After a strong 2014, the Indian Equity Market was in a phase of consolidation. The Nifty was down 7.02% on a Year to Date Basis. In comparison, the Scripbox equity portfolio was down by 2.52% resulting in an outperformance of 4.51% over the benchmark index. This out-performance is in line with the historical average out performance of the Scripbox portfolio over the Nifty.

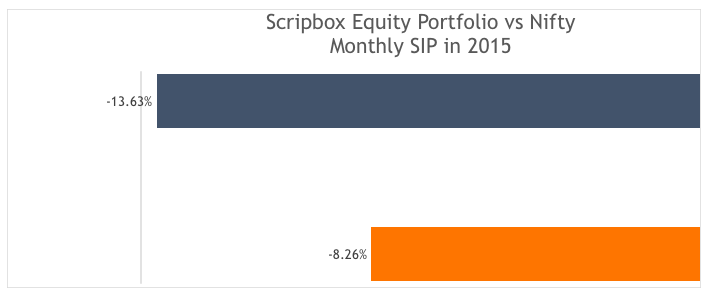

For our regular SIP investors, a monthly SIP in Scripbox recommended portfolio would have returned -8.26% this year against -13.63% for a SIP in the Nifty. On the other hand, the Scripbox Index lagged some of the larger mutual funds, as some of the mid-cap oriented funds did better than the large-cap oriented funds during the year.

Overall, we believe that the equities continue to be the best option among investable assets and we are quite confident entering 2016.

1. The core idea of Scripbox:

The objective of the Scripbox portfolio of equity funds is to select a portfolio of 4 Diversified Equity funds that have a consistent track record of performing better than the Nifty, and therefore expected to do better than the Nifty.

We had the following 4 diversified equity funds in the 2015 portfolio of equity funds. This Report card is based on the performance of these funds from Jan 1, 2015 till Dec 15, 2015.

- Kotak Select Focus Fund (G)

- UTI-Equity Fund (G)

- ICICI Pru Focused Bluechip Equity Fund (G)

- ICICI Pru Top 100 Fund – (G)

The analysis of the absolute performance of the Scripbox equity portfolio is a combination of the performance of the Nifty, and the performance of the portfolio relative to the Nifty.

2. Nifty Performance:

- In 2015, the Nifty was down 7.02% (till 15, Dec 2015)

- Over a decade, the Nifty has returned a CAGR of 10.5%.

- We continue to believe that the case of Indian equities remains strong and equities as an asset class will continue to outperform fixed income over the long run.

These are returns based on a one time investment, for returns for a SIP investor, kindly refer section 6 below.

3. Nifty Relative to Other Benchmarks:

In 2015, most benchmarks including the mid cap and small cap indices were in the negative, there was some relative outperformance of the mid and small caps over the benchmark large cap index

4. Scripbox Portfolio of Equity Funds:

All the 4 funds in the Scripbox portfolio outperformed the benchmark index.

Off the funds in the portfolio, Kotak Select was the best performing funds with a positive 0.22% return in the period.

5. Scripbox Portfolio compared to other funds:

The top 25 funds by assets delivered an average return of -2.61% in the current year and the Scripbox portfolio performed in line at -2.52%

6. Returns for SIP investors:

Assuming a SIP on the 10th of each month, the XIRR returns for a SIP investor was -8.26% in the Scripbox portfolio of equity funds, compared with -13.63% in the Nifty.

The SIP out performance of 5.38% was slightly higher than the absolute out-performance.

This is in line with the track record of Scripbox equity portfolio over the long term. SIP returns in the Scripbox equity portfolio have been better than the Nifty over all holding periods.