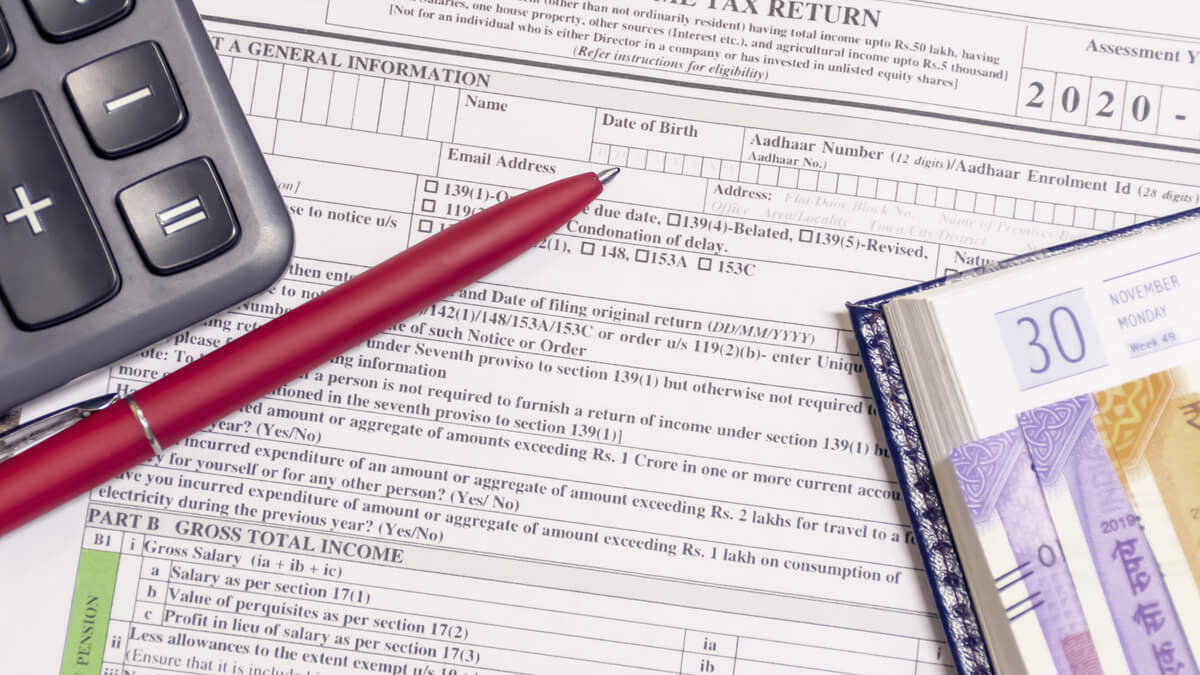

There are various options to save tax under section 80C of the Income Tax Act. But, one of them is better than the others. Scripbox suggests tax saving investments under 80C.

What are ELSS funds?

They are open-ended equity mutual funds that are eligible for tax deductions under Section 80C of the Indian Income Tax Act. They have the dual advantage of growing your wealth in addition to saving tax.

ELSS funds provide the best combination of

- Potential for long-term inflation-beating returns (14-16%)

- Lowest lock-in period (only 3 years) among all tax saving under 80C investments and

Like all equity funds, the returns on ELSS funds are not guaranteed but this is the historical average for long-term investments in ELSS funds.

