During the initial years of work-life, many live a carefree life squandering away their hard-earned money on trendy gadgets, exotic vacations and dine-outs. It’s when they hit the 40s or the 50s that it sinks in that they need to save for the sunset years.

Waking up one day and realising that you haven’t saved enough for retirement can be worrying. However, it’s never too late to make amends.

Some steps can put you back in control of your financial future.

1. Assess your financial position

Take stock of your current investments in mutual funds, stocks, bank FDs and other instruments. It will give you an inkling of where you stand financially at this juncture. For instance, you might be in your 50s with total savings worth Rs 25 lakh.

2. Set up a retirement goal

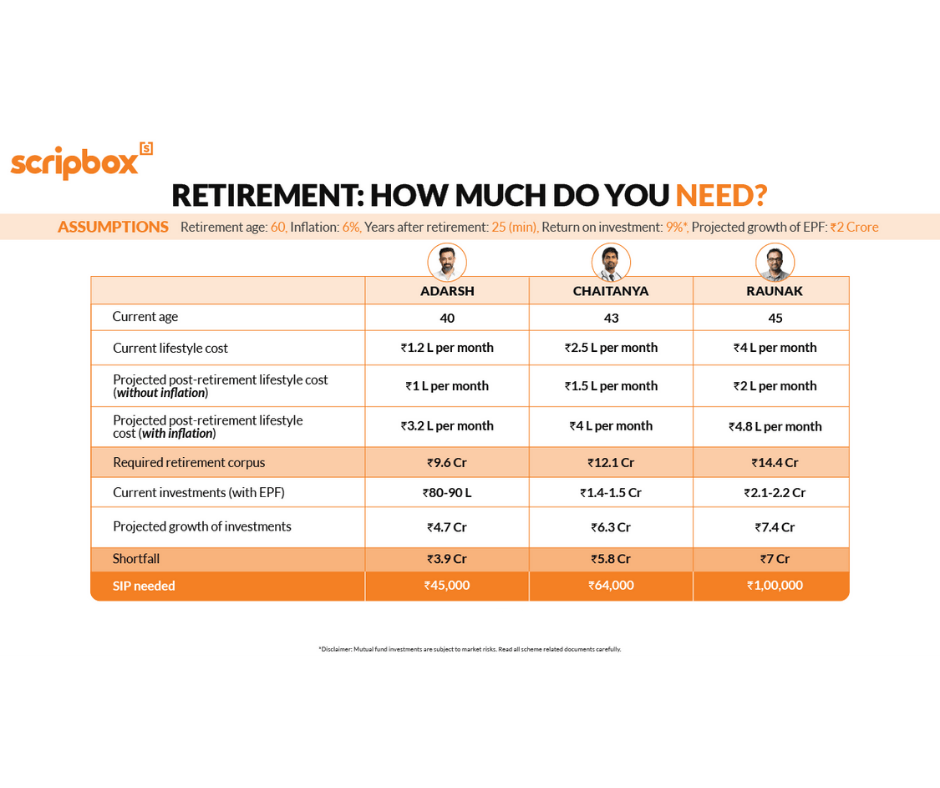

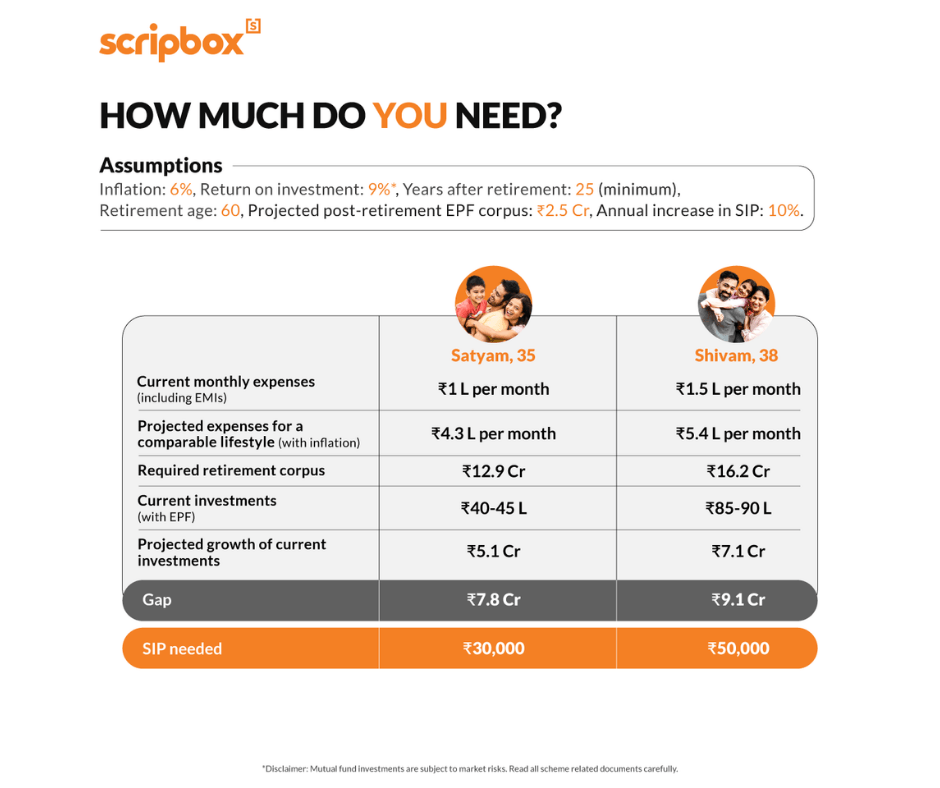

Then, figure out at what age you plan to hang up your boots. A 50-year old person with a plan to retire by the age of 60 has effectively 10 years to do the ‘catching up’.

With medical advancements and technology, lifespan is improving for people across the globe. Ensure you plan for a retirement life that lasts 25-30 years, if not more.

Moreover, have a fix on the type of lifestyle you plan to live in your retirement years. Will it be a modest daily life or one that will involve a high standard of living? In the above example, one needs to target a retirement kitty of Rs 1.3 crore or more by 2030 for a worry-free retirement.

3. Get there

Once you know the target retirement nest, calculate the monthly investment you need to do. In the above case, a SIP of Rs 25,000 in equities – that increases by 8 per cent every year – will get you close to the targeted retirement nest of Rs 1.3 crore in 10 years. At a salary of Rs 1 lakh a month, it will mean upping the savings rate upwards of 25 per cent and improving upon it year after year.

How to improve your savings rate?

