Many people ask which is the best investment option in between Mutual funds and stocks. Let us differentiate between mutual funds Vs stock to get the best returns on your investment.

When it comes to investments, there are many fundamental differences between mutual funds and stocks.

Right from the Return on Investment and risk, both instruments differ in investment style and management. As an informed investor, you should be prudent enough to know these differences before making an investment decision.

Mutual funds are investment options that pool money from investors and invest across a diversified portfolio. The fund manager is responsible for creating a portfolio that align with the fund’s investment objective. The diversification can be across asset classes or within a asset class. Investing in a mutual fund will you the exposure to all the securities in the portfolio.

On the other hand, shares are securities that give you ownership of a firm. Investing in the stock market is a high risk proposition. These shares are highly volatile and hence are high risk investments. To invest in the share market you must have a good understanding of its fundamentals and techniques.

This article helps you understand the differences between stocks and mutual funds and also gives you the reason as to why investment in mutual funds is better than stocks.

Difference Between Mutual Funds and Stocks Investment

The following table summarizes Mutual Fund Vs Shares

| Basis of Difference | Mutual Fund | Shares |

| Risk | High Risk, but lower than shares. | High Risk |

| Return | High | High |

| Management | Fund Manager | You must manage your investments. |

| Diversification | Instant diversification | You must invest in at least 15-20 stocks to achieve diversification. |

| Cost | Low | High |

| Price | NAV is finalized at the end of the trading day. | Prices fluctuate in real time. |

| Tax Benefit | ELSS fund qualify for Section 80C deductions | No tax benefit |

When you buy a share, you get legal ownership in the company with voting rights along with the entitlement to a share of the profits earned by the company. You can also participate in the Annual General Meetings and correspond with the company.

Buying stock, however, is direct participation in the Stock Market, the earnings from which can be in two ways:

- Dividends received and,

- Sale of stocks

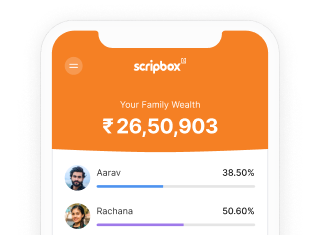

When you invest in mutual funds, you get a share in the pooled fund collected by several investors. Your share is the number of units of mutual funds you purchased during the investment. Your rights and benefits are restricted to the mutual fund house.

While investing in stocks, you can lay hands on equity as an asset class but in case of mutual funds, it can be investing in one or more asset classes or sub-asset classes because mutual fund schemes can hold a diversified portfolio.

Investing in mutual funds is in-direct participation in the share market.

In mutual funds, you can earn only through the sale of units and the dividends received on shares of the scheme may or may not be directly available to you.

If you have selected the “Dividend” option, then the fund house shares the dividend received. In case you have opted for the “Growth” option, then the dividends are reinvested in the fund to generate returns.

If you have selected the “Dividend” option, then the fund house shares the dividend received. In case you have opted for the “Growth” option, then the dividends are reinvested in the fund to generate returns.

Now that you understand the difference between mutual funds and stock market investments. Now let’s compare the features of stocks and mutual funds to understand which option is better for you.

Check Out Basics of Stock Market

Mutual Funds Vs Stocks Investment

1. Risk and Return

Individual stock purchases are a high risk – high return proposition. There is also a chance that you may end up with negative returns.

Even though Equity mutual fund schemes have a higher risk due to the asset class they invest in, they have a diversified portfolio. Any negative returns on a single stock can get compensated by the returns generated by another stock.

Thus, by investing in mutual funds, you end up avoiding scenarios of negative returns.

2. Management

You solely rely on your research, knowledge, and skills while making an equity investment, which may or may not be adequate in all market scenarios. You may be constrained by tools and resources which could help you manage your equity investment properly.

All of these drawbacks are not present with mutual fund purchases. Mutual fund houses have experienced financial experts who are fund managers and take care of your investments. Additionally, the fund house also has access to all the tools and resources required to manage the funds.

3. Diversification

A well-diversified portfolio should include at least 15 to 20 stocks but that might be a huge investment for an individual investor.

With mutual funds, investors with little funds, as low as INR 1000, can get access to a diversified portfolio. Buying units of a fund allows you to invest in multiple stocks without the need to invest a huge amount.

