Founded on principles.

Driven by science.

Our Foundersstarted Scripbox to solve a very real wealth management problem: Human bias.

With 100+ years of investing experience between them, the founding principle at Scripbox is to help you invest smarter with the power of science. So, go ahead, accomplish all that matters to you without getting lost in a jargon-heavy maze.

A time-tested investment strategy. Revolutionised by technology.

Our wealth management strategies are rooted in tested-and-proven research and methods. We bring these strategies to life with technology, so that you get automated best practices to take your investment journey to a new high.

As your client managers, we do all of this and more.

Schedule a callor call us at1800-102-1265

Asset Allocation

Scripbox’s promise of right wealth management and investments for your objectives begins with asset allocation, orbuilding a diversified portfoliowith the right asset and sub-asset classes. You need different asset classes to fulfil different roles within the portfolio. For eg., Scripbox Long Term Wealth is a portfolio that gives inflation-beating returns along with stability for long-term goals, such as, retirement, child’s education, etc. 50% of the portfolio is allocated to stable, large-cap funds while 50% is growth-driving, diversified multi-cap funds.

The science is in optimising the right asset class and the allocation ratio for each. With our Glide Paths, we also help you move your investments to lesser-risk asset classes as you near your goal, besides regular rebalancing of your portfolio to ensure an asset allocation most suited to your life’s needs.

Algorithmic Product Selection

After the asset allocation, our proprietary algorithmchooses the best products, viz, mutual funds within each asset class for you. Considering hundreds of mutual funds in India, selecting the right ones is a process!

Certain fundamentals observed while arriving at the mutual funds include:

1Focus on growth options only; with tax-efficiency in mind.

2Elimination of small funds; since they are susceptible to redemption pressure.

3Discarding funds without a 4-year track record; because short-term performances can be misleading.

4Evaluation on the consistency of performance.

5Annual reviews to ensure the recommended funds’ health.

Active Portfolio Management

We use the power of science (and good conscience!) to de-risk and manage your portfolio. In theScripbox Annual Review™, our algorithms check on previous year’s mutual fund recommendations for bad performance, or other danger signs. The algorithm then recommends new funds, if needed.

