keep this in mind, true peace does not come from just the size of a portfolio, but from the resilience of its structure. A ₹4 crore portfolio engineered to withstand a storm will bring more peace than an anxious ₹8 crore portfolio that is vulnerable to every headline.

So, the final question I leave you with is this:

“What would need to be true about your wealth for you to sleep peacefully, regardless of tomorrow’s financial news?”

Thinking deeply about that question is the foundation for building not just wealth, but unshakeable financial confidence. The goal, after all, is not to eliminate uncertainty. That is impossible. The goal is to build a life so well-structured that uncertainty simply loses its power over your peace of mind.

Thanks for reading,

Atul Shinghal

CEO and Founder, Scripbox

P.S. This conversation is at the very heart of why we do what we do at Scripbox. We believe that before wealth can be managed, a person’s life, fears, and dreams must first be understood. It is our privilege to listen, and to help build that fortress for your peace of mind.

Show comments