4. Cost

Due to the economies of scale, mutual funds attract lesser transaction costs when purchasing shares and therefore, pay lower brokerages as compared to individual investors.

You can also save the annual maintenance charges on Demat accounts as you do not require it while investing in mutual funds.

5. Investment Style

When you invest in stocks directly, you have to do your own research, based on the knowledge of which you enter and exit the market and devote time in managing them.

The decision of buying and selling rests with you. Hence, you have full control over the investment decision when you invest in stocks, which makes you an active investor as you look to optimize your returns.

In case of mutual funds, you do not have the freedom to choose or transact in stocks or any assets as for that matter, during the time period of investment.

The fund manager does all the investment, tracking and management on your behalf which makes you a passive investor. So if you are new to stock investing and don’t want to spend a lot of time on stock analysis, then mutual funds are the best option for you.

explore our article on Best Time to Invest in Mutual Funds

6. Investing / Trading time

Stock can be bought at any time during the exchange trading hours which start from 9:15 a.m. to 3:30 p.m. during which the transactions happen at the existing price.

In the case of mutual funds, you can buy them at any time. However, the applicable NAV depends on the time of purchase. If you purchase the units before 3 PM, the applicable NAV will be of the same day. For all purchases after 3 PM, the applicable NAV will be of the following day.

7. Tax Benefits

ELSS mutual funds offer you the option to save taxes and can help you save up to INR 1.5 Lakhs under Section 80C of the Income Tax Act, 1961 by investing in tax saving mutual funds,

There is no such option to save tax while investing in stocks.

Explore What is Equity Shares?

Why You Should Choose Mutual Funds Over Individual Stocks

1. Professional Management

When you choose to invest through a mutual fund, you need not worry about analyzing, picking, timing, tracking, and managing the purchases. The fund manager will do all the heavy lifting on your behalf.

2. Diversification

In order to get a diversified equity portfolio, you need to invest in at least 15 to 20 stocks, which means that you need to make a large upfront investment.

This is where investing through a mutual fund is more beneficial. With INR 1000 of investment, you get a diversified portfolio across assets, meaning that if you are investing in Equity Mutual Funds, you get a diversified equity portfolio.

3. Lower Cost

Mutual funds work on the economies of scale while buying and selling. They even negotiate with brokers to get better rates, all of which lead to lower costs while the benefits are indirectly passed on to the unit-holders.

This is not in the case when you buy shares. Plus, you do not have to maintain a Demat account when you invest through mutual funds.

Conclusion

We hope you now have some clarity on mutual funds vs stock, and which is a better investment option. If you want to benefit from the inflation-beating returns generated by equities without many of the drawbacks of direct equity investing, but are constrained by time and expertise then, the best way to earn those returns is by investing through mutual funds.

Frequently Aksed Questions

Yes, certain mutual funds accept SIP investments as low as INR 100. Therefore, you can identify such funds whose minimum SIP investment is INR 100 and invest in the best one. Such low investments have helped any investors to start their investment journey in mutual funds.

Yes, mutual funds are affected by the stock market. As the disclaimer goes, Mutual fund investments are subject to market risks. Hence investors should be mindful while selecting and investing in a fund. In other words, mutual funds invest the money pooled from investors across different asset classes. Equity mutual funds primarily invest in shares or stocks of companies. Therefore, any price fluctuation in these shares will impact the fund’s NAV. Stock market fluctuations impact mutual funds though they may not be very high as a mutual fund is a collection of many shares and stocks.

Shares are riskier. Even though mutual funds invest in shares, they offer a diversified portfolio. Thus, the fluctuations in the stock market will not affect the mutual fund as much as they would an individual stock. The diversified portfolio averages out the volatility.

You can start investing in mutual funds with as low as INR 100 through SIP investing. The minimum investment amount for shares depends on the current market price of the share.

Both mutual funds and stocks do not offer security. They are market-linked instruments and are subject to market volatility. Both instruments do not guarantee returns. However, mutual funds offer a diversified investment portfolio, such the impact of market fluctuations is comparatively lesser.

Open-ended mutual funds can be withdrawn anytime. ELSS mutual funds have a three-year lock in period. These funds cannot be withdrawn until the lock in period is completed.

The investment duration for mutual funds depends on the type of fund. For equity mutual funds, the recommended investment tenure is at least 5 years. For debt mutual funds, the recommended investment tenure is at least 3 years.

Related Pages

Show comments