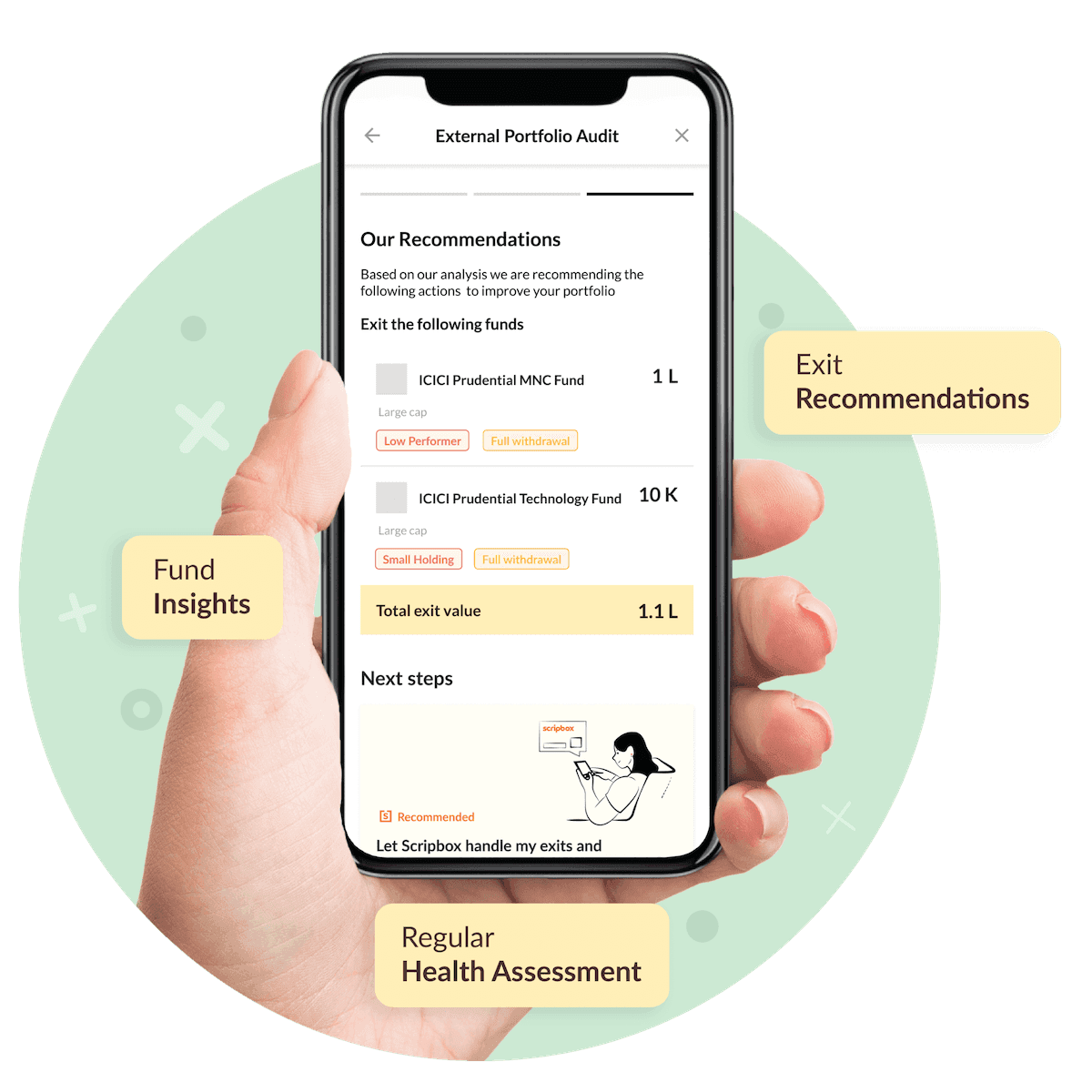

Thrice a year, the algorithm runs the personalisedScripbox Portfolio Scan™to identify if you need to exit any underperforming funds and/or declutter your portfolio of funds with smaller amounts. You are then prompted to re-invest this amount into new recommended funds. These measures ensure that you stay invested in only the right funds.

Tax-Optimised Withdrawals

At Scripbox, we don’t just help you invest in the right funds, but also ensure that your exit is tax-optimised and intelligent.

With Scripbox Smart Withdraw™, we ensure that you only withdraw from funds withminimal tax implications and reduce your long-term capital gains.

Our algorithms also track the possible impact of capital gains, and alert you about the same at the time of withdrawals.

Get started withease!

Don't have an eCAS.Signup here

Frequently Asked Questions

What are Scripbox's credentials?

Scripbox has been built by finance professionals who have over 60 years of collective industry experience. We started in 2012, and now manage Rs.4400+ crores for investors in over 2500 cities. We have received numerous awards, but our favourite credential is that we have a 95% retention rate.

What is Scripbox Portfolio Scan? How will it help me?

You will get:

- Personalised fund reviews: Periodic reviews and continuous monitoring of the funds you’ve invested in.

- Portfolio realignment: Exiting under-performers and aligning your investments to recommended funds.

- Portfolio decluttering: Exiting funds with small investments. While we continuously monitor your portfolio, we run the ‘Scripbox Portfolio Scan’ thrice a year and will let you know if any action is required.

If the mutual fund company is paying you, how can I be assured that you won’t sell me investments where you make the most commission?

How often will you review the funds you are recommending?

What are tax optimized withdrawals?

What are tax optimized withdrawals?

- Compounding: In the Growth option, your returns are reinvested in the fund. This ensures that it grows at a faster rate (than if no reinvestments happened) and with time, this effect is cumulative. Like a snowball rolling down the hill - the more it travels, the bigger it gets.

- Taxation: In the Growth option, the returns are treated as capital gains on withdrawal, and taxed at 10% for a holding period of more than 1 year, on gains of more than Rs 1 lakh. In the Dividend option, you have to pay tax on the dividends as per your tax slab, as well as capital gains tax on the returns on withdrawal.