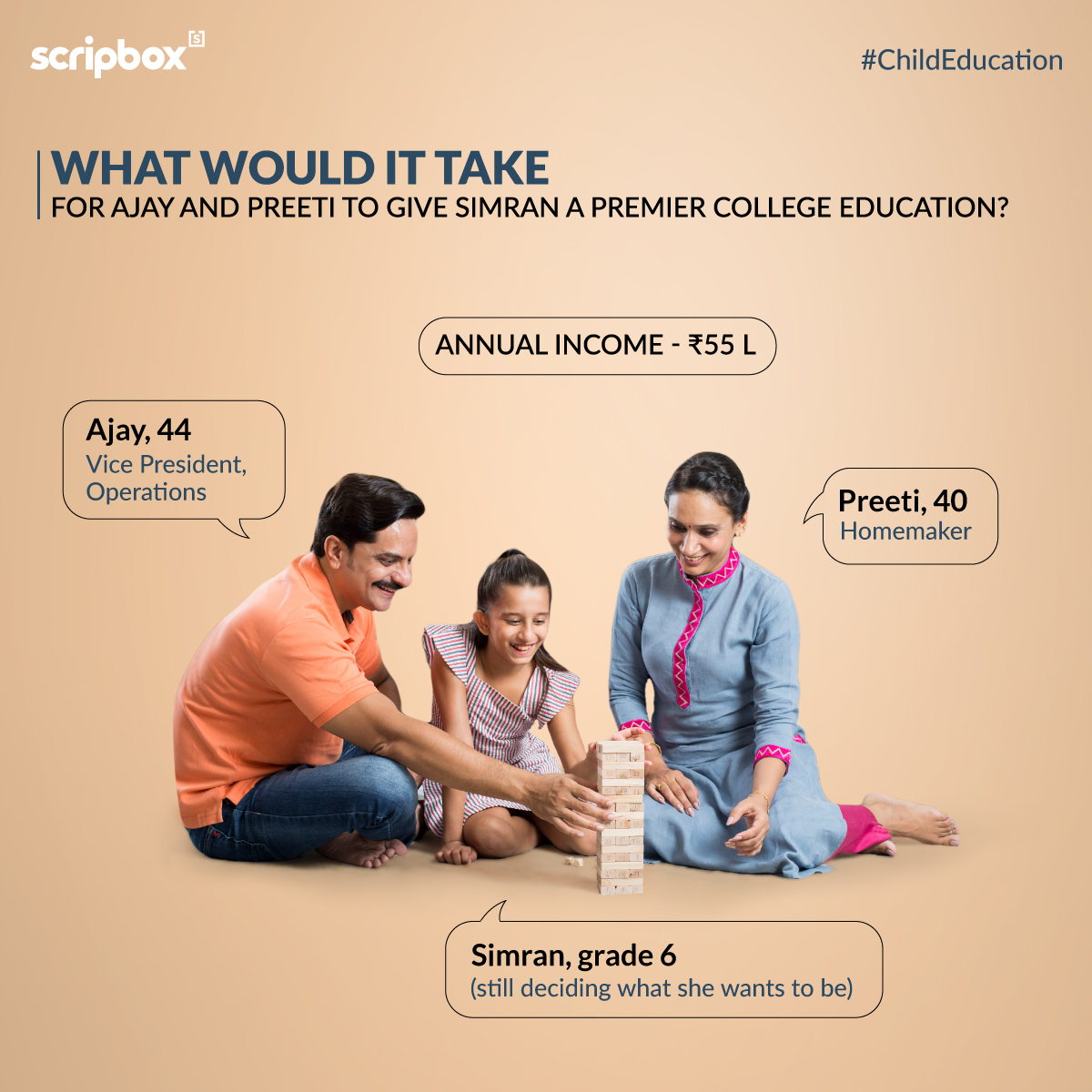

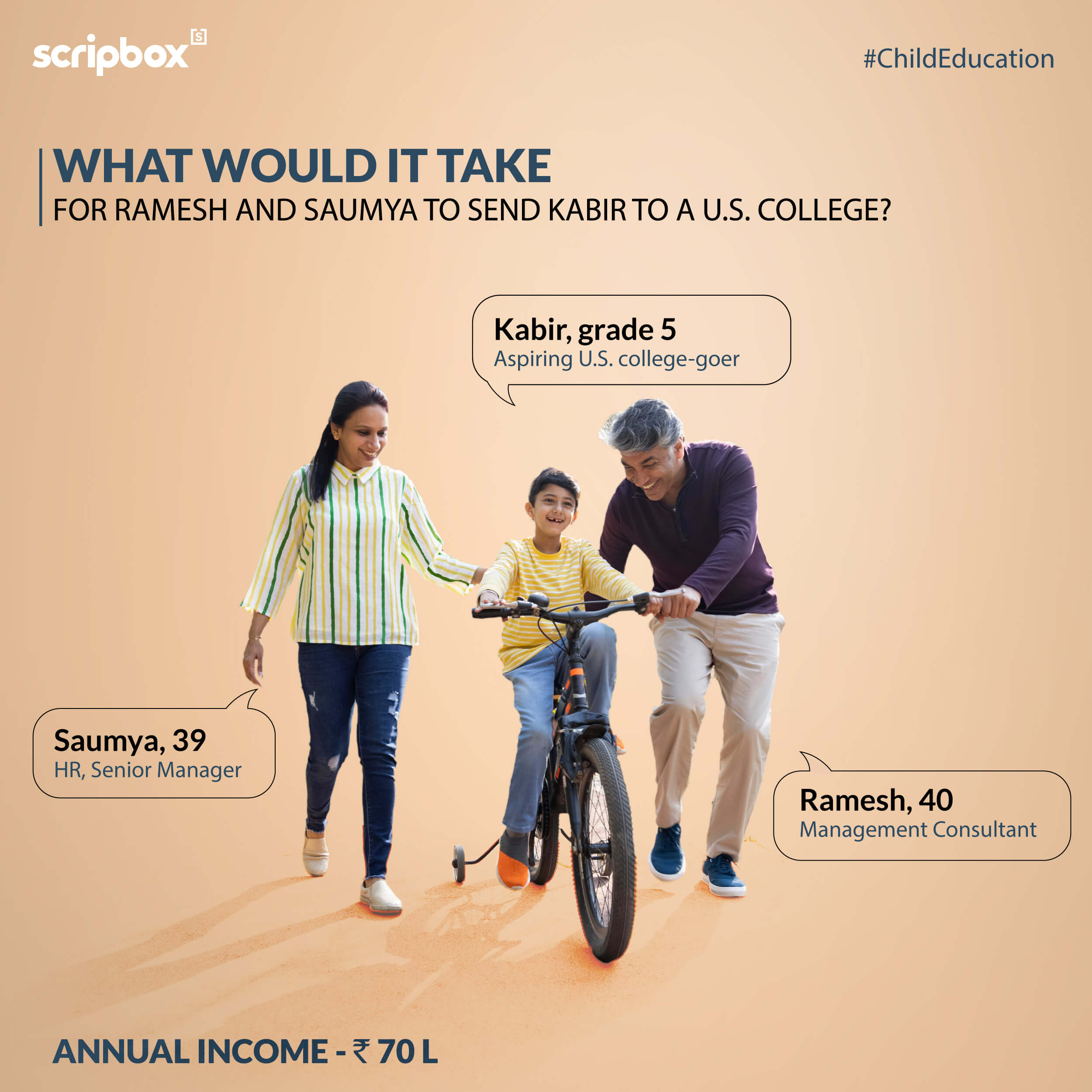

At Scripbox, using our scientific algorithm, we carefully select ELSS funds with the best long-term prospects for you.

How will my money grow by investing in ELSS tax saving funds?

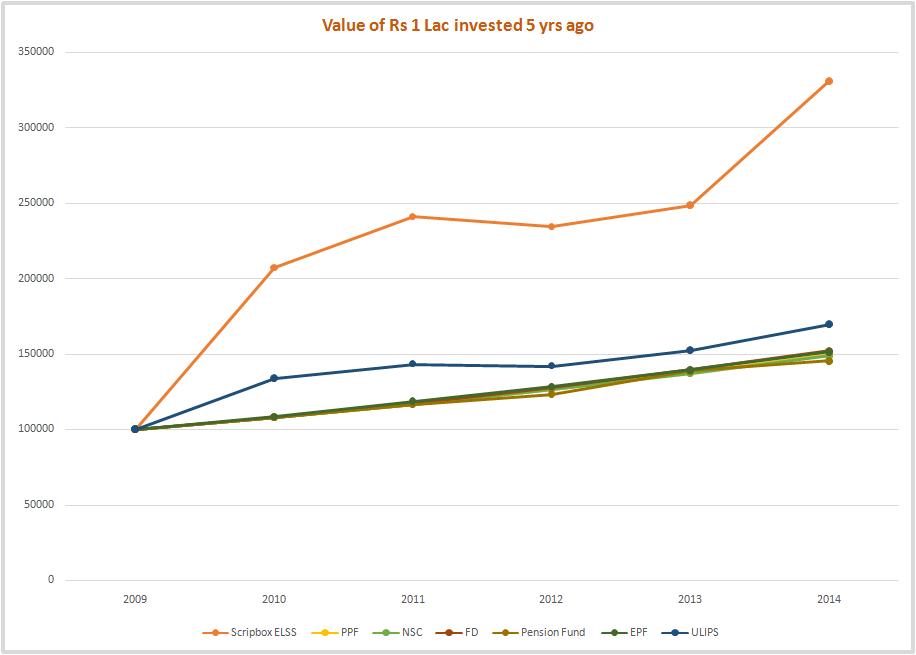

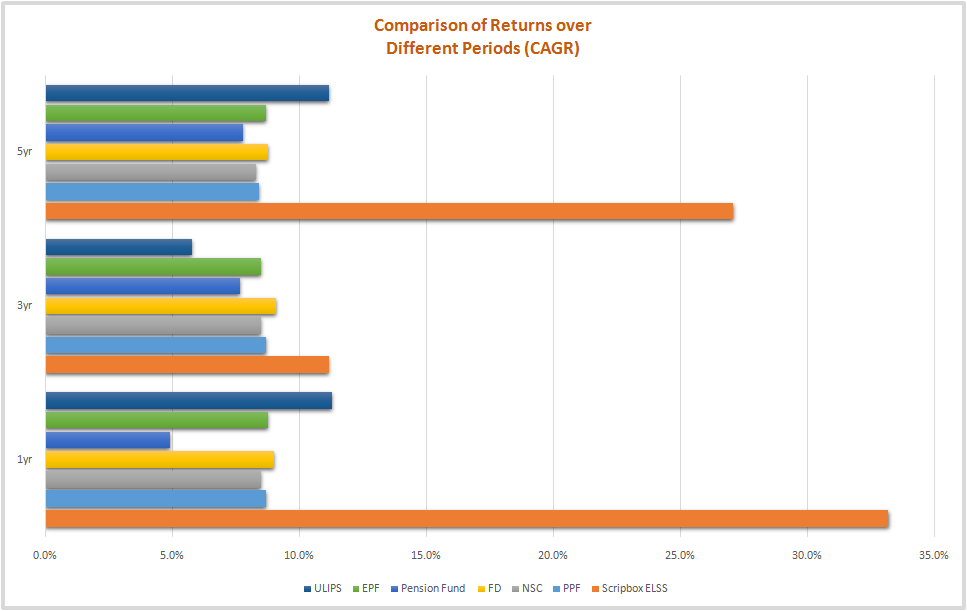

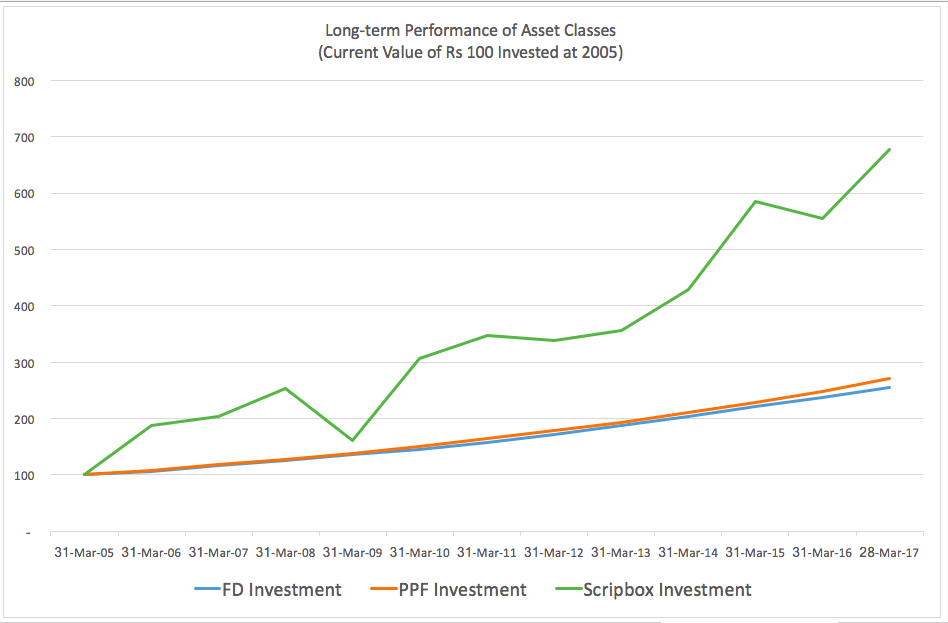

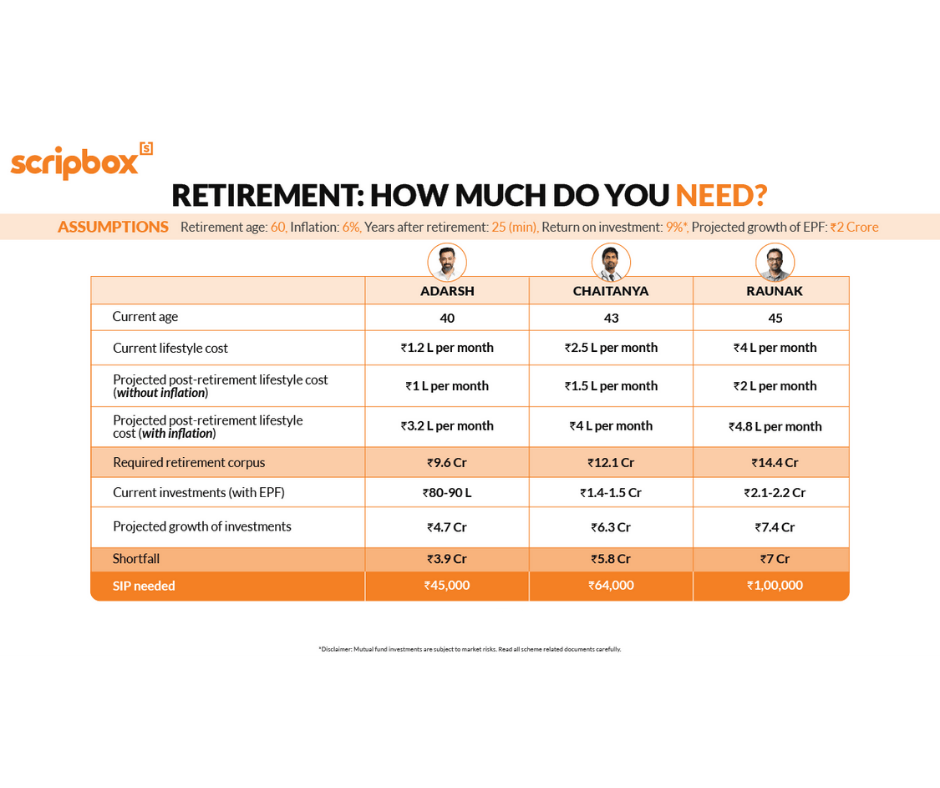

Careful ELSS fund selection can help you grow your wealth quickly compared to other 80C investment options.

ELSS funds potentially give you inflation-beating returns (14-16% historical long-term average), which help you grow your wealth in addition to saving tax.

Scripbox tax saving investment Versus traditional tax saving investments

Open a free Scripbox account to start investing in ELSS funds.

You may also like to read PPF vs ELSS, which is a better tax saving option.

You must check out the best ELSS funds to invest in India

Check out ELSS mutual fund vs PPF

Show comments