Higher expenses and constraints in exit for ULIPs (Unit Linked Insurance Plans) make the choice a no-brainer – invest in mutual funds, with a separate term plan for life insurance. This is a better option than ULIPs.

Why investing in ULIPs is not recommended?

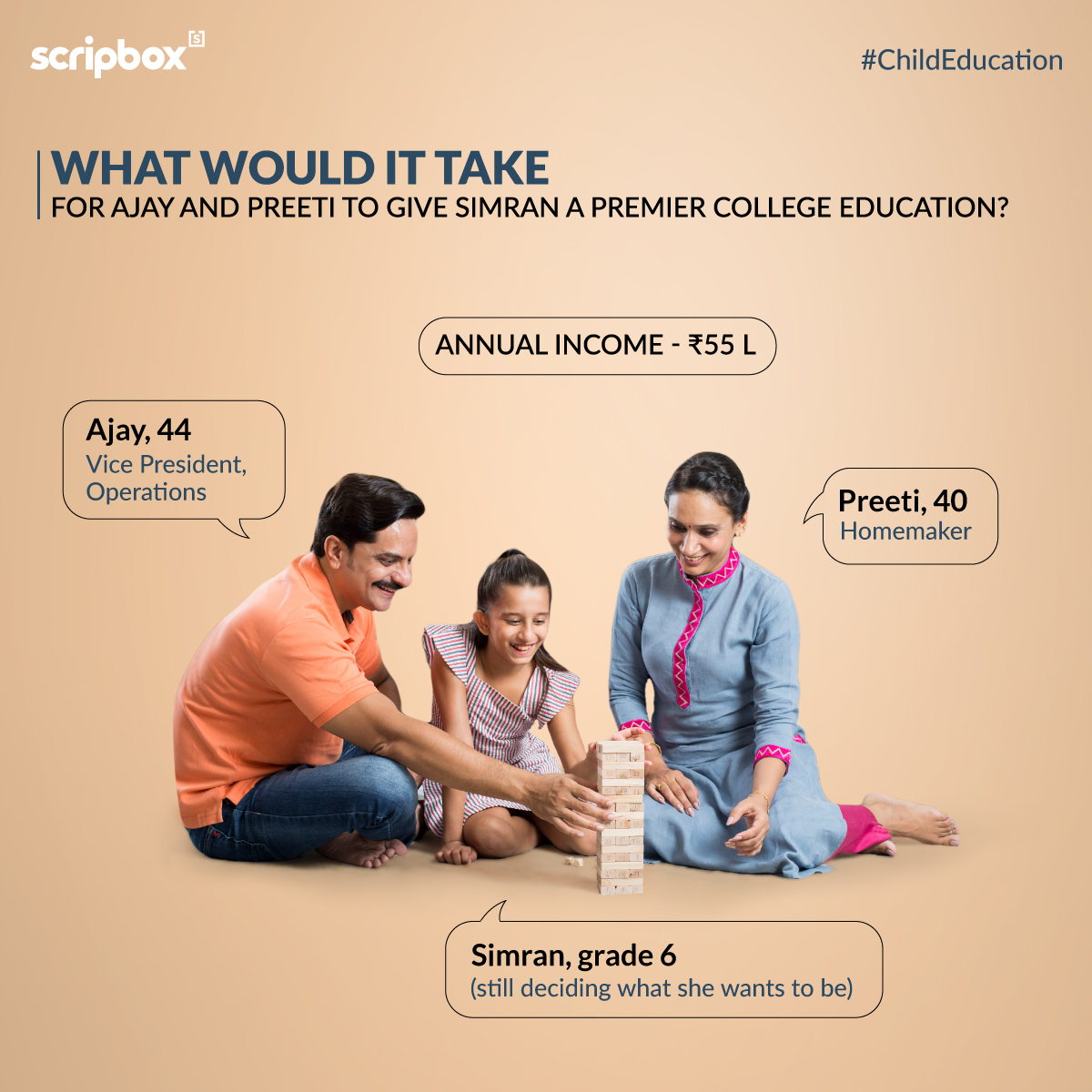

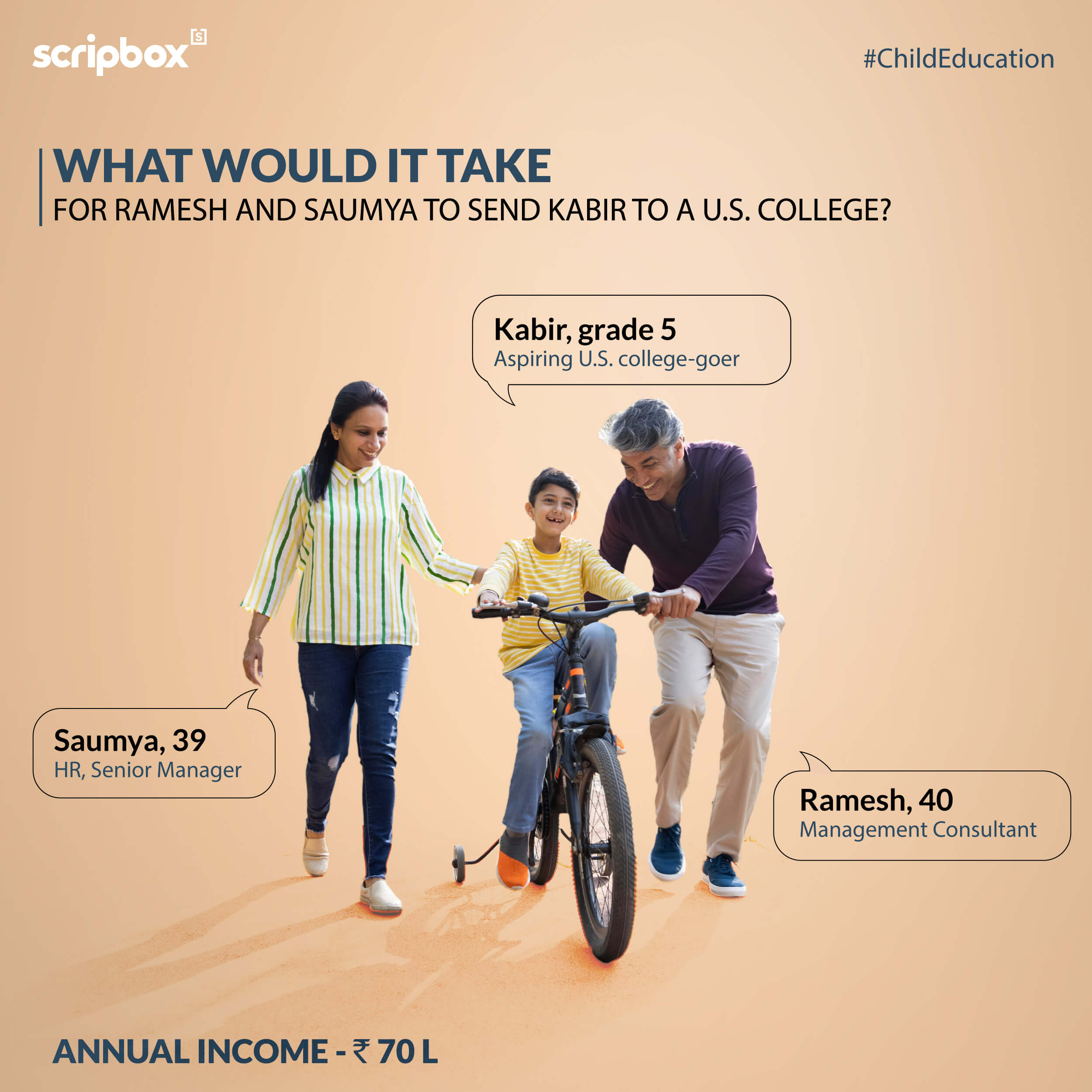

Buffet or a-la-carte? That’s the choice you often make when you visit a restaurant. Similarly, individuals often face the tough task of deciding whether to invest in ULIPs , which give life cover as well as an investment option; or should they separate the insurance needs from that of investment by investing into mutual funds, while taking life cover separately from an insurance company. Which is the best way, one might be tempted to ask?