If there is a shortfall in your savings, cut back on unnecessary expenses or boost your income. Target big line items in your household budget – say housing and transportation. House rent can be reduced by relocating while using public transport or selling car can save transportation costs.

To enhance your income, resort to a side hustle; give lessons on music, dance, or a foreign language, or take up some freelancing work based on your talent.

4. Repay debt

Savings rate and thus your ability to invest improves once debt is off your books. So, look towards repaying high-interest debt like credit card or car loans as soon as possible. Similarly, prepay home loans – especially if it’s in the early stage of high-interest payment.

Income levels usually peak in your 50s and by this time if you are debt-free, you can save and invest a lot to catch up.

Often, in the quest for higher returns (and to do the ‘catch up’), investors take higher risk on their portfolio. While it is important to adopt growth as part of your investment strategy – as it will help you reach your goals faster – ensure you give a long timeframe for such investments to realise its potential.

5. Retire late

You can also do the catching up by elongating your working years. If you retire at 65 instead of 60, you get five extra years of earning as well as more time for the power of compounding to work its wonders on your portfolio.

6. Adopt growth

Often, in the quest for higher returns (and to do the ‘catch up’), investors take a higher risk on their portfolio. While it is important to adopt growth as part of your investment strategy – as it will help you reach your goals faster – ensure you give a long timeframe for such investments to realise its potential. Always assess your understanding of risk and your ability to handle uncertainty and accordingly choose a financial plan.

Takeaway

If you are falling behind on the retirement savings, don’t panic. Adopt growth as part of your investment strategy and bump up your savings rate to do the catching up.

Show comments