Recently, I got an excited call from a friend saying that she’s just one lakh short of Rs 10 lakhs in her Scripbox account and that too in a fairly short time.

The word ‘millionaire’ does have a nice ring to it. In India, the big indicator of wealth used to be ‘lakhpati’ but today everyone wants to make their million as fast as possible. The big question is, how does one do it with inflation eating away the value of your earnings.

For a lot of young earners starting out on their first job, it seems impossible to have that much money. This article will show you how to become a millionaire before you turn 30! All you need is a simple, easy to follow plan.

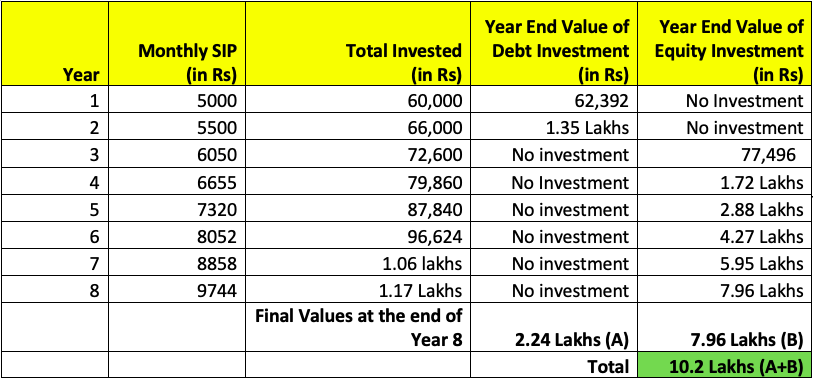

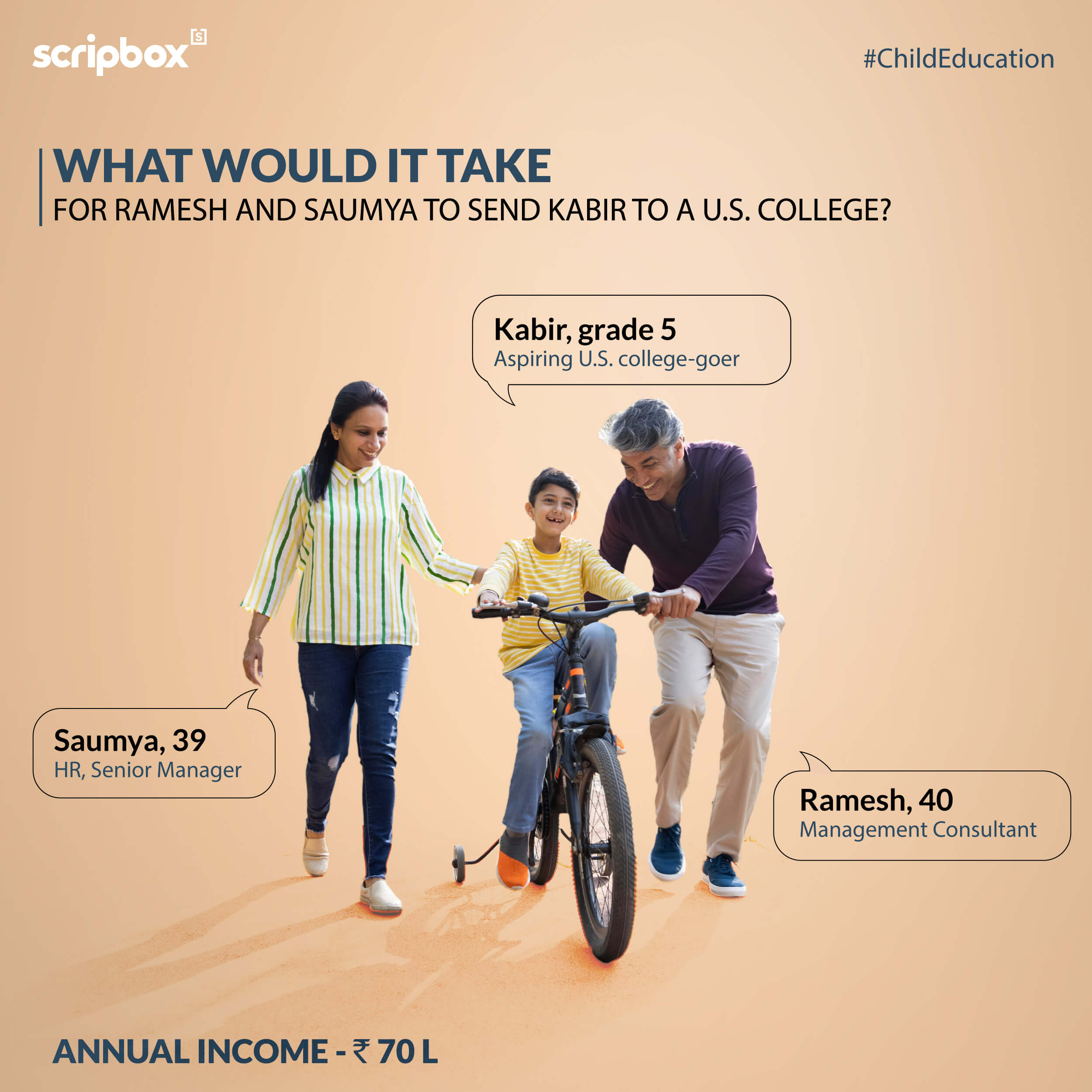

Let’s say you are a 22-year-old making Rs. 25,000 a month and able to save Rs. 5,000 to begin with.

Here’s your plan:

Year 1: Save Rs. 5,000 per month and invest in Debt funds or a recurring deposit. We recommend a debt fund because it has no TDS (Tax Deductable at Source).

Year 2: Increase your savings by 10% annually, to Rs. 5,500 per month (We’re sure you’ll get a salary hike!) and invest it in debt funds.

Year 3-8: Increase your savings by 10% every year, but now start investing it into tax saving equity funds. So, Rs. 6,050 in year 3, Rs. 6,655 in year 4, and so on.

By the time you are 30, you can expect to have more than a million (Rs.10 Lakhs)!

*Equity growth is illustrative. It will never grow at a steady pace as shown. Markets tend to fluctuate and you will see large ups and downs.

On your way to becoming a millionaire, you would also have achieved the following two things:

1. By the end of year 2, you would have created an emergency fund of Rs. 1.35 lakhs or approx. 4 times your salary. This is why we don’t recommend starting with equity in the first year itself.

2. You would not have needed to worry about tax-saving investments every year.

Most importantly, you would have contributed only about Rs. 7 lakhs to get to that Rs. 10 lakhs goal. The rest would have come from earnings on your investments.

Tip: if your salary goes up by 20%, you should increase savings also by that amount – you will get to your goals faster.

What if you can only save half of this amount?

The amazing part is that it won’t take you twice the number of years to get there. In only 3 more years (when you’re 33), you can get to your first million!

And of course, if you save more, you’ll get there faster.

What after the first million?

Just keep saving 20-25% of your income each year in a combination of debt and equity funds and you shouldn’t have to worry about a thing. You could also adopt this simple financial plan.

So, no more excuses. Take your first step towards your first million today.

Note: We’ve assumed an 7% return on your debt fund investments and 12% on equity funds. The historical returns for equity are higher but assuming a lower return is good for planning as the rates of return are not fixed.

Show comments