Our analysis suggests ULIPs give you fewer net returns while giving no advantage in cost of life cover. Moreover, ULIPs usually carry a lock-in, so in case you need some money out for an emergency, you risk paying a penalty. In short, there is no good reason anyone should buy ULIPs.

The cost of life cover remains almost the same

Take, for instance, a 40-year old man who is looking at taking a ULIP plan, and requires a life cover for Rs 1 crore. Here, the insurer deducts units from his overall unit balance on a monthly basis to pay for his life cover. Popularly known as mortality charge, it works out to Rs 18,025 for a 40-year old for HDFC Life. And these charges keep increasing if the policy commences at a later age, similar to a term plan. In contrast, if the individual goes for an HDFC term plan, the annual premium works out to Rs 18,500 for a Rs 1 crore of life cover for the next 25 years.

Mutual funds give better returns compared to ULIPs

However, what makes mutual funds significantly better than ULIPs are their lower costs, therefore better net returns.

There are various costs in case of an insurance product such as premium allocation charge, policy administration charges, fund management fees in addition to mortality charges called a reduction in yield (read expense ratio). These are allowed be as high as 4% per year for first five years as per rules framed by sector regulator IRDA. These expense caps keep reducing as years pass by:

- 3 percent in the 10th year

- 2.5% in the 13th year and

- 2.25% from 15th year on wards

In case of equity mutual funds, the expense ratio has been capped by its regulatory SEBI at a maximum of 2.5% per year for the initial Rs 100 cr of the fund, and falling off to 1.7% as the fund size grows larger than Rs 300 Cr.

The effect of these differing expense ratios is that you will make less overall returns with ULIPs even if you assume both the ULIP and mutual fund managers are doing equally well in giving investment returns.

Mutual funds can give as much as Rs 1.84 lakhs higher returns compared to ULIPs

We illustrate an example, where an individual invests Rs 50,000 each year for next 25 years, in both ULIPs and mutual funds. Both folios give the identical return of 15% per annum every year.

At the end of 10 years, ULIP portfolio works out to Rs 9.53 lakh while it is Rs 10.11 lakh for the MF folio.And at the end of 15 years, mutual fund portfolio is about Rs 1.08 lakh higher than that of ULIP. At the end of 25 years, the gap increases to Rs 1.84 lakh!

Flexibility: Mutual funds win

The flexibility of exit is another big issue with ULIPs. If you need your money in an emergency, or if you find the ULIP fund manager is not doing well, you will lose a lot of money if you withdraw.

Called discontinuance charges, these

- Start at 6% of premium in year 1 (with a maximum of Rs 6000)

- Go down to 4% in year 2 (maximum of Rs 5000) etc

- After 5 years, there is no cost, but many plans allow only partial withdrawal, up to 20% of fund value

In contrast, in mutual funds, exit load is typically only for the first 12 months, after that you can take all your money out at no cost.

Expert Advice: So go a-la-carte and invest into equity funds for your investment needs, while taking term policies for life cover.

Additional info about ULIP mortality charges:

It needs to be noted that mortality charges in case of ULIPs is charged on the difference between the sum assured and the portfolio value. To enumerate, at 58 years, when the individual’s portfolio value works out to Rs 32 lakh, the mortality charge deducted from his units is only for a cover of Rs 68 lakh (Rs 1 crore minus 32 lakh), which totals to Rs 12,257 (and not Rs 18,025).

There are no extra benefits derived from such offering since in case of death of ULIP policy holder, your dependents get only the highest of the sum assured or fund value and not its sum. You could do similar structuring by taking a term plan and a mutual fund separately.

Check out the Ulip vs mutual fund

